France Tax Refund Rate For Tourist Verkko 24 lokak 2023 nbsp 0183 32 As a visitor to France you may be eligible to buy goods tax free and get a refund on the Value Added Tax VAT you paid during your stay This guide will walk you through the process of obtaining a VAT refund step by step making your shopping experience in France even more enjoyable cheaper

Verkko Guide to VAT refund for visitors to the EU If you are a visitor to the EU and are about to leave EU territory to go home or to some other place outside the EU you may be able to buy goods free of VAT Verkko 17 marrask 2022 nbsp 0183 32 Non EU residents are entitled to VAT refunds la d 233 taxe on some purchases made in the EU and since Brexit this also applies to permanent British residents In France VAT taxe sur la valeur ajout 233 e TVA is applied at 20 on most items but only 2 1 on newspapers for example and it is possible to get this

France Tax Refund Rate For Tourist

France Tax Refund Rate For Tourist

https://newyork.consulfrance.org/local/cache-vignettes/L945xH675/50346d94a5ddda50-c6811.jpg?1678899092

France Approves Tax On Big Tech And U S Threatens To Retaliate NPR

https://media.npr.org/assets/img/2019/07/11/gettyimages-1154865535_wide-e06a627898fcdf0c82387932cbdb3171116cf2ae.jpg

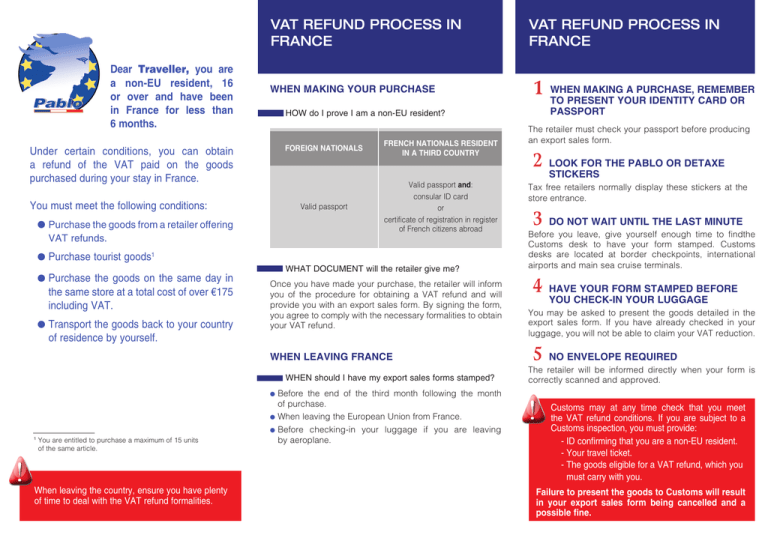

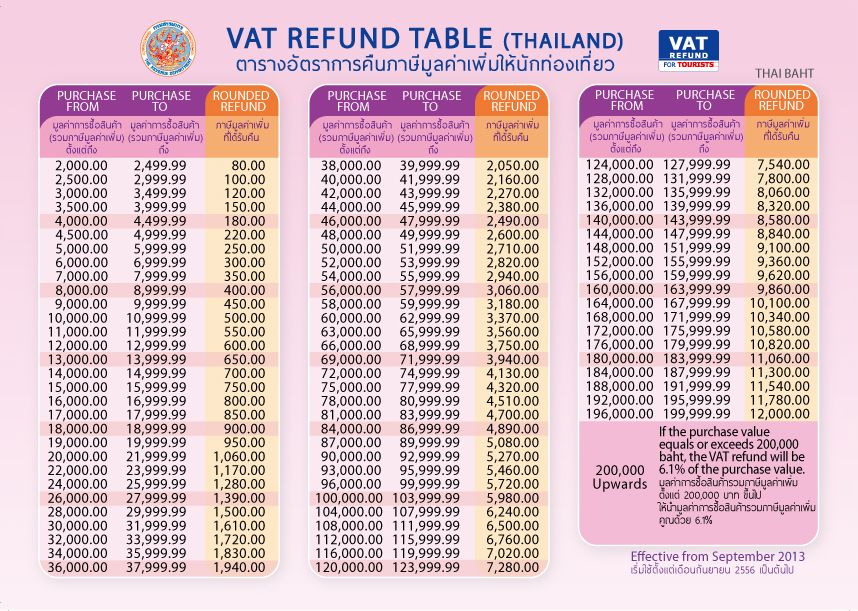

Thailand Offers VAT Refund For Tourists Thailand Insider

https://thailandinsider.com/wp-content/uploads/2022/12/1124-20937-1086x1536.jpeg

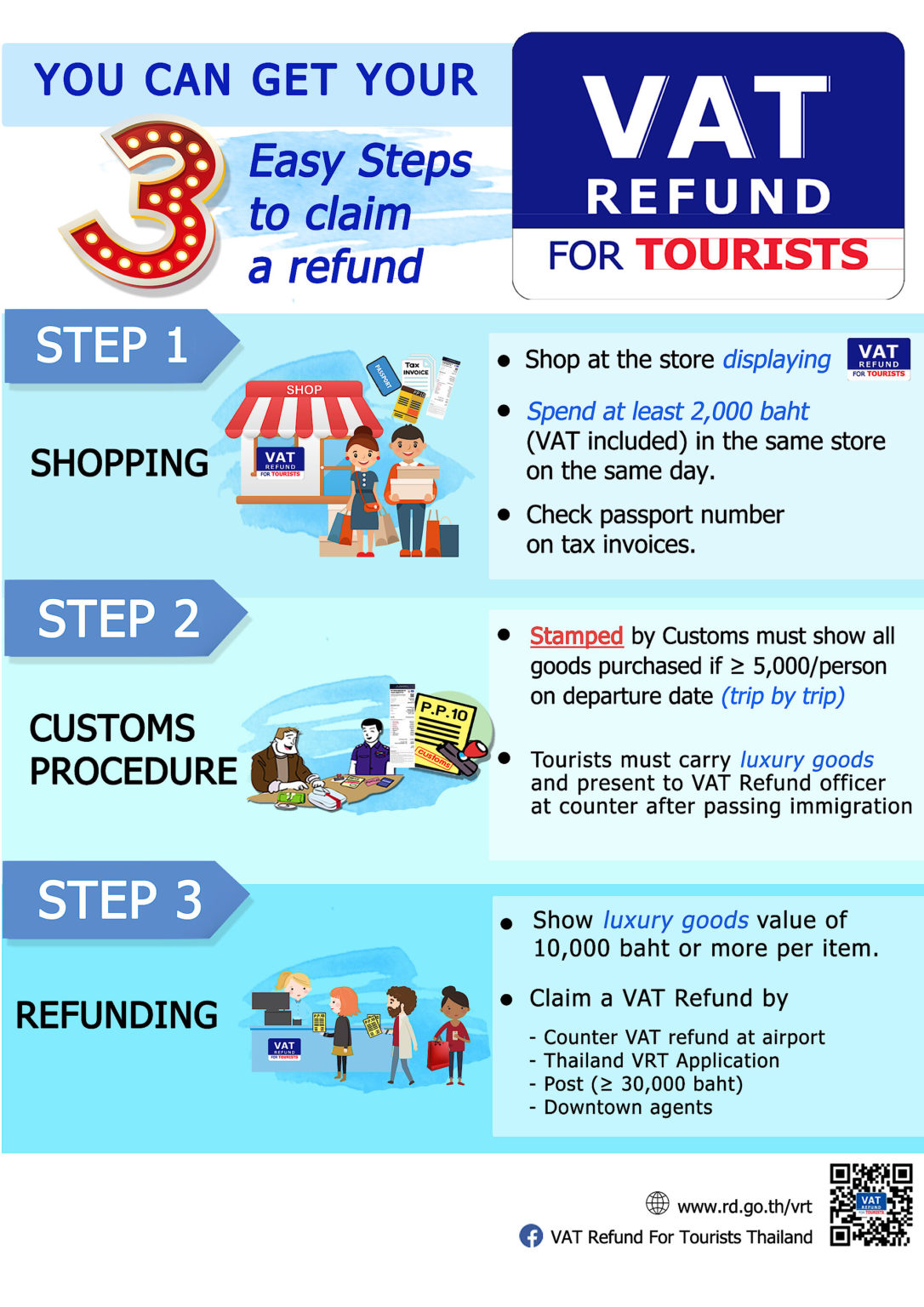

Verkko Here s the best news in August 2021 the minimum amount of your purchase decreased from 175 to 100 While the typical tax is 20 the average refund is 12 It could be higher or lower depending on the purchase Qualifying To Get The Euro VAT Tax Refund In order to qualify for the VAT refund Verkko Text and images are attributed to their respective sources Courtesy of the French Embassy this document explains the necessary paperwork and procedures that non EU visitors must follow to qualify for a 12 value added tax refund on purchases made in

Verkko 8 maalisk 2020 nbsp 0183 32 To be able to get a VAT Refund also called detaxe you should meet the following You should be a visitor in France Shouldn t be living in France for more than 6 months Have to be more than 15 years old Spend more than 175 Euros on the same store in the same day Get a valid customs stamp upon leaving the EU and Verkko Direction G 233 n 233 rale des Douanes Who can benefit from the tax refund VAT refunds The tax refund can be granted to the buyer who follow those 3 conditions your primary residence is located in a non EU country purchase made outside EU over 16 years of age minimum have made purchases for an amount of more than 100 including tax

Download France Tax Refund Rate For Tourist

More picture related to France Tax Refund Rate For Tourist

How To Apply For The EU VAT Refund In France France Travel Tips

https://www.francetraveltips.com/wp-content/uploads/2022/06/Tax-refund-area-at-Charles-de-Gaulle-airport-1-780x585.jpeg

Purchases Made In France Tax Refund Made Easy

https://s2.studylib.net/store/data/018048964_1-b8e11edaf9cabb8232522829f93ff766-768x994.png

Vat Refund Calculator StormTallulah

https://www.rd.go.th/fileadmin/user_upload/kortor/images/Vat-Refund-Sheet1.jpg

Verkko Verified 01 January 2023 Legal and Administrative Information Directorate Prime Minister Ministry of Finance The sale in tax free form is an exemption from value added tax VAT on the Verkko Pablo Douchette D 233 taxeEN FRANCE SIMPLIFIEZ VOUS LA D 201 TAXE AVEC PABLOp Dear Traveller you are a non EU resident 16 or over and have been in France for less than 6 months Under certain conditions you can obtain a refund of the VAT paid on the goods purchased during your stay in France You must meet the following conditions

Verkko Welcome to sejour tax A quick and easy way to view and calculate French tourism taxes Our calculator uses the data collected in the OCSITAN application The current file in use here is version 2 1 2 dated 10 10 2023 Verkko Mise 224 jour le 18 07 2023 If your primary residence is in a non EU country you may be eligible for a refund of the VAT on the price of goods you purchased in France VERSION FRAN 199 AISE French Customs is in no way responsible for reimbursing the VAT paid on purchases made in France

Tax free Shopping In France Complete Guide To Getting Your VAT Refund

https://images.squarespace-cdn.com/content/v1/5eccccff3108d31237957f5a/891c940a-7a1f-4e06-829e-b3b4390bdaed/Tax-free+shopping+in+France+–+the+complete+guide+to+getting+your+VAT+refund+when+leaving+from+Paris+airports+and+train+stations-4

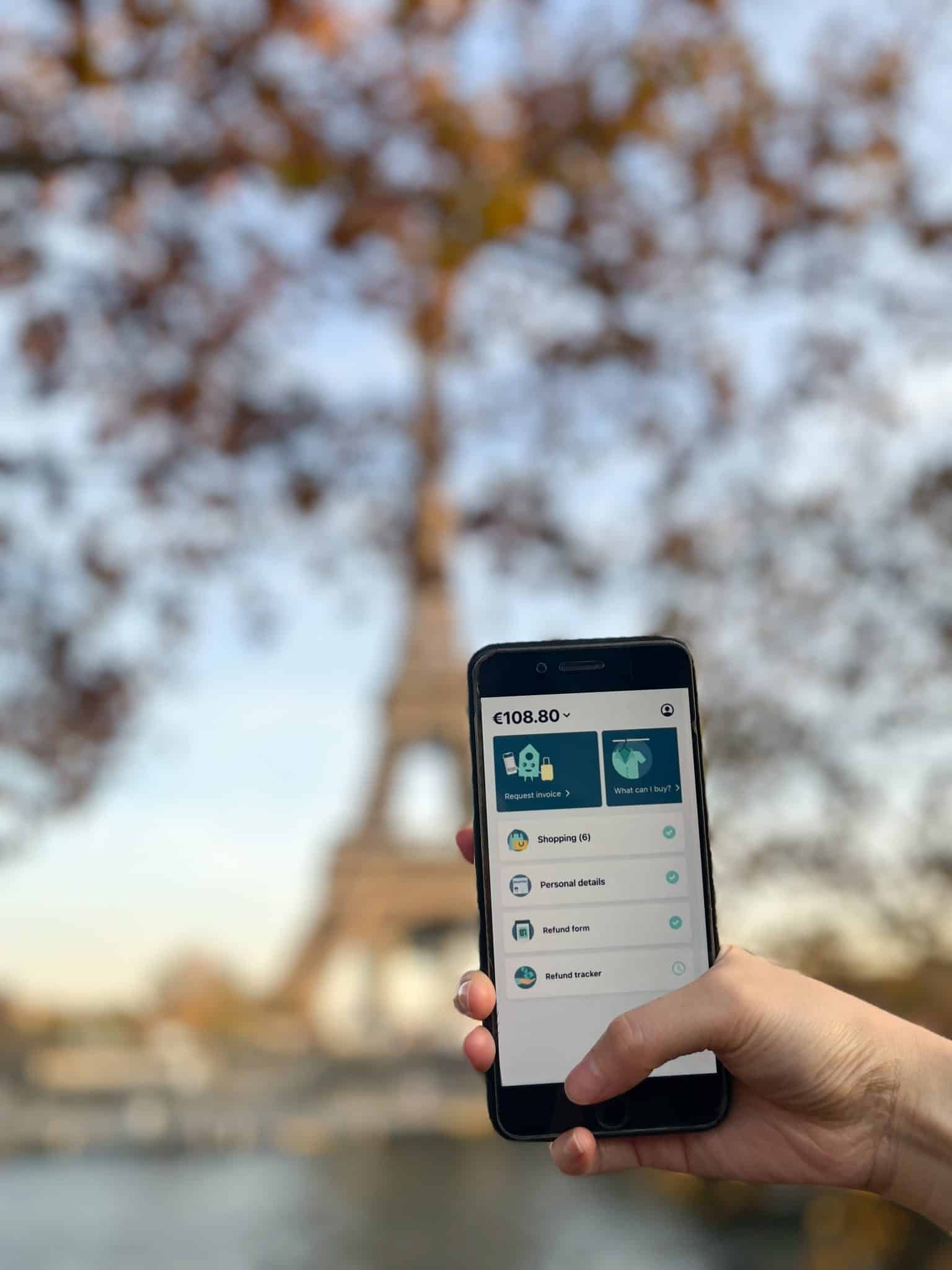

New Digital VAT Tax Refund Process In Paris France With Wevat Petite

https://petiteinparis.com/wp-content/uploads/2021/12/digital-tax-refund-process-1-1536x2048.jpg

https://www.vatrefund.org/countries/france

Verkko 24 lokak 2023 nbsp 0183 32 As a visitor to France you may be eligible to buy goods tax free and get a refund on the Value Added Tax VAT you paid during your stay This guide will walk you through the process of obtaining a VAT refund step by step making your shopping experience in France even more enjoyable cheaper

https://taxation-customs.ec.europa.eu/guide-vat-refund-visitors-eu

Verkko Guide to VAT refund for visitors to the EU If you are a visitor to the EU and are about to leave EU territory to go home or to some other place outside the EU you may be able to buy goods free of VAT

How To Get Your VAT Refund In Paris Charles De Gaulle Airport France

Tax free Shopping In France Complete Guide To Getting Your VAT Refund

How To Get A Travel Tax Refund When Leaving The EU

Tax Refund In France All You Need To Know May 2024 Update

France Corporate Tax Rate Forecast

How To Apply For A Tax Refund Theatrecouple12

How To Apply For A Tax Refund Theatrecouple12

How To Apply For The EU VAT Refund In France France Travel Tips

Tax free Shopping In France How To Claim VAT Refunds If Leaving France

France Corporate Tax Rate 2022 Data 2023 Forecast 1981 2021

France Tax Refund Rate For Tourist - Verkko 2 kes 228 k 2021 nbsp 0183 32 To find out the amount of the tourist tax payable you can consult this online service Tourist tax rates per municipality In addition the amount of the tax must be displayed at the lodger the