Florida Property Tax Protest You may file a lawsuit in circuit court to challenge the property appraiser s assessment or denial of an exemption or classification You are not required to participate in an informal

The value adjustment board is an independent forum for property owners to appeal their property value or a denial of an exemption classification or tax deferral Value South Florida Law PLLC appeals property tax on behalf of Florida residents and businesses every summer If your property is in Miami Dade or Broward County

Florida Property Tax Protest

Florida Property Tax Protest

https://cviewllc.com/wp-content/uploads/2023/01/01_10_Blog_SDAT.jpg

Florida Property Tax H R Block

https://www.hrblock.com/tax-center/wp-content/uploads/2020/03/property-tax-2-1080x675.jpg

Listen Who Filed A Property Tax Protest On My Home

https://s.hdnux.com/photos/74/45/26/15881646/7/rawImage.jpg

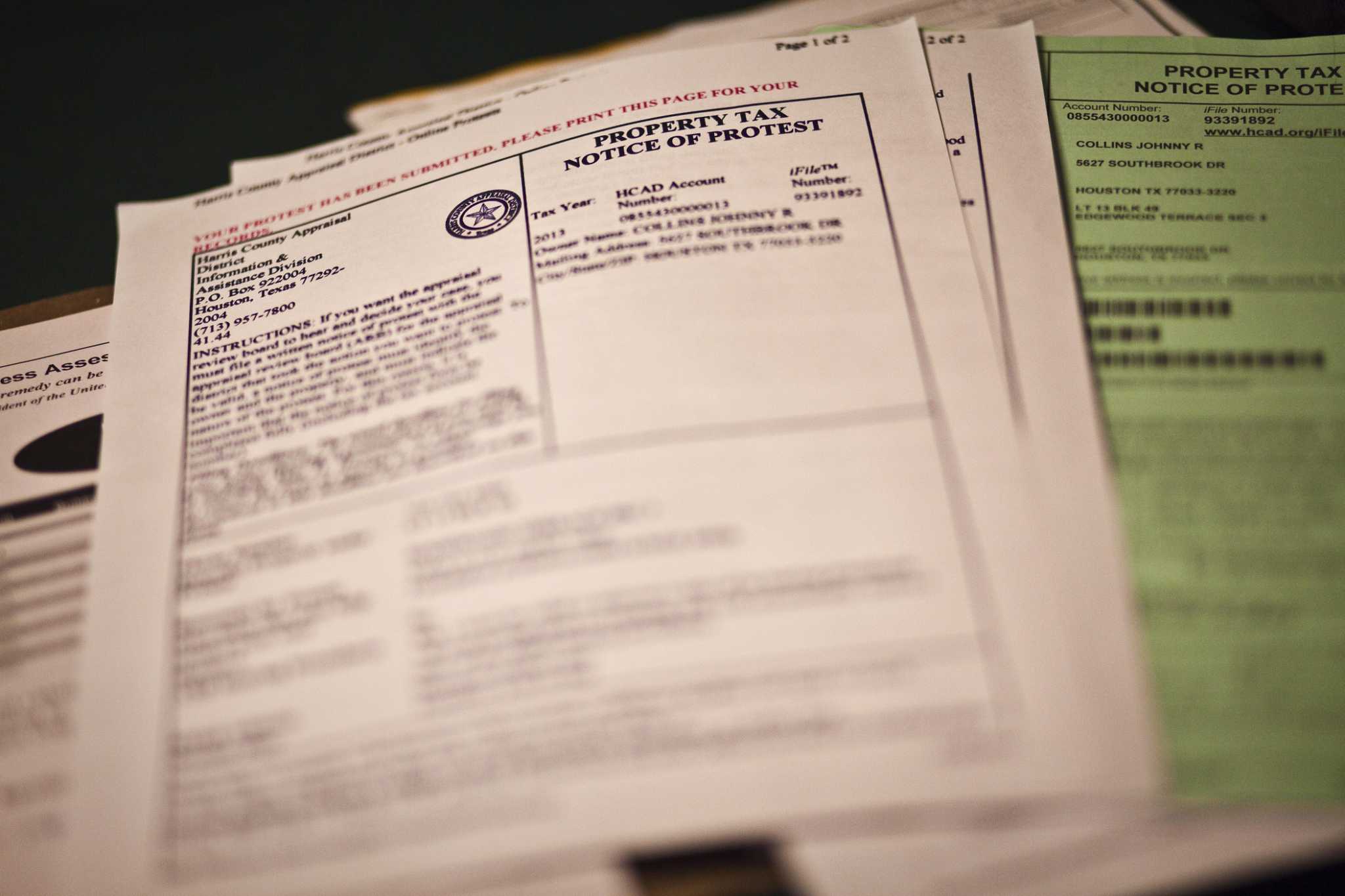

A Florida law caps property taxes at 3 a year for existing homebuyers But new homebuyers are paying thousands more than the previous homeowners The tax bills have come as a shock for Taxpayers wishing to protest these matters must submit a written protest within the time period stated on the applicable notice In addition the written protest must conform to

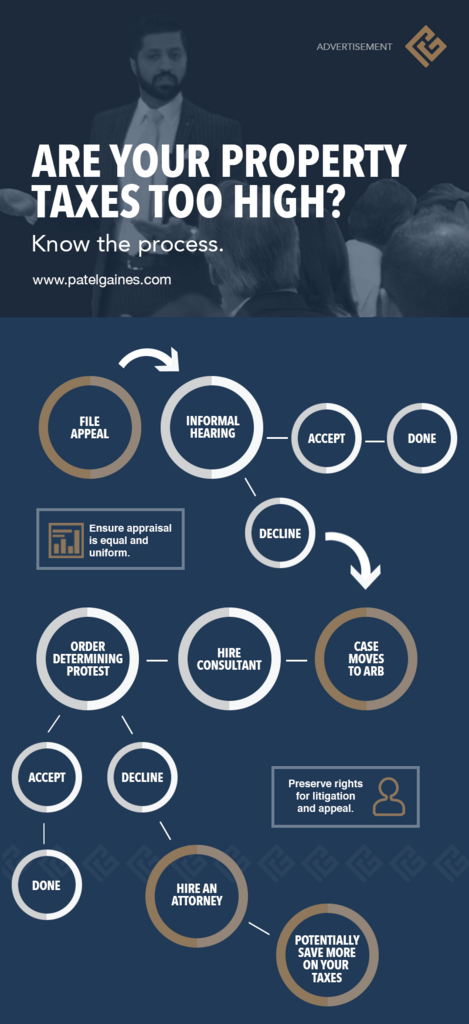

Contesting Property Taxes in Florida Home Services Contesting Property Taxes in Florida In Florida if you are seeking to minimize the amount you are paying in property taxes you can contest your market Florida law provides a taxpayer the option of appealing his or her assessment in an administrative appeal before the Value Adjustment Board VAB

Download Florida Property Tax Protest

More picture related to Florida Property Tax Protest

How To Write A Tax Protest Letter To The IRS Contesting An Issue YouTube

https://i.ytimg.com/vi/v1XjCIbyZTo/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHEBIAC0AWKAgwIABABGGUgZShlMA8=&rs=AOn4CLD_Re1xR4nMobEEgKjDpSRTm_XneA

File A Protest If Your Residential 2022 Property Taxes Are High

https://www.cutmytaxes.com/wp-content/uploads/2022/02/File-a-protest-if-your-residential-2022-property-taxes-are-high-01-01-scaled.jpg

Protest Property Tax Appraisal In Texas 2022 TexasLending

https://www.texaslending.com/wp-content/uploads/2022/04/PropertyTax.jpg

Try 1 month for 1 Property appraisers in Florida send out TRIM Notices in August Your tax bill is due in November Here s how to appeal if you think your home s Contest My Property Taxes File For Look Up or View Make a Payment Obtain Copies Of Purchase at Auction

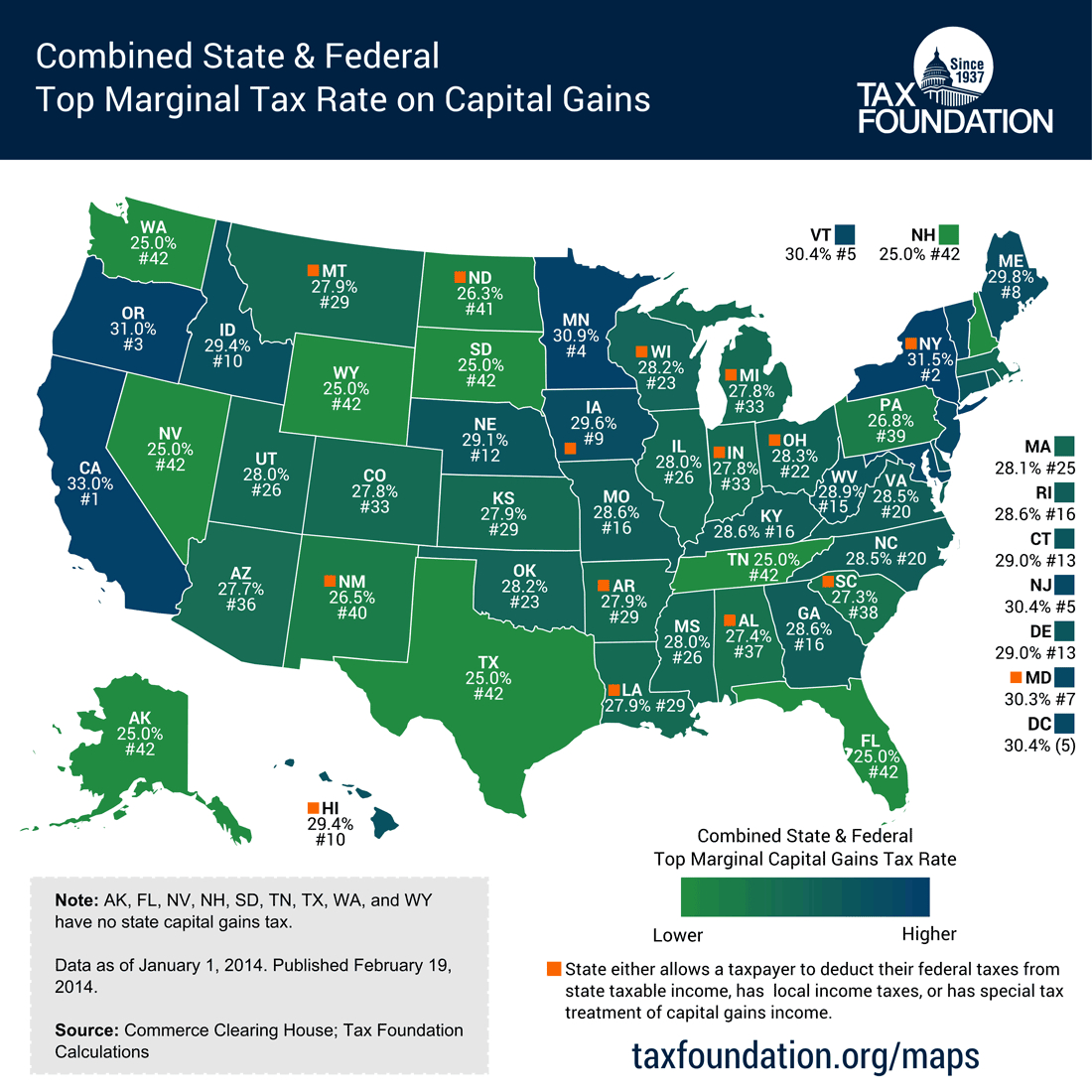

According to the Tax Foundation Florida ranks 26th nationwide in property taxes paid as a percentage of household value 0 91 and 29th in state and local Being improperly taxed can have significant financial repercussions on homeowners so if you live in the Daytona Beach Orlando Miami or Jacksonville areas and you believe

Property Tax Protests Appeals Sopinski Law Office

https://bucket.mlcdn.com/a/1193/1193180/images/ad763878afee07cb87091aff2933cc4d74887181.png

Texas Property Tax Protests Attorneys Wharton Matagorda Richmond TX

https://wphk-law.com/wp-content/uploads/2016/06/Property-TaxProtests.jpg

https://floridarevenue.com/property/Pages/...

You may file a lawsuit in circuit court to challenge the property appraiser s assessment or denial of an exemption or classification You are not required to participate in an informal

https://www.floridarevenue.com/property/Documents/pt101.pdf

The value adjustment board is an independent forum for property owners to appeal their property value or a denial of an exemption classification or tax deferral Value

Property Tax Protest

Property Tax Protests Appeals Sopinski Law Office

How Do I Protest My Property Taxes In Texas Tax Walls

State By State Guide To Taxes On Retirees Florida Property Tax Map

Florida Legislature Wants To Roll Property Taxes Into State Sales

Property Tax Lupon gov ph

Property Tax Lupon gov ph

How To Prepare For Protesting Your Property Tax Appraisal

How To Protest Property Appraisal Values In Bexar County San Antonio

3 Reasons To Protest Your Commercial Property Taxes Five Stone Tax

Florida Property Tax Protest - Contesting Property Taxes in Florida Home Services Contesting Property Taxes in Florida In Florida if you are seeking to minimize the amount you are paying in property taxes you can contest your market