Florida Exemption Codes 11 rows Property owners in Florida may be eligible for exemptions and additional

Florida Law entitles every person who has legal or equitable title to real estate and maintains it as his her permanent residence to apply and receive up to a 50 000 Every person who owns and resides on real property in Florida on January 1 makes the property their permanent residence and files a timely application may receive a property tax exemption up to 50 000 of the

Florida Exemption Codes

Florida Exemption Codes

https://sandbergteam.com/wp-content/uploads/2022/01/Homestead-Exemption-Header-2022-1024x630.png

Must Know Facts About Florida Homestead Exemptions Lakeland Real Estate

https://lakelandfloridaliving.com/wp-content/uploads/2021/09/Things-To-Know-About-Florida-Homestead-Exemption.png

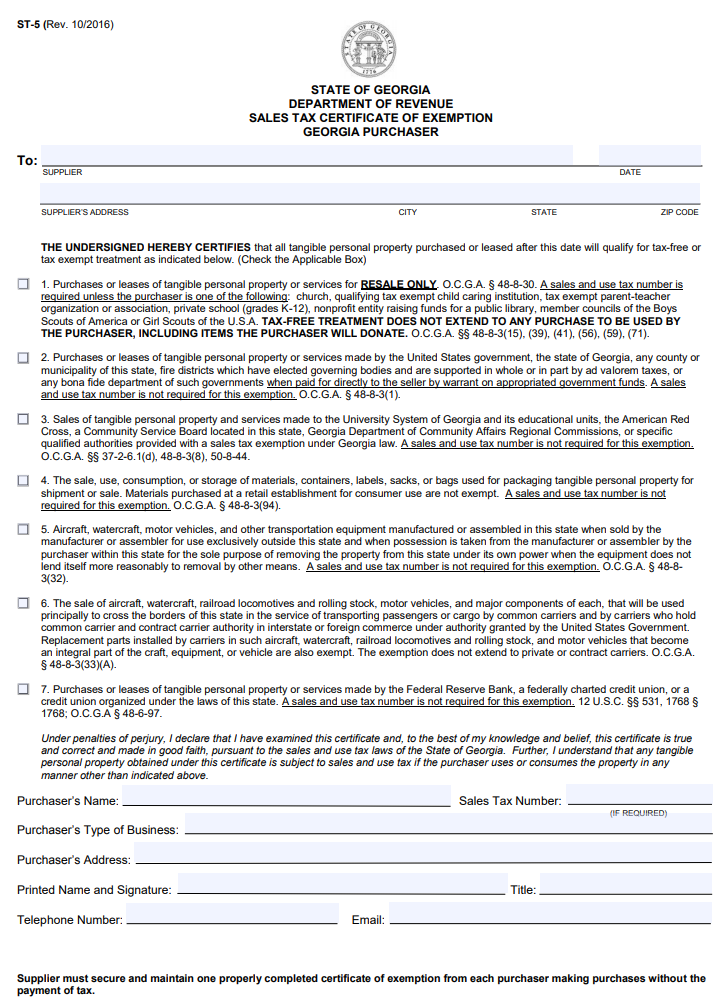

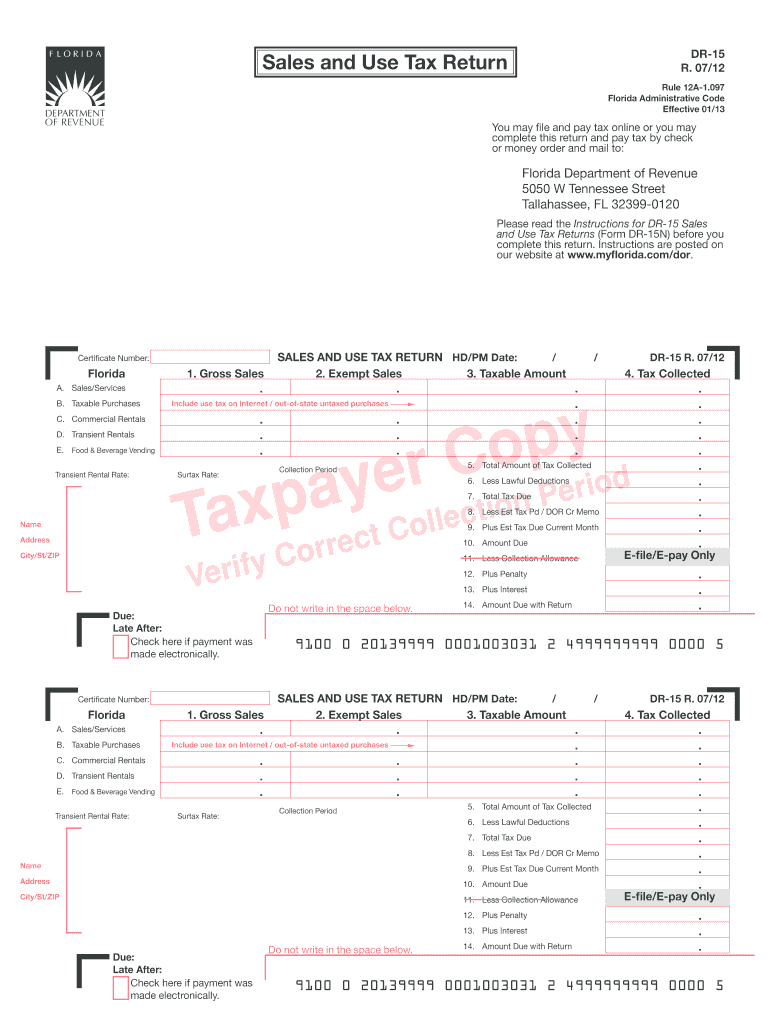

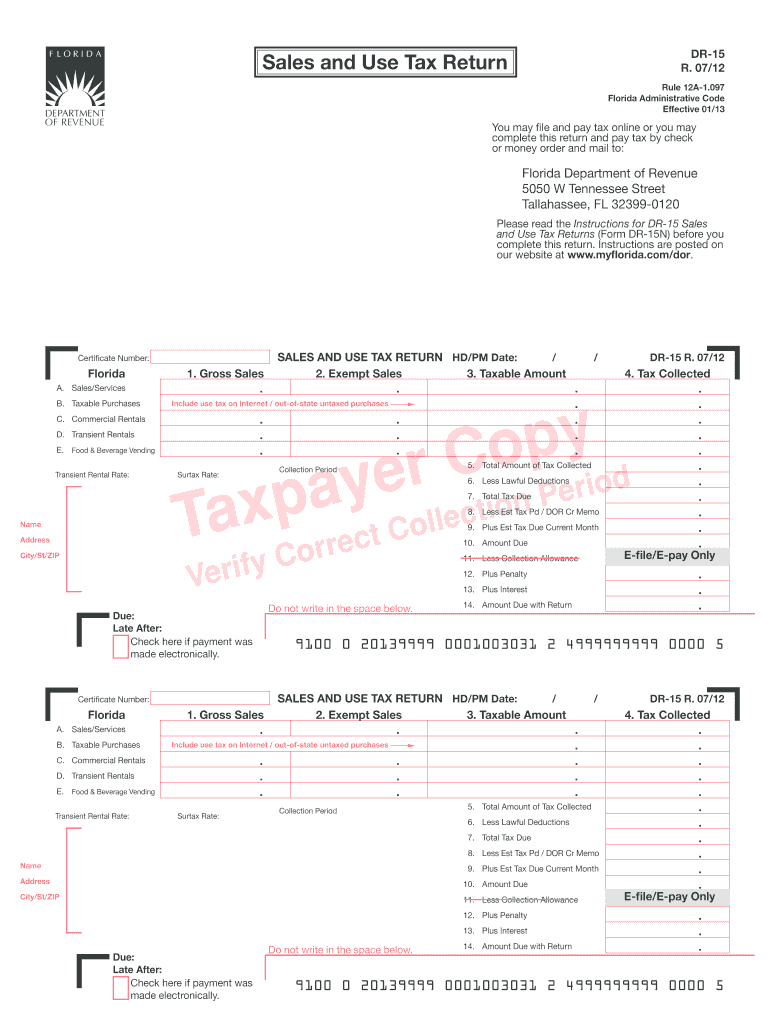

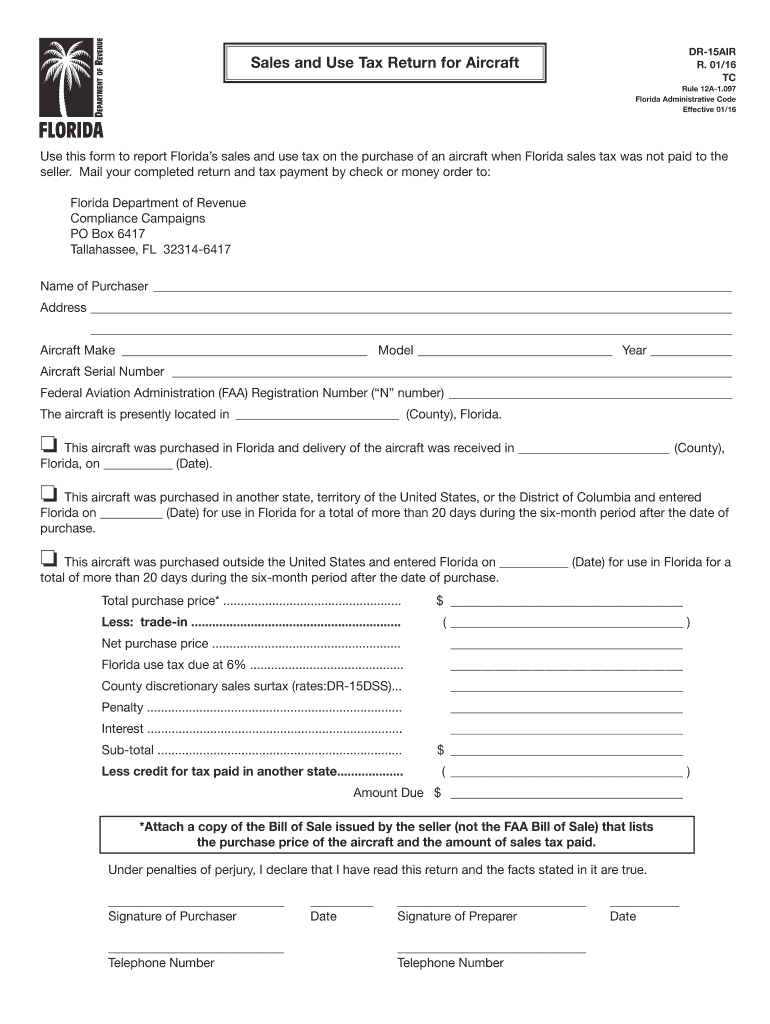

Florida Sales And Use Tax Certificate Of Exemption Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/florida-consumers-certificate-of-exemption-updated-on-august-2021.png

Florida Homestead exemption up to 50 000 a The first 25 000 of the exemption applies to all taxing authorities An additional 25 000 exemption that excludes school taxes if your assessed value is Exemption codes 11 1 2023 exempt code description ah affordable housing d2 disabled dx disabled e2 economic ec economic ex energy gv government hs historic hx

Homestead exemption provides a tax exemption up to 50 000 for persons who are permanent residents of the State of Florida who hold legal or equitable title to the real Florida law allows up to 50 000 to be deducted from the assessed value of a primary permanent residence The first 25 000 of value is entirely exempt The second 25 000

Download Florida Exemption Codes

More picture related to Florida Exemption Codes

What Is A Sales Tax Exemption Certificate In Florida Printable Form

https://www.salestaxhandbook.com/img/MTC_Thumbnail.jpg

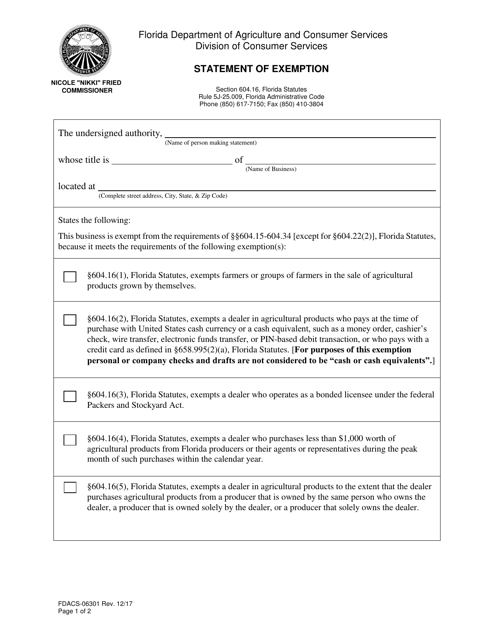

Form FDACS 06301 Fill Out Sign Online And Download Fillable PDF

https://data.templateroller.com/pdf_docs_html/2021/20218/2021819/form-fdacs-06301-statement-of-exemption-florida_big.png

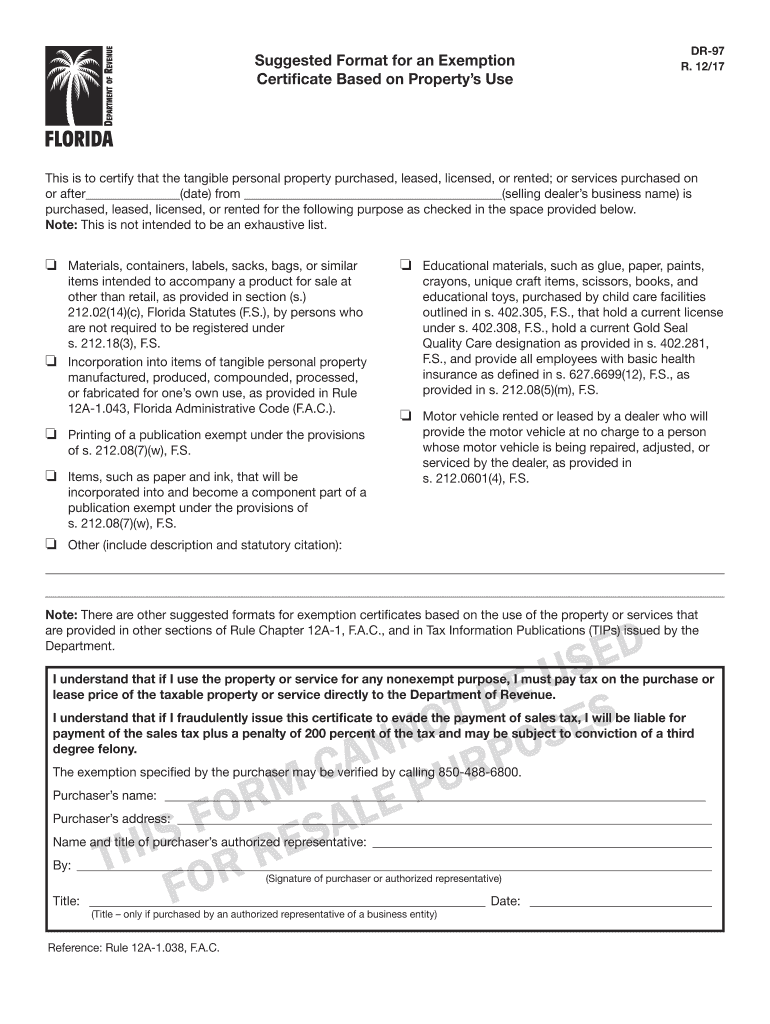

Florida Tax Exempt PDF 2017 2023 Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/423/576/423576804/large.png

Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability The Homestead Exemption and Save Our Homes 102 rows Click on the word icon to view the latest rule version Or click on the rule number to see the detail of the rule Sales of Food Products Served Prepared or Sold in or by

19 rows The purpose of the proposed amendments to Rule 12B 4 014 Florida Administrative Code F A C Conveyances Not Subject to Tax is to remove the 196 031 1 a Exemption of homesteads X Yes Yes Yes 25 000 1 196 031 1 b Additional 25 000 homestead exemption X No Yes Yes 25 000 2 196 075 NAL

Florida State Sales Tax Exemption Form Example ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/florida-sales-tax-fill-out-and-sign-printable-pdf-template-signnow.png

-1920w.jpg)

Florida Homestead Exemption What You Should Know

https://lirp.cdn-website.com/17d53756/dms3rep/multi/opt/Homestead+exemption+(2)-1920w.jpg

https://floridarevenue.com/property/pages/...

11 rows Property owners in Florida may be eligible for exemptions and additional

https://www.property-appraiser.org/all-exemptions

Florida Law entitles every person who has legal or equitable title to real estate and maintains it as his her permanent residence to apply and receive up to a 50 000

Religious Exemption Florida Dh 681 Form Printable

Florida State Sales Tax Exemption Form Example ExemptForm

FL DMV Vehicle Registration Exemption PDF Military Discharge

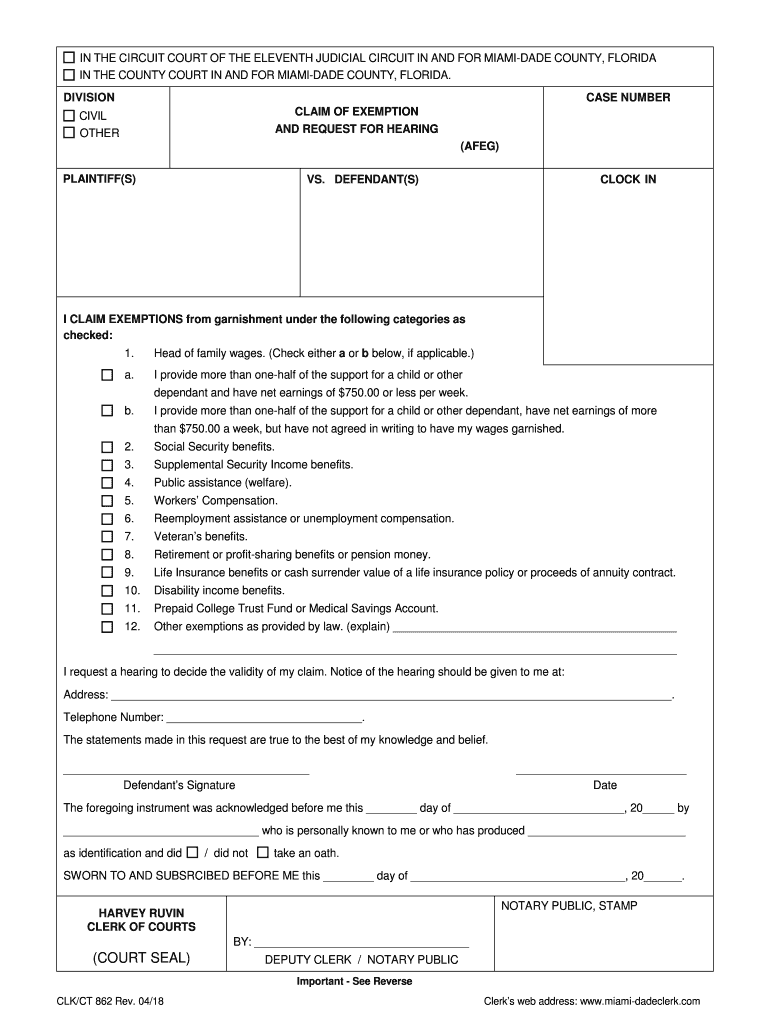

Florida Claim Exemption Form Fill Out And Sign Printable PDF Template

What Is A W 9 Tax Form LoveToKnow

Florida Agricultural Tax Exempt Form ExemptForm

Florida Agricultural Tax Exempt Form ExemptForm

The Fund Shop Print 2019 Florida Homestead Exemption

Florida Sales Tax Exemption Form Dr 13 ExemptForm

Clain Of Exemption Forms For Charlotte County Florida ExemptForm

Florida Exemption Codes - To be eligible for the exemption Florida law requires that political subdivisions obtain a sales tax Consumer s Certificate of Exemption Form DR 14 from the Florida