Franking Credits Labor Policy Explained Print article Explainer Why is Labor reviewing franking credits John Kehoe Economics editor Sep 26 2022 5 00am The Albanese government is proposing to stop companies paying

Wikipedia 51K views 4 years ago Labor s proposed changes to franking credits tax credits used by some retirees to minimise tax remain one of the key difference between Franking credit broken promise is Labor s retirement tax 2 0 Eliminating the payment of franked dividends to Australian investors through off market share buybacks is an underhand

Franking Credits Labor Policy Explained

Franking Credits Labor Policy Explained

https://i.ytimg.com/vi/puqGW0xryUo/maxresdefault.jpg

Franking Credits Explained Where Are We Now

https://www.elliotwatson.com.au/wp-content/uploads/2019/04/photo-of-computer-scaled.jpg

Franking Credits Explained Where Are We Now

https://www.elliotwatson.com.au/wp-content/uploads/2019/04/retirees-in-their-garden-scaled.jpg

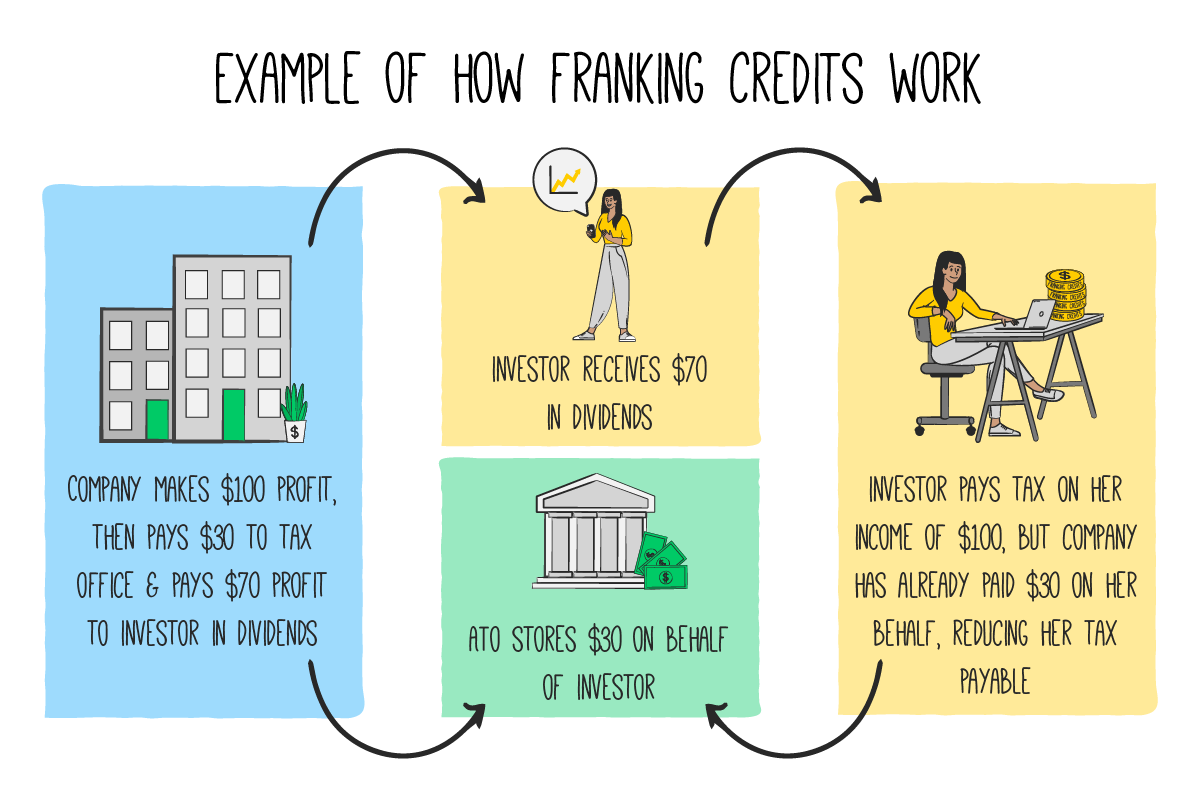

Dominic Lorrimer So what are franking credits and who benefits from them In short the credits represent tax that has already been paid by a company on your investment They relate only to Australian shares and then only to the portion of profits Australian companies have generated within Australia and paid Australian company Franking Credits Explained The goal of franking credits is essentially to prevent double taxation Franking credits work like this when a company earns a profit it is required to pay

Oct 5 2022 8 46am Assistant Treasurer Stephen Jones has signalled the government will consider delaying the start date of its crackdown on franked dividends funded by capital raisings but Franking credits are back on the agenda with the latest attempt by Labor to ensure that only distributions equivalent to realised profits can be franked It s small bikkies in the scheme of things with

Download Franking Credits Labor Policy Explained

More picture related to Franking Credits Labor Policy Explained

Dividend Franking Credits Explained Man Of Many

https://manofmany.com/wp-content/uploads/2020/07/Franking-Credits-768x512.jpg

Who Will Be The Losers Under Labor s Proposed Franking Credit Change

https://unitypartners.com.au/wp-content/uploads/2018/03/franking-credit.jpg

Franking Credits Explained Plus 1 Group

https://plus1group.com.au/wp-content/uploads/2021/10/franking-credit.png

What are franking credits It s complicated Very complicated In essence they are a rebate that some Australian shareholders receive from the government at tax time Shareholders are entitled to a slice of the company s profits or It is called an imputation system as the tax paid by a company may be imputed or attributed to shareholders by way of a franking credit which is attached to the dividend This is how the taxes paid by the company at a maximum rate of 30 per cent are allocated to shareholders Franked dividends

Franking credits explained For those relying on their share portfolio in retirement Labor s plan to curtail cash refunds of excess franking credits has many retirees worried Labor says the changes will not affect pensioners but the Coalition disagrees So where does the truth lie Guest Keating s dividend imputation system worked by attaching a tax credit called a Franking Credit to each dividend To avoid double taxation the franking credit attached to each dividend was set at an amount equal to the tax the company had already paid on the profits from which the dividend was paid

Labor s Franking Policy could Be Based On Old Data The Australian

https://content.api.news/v3/images/bin/746aa14d6548b37d96c014350d538256

ETF Tax Distributions DRPs And Franking Credits EVERYTHING Explained

https://www.bestetfs.com.au/wp-content/uploads/2022/07/franking-credits-tax-rask.png

https://www.afr.com/policy/tax-and-super/explainer...

Print article Explainer Why is Labor reviewing franking credits John Kehoe Economics editor Sep 26 2022 5 00am The Albanese government is proposing to stop companies paying

https://www.youtube.com/watch?v=H6LG4Yeh6fE

Wikipedia 51K views 4 years ago Labor s proposed changes to franking credits tax credits used by some retirees to minimise tax remain one of the key difference between

Franking Credits Explained Where Are We Now

Labor s Franking Policy could Be Based On Old Data The Australian

Frank Dividends Franking Credits Chan Naylor

Potential Changes To Labor s Franking Credits Policy Don t Go Far

Franking Credit Refund 2023 Atotaxrates info

Labor Franking Credits Change Labor Signals Delay To Crackdown

Labor Franking Credits Change Labor Signals Delay To Crackdown

ETF Tax Distributions DRPs And Franking Credits EVERYTHING Explained

Labor s Franking Credits Policy Wasn t Fair But Not Why You Might Think

Labor s Franking Credits Policy creates Uncertainty Sky News Australia

Franking Credits Labor Policy Explained - Listen 10m Franking credits explained For those relying on their share portfolio in retirement Labor s plan to curtail cash refunds of excess franking credits has many retirees worried Labor says the changes will not affect pensioners but the Coalition disagrees So where does the truth lie Guest