Freelance Tax Rate Netherlands This guide aims to provide a clear and concise overview of the taxes for freelancers and self employed workers in the Netherlands including income tax and

Do you have your own business or are you making money on the side Here s what you need to know about freelance taxes in the Netherlands Even though it is sitting in your bank account the tax office still wants its share How much income tax you pay depends on your income There are two potential

Freelance Tax Rate Netherlands

Freelance Tax Rate Netherlands

https://www.suurmond-taxconsultants.com/wp-content/uploads/2023/06/corporate-tax-rate-netherlands-business-international-tax-advice-netherlands-suurmond-taxconsultants-the-hague-1024x683.jpg

Dutch Tax Brackets 2021 NEWREAY

https://d2dzik4ii1e1u6.cloudfront.net/images/lexology/static/6acc7e7a-739f-4a60-8990-009102861788.png

Flat Income Tax Rate To Be Introduced In Armenia 2020

https://armenian-lawyer.com/wp-content/uploads/2019/01/Tax-Administration-under-the-risk-classification-method.jpg?x84312

The Dutch tax office collects a 21 BTW tax from freelancers in the Netherlands typically four times per year In addition to the regular rates for your goods This deduction is being reduced every year and is expected to be set at 3 240 by 2036 You can check how much income tax you will have to pay by completing the income tax

This blog is a brief overview and explanation of the taxes you probably need to pay as a freelancer or self employed professional in the Netherlands We will also show you If you are based in the Netherlands as a freelancer self employed professional you nearly always have to pay turnover tax VAT Some services are exempt from VAT

Download Freelance Tax Rate Netherlands

More picture related to Freelance Tax Rate Netherlands

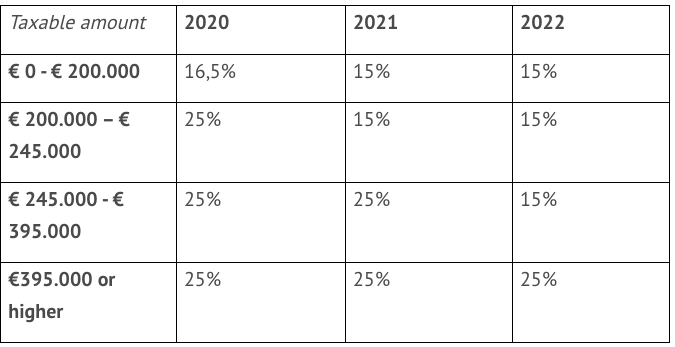

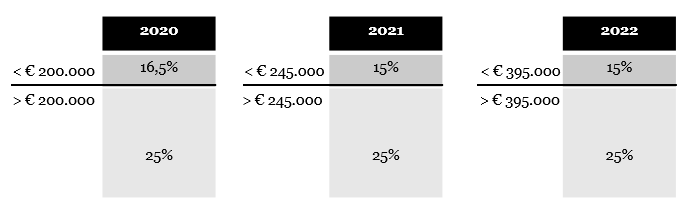

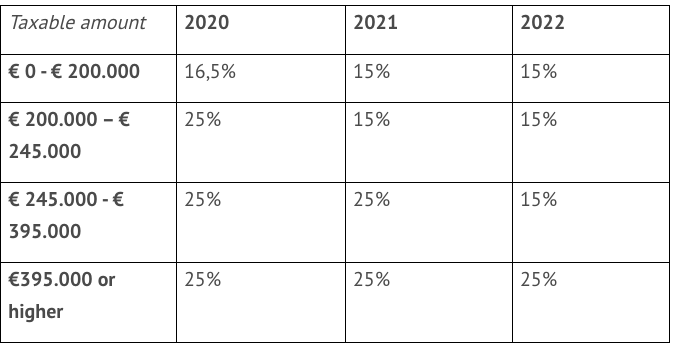

Netherlands Keeps Corporate Tax Rate At The Same Level Law Trust

https://lawstrust.com/sites/default/files/field/image/j54dtxer9ose2aocy9_da6kl2hlr11nq.jpg

Dutch 2021 Tax Bill And Real Estate In The Netherlands Insights

https://www.gtlaw.com/-/media/images/alerts/2020/9/cit-rates.png?la=en

No City Tax Rate Increase Foreseen

https://s.hdnux.com/photos/14/46/37/3303378/6/rawImage.jpg

As a freelancer like any other working Dutch citizen you are obliged to pay taxes on your income The difference between being self employed and working as an employee is Depending on the circumstances and personal preferences Dutch freelancers can choose between a sole proprietorship and a Dutch BV to perform business activities in the

Use our Dutch tax calculator to find out how much income tax you pay in the Netherlands Check the I enjoy the 30 ruling and find the maximum amount of tax you can save For the year 2021 the tax rate and premiums for income from work and home are Combined rates in Box 1 for persons younger than retirement age

Netherlands Corporate Tax Rate 1981 2021 Data 2022 2023 Forecast

https://d3fy651gv2fhd3.cloudfront.net/charts/[email protected]?s=nldcorptax&v=202109081354V20200908

Income Tax Rate For Company Private Limited Provenience Provenience

https://provenience.in/wp-content/uploads/2020/03/income-tax-rate-for-company.png

https://netherlandsexpat.nl/taxes-for-freelancers-and-self-employed

This guide aims to provide a clear and concise overview of the taxes for freelancers and self employed workers in the Netherlands including income tax and

https://www.expatica.com/nl/finance/taxes/...

Do you have your own business or are you making money on the side Here s what you need to know about freelance taxes in the Netherlands

Where Could Interest And Tax Rates Be Headed Mercer Advisors

Netherlands Corporate Tax Rate 1981 2021 Data 2022 2023 Forecast

.webp)

Explaining The 60 Income Tax Rate In The UK Earnr

Reliance On Individual Income Tax Revenue In Europe Tax Foundation

Netherlands Law And Taxation System Things To Know About Relocating

Global Minimum Tax Rate The Impact On Multinational Companies

Global Minimum Tax Rate The Impact On Multinational Companies

The Netherlands And German Corporate Tax Rate Download Scientific Diagram

Divisions Emerge Over Biden s Proposal To Raise The Corporate Tax Rate

Lowering Tax Rate Won t Stop Inversions Rep Levin

Freelance Tax Rate Netherlands - Contractors and freelancers in the Netherlands are eligible for a number of tax deductions meaning you can deduct an amount from your profits thereby reducing