Fuel Reimbursement In Salary The IRS sets a standard mileage reimbursement rate of 58 5 cents per business mile driven in 2022 This rate is based on an annual study of the fixed and variable costs of operating a vehicle like gas insurance

Organisations often offer fuel expense reimbursements as a pay component for tax saving particularly for members of the middle and senior Mileage reimbursement is when a company pays an employee to recoup the costs of driving a personal vehicle for work purposes Companies can choose to reimburse the exact amount an employee incurred on the trip or use

Fuel Reimbursement In Salary

Fuel Reimbursement In Salary

https://www.cornerstonerehab.com/wp-content/uploads/2020/12/shutterstock_622352348-scaled.jpg

Fuel Expense Reimbursement Policy Sample PDF Fuel Economy In

https://imgv2-1-f.scribdassets.com/img/document/538813090/original/aa739c6965/1673345977?v=1

Fuel Reimbursement Expenses For UAE Companies Increase By 38

https://gulfbusiness.com/wp-content/uploads/2022/07/engin-akyurt-ATiv-MR0d4U-unsplash-768x509.jpg

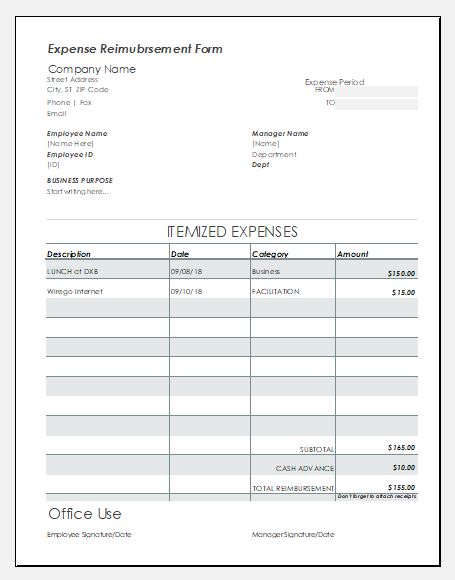

The expense reimbursement process allows employers to pay back employees who have spent their own money for business related expenses When employees receive an expense reimbursement typically they won t be The fuel benefit is fixed each year for the 2018 19 tax year it is 23 400 This is multiplied by the car s benefit in kind BIK percentage and the tax band for your salary A BIK is a taxable

For reimbursements to be tax free companies need to use standard mileage rates provided by the IRS In 2024 it means that companies can issue tax free reimbursements at the maximum rate of 67 cents per mile Any vehicle What Is a Fringe Benefit A fringe benefit is a form of pay including property services cash or cash equivalent in addition to stated pay for the performance of services Under Internal

Download Fuel Reimbursement In Salary

More picture related to Fuel Reimbursement In Salary

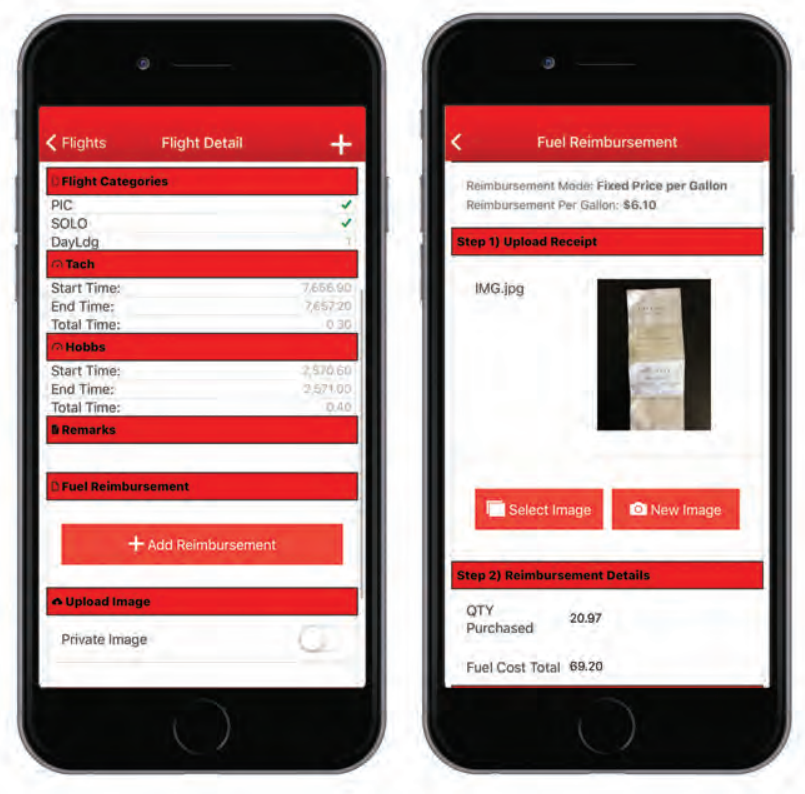

Fleet Member How To Submit Fuel Reimbursement Pilot Partner

http://www.pilotpartner.net/wp-content/uploads/2021/04/FuelReimbursement.png

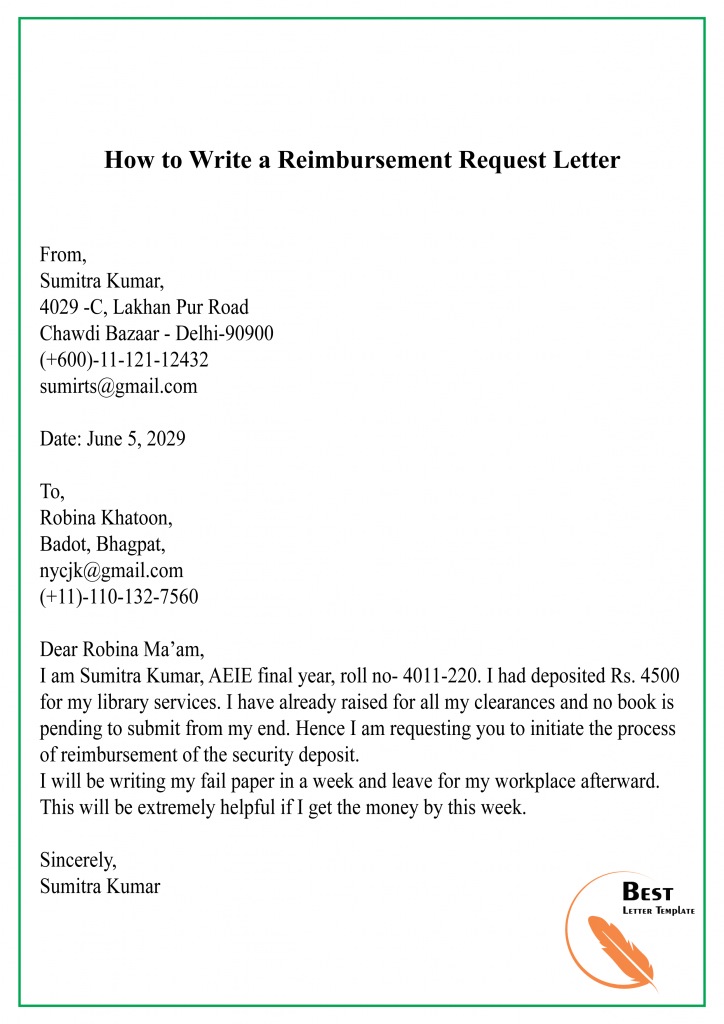

Reimbursement Expense Receipt How To Create A Reimbursement Expense

https://i.pinimg.com/originals/f8/78/20/f87820a839eff6a90ce8fb5c1c8a6242.png

Cash Flow Basics Disbursement Vs Reimbursement

https://synder.com/blog/wp-content/uploads/sites/5/2023/11/disbursement-vs-reimbursement.png

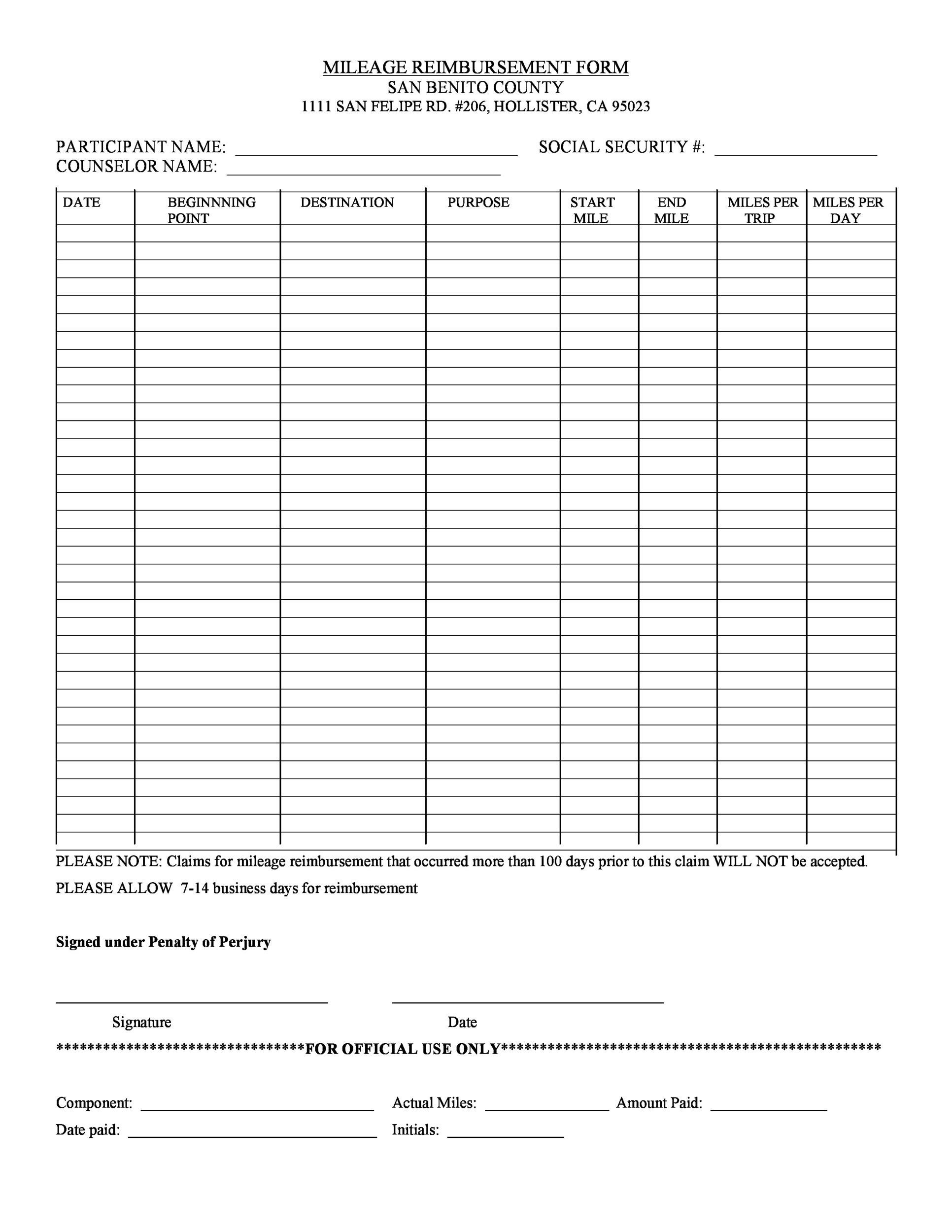

What is mileage reimbursement Mileage reimbursement is when employers offer employees reimbursement for expenses associated with driving on behalf of the business These expenses can include Assuming Rs 8 per KM as fuel and maintenance expense for running the car you would be spending Rs 8 000 on car and Rs 8 000 on driver s salary making it total of Rs

Fuel reimbursement Employees can request reimbursement from their employer to cover petrol or diesel expenses for their car However not all employees are Due to the spike in fuel prices the IRS announced a mid year increase of the rate to 62 5 cents per mile effective July 1 2022 For 2023 the new rate is 65 5 cents per mile up

Example Mileage Reimbursement Form Printable Form Templates And Letter

https://i2.wp.com/eforms.com/images/2020/01/IRS-Mileage-Reimbursement-Form.png?fit=1600%2C2070&ssl=1

2023 Mileage Reimbursement Form Printable Forms Free Online

https://www.workyard.com/wp-content/uploads/2023/02/Mileage-Reimbursement-Form-Template.jpg

https://www.uschamber.com/co/run/fina…

The IRS sets a standard mileage reimbursement rate of 58 5 cents per business mile driven in 2022 This rate is based on an annual study of the fixed and variable costs of operating a vehicle like gas insurance

https://www.zeebiz.com/personal-financ…

Organisations often offer fuel expense reimbursements as a pay component for tax saving particularly for members of the middle and senior

Mileage Reimbursement Form In PDF Basic

Example Mileage Reimbursement Form Printable Form Templates And Letter

How Much Fuel Does ENGINE IDLING Use How Much Fuel Does ENGINE

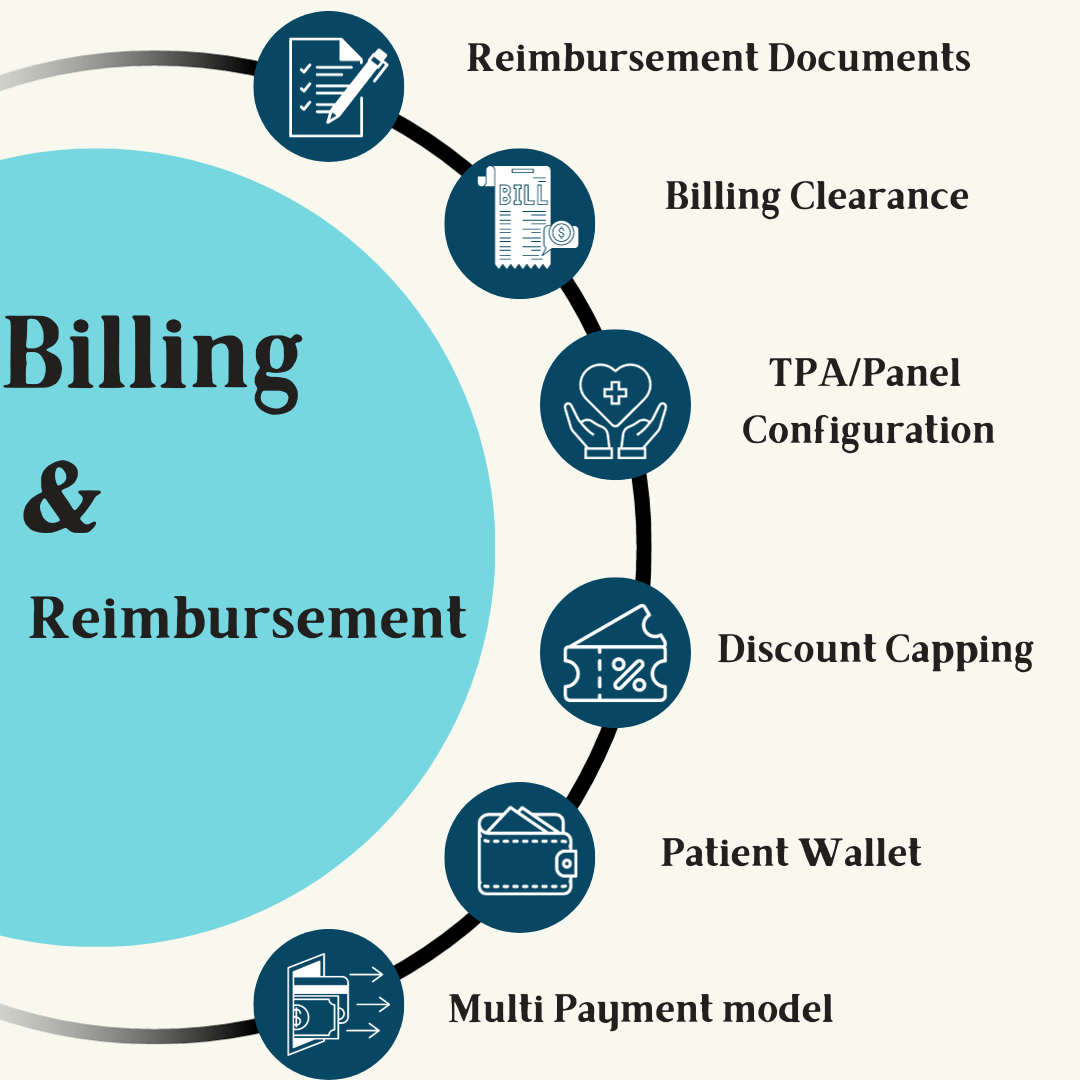

Billing And Reimbursement Billing And Reimbursement In Electronic

Driver Salary Reimbursement Business Free 30 day Trial Scribd

How To Report Gas Reimbursement On Tax Returns Finance Zacks

How To Report Gas Reimbursement On Tax Returns Finance Zacks

How To Write A Memorandum Requesting Rental Allowance The Student

Expense Reimbursement Forms For MS Excel Excel Templates

47 Reimbursement Form Templates Mileage Expense VSP

Fuel Reimbursement In Salary - Learn about mileage reimbursement in the US rates rules IRS deductions for employees self employed and employers Ensure compliance with our guide