Florida Property Tax Homeowners Exemption Web When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to receive a homestead exemption up to 50 000 The first 25 000 applies to all property taxes including school district taxes

Web 20 Apr 2021 nbsp 0183 32 There is a Super Senior Long Term Exemption that completely exempts some senior citizens who have lived in their homes for more than 25 years from having to pay any property taxes at all Check with your county property appraisal office for a list of these exemptions Web Florida s public policy of protecting homesteads from creditors is so strong that the Florida Supreme Court has held that a homestead is protected from creditors even if the homestead is purchased by the owner of the homestead for

Florida Property Tax Homeowners Exemption

.jpg)

Florida Property Tax Homeowners Exemption

https://irp.cdn-website.com/17d53756/dms3rep/multi/Homestead+exemption+(2).jpg

Commissioners Approve New Homestead Exemptions For Tarrant County

https://fortworthreport.org/wp-content/uploads/2023/06/taxexemption-scaled.jpg

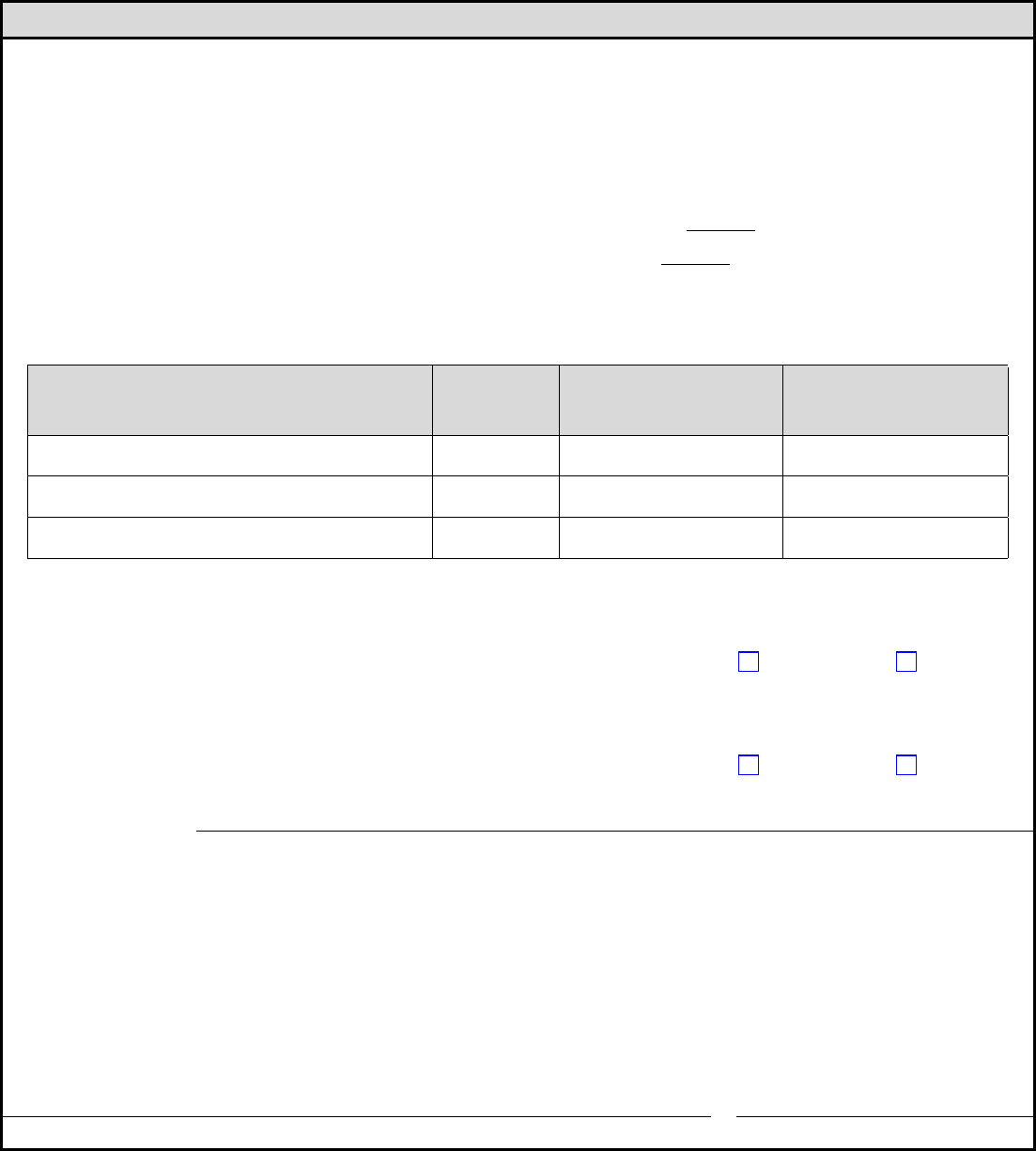

How To File A Claim For Homeowners Exemption Proposition19

https://proposition19.org/wp-content/uploads/2023/02/Homeowners-Property-Tax-Exemption-1536x853.png

Web 7 Aug 2023 nbsp 0183 32 While Florida is one of only a handful of states with no state income tax there are other ways local governments try to collect their fair share including property taxes on any real estate you own in the Sunshine State Web Vor 6 Tagen nbsp 0183 32 The Florida homestead exemption is a property tax break that s offered based on your home s assessed value and provides exemptions within a certain value limit With it you can reduce the taxable value of your home by as much as 50 000 if you owned your property on January 1 of the tax year

Web Certain property tax benefits are available to persons 65 or older in Florida Eligibility for property tax exemptions depends on certain requirements Information is available from the property appraiser s office in the county where the applicant owns a Web Method 1 Appeal the Taxable Value of Your Florida Home Florida authorities compute homeowners property tax by multiplying the home s taxable value by the applicable tax rate A property appraiser is supposed to physically inspect one s property at least once in every five years

Download Florida Property Tax Homeowners Exemption

More picture related to Florida Property Tax Homeowners Exemption

Property Tax Homestead Exemption For Homeowners In Florida

https://b9v9j8r7.rocketcdn.me/wp-content/uploads/2023/07/States-With-Exceptional-Campgrounds-1.jpg

Homeowners Exemption California How To Save On Property Taxes YouTube

https://i.ytimg.com/vi/niAW-BsBC_I/maxresdefault.jpg

Bought A Home In Florida In 2021 File For Your Homestead Exemption By

https://sandbergteam.com/wp-content/uploads/2022/01/Homestead-Exemption-Header-2022-1024x630.png

Web 5 M 228 rz 2023 nbsp 0183 32 The homestead exemption in Florida can save you hundreds of dollars in property taxes if you are a permanent Florida resident If you qualify you can reduce the assessed value of your homestead up to 50 000 There is a standard 25 000 exemption plus an additional exemption up to 25 000 Web Florida residents above 65 years and who have lived in the state for more than 25 years may receive up to 100 property tax deduction The limits to these exemptions state that your property s value must not exceed 250 000 you must come from specific regions of the state and your income must fall within specified limits

Web 31 M 228 rz 2020 nbsp 0183 32 Military members and families in Florida have access to several potential property tax exemptions including these Mortgage interest deduction This is available to military members even if you receive a non taxable military housing Deployment exemptions If you were deployed during the tax Web 14 Jan 2022 nbsp 0183 32 What is the Florida Homestead Property Tax Exemption Under Article VII Section 6 of the Florida Constitution and Section 196 031 Florida Statute certain property owners in Florida are eligible for exemptions that can reduce their property tax liability by decreasing the property s taxable value by up to 50 000 The first

VA Lending And Property Tax Exemptions For Veterans Homeowners

https://www.veteransunited.com/assets/craft/images/blog/_blogHero/va-home-loan-property-tax.jpg

Homestead Exemptions What You Need To Know Rachael V Peterson

https://images.squarespace-cdn.com/content/v1/5a8e3375b7411c86343f7044/1578252541735-X38IFVQXZA2WV3MAY7J7/homestead-exempt-1-1+photo+for+exemption+article.jpg

.jpg?w=186)

https://floridarevenue.com/property/documents/pt113.pdf

Web When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to receive a homestead exemption up to 50 000 The first 25 000 applies to all property taxes including school district taxes

https://www.floridarealtors.org/news-media/news-articles/2021/04/...

Web 20 Apr 2021 nbsp 0183 32 There is a Super Senior Long Term Exemption that completely exempts some senior citizens who have lived in their homes for more than 25 years from having to pay any property taxes at all Check with your county property appraisal office for a list of these exemptions

Idaho Property Tax Homeowners Exemption YouTube

VA Lending And Property Tax Exemptions For Veterans Homeowners

Application For Real Property Tax Exemption And Remission Ohio In

Homeowners Exemption Form Riverside County ExemptForm

Benefits Of Home Ownership And Tax Exemptions MSI Credit Solutions

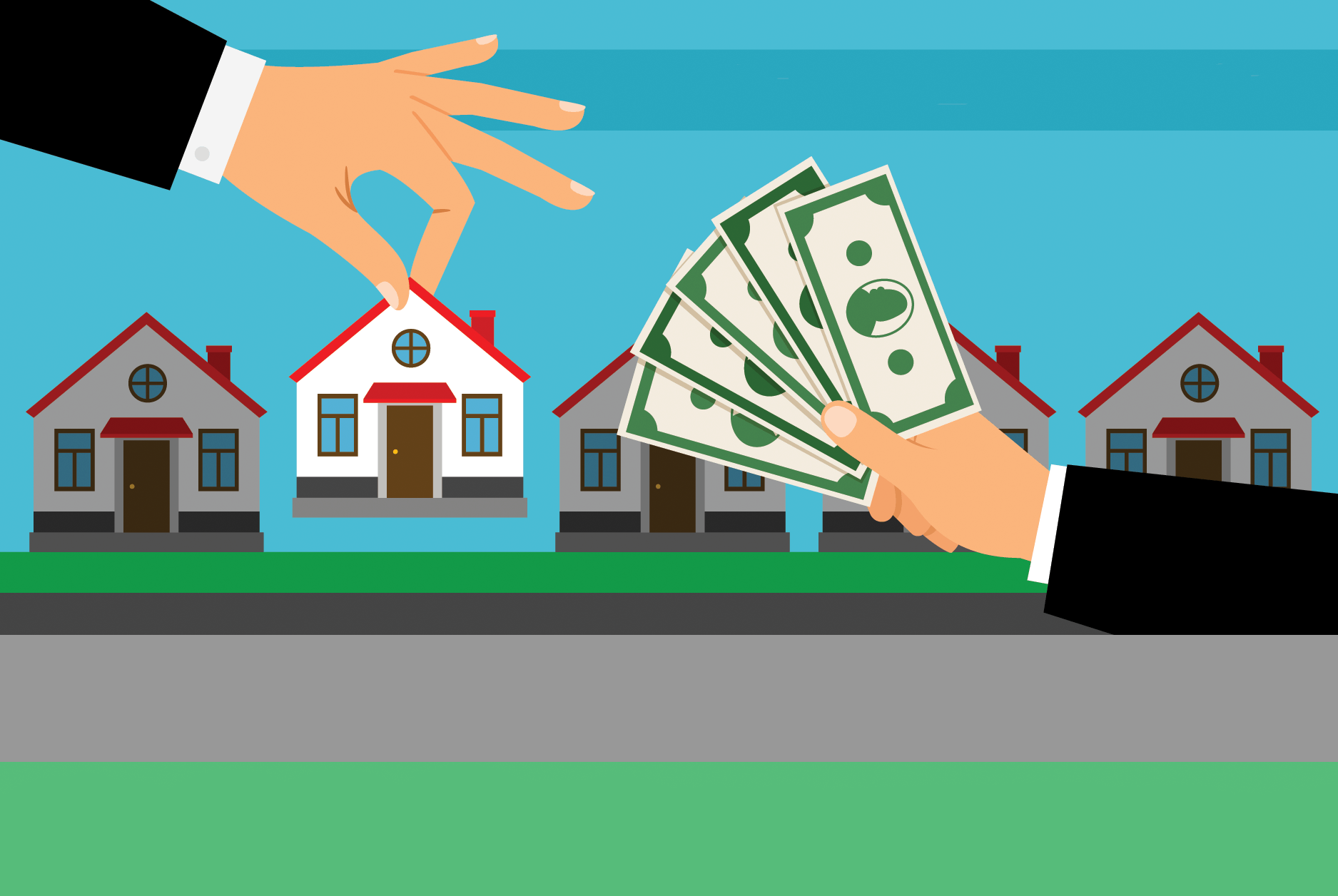

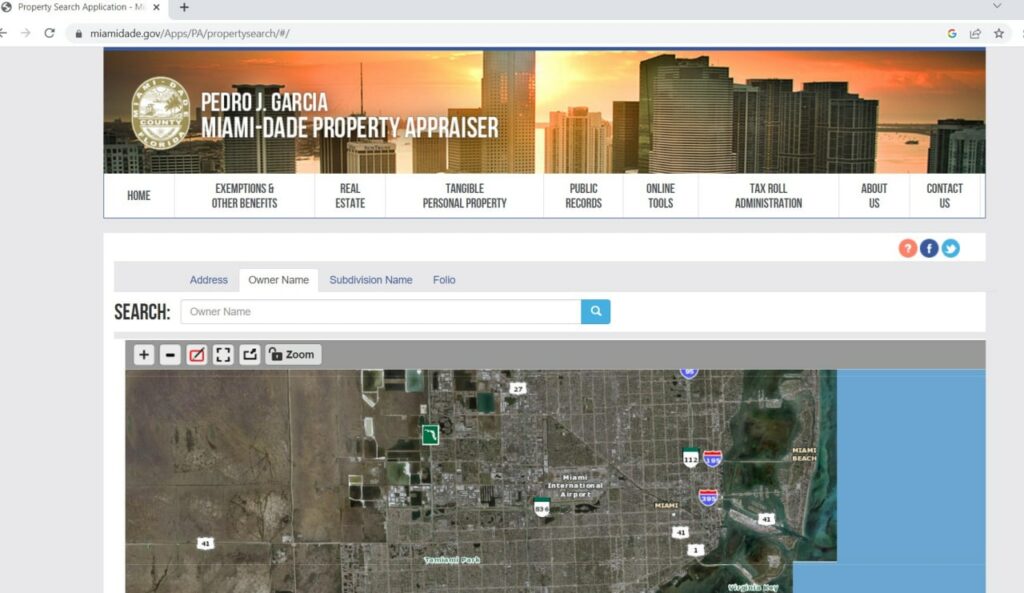

How To Find Your Florida Property Tax Number Folio Or Parcel ID Number

How To Find Your Florida Property Tax Number Folio Or Parcel ID Number

SC To Submit Recommendations To Housing Land Trust Committee During

Property Tax Homeowners Exemption Bill Gains Traction Sheridan

Senior Citizen Property Tax Exemption California Form Riverside County

Florida Property Tax Homeowners Exemption - Web Vor 6 Tagen nbsp 0183 32 The Florida homestead exemption is a property tax break that s offered based on your home s assessed value and provides exemptions within a certain value limit With it you can reduce the taxable value of your home by as much as 50 000 if you owned your property on January 1 of the tax year