Florida Solar Investment Tax Credit With a statewide tax rate average of 0 8 and a typical solar system value of 34 960 in Florida it s expected that this perk will save you around 279 per year on your tax bill 3 Over the life of your system an estimated 20 years that comes out to a total savings of approximately 55 93

Federal solar investment tax credit The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in Florida If you install your photovoltaic system before the end of 2032 the federal tax credit is Considering Florida residents pay an average electric tariff of 14 98 cents per kWh annual power bill savings can range from 1 348 to 1 498 Based on our research a 6 kW solar system has a

Florida Solar Investment Tax Credit

Florida Solar Investment Tax Credit

https://aztecsolar.com/wp-content/uploads/2022/01/A-Comprehensive-Guide-to-the-Solar-Investment-Tax-Credit-in-2022.jpg

What Is The Solar Investment Tax Credit ITC BizReps

https://biz-reps.com/wp-content/uploads/2021/01/american-public-power-association-513dBrMJ_5w-unsplash-1080x675.jpg

Federal Solar Investment Tax Credit Extends Until 2023 Commercial

https://www.agt.com/wp-content/uploads/2016/04/Solar-Investment-Tax-Credit-Extension.png

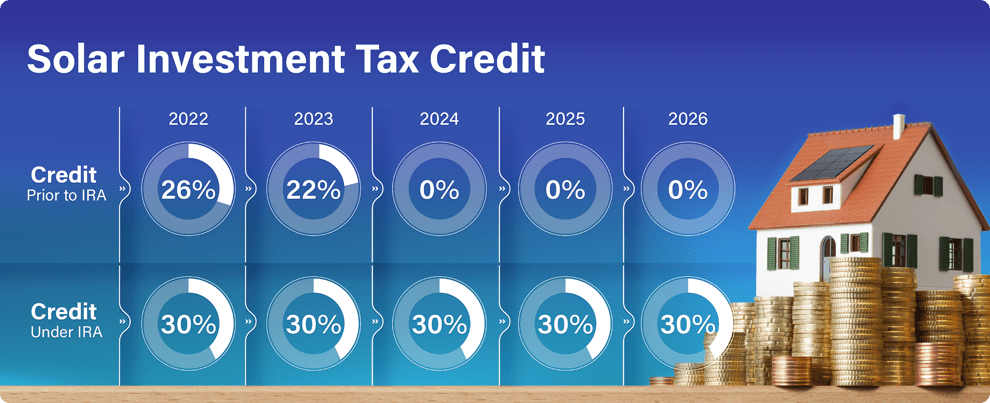

Most Florida residents are eligible to receive the Federal Solar Tax Credit also known as the Residential Clean Energy Credit This allows eligible homeowners to deduct up to 30 of their solar panel installation cost from their federal income taxes Many Florida homeowners also pair battery storage with their solar panel Using the federal solar tax credit for that year 30 you can claim a credit of 3 000 30 x 10 000 3 000 Now let s say you owe 15 000 in federal income taxes in 2024

The federal solar tax credit Don t forget about federal solar incentives With the investment tax credit ITC now referred to as the Residential Clean Energy Credit for residential systems you can reduce the cost of your PV solar energy system by 30 percent Learn about the solar incentives tax credits and rebates in Florida to save money and maximize your solar investment

Download Florida Solar Investment Tax Credit

More picture related to Florida Solar Investment Tax Credit

The Full Guide Solar Investment Tax Credit In 2022 Karla Dennis

https://www.karladennis.com/wp-content/uploads/2022/10/solar-credit-blog-pic-scaled.jpg

From Rooftops To Roadways What The Inflation Reduction Act Means For

https://www.sunnova.com/-/media/Marketing-Components/Blog/inflation-reduction-act-sunnova/Solar-Investment-Tax-Credit.ashx

Everything You Need To Know About The Solar Investment Tax Credit

https://blog.mgallp.com/hs-fs/hubfs/Solar Investment Tax Credit.jpg?width=1200&name=Solar Investment Tax Credit.jpg

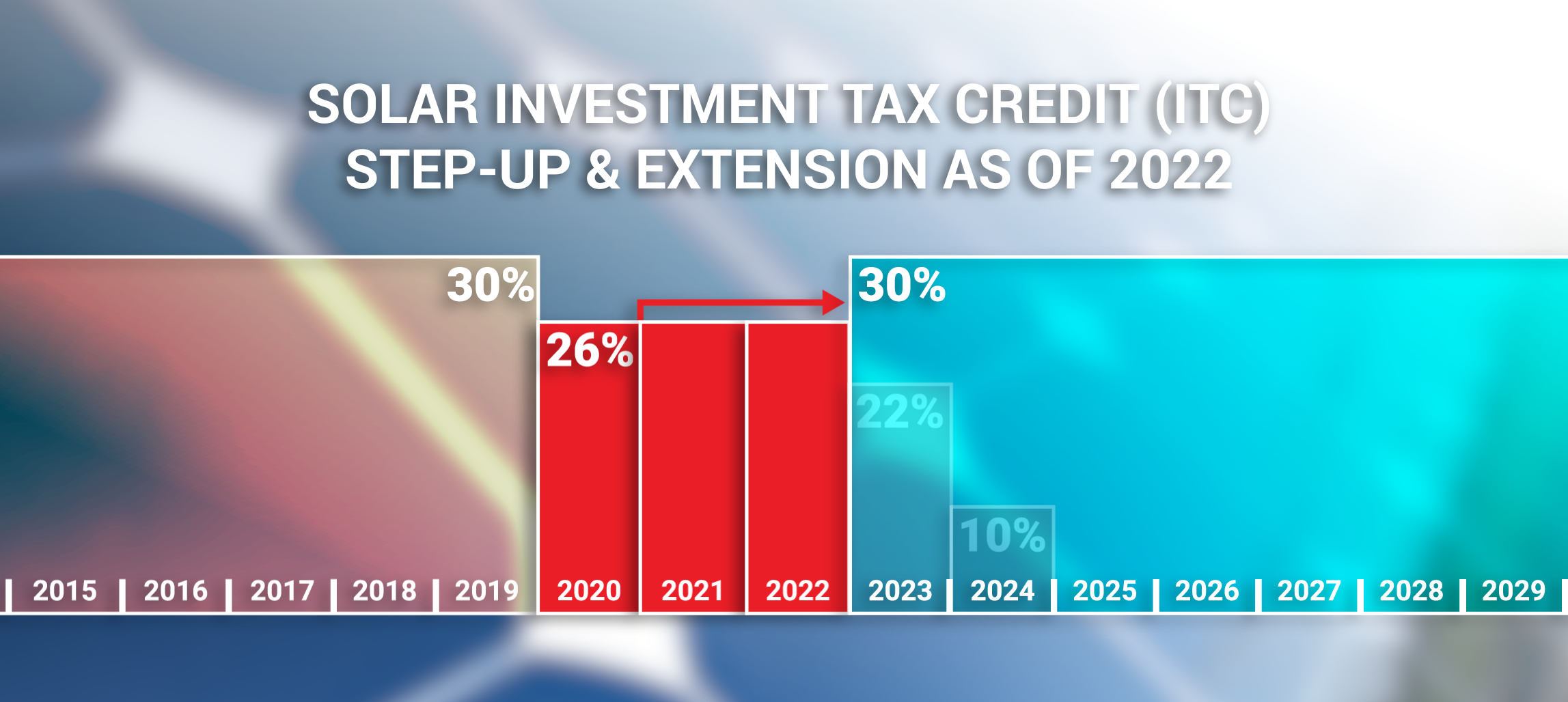

All Americans can be eligible for the federal solar investment tax credit ITC which offers a tax credit of up to 26 of the cost of your solar system For example if your solar system cost 10 000 you can deduct 2 600 from your federal income taxes which essentially translates to a 2 600 discount But heads up The ITC drops to 22 in The Solar Investment Tax Credit ITC in Florida is a federal incentive designed to promote solar energy adoption It offers a tax credit of 30 of the total cost of going solar for Florida homeowners This credit helps offset the upfront expenses of installing solar panels making solar energy more affordable

Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034 If you ve already installed a system in 2022 your tax credit has increased from 22 to 30 if you haven t already claimed it The average property tax in Florida is 0 98 according to AARP There are lots of different ways to calculate the value of adding solar panels to a house but using an 24 000 average cost

Determining Eligibility For The Solar Investment Tax Credit Geoscape

https://geoscapesolar.com/wp-content/uploads/2021/10/ITC-Infographic-768x520-1.jpg

2021 Solar Investment Tax Credit What You Need To Know

https://www.michigansolarsolutions.com/hs-fs/hubfs/Solar Investment Tax Credit.png?width=1400&name=Solar Investment Tax Credit.png

https://www.ecowatch.com/solar/incentives/fl

With a statewide tax rate average of 0 8 and a typical solar system value of 34 960 in Florida it s expected that this perk will save you around 279 per year on your tax bill 3 Over the life of your system an estimated 20 years that comes out to a total savings of approximately 55 93

https://www.solarreviews.com/solar-incentives/florida

Federal solar investment tax credit The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in Florida If you install your photovoltaic system before the end of 2032 the federal tax credit is

Federal Solar Tax Credits For Businesses Department Of Energy

Determining Eligibility For The Solar Investment Tax Credit Geoscape

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

Claim Your 30 Solar Investment Tax Credit ITC Solar Electric

Solar Investment Tax Credit

How The Solar Investment Tax Credit Works Dividend Finance

How The Solar Investment Tax Credit Works Dividend Finance

Federal Solar Tax Credit What It Is How To Claim It For 2024

2022 Solar Investment Tax Credit ITC Increased Extended

Solar Investment Tax Credit American Sentry Solar

Florida Solar Investment Tax Credit - The federal solar tax credit Don t forget about federal solar incentives With the investment tax credit ITC now referred to as the Residential Clean Energy Credit for residential systems you can reduce the cost of your PV solar energy system by 30 percent