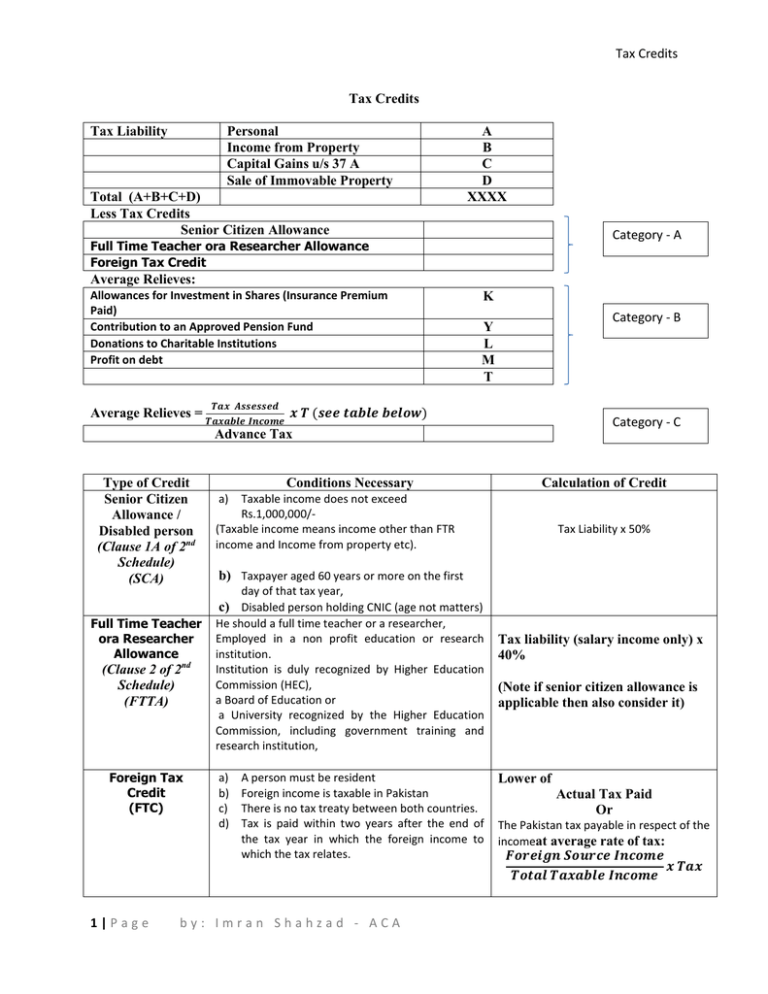

Foreign Tax Credit Time Limit For 2022 your foreign tax credit limit is 700 If you choose to claim a credit for your foreign taxes in 2022 you would be allowed a

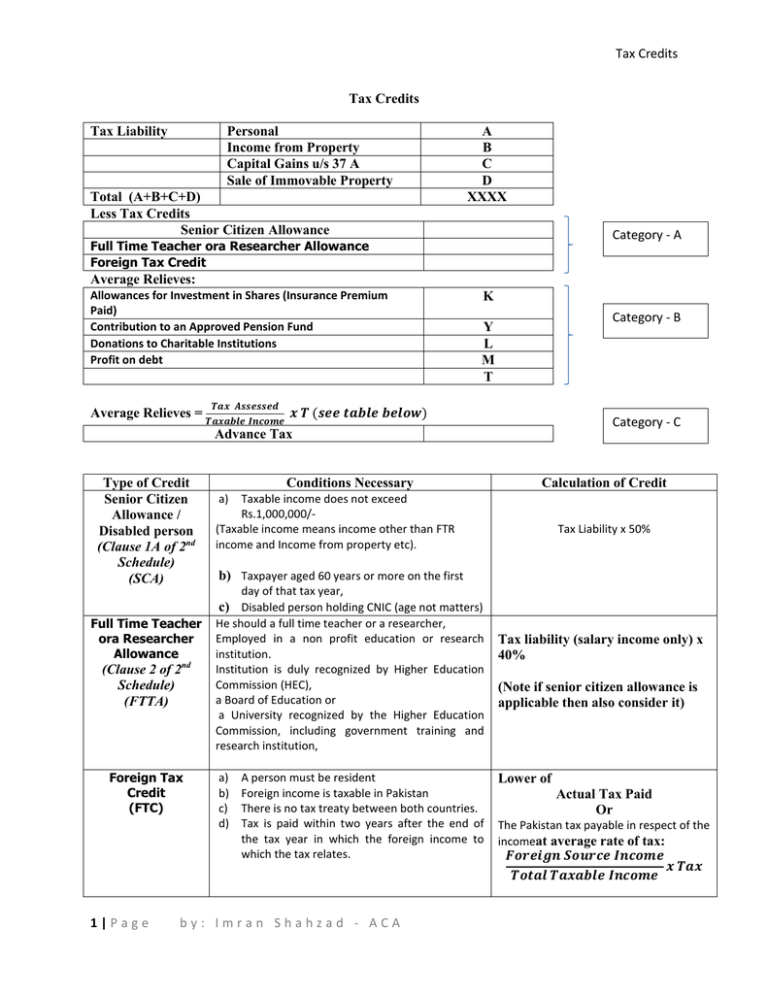

Individuals estates and trusts can use the foreign tax credit to reduce their income tax liability Additionally taxpayers can There are a few foreign tax credit limitations for U S expats you can t just claim it on any income earned abroad To get your maximum credit amount and income limit you ll divide your foreign

Foreign Tax Credit Time Limit

Foreign Tax Credit Time Limit

https://www.wallstreetmojo.com/wp-content/uploads/2021/02/what-is-foreign-tax-credit.png

File

https://s2.studylib.net/store/data/010052453_1-7db53f4f4f719eafe31b10899d4f6169-768x994.png

Foreign Tax Credit USA

https://kotaxusa.com/wp-content/uploads/2022/03/A-Complete-Guide-of-foreign-tax-credit-.jpeg

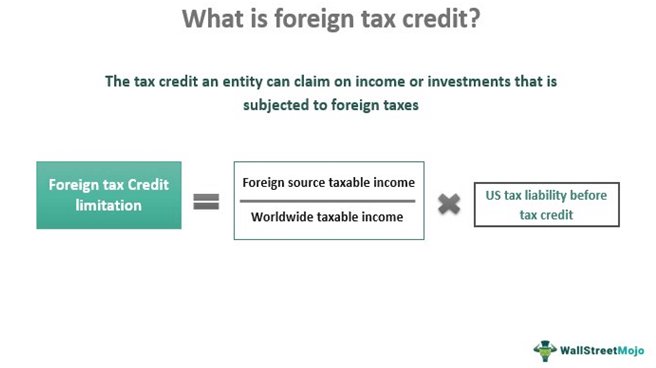

In general the foreign earned income exclusion allows you to treat up to 120 000 of your income in 2023 taxes due in 2024 as not taxable by the United According to the IRS your Foreign Tax Credit Limitation is your total US tax liability multiplied by the fraction of your foreign income over your total worldwide income In its essence the limitation allows the

The Foreign Tax Credit FTC is a non refundable tax credit designed to alleviate this burden for U S citizens who earn income abroad by offsetting taxes paid to Portfolio 6060 1st The Foreign Tax Credit Limitation Under Section 904 Learn about one part of the U S foreign tax credit mechanism the foreign tax credit

Download Foreign Tax Credit Time Limit

More picture related to Foreign Tax Credit Time Limit

San Francisco Foreign Tax Credit Attorney SF Tax Counsel

https://sftaxcounsel.com/wp-content/uploads/2020/07/shutterstock_1719160864.jpg

Calculating The Credit How Foreign Tax Credits Work HowStuffWorks

https://resize.hswstatic.com/w_1200/gif/foreign-tax-credit-orig.jpg

Claiming The Foreign Tax Credit With Form 1116 TurboTax Tax Tips Videos

https://digitalasset.intuit.com/IMAGE/A2s0UrkOy/Claiming_the_Foreign_Tax_Credit_with_Form_1116.jpg

On 4 January 2022 the United States US Treasury Department published its third set of final regulations T D 9959 the Final Regulations on foreign tax credits since the This week a welcome delay In July the IRS announced a temporary reprieve to the implementation of new foreign tax credit regulations So what effect will

Relief for Foreign Tax Paid 2021 HS263 Updated 6 April 2023 If you ve paid foreign tax on income received or capital gains made that are also taxable in the UK Relief for Foreign Tax Paid 2022 HS263 Updated 6 April 2023 The following guidance includes calculations If you ve paid foreign tax on income received or capital gains

Foreign Tax Credit Processing Of Tax Returns HLS 2234 Harvard

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/d18218b6267fdbd1e87d7cd894b93d27/thumb_1200_1553.png

How To Soothe Withholding Tax Pain On U S Dividends The Globe And Mail

https://www.theglobeandmail.com/resizer/77RGya3_skR6j2KS_FxmBXttGpk=/1200x675/filters:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/tgam/FTGQKRQ5ENFUJDLISVPNPCCDEQ

https://www.irs.gov/publications/p514

For 2022 your foreign tax credit limit is 700 If you choose to claim a credit for your foreign taxes in 2022 you would be allowed a

https://www.investopedia.com/terms/f/foreig…

Individuals estates and trusts can use the foreign tax credit to reduce their income tax liability Additionally taxpayers can

2021 Foreign Earned Income Exclusion And Tax Rates Premier Offshore

Foreign Tax Credit Processing Of Tax Returns HLS 2234 Harvard

How Do I Claim Foreign Tax Credit In USA Leia Aqui Can A US Citizen

Is Foreign Tax Credit Allowed For Taxes That Are Paid Or Accrued

Foreign Tax Credits Insights From The Tax Lawyer

Foreign Tax Credit Form 1116

Foreign Tax Credit Form 1116

Foreign Tax Credit Part 9 Losses And Recap Of 9 Videos YouTube

Form 1116 How To Claim The Foreign Tax Credit

Foreign Tax Credit How To Claim Tax Credit On Foreign Income

Foreign Tax Credit Time Limit - Foreign income earned by your Singapore company may be subject to taxation twice once in the foreign jurisdiction and a second time when the foreign income is remitted into

/cloudfront-us-east-1.images.arcpublishing.com/tgam/FTGQKRQ5ENFUJDLISVPNPCCDEQ)