Fixed Deposit Interest Deduction Under Section 80tta Is it possible to claim a Tax deduction for a fixed deposit under Section 80TTA No Tax deduction under Section 80TTA cannot be claimed in the case of fixed deposits However

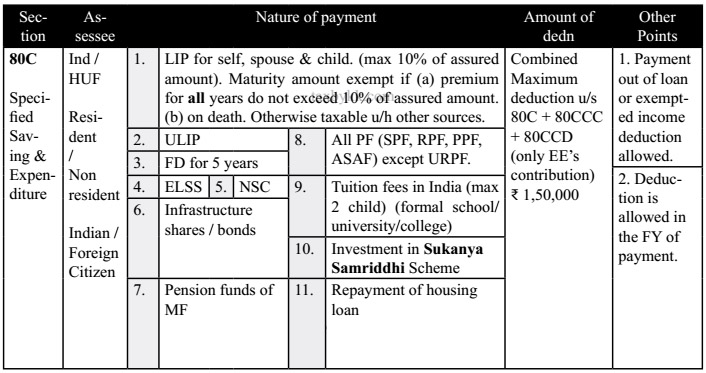

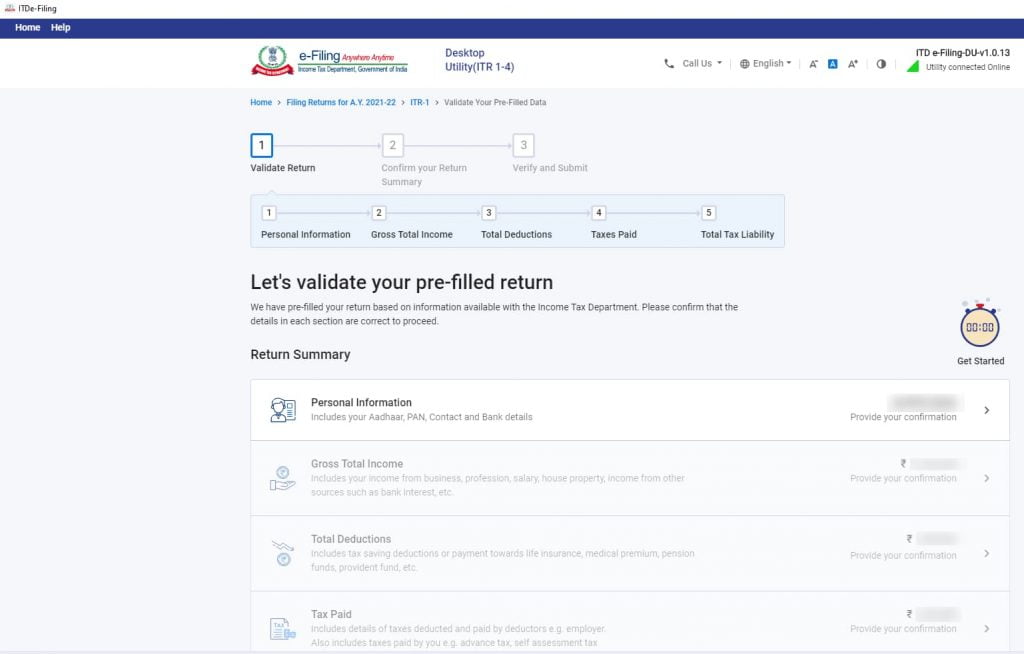

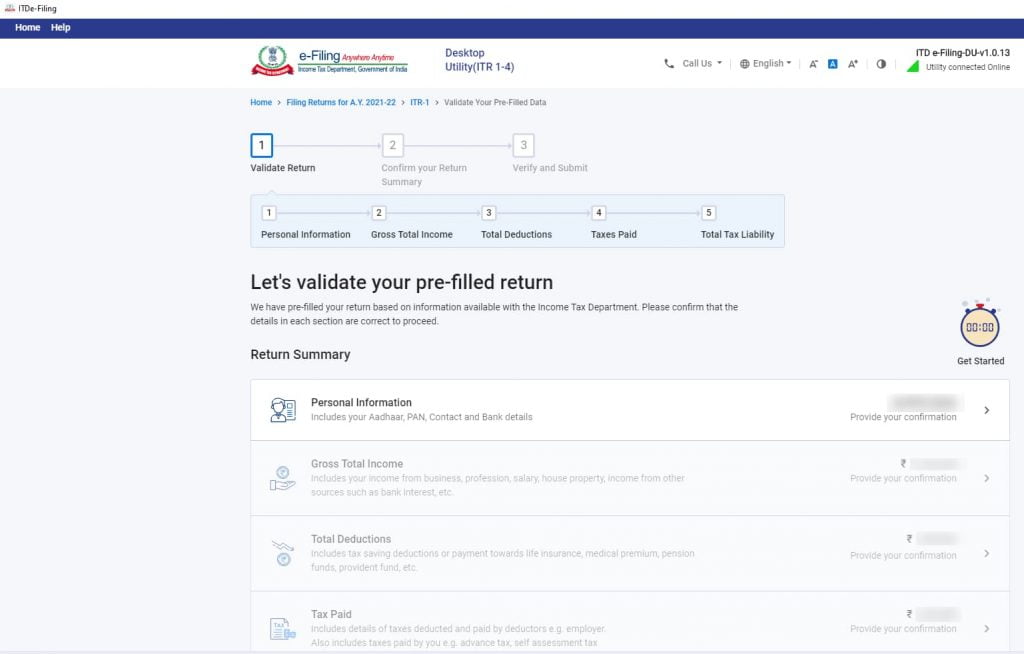

Section 80TTA provides a deduction of Rs 10 000 on interest income This deduction is available to Resident Individual or HUF other than those assessee who has covered in Section 80TTB This deduction is The maximum amount of deduction that can be claimed under section 80TTA is 10 000 per financial year The purpose of this deduction is to provide relief to individuals from

Fixed Deposit Interest Deduction Under Section 80tta

Fixed Deposit Interest Deduction Under Section 80tta

https://1.bp.blogspot.com/-Cwzsv_Dq1dU/XlVUchC0u4I/AAAAAAAAb1A/XyxDrta71MAcD1DgGqJWSdqNv_kI2Mi3QCLcBGAsYHQ/s1600/photo-1579621970563-ebec7560ff3e.jpeg

Deduction Under Section 80TTA Deduction On Savings Account Interest

https://i.ytimg.com/vi/pLTEggSa2pA/maxresdefault.jpg

Section 80TTA Savings Account Interest Deduction FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2023/10/section-80tta-1024x576.webp

Only interest from savings accounts is eligible for deduction If interest is earned under the following cases Section 80TTA cannot be availed Interest from Fixed Deposits Interest from Recurring Deposits Interest from Section 80TTA is introduced to provide deduction to an individual or a Hindu undivided family in respect of interest received on deposits not being time deposits in a savings account held with banks cooperative banks and

Deduction under section 80tta is not applicable to FD i e fixed deposit interest Deduction under section 80tta is available only in respect of interest income earned on a Can NRIs claim a deduction under 80TTA Yes NRIs can claim deduction u s 80TTA Interest earned from an NRO savings account is eligible for an 80TTA deduction Also NRO term deposits fixed deposits do not qualify

Download Fixed Deposit Interest Deduction Under Section 80tta

More picture related to Fixed Deposit Interest Deduction Under Section 80tta

SECTION 80TTA DEDUCTION INTEREST ON BANK SAVINGS DEPOSIT YouTube

https://i.ytimg.com/vi/ce7VsEvT5Vs/maxresdefault.jpg

Section 80TTA Deduction TDS On Interest Lifehack

https://res.cloudinary.com/jerrick/image/upload/c_scale,f_jpg,q_auto/5f94f76bf18c4a001c78f27e.png

Fixed Deposit Rate Of Interest In India

https://www.taxaj.com/files/Images/FixedDeposit.png

By availing the deduction under Section 80TTA you can reduce the tax liability on the interest from your savings account or even end up paying no tax if the interest earned is less than 10 000 The deduction under Section 80TTA of the Income Tax Act 1961 provides deduction on the interest earned on a savings accounts maintained with a bank cooperative society or post office The maximum deduction that can be claimed in this

Deduction in respect of interest income on deposits can be claimed under section 80TTB by senior citizens under section 80TTA by non senior citizens HUFs Both the sections were introduced in the Finance Bill 80TTA Deduction Limit Maximum Rs 10 000 This deduction is available to a Resident Individuals or HUF The deduction can be availed on Interest earned on saving

Section 80TTA Claim Tax Deduction On Savings Account Interest Income

https://life.futuregenerali.in/media/2qsf3zkl/taxation-on-savings-interest.jpg

TAX DEDUCTION UNDER SECTION 80TTA DEDUCTION ON SAVINGS INTEREST

https://1.bp.blogspot.com/--3aJsdyy8TA/XVb06wmCXhI/AAAAAAAAARM/8k81jTpDWDcKNFWboPjtuyMCrGa2_E3BwCLcBGAs/s1600/SocialMediaPostMaker_16082019_235322.png

https://www.bankbazaar.com › tax

Is it possible to claim a Tax deduction for a fixed deposit under Section 80TTA No Tax deduction under Section 80TTA cannot be claimed in the case of fixed deposits However

https://taxguru.in › income-tax

Section 80TTA provides a deduction of Rs 10 000 on interest income This deduction is available to Resident Individual or HUF other than those assessee who has covered in Section 80TTB This deduction is

Section 80TTA Deduction Limit Under Income Tax Act Paisabazaar

Section 80TTA Claim Tax Deduction On Savings Account Interest Income

Deduction From Gross Total Income Section 80C To 80U Graphical Table

Section 80TTA All About Claiming Deduction On Interest

Deduction Section 80TTA Interest On Savings Bank Account Fintrakk

Section 80TTA How You Can Claim Tax Deduction

Section 80TTA How You Can Claim Tax Deduction

Deductions On Interest On Deposits In Savings Account Section 80TTA

Deductions On Interest On Deposits In Savings Account Section 80TTA

Section 80TTA Deduction Interest Deposits Savings Account GST Guntur

Fixed Deposit Interest Deduction Under Section 80tta - Section 80TTA is introduced to provide deduction to an individual or a Hindu undivided family in respect of interest received on deposits not being time deposits in a savings account held with banks cooperative banks and