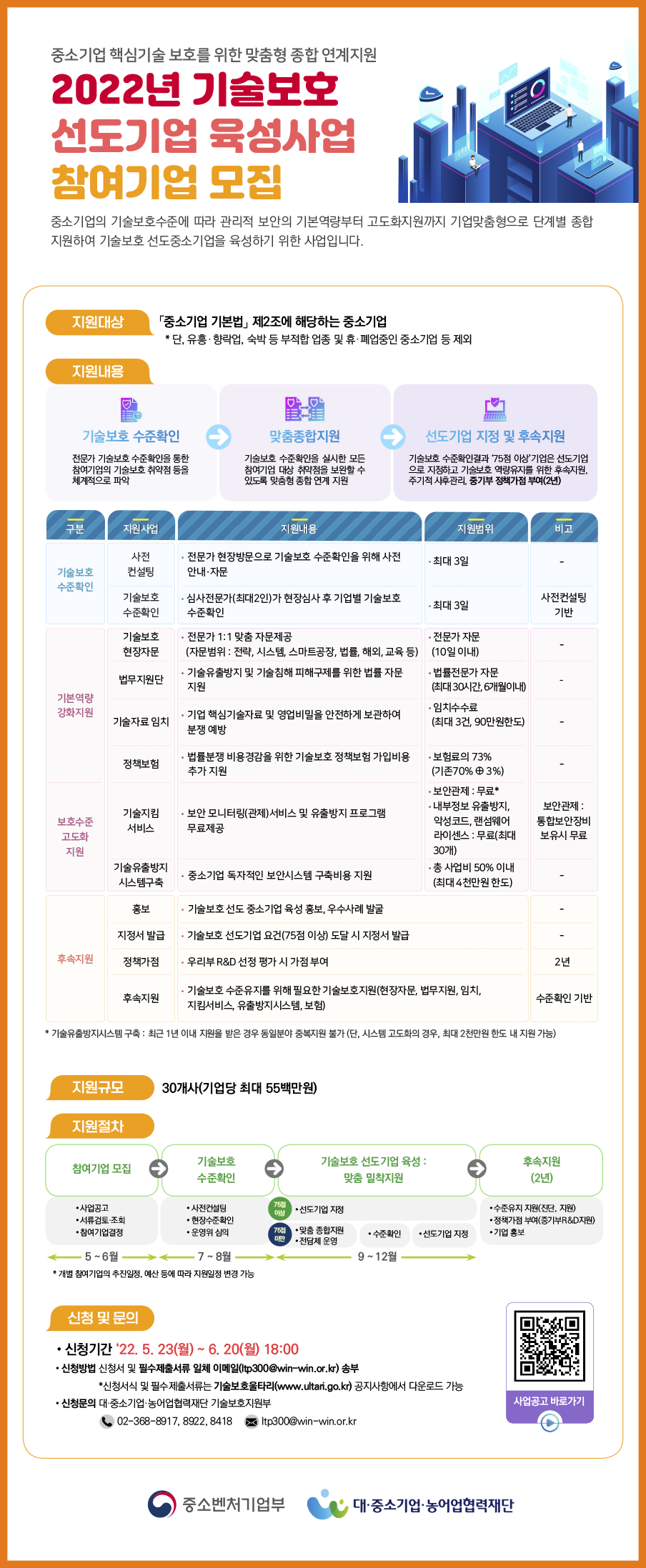

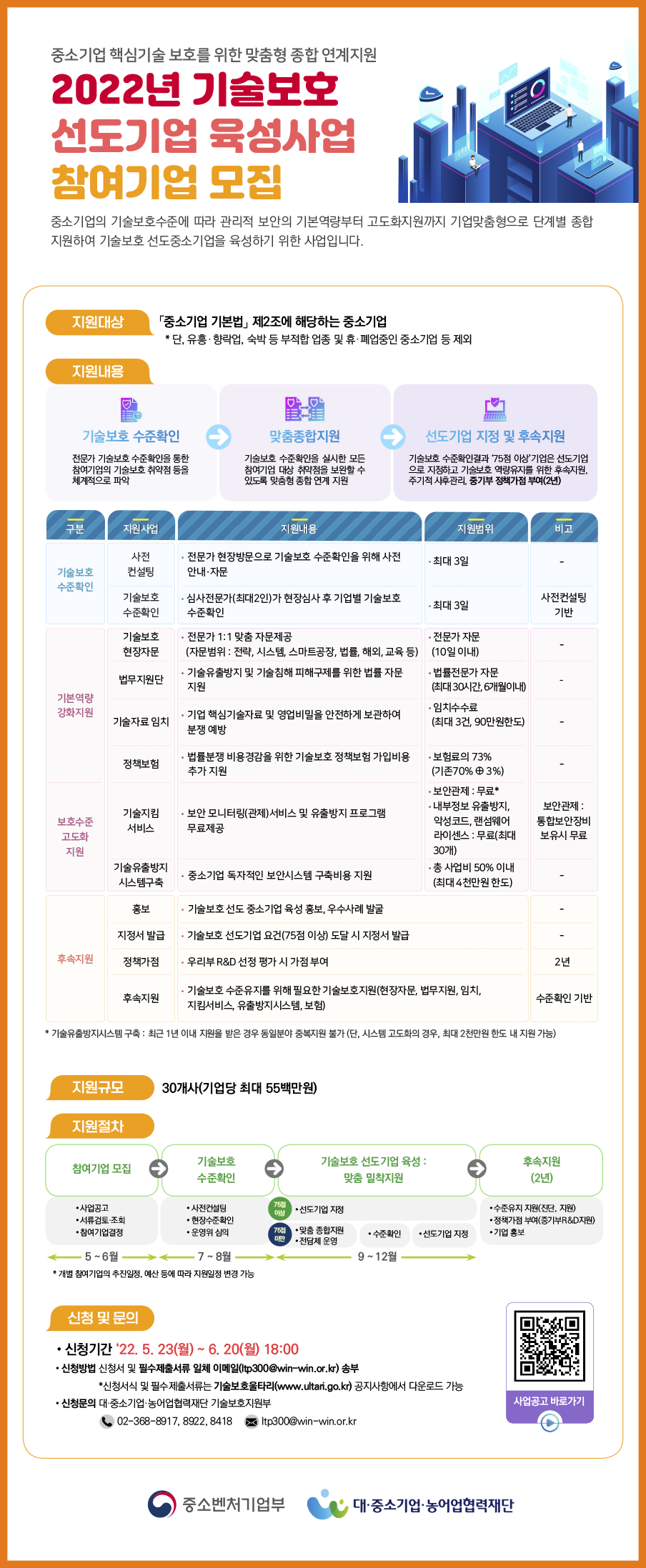

Fuel Rebate Rates 2022 Check the fuel tax credit rates for businesses from 1 July 2023 to 30 June 2024 You need to use the rate that applies on the date you acquired the fuel Use the fuel tax credit

Currently the road user charge reduces fuel tax credits for gaseous fuels to nil Check the fuel tax credit rates from 1 July 2024 to 30 June 2025 for business These changes are effective for fuel sold or used after December 31 2022 The Inflation Reduction Act of 2022 retroactively extended several fuel tax credits

Fuel Rebate Rates 2022

Fuel Rebate Rates 2022

https://www.brewsterbros.com/wp-content/uploads/2022/02/Red-Fuel-Rebate.jpg

Gold 2022 3d Vector 2022 Gold 3d Rendering New Year 2022 2022 Gold

https://png.pngtree.com/png-clipart/20211024/original/pngtree-2022-gold-3d-rendering-png-image_6869618.png

ISDW 2022

https://www.fecfau.unicamp.br/~isdw-2022/images/logo.png

Fuel tax credit rates are adjusted every year in February and August in line with the consumer price index Check the rates each time you do your BAS It s possible to have Red diesel is entitled to a rebate of 46 81ppl giving it an effective duty rate of 11 14ppl At Budget 2020 the government announced that it was removing entitlement to use

Manufacturers importers distributors retailers and household and business consumers of petrol diesel and other fuel products subject to Fuel Duty This measure The diesel fuel rebate rates change from time to time Before claiming you need to check not only the category but also the current rate This ensures your fuel rebate calculator returns the correct result

Download Fuel Rebate Rates 2022

More picture related to Fuel Rebate Rates 2022

National Fuel Rebate Form 2023 Printable Forms Free Online

https://fuelingtomorrowtoday.com/wp-content/uploads/2021/12/Residential-appliance-chart-1.jpg

LHDN IRB Personal Income Tax Rebate 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

Bank Interest Rates 2022 7 5

https://www.ek24.in/wp-content/uploads/2022/02/fixed-diposit-interest-rate-2022.jpg

This calculator focuses on the ROI that results from better cost control especially the costs associated with fuel and labour and the tax rebates available from the Australian Fuel Tax Credit system 26 rowsThe quarterly diesel repayment rate may vary depending on the national average purchase price You can view each quarterly repayment rate on this page

Updated tables for period from 1 July 2022 Budget 2022 measure Temporary rate reduction Fuel excise is temporarily halved for a period of 6 months from 30 March 2022 to 28 Fuel tax credit rates change regularly The fuel tax credit calculator is the easiest way to help you work out adjustments for fuel tax credits from a previous BAS From 30

2022

https://www.ultari.go.kr/resource/images/LeadingCompanyRaisingProgram2022.png

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

https://www.ato.gov.au › ... › rates-business

Check the fuel tax credit rates for businesses from 1 July 2023 to 30 June 2024 You need to use the rate that applies on the date you acquired the fuel Use the fuel tax credit

https://www.ato.gov.au › ... › rates-business

Currently the road user charge reduces fuel tax credits for gaseous fuels to nil Check the fuel tax credit rates from 1 July 2024 to 30 June 2025 for business

2022

2022

1 5 News 2022

SWaMfest 2022 VERSES

Mar Apr 2022

Alcon Rebate Form 2022 Printable Printable Rebate Form

Alcon Rebate Form 2022 Printable Printable Rebate Form

Free Images Advertising Environment Industry Stadium Public

Saudi Aramco CEO Warns Of Unrest If Fossil Fuel Investment Cut Too Fast

Emergency Declaration 2022

Fuel Rebate Rates 2022 - Energy bills will be capped at 2 500 a year for a typical household from 1 October 2022 for the next two winters Prime Minister Liz Truss has announced A 400 energy rebate