Florida Child Care Tax Credit The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3 600 for children under the age of 6 and to 3 000 per child for children between ages

The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses for a child under 13 a A listing of eligible charitable organizations can be found on the Florida Department of Children and Families Strong Families Tax Credit webpage Taxpayers who wish to

Florida Child Care Tax Credit

Florida Child Care Tax Credit

https://www.taxdefensenetwork.com/wp-content/uploads/2021/05/young-child-in-daycare-compressed.jpg

Child Care Tax Savings 2021 Curious And Calculated

https://www.kitces.com/wp-content/uploads/2021/03/04CHAN1.png

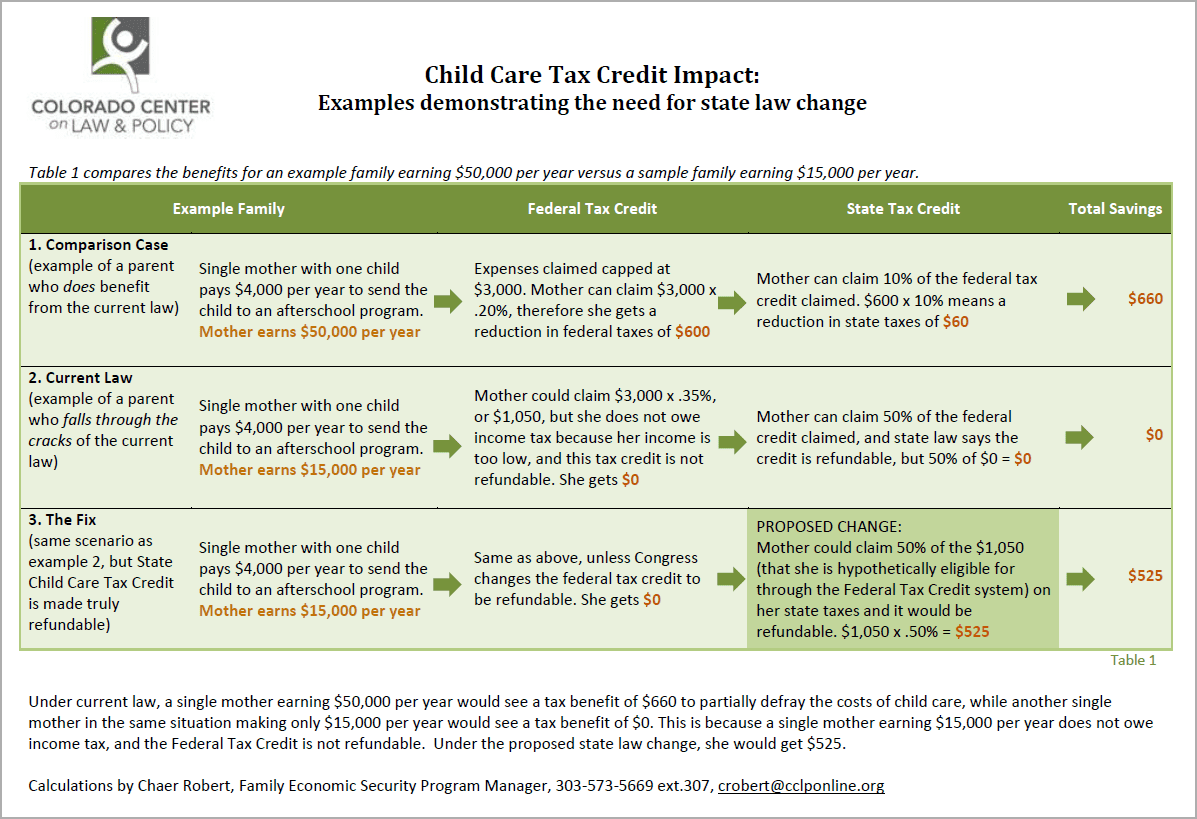

Fixing The Child Care Tax Credit EOPRTF CCLP

http://cclponline.org/wp-content/uploads/2014/02/Child-Chare-Tax-Credit-Impact-Chart.png

The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons The credit is The next round of child tax credit payments goes out Thursday in Florida Here s what day you ll get the payment how you ll get it and much more

This year Florida families with incomes below 125 000 will get back up to half of what they spent on child care in 2021 while working or studying saving up to 4 000 for one child If you have one child and your adjusted gross income was 46 560 filing alone or 53 120 filing jointly with a spouse in 2023 you could claim up to 3 995 in a

Download Florida Child Care Tax Credit

More picture related to Florida Child Care Tax Credit

What Families Need To Know About The CTC In 2022 CLASP

https://www.clasp.org/wp-content/uploads/2022/04/CTC20_f202220Infographic_final_crop.png

2023 Child Tax Credits Form Fillable Printable PDF Forms Handypdf

https://handypdf.com/resources/formfile/images/fb/source_images/child-tax-credits-form-irs-d1.png

What Is The Child Care Tax Credit And Who Can Benefit From It

https://www.wonderschool.com/p/wp-content/uploads/2020/09/child-care-tax-credit.jpg

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a The American Rescue Plan increased the amount of the Child Tax Credit from 2 000 to 3 600 for qualifying children under age 6 and 3 000 for other qualifying children under

This year for the first time ever families with children can receive up to half their CTC as advance payments rather than as one lump sum when they file their taxes This will A Florida law went into effect July 1 that will provide businesses with tax incentives to support employees childcare needs House Bill 7073 was approved by

Dependent And Child Care Credits Tax Policy Center

https://www.taxpolicycenter.org/sites/default/files/styles/full-page-1500x700/public/statistics/images/dependent_credit_6.png?itok=LHCG_yxd

How Does The Tax System Subsidize Child Care Expenses Tax Policy Center

http://www.taxpolicycenter.org/sites/default/files/4.2.6-table1_4.png

https://www.irs.gov/newsroom/child-tax-credit-most-eligible-families-will...

The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3 600 for children under the age of 6 and to 3 000 per child for children between ages

https://www.nerdwallet.com/article/taxes/child-and...

The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses for a child under 13 a

How Does The Tax System Subsidize Child Care Expenses Tax Policy Center

Dependent And Child Care Credits Tax Policy Center

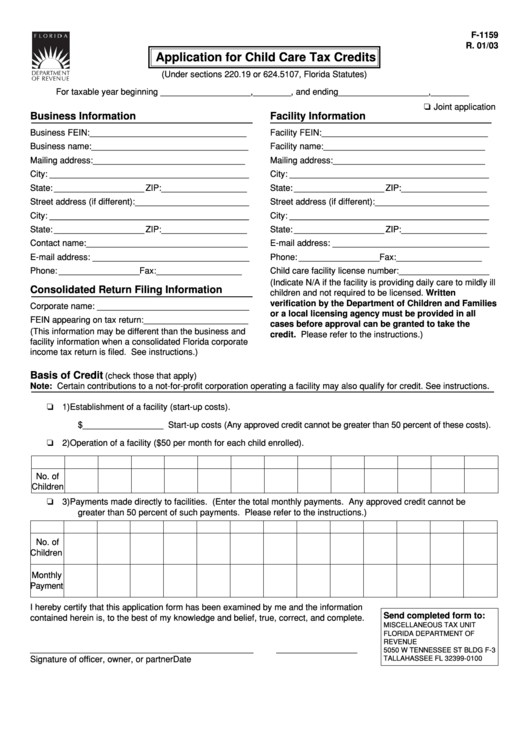

Form F 1159 Application For Child Care Tax Credits 2003 Printable

Promise The Children 2016 Child Care For All Promise The Children

2021 Child Tax Credits Paar Melis Associates P C

Child Care Tax Credit 2020 Care World Zones

Child Care Tax Credit 2020 Care World Zones

The Child Tax Credit Arrives This Week What You Need To Know SBF

What To Know About The New Monthly Child Tax Credit Payments

Child Care Tax Credit Calculator For 2012 2013 YouTube

Florida Child Care Tax Credit - This year Florida families with incomes below 125 000 will get back up to half of what they spent on child care in 2021 while working or studying saving up to 4 000 for one child