Franking Credits Tax Refund How to get a copy of the application for refund of franking credits form and instructions What is a refund of franking credits Find out what franking credits are

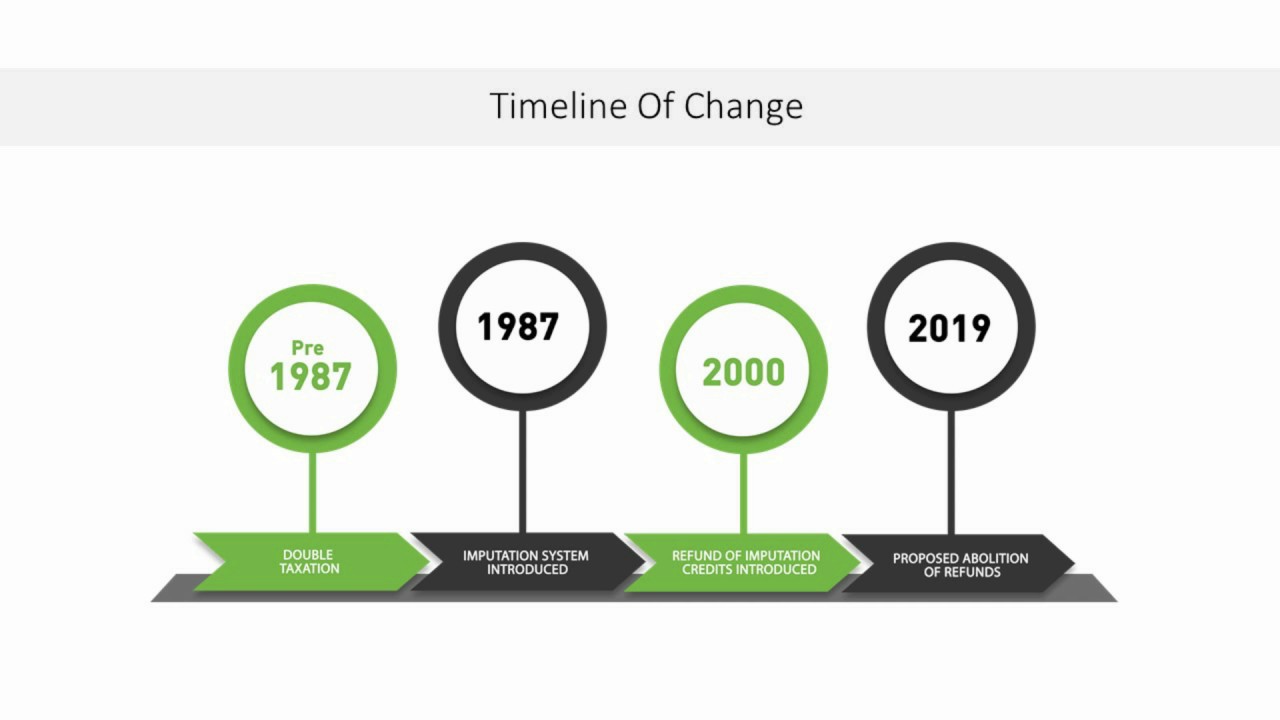

You can claim a tax refund if the franking credits you receive exceed the tax you have to pay This is a refund of excess franking credits You may receive a You can claim a tax refund if the franking credits you receive exceed the tax you have to pay This is a refund of excess franking credits You may receive a refund of

Franking Credits Tax Refund

Franking Credits Tax Refund

https://plato.com.au/wp-content/uploads/Screen-Shot-2022-06-02-at-3.23.45-pm.png

Application For A Refund Of Franking Credits MGI South Qld

https://www.mgisq.com.au/wp-content/uploads/2022/06/Franking-Credits-refund.jpg

ETF Tax Distributions DRPs And Franking Credits EVERYTHING Explained

https://www.bestetfs.com.au/wp-content/uploads/2022/07/franking-credits-tax-rask.png

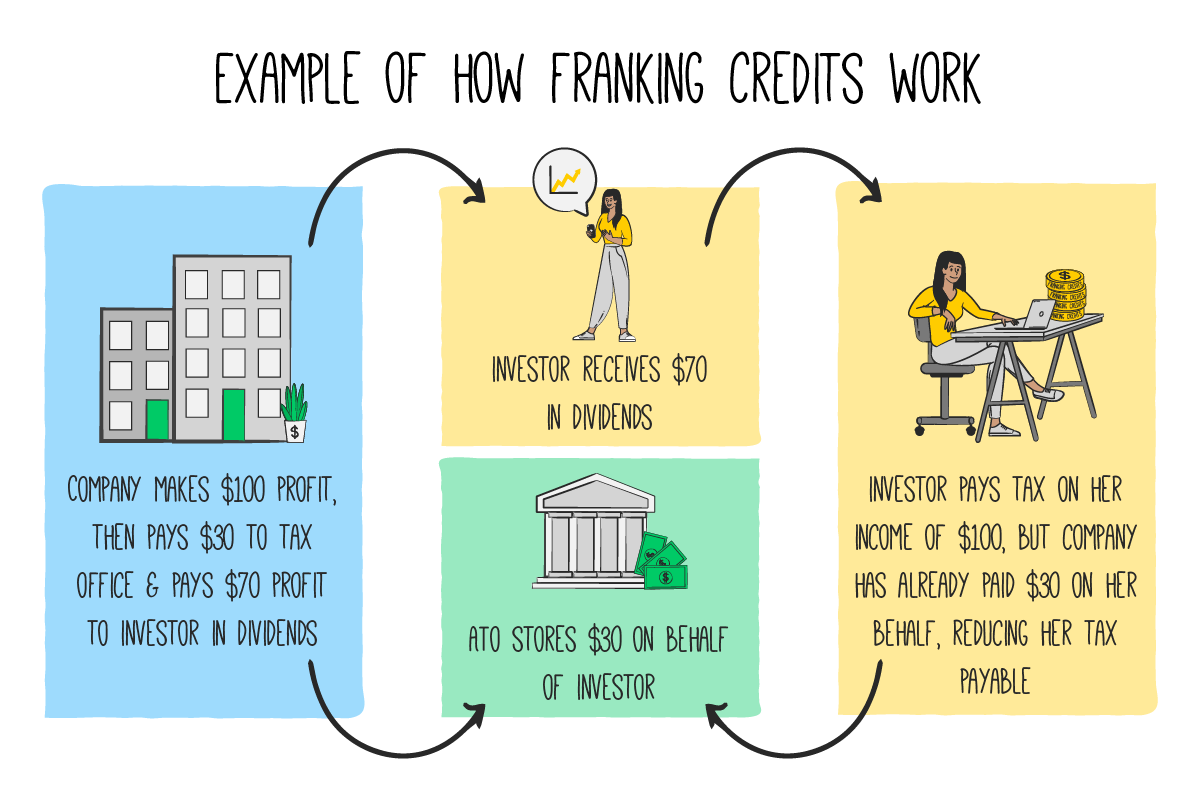

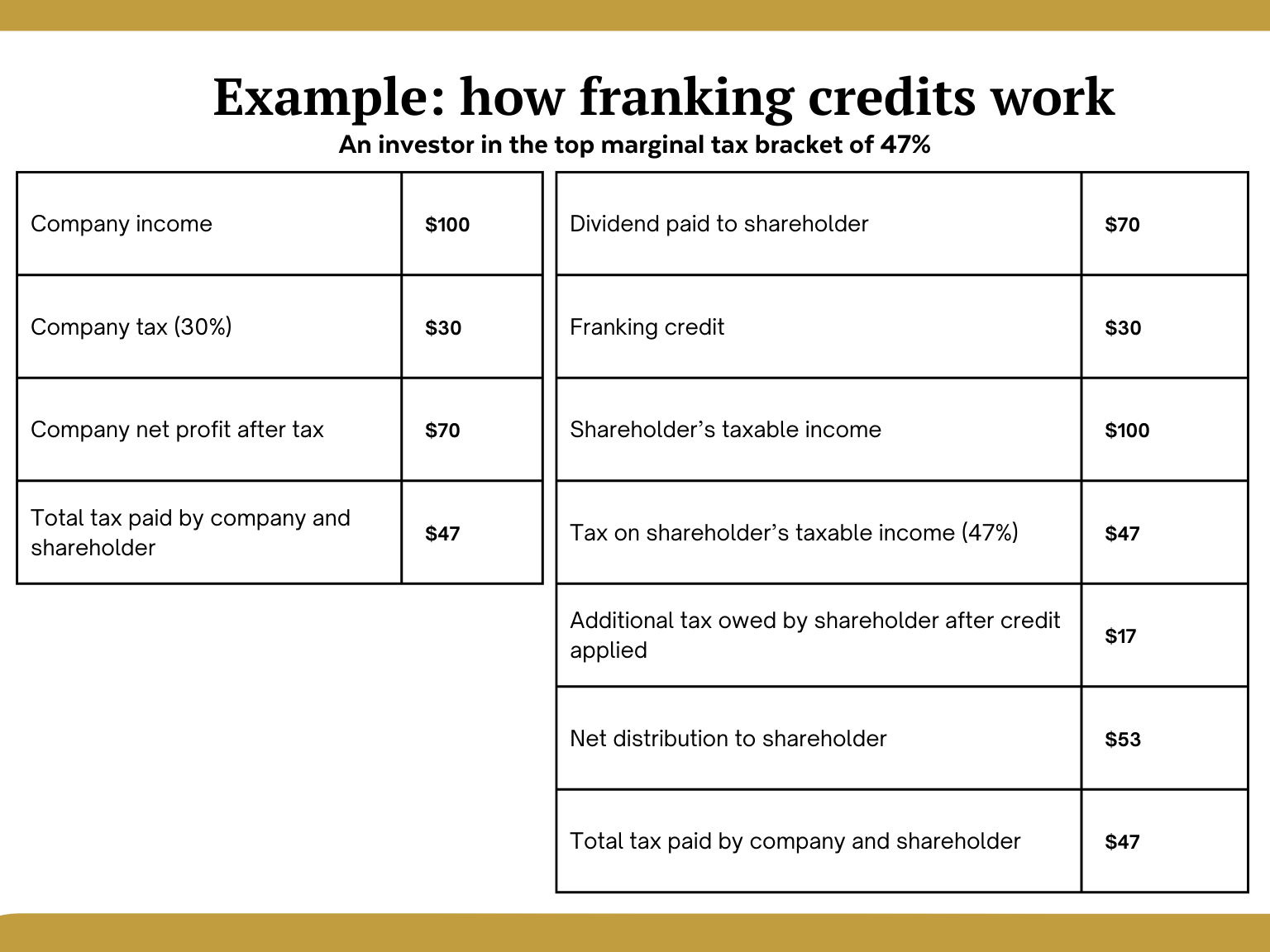

You must be an Australian resident for tax purposes for the whole period 1 July 2022 to 30 June 2023 to apply for a refund of franking credits We work out your Franking credits represent the tax a company has already paid on any profit it distributes to shareholders as a dividend The credits reduce a shareholder s tax liability at the end of the financial year and

In fact if your personal tax rate is less than 30 per cent you can actually receive any excess franking credit as a refund something that is quite attractive to Complete an Application for refund of franking credits 2023 if you re a resident and don t need to lodge a tax return Last updated 24 May 2023 Print or

Download Franking Credits Tax Refund

More picture related to Franking Credits Tax Refund

Franking Credits Refund Ban To Still Begin From 1 July SMS Magazine

https://i0.wp.com/smsmagazine.com.au/wp-content/uploads/2018/09/rc-interim-report.jpg?fit=610%2C260&ssl=1

Franking Credits And Proposed Changes Guide Financial Spectrum

https://s3-ap-southeast-2.amazonaws.com/finspecweb/wp-content/uploads/2019/03/17030142/Franking-credits-resized.png

Refund Of Franking Credits BAN TACS

https://www.bantacs.com.au/wp-content/uploads/2017/10/refund-franking-credit-528x340.jpg

Depending on their tax bracket investors who receive a franking credit may get a reduction in their income taxes or a tax refund Franking credits help promote long term equity You can claim a refund of unused franking credits from the ATO in a number of ways Louie Douvis You can do a computer search for ATO form NAT4098

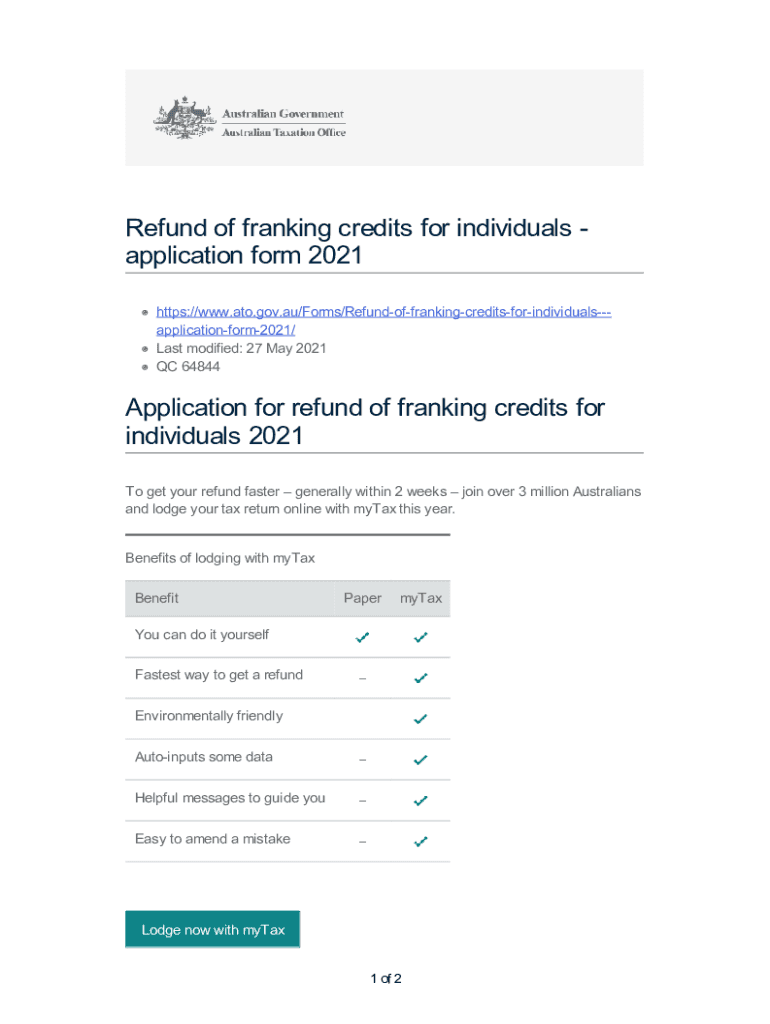

How these instructions can help you to complete the application for refund of franking credits for individuals 2023 For the 2021 22 and future years the Application for refund of franking credits is available for download from the ATO website as a fillable PDF Eligible NFPs will no longer

How Do Franking Credits Work Melior Accounting

https://www.melior.com.au/wp-content/uploads/2016/09/money-1012622__1801-1024x596.jpg

What Are Franking Credits And How Do They Work Financial Autonomy

https://financialautonomy.com.au/wp-content/uploads/2022/10/Tax-2.jpg

https://www.ato.gov.au/forms-and-instructions/...

How to get a copy of the application for refund of franking credits form and instructions What is a refund of franking credits Find out what franking credits are

https://www.ato.gov.au/individuals-and-families/...

You can claim a tax refund if the franking credits you receive exceed the tax you have to pay This is a refund of excess franking credits You may receive a

.png)

The Divide nd Of Income How To Invest For Franking Credits Sara

How Do Franking Credits Work Melior Accounting

Fillable Online Refund Of Franking Credits For Individuals

Understanding Franking Credits Tax Benefits Explained Veye

Labor s Proposed Tax Changes 4 5 Franking Credits YouTube

Franking Credits Explained What Are They And How Do They Work

Franking Credits Explained What Are They And How Do They Work

Franking Credits Guidelines Expat US Tax

Search Publication

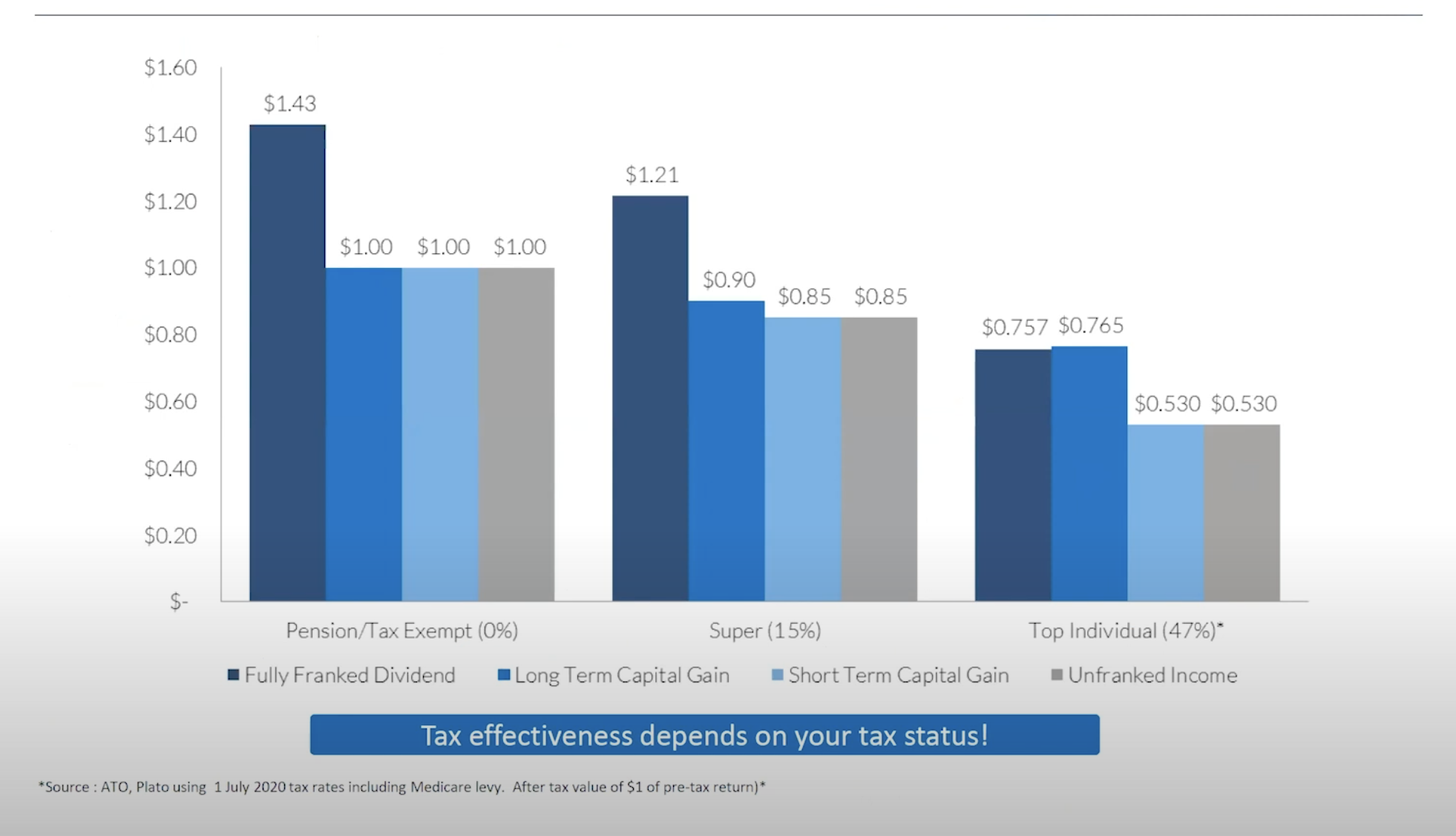

How Retirees Benefit From Franking Credits Plato Investment Management

Franking Credits Tax Refund - In fact if your personal tax rate is less than 30 per cent you can actually receive any excess franking credit as a refund something that is quite attractive to