Foreign Tax Credit Us For foreign tax credit purposes all qualified taxes paid to U S possessions are considered foreign taxes For this purpose U S possessions include Puerto Rico the U S Virgin Islands Guam the Northern Mariana Islands and American Samoa

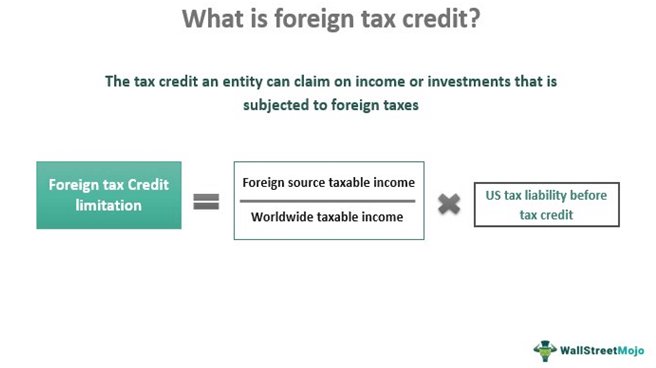

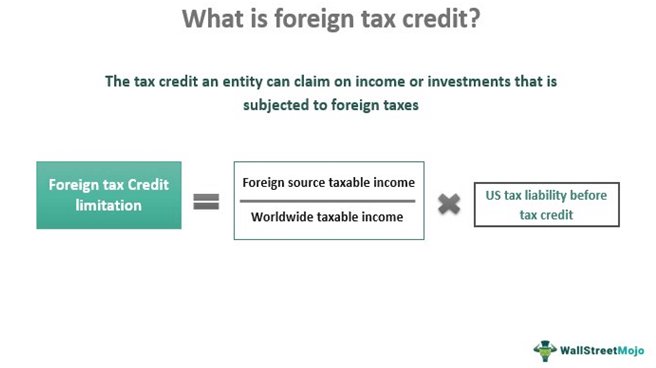

You can claim a foreign tax credit only for foreign taxes on income war profits or excess profits or taxes in lieu of those taxes In addition there is a limit on the amount of the credit that you can claim Your foreign tax credit is the amount of foreign tax you paid or accrued or if smaller the foreign tax credit limit The foreign tax credit is a U S tax break that offsets income tax paid to other countries The credit is available to U S citizens and residents who earn income abroad and have paid

Foreign Tax Credit Us

Foreign Tax Credit Us

https://www.ustaxhelp.com/wp-content/uploads/Tax-Credits-1024x683-768x512.jpg

What Is A Tax Credit Tax Credits Explained

https://media.valuethemarkets.com/img/Whatisataxcredit__685660f27b96fbc6e0edb67eb5c59039.jpg

Demystifying The Form 1118 Foreign Tax Credit Corporations Part 2

https://sftaxcounsel.com/wp-content/uploads/2020/06/shutterstock_339923021.jpg

What is the Foreign Tax Credit The US Foreign Tax Credit allows Americans who pay foreign income taxes to reduce their overall US tax liability How For every dollar paid in foreign taxes expats are able to claim a credit for foreign taxes paid on their US tax bill To illustrate let s consider a Foreign Tax Credit example Tony a The foreign tax credit is a U S tax credit for income tax paid to other countries The general objective is to help taxpayers avoid double taxation on foreign income Taxpayers can

The 2021 Final Regulations are among the most significant developments in the US FTC regime during its 100 year existence as they fundamentally change the definition of what is a creditable foreign income tax under Sections 901 and 903 The regulations are expected to reduce significantly the amount of FTCs that taxpayers may 1 You re an American expat living abroad 2 You earn income in your host country or anywhere 3 Your annual global income is more than IRS Foreign Tax Credit minimum filing thresholds If you re checking all the boxes above you have to

Download Foreign Tax Credit Us

More picture related to Foreign Tax Credit Us

Foreign Tax Credit Eligibility Limits Form 1116 How To Claim

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiGVYW453n0rJ9HYr-WXTuCc_WbHgGJWBCYnfCvgMCYM2kOSi3Mdhn_in3bsrltNXQIKQUe0yhET4vk19FZxJ0BZCYG-av-JnS8vbDxBC2d6ofxaHs3xjcxYX4HsnMWKOSo-3vtJo5vItO1VTWWxSAFNP3Pnfbczcr50ZyDgHE_LerNoBR33vy44mQC/s928/ftc.jpg

Tax Accounting Services Lee s Tax Service

https://leestaxservicellc.com/files/IMG_1348.png

The U S Foreign Tax Credit Guide For Expats Expat US Tax

https://www.expatustax.com/wp-content/uploads/2021/06/Foreign-Tax-Credit.jpg

Executive summary On 4 January 2022 the United States US Treasury Department published its third set of final regulations T D 9959 the Final Regulations on foreign tax credits since the enactment of the Tax Cuts and Jobs Act TCJA The Final Regulations adopt proposed regulations that were published on 12 November 2020 the Proposed What is the Foreign Tax Credit The Foreign Tax Credit FTC is one method U S expats can use to offset foreign taxes paid abroad dollar for dollar Tax credits in general work like this If you owe the U S government 1 500 in taxes and you have a 500 tax credit you ll end up only owing 1 000 and the Foreign Tax Credit

Proposed regulations forthcoming On Dec 11 2023 the IRS and Treasury announced their intent to issue proposed regulations to address the application of the foreign tax credit FTC and dual consolidated loss DCL rules in relation to certain types of taxes described in the Tax Challenges Arising from the Digitalisation of the Economy The Foreign Tax Credit allows American expatriates to offset their United States tax liability with foreign income tax obligations Some taxpayers may not be able to use it such as those who only have income from sources within the United States and those that do not pay any foreign taxes Instead of claiming the foreign tax credit on

Foreign Tax Credit Meaning Example Limitation Carryover

https://www.wallstreetmojo.com/wp-content/uploads/2021/02/what-is-foreign-tax-credit.png

Foreign Tax Credits A Complete Guide

https://taxsaversonline.com/wp-content/uploads/2022/06/Foreign-Tax-Credits.jpg

https://www.irs.gov/.../foreign-taxes-that-qualify-for-the-foreign-tax-credit

For foreign tax credit purposes all qualified taxes paid to U S possessions are considered foreign taxes For this purpose U S possessions include Puerto Rico the U S Virgin Islands Guam the Northern Mariana Islands and American Samoa

https://www.irs.gov/individuals/international...

You can claim a foreign tax credit only for foreign taxes on income war profits or excess profits or taxes in lieu of those taxes In addition there is a limit on the amount of the credit that you can claim Your foreign tax credit is the amount of foreign tax you paid or accrued or if smaller the foreign tax credit limit

Foreign Tax Credit USA

Foreign Tax Credit Meaning Example Limitation Carryover

Foreign Tax Credit

Calculating The Credit How Foreign Tax Credits Work HowStuffWorks

Foreign Tax Credit For U S Citizens And Residents

Foreign Tax Credit For U S Citizens And Residents

San Francisco Foreign Tax Credit Attorney SF Tax Counsel

Claiming The Foreign Tax Credit With Form 1116 TurboTax Tax Tips Videos

Is Foreign Tax Credit Allowed For Taxes That Are Paid Or Accrued

Foreign Tax Credit Us - The credit is a general business credit equal to 25 of qualified first year wages for employees employed at least 120 hours but fewer than 400 hours and 40 of qualified wages for those employed 400 hours or more for a maximum credit of USD 2 400 per qualified employee There are exceptions providing for increased wage eligibility and