Florida Homestead Tax Exemption Deadline 2023 Every person who owns real property in Florida on January 1 makes the property his or her permanent residenceor the permanent residence of a legal or natural dependent and files an application may receive a property tax exemption up to

All homestead exemption applications must be eligible as of January 1 and submitted by March 1 of the year in which the benefit will be applied A 25 000 exemption is applied to the first 50 000 of your property s assessed value When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to receive a homestead exemption that would decrease the property s taxable value by as much as 50 000

Florida Homestead Tax Exemption Deadline 2023

Florida Homestead Tax Exemption Deadline 2023

https://lakelandfloridaliving.com/wp-content/uploads/2021/09/Things-To-Know-About-Florida-Homestead-Exemption-663x1024.png

How Do I Register For Florida Homestead Tax Exemption W Video

https://www.yourwaypointe.com/wp-content/uploads/2017/07/Florida-Homestead-Tax-Exemption.jpg

-1920w.jpg)

Florida Homestead Exemption What You Should Know

https://lirp.cdn-website.com/17d53756/dms3rep/multi/opt/Homestead+exemption+(2)-1920w.jpg

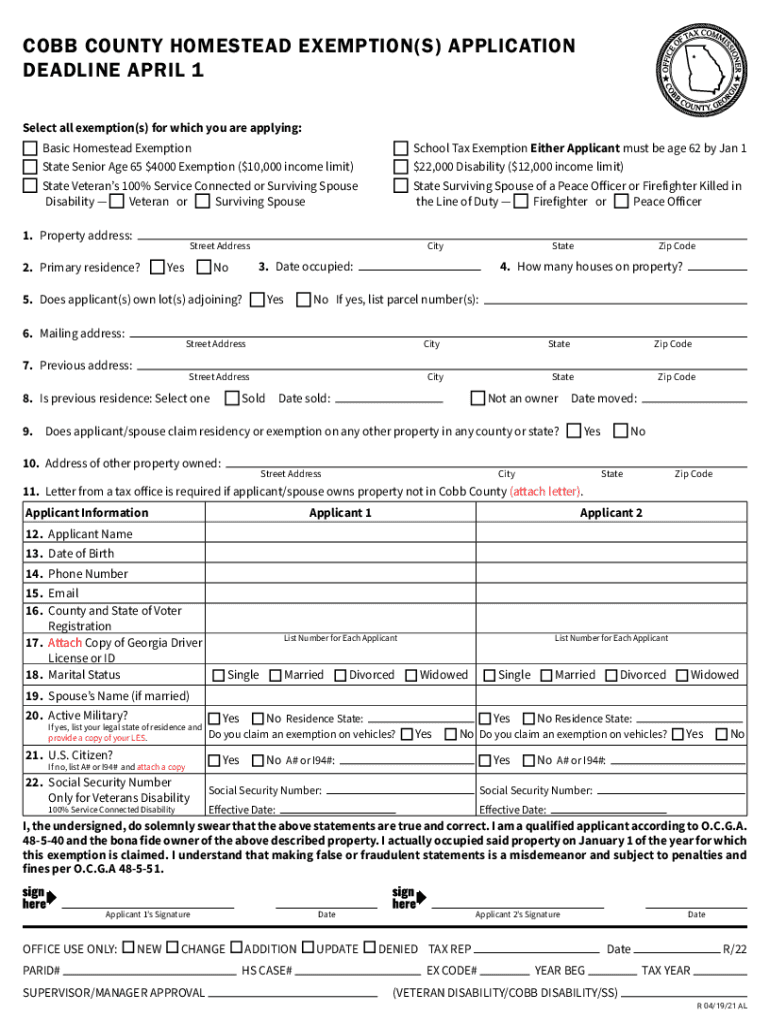

Exemptions reduce the taxable value of your property They must be applied for and are not granted retroactively The State s deadline to apply for exemptions is March 1 Most exemptions renew annually on January 1st as long as there are no changes in ownership or in residency State law allows Florida homeowners to claim up to a 50 000 Homestead Exemption on their primary residence

File for Your Homestead Exemption Before March 1 2023 Save on Your Property Taxes If you bought a home in Florida in 2022 you likely qualify for a homestead exemption of up to 50 000 That means that your property tax will be based on your home s assessed value minus the amount of your exemption up to 50 000 All legal Florida residents are eligible for a Homestead Exemption on their homes condominiums co op apartments and certain mobile home lots if they qualify The Florida Constitution provides this tax saving exemption on the first and third 25 000 of the assessed value of an owner occupied residence

Download Florida Homestead Tax Exemption Deadline 2023

More picture related to Florida Homestead Tax Exemption Deadline 2023

Miami dade County Claim Of Exemption Form ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/miami-dade-homestead-exemption-form-fill-online-printable-fillable-1.png

York County Sc Residential Tax Forms Homestead Exemption CountyForms

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/sc-application-for-homestead-exemption-fill-and-sign-printable.png

Homestead Exemption Deadline Is March 1

https://i.pinimg.com/originals/88/53/84/88538491669e6a4264010dd64356a3cb.png

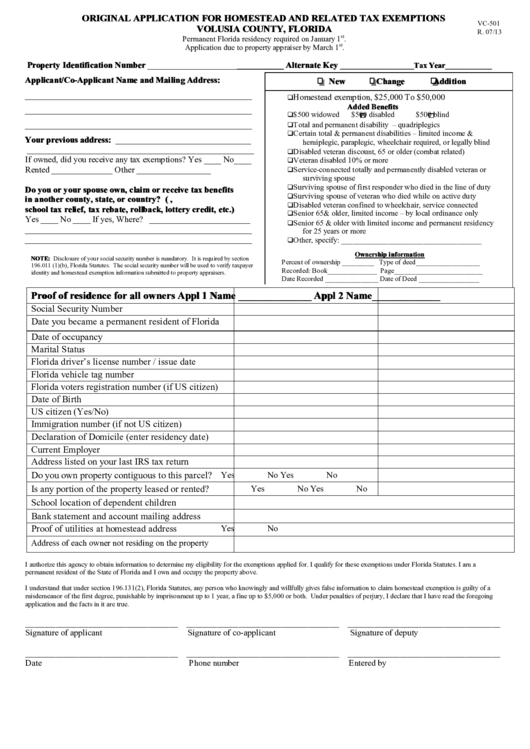

The Pasco County Property Appraiser s Office accepts applications for Homestead Exemption online for your convenience Though applications are accepted year round the deadline to file for the current year is March 1 There are several personal tax exemptions that may be available to you as a residential property owner if you qualify and apply for them o n l i n e or in person by the MARCH 1 DEADLINE In order to qualify for homestead exemption permanent Florida residency must be established as of

Thanks to the passage of Amendment 5 on the November 2020 Florida ballot you now have until the end of the second year following the year in which you sell your homestead to establish your next Florida homestead If you sold in December 2020 you have until Dec 31 2022 to buy and move into your next Florida homestead March 1 is the deadline to file a timely exemption application Note The social security number of all applicants and any spouse of all applicants is required for an application to be considered complete Complete this form if you had homestead exemption on a previous property in the State of Florida during any of the three previous tax years

PRORFETY Homestead Property Tax Exemption Kissimmee Fl

https://i.ytimg.com/vi/QXPFtfP_0fU/maxresdefault.jpg

Homestead Reminder Shayla Twit

https://www.sarasotarealestatesold.com/wp-content/uploads/2021/12/GaY66es9TaScia2JjL6t_DONT-Forget.png

https://floridarevenue.com/property/Documents/dr501.pdf

Every person who owns real property in Florida on January 1 makes the property his or her permanent residenceor the permanent residence of a legal or natural dependent and files an application may receive a property tax exemption up to

https://pbcpao.gov/homestead-exemption.htm

All homestead exemption applications must be eligible as of January 1 and submitted by March 1 of the year in which the benefit will be applied A 25 000 exemption is applied to the first 50 000 of your property s assessed value

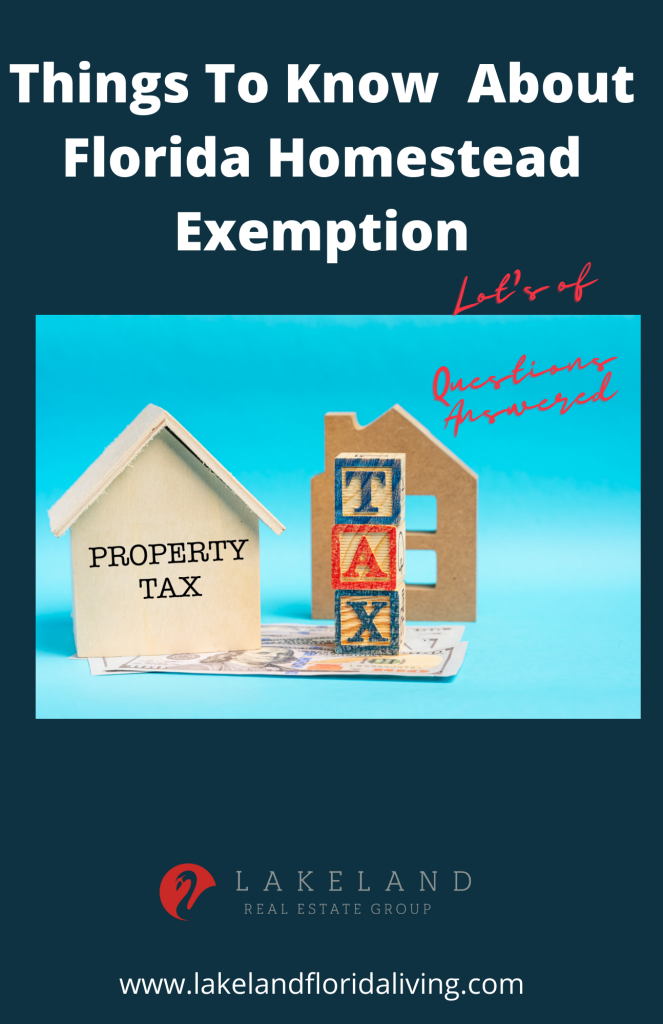

Cobb Homestead Exemptions 2021 2024 Form Fill Out And Sign Printable

PRORFETY Homestead Property Tax Exemption Kissimmee Fl

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/5P7OT6B7WJBD3HP4AB6FSFSOQQ.jpg)

Homestead Tax Exemption Deadline To Apply Is This Week WHIO TV 7 And

Homestead Exemption Mojgan JJ Panah

Florida Homestead Exemption Application Deadline ASR Law Firm

How To File For Florida Homestead Exemption Smart Title

How To File For Florida Homestead Exemption Smart Title

File For Your Homestead Exemption Mike Jansen Campbell County

Florida Homestead Tax Exemption Form ExemptForm

The Fund 2019 Florida Homestead Exemption

Florida Homestead Tax Exemption Deadline 2023 - The deadline to timely file for a homestead exemption is March 1 2024 Late filing is permitted through early September The deadline for late filing is set by Florida law and falls on the 25 th day following the mailing of the Notices of Proposed Property Taxes which occurs in mid August