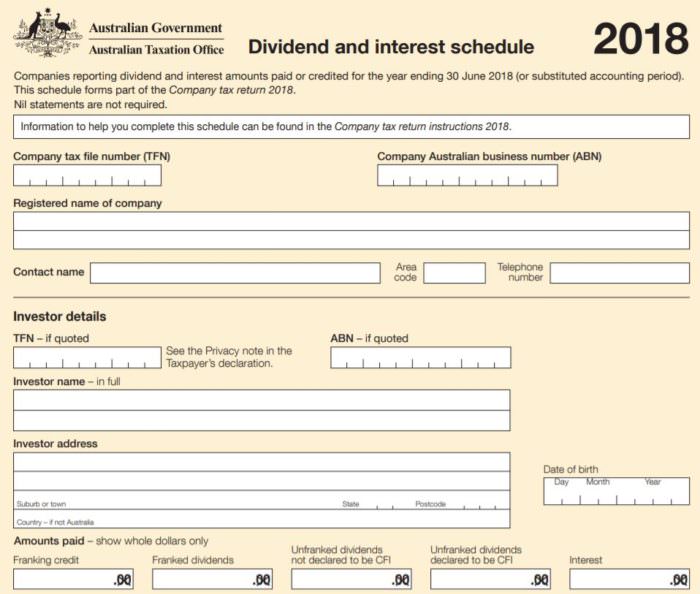

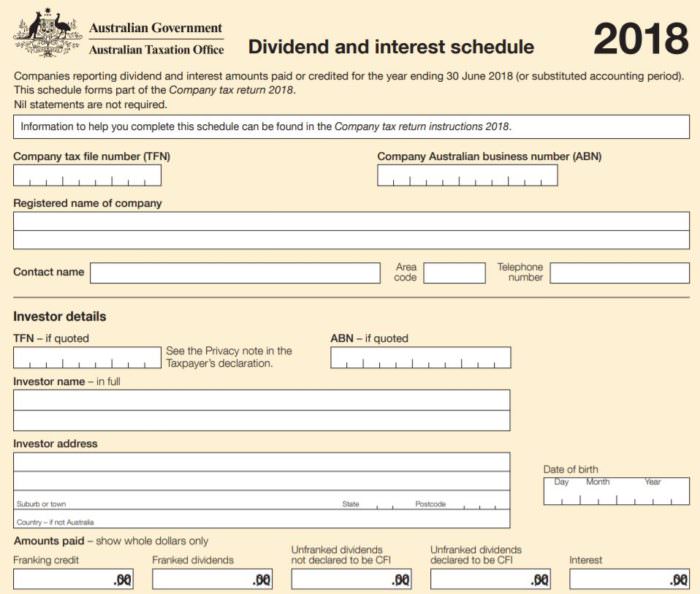

Franking Credit Rebate Form Web Application for refund of franking credits for individuals 2021 1 July 2020 to 30 June 2021 For individuals who do not need to lodge a tax return You must read the publication

Web 9 oct 2021 nbsp 0183 32 You can do a computer search for ATO form NAT4098 Application for refund of franking credits for individuals fill it in and mail it to the ATO Or you can fill in the Web 30 juin 2023 nbsp 0183 32 Refunding excess franking credits individuals If you received excess franking credits you may be eligible for a refund Find out how to apply On this page

Franking Credit Rebate Form

Franking Credit Rebate Form

https://iorder.com.au/upload/image/publications/ex_4098-6.2019_full.jpg

Franking Credits Made Easy

https://www.firstlinks.com.au/uploads/wp/ATO-return-franking-700x594.jpg

Search Publication

https://iorder.com.au/upload/image/publications/ex_4098-6.2021_full.jpg

Web You can apply for your 2021 refund of franking credits any time after 1 July 2021 either by phone or by post To apply for a refund fill in one of the applications at the back of this Web Instructions for shareholders with franking credits Refund of franking credits instructions and application for individuals 2021 To help you claim a refund for franking credits if you

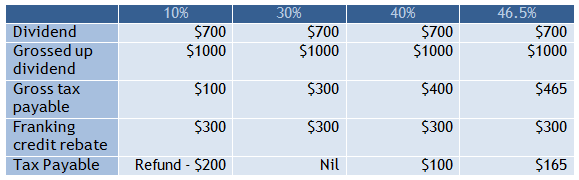

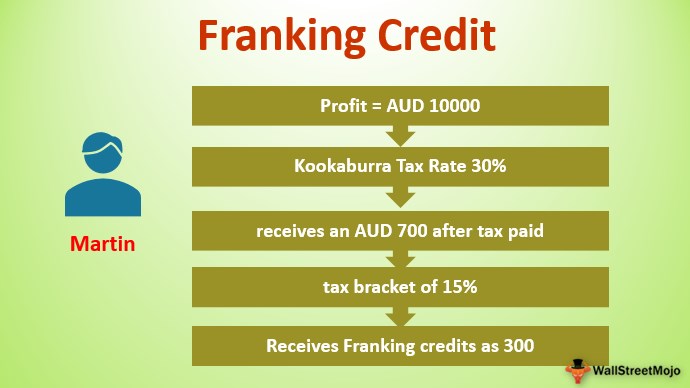

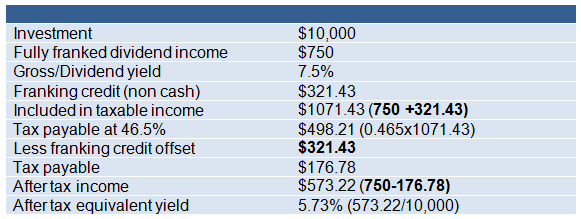

Web 22 ao 251 t 2019 nbsp 0183 32 Published August 22 2019 Updated January 6 2023 What is Franking Credit Also known as imputation credit franking credit is a type of tax credit that Web Formula The franking credit depends on the individual tax rate and differs from person to person however we have a standard formula for the franking credit calculator which helps to understand the tax rebate

Download Franking Credit Rebate Form

More picture related to Franking Credit Rebate Form

Dividend Imputation System Franking Credits Explained Calculations

http://s.stockwatch.com.au/Assets/Images/franking-credits-fig3.png

Form To Request Payment Of Franking Credits For Individuals Australia

https://jardinesdecastalia.com/blogimgs/http/cip/www.ferraiuoli.com/wp-content/uploads/Large-Taxpayers-2.jpg

Application For Refund Of Franking Credits 2017 Instructions

https://jewelryrepairfayetteville.com/pictures/794001.gif

Web 10 mai 2022 nbsp 0183 32 If charities received fully franked dividends then they are able to apply for a refund of the franking credits In previous years in most cases a charity was required to Web Refund of franking credits standalone short form To lodge this form with the ATO the applicant must be claiming a refund of franking credits and have no requirement to

Web Franfinance un espace client aux fonctions les plus avantageuses G 233 rer vos contrats en ligne en toute facilit 233 Profiter de votre programme de fid 233 lit 233 Carr 233 Priv 233 jusqu 224 20 Web 28 juil 2020 nbsp 0183 32 Franking credit dividend amount 1 company tax rate dividend amount If an investor receives a 70 dividend from a company paying a 30 tax rate their full

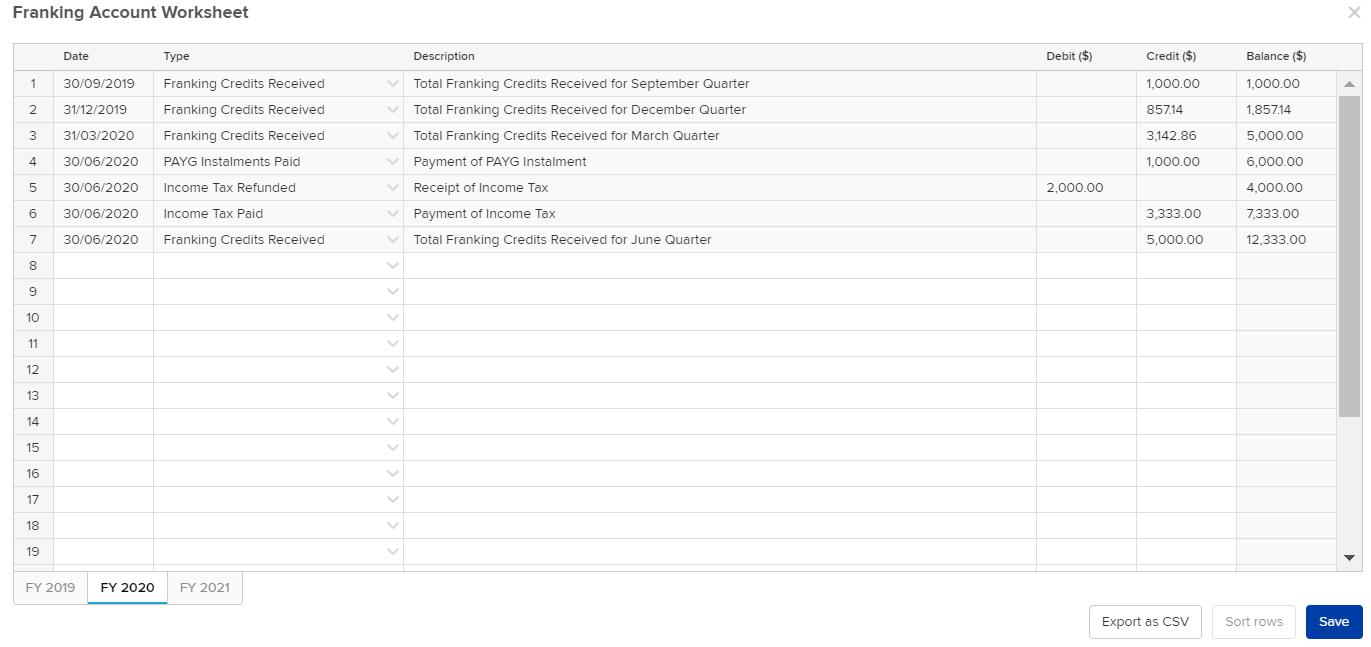

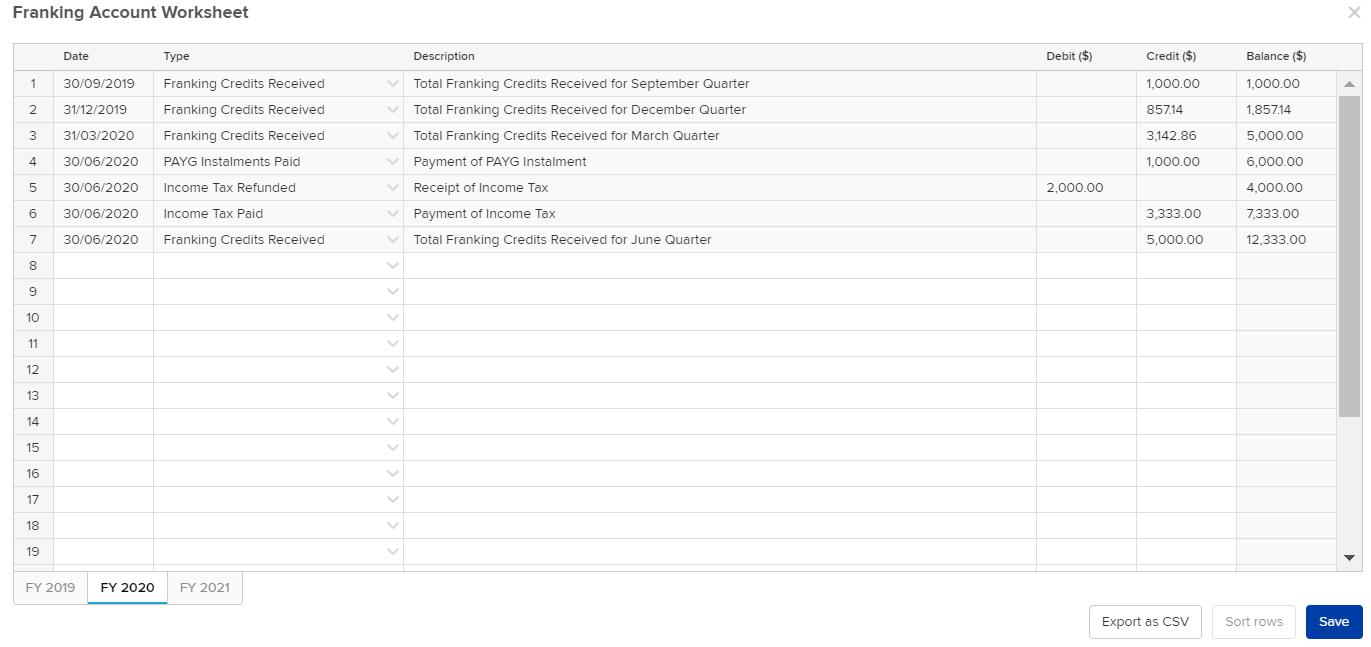

Understanding Franking Credits LodgeiT

https://lodgeit.s3-ap-southeast-2.amazonaws.com/help/image/ato1.png

Search Publication

https://iorder.com.au/upload/image/publications/ex_0656-6.2021_full.jpg

https://www.ato.gov.au/uploadedFiles/Content/IND/Downloa…

Web Application for refund of franking credits for individuals 2021 1 July 2020 to 30 June 2021 For individuals who do not need to lodge a tax return You must read the publication

https://www.smh.com.au/money/super-and-retirement/various-ways-to...

Web 9 oct 2021 nbsp 0183 32 You can do a computer search for ATO form NAT4098 Application for refund of franking credits for individuals fill it in and mail it to the ATO Or you can fill in the

Solved Question 2 5 Marks Xylophone Pty Ltd Is A Private Company

Understanding Franking Credits LodgeiT

Franking Credit Formula Examples How To Calculate

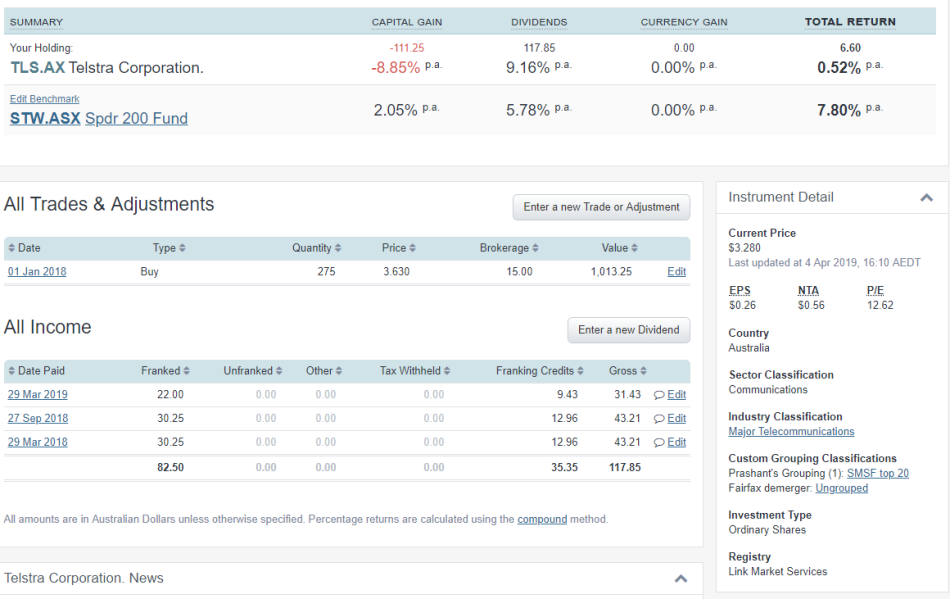

Franking Credits Are Super For Your SMSF

Dividend Imputation System Franking Credits Explained Calculations

Franking Account Worksheet Simple Invest 360

Franking Account Worksheet Simple Invest 360

Franking credits formula Rask Education

The Curious Case Of Franking Credits And The FIRE Community Aussie

How To Calculate Franking Credits On Your Investment Portfolio Sharesight

Franking Credit Rebate Form - Web 10 nov 2022 nbsp 0183 32 Opinion Franking credit broken promise is Labor s retirement tax 2 0 Eliminating the payment of franked dividends to Australian investors through off market