Fuel Reimbursement Rate WASHINGTON The Internal Revenue Service today issued the 2024 optional standard mileage rates used to calculate the deductible costs of operating an

For the final 6 months of 2022 the standard mileage rate for business travel will be 62 5 cents per mile up 4 cents from the rate effective at the start of the year The new rate The following lists the Privately Owned Vehicle POV reimbursement rates for automobiles motorcycles and airplanes

Fuel Reimbursement Rate

Fuel Reimbursement Rate

https://www.workyard.com/wp-content/uploads/2023/02/Mileage-Reimbursement-Form-Template.jpg

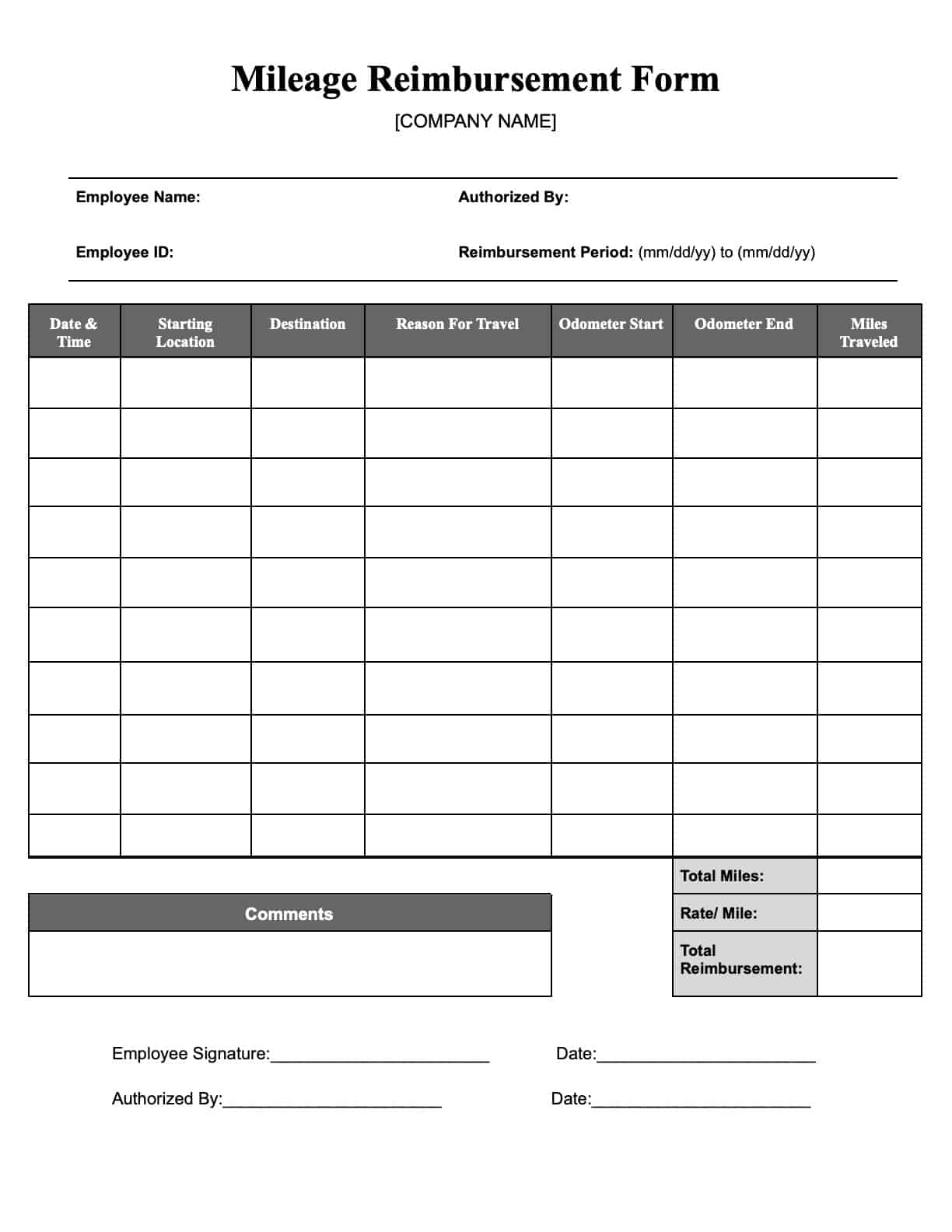

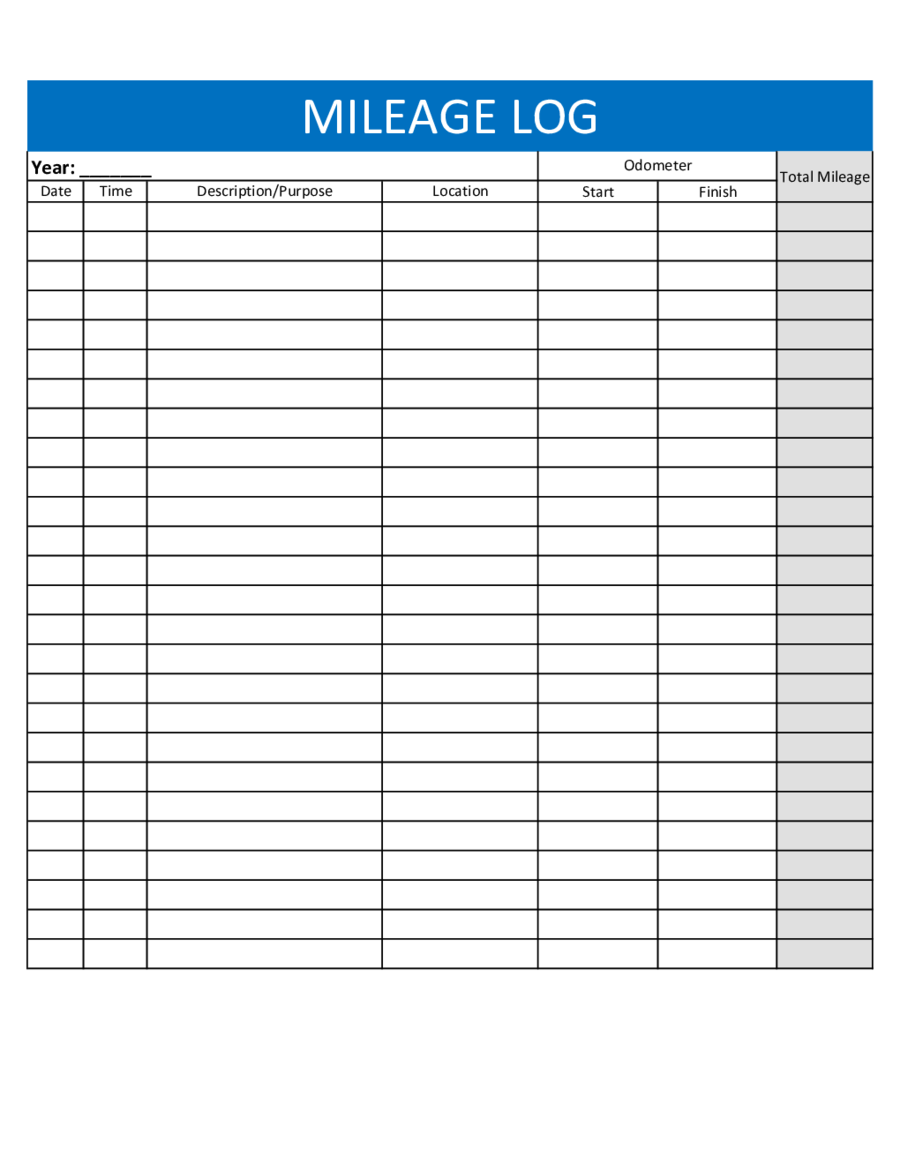

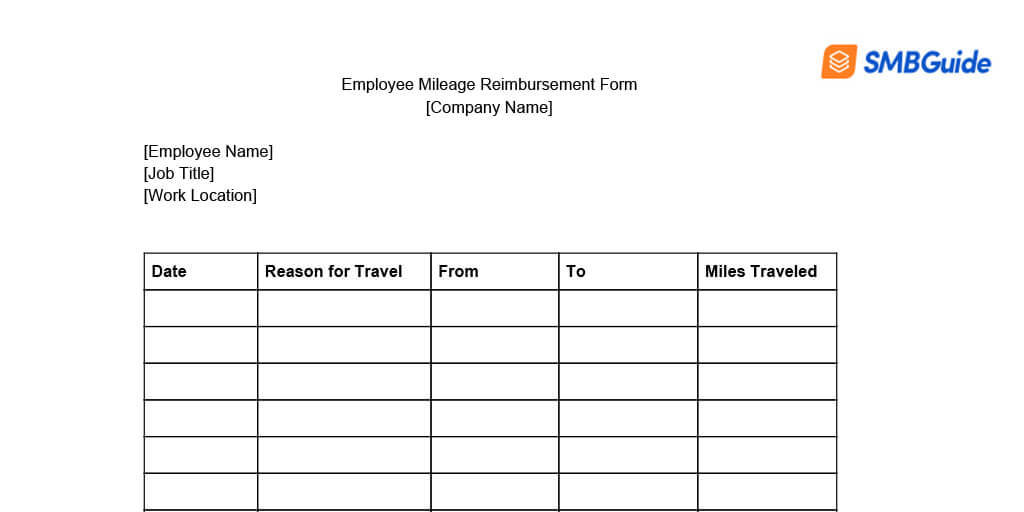

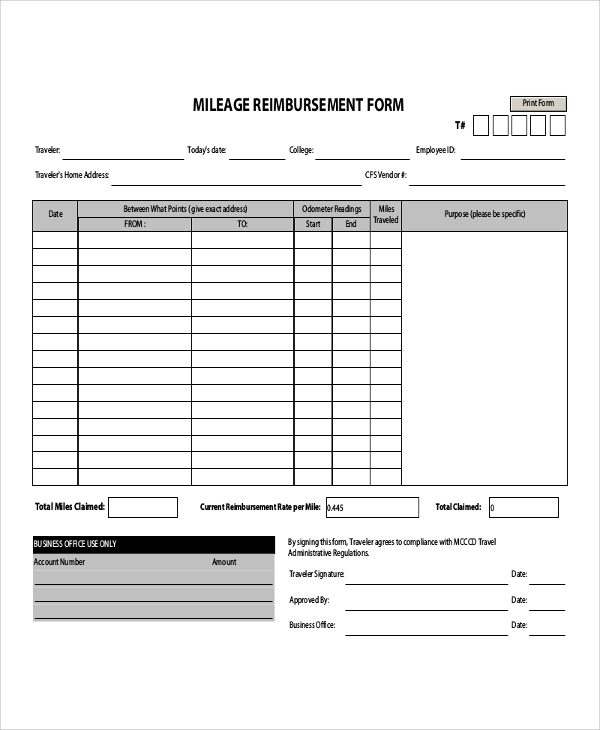

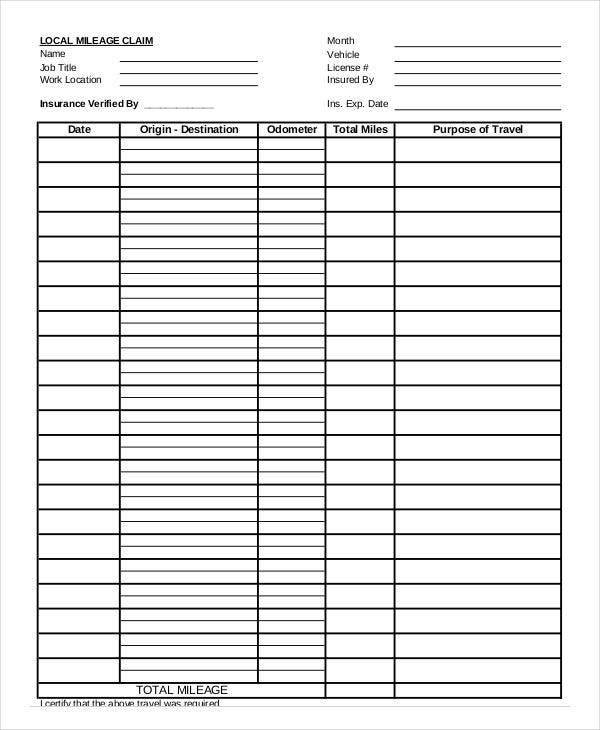

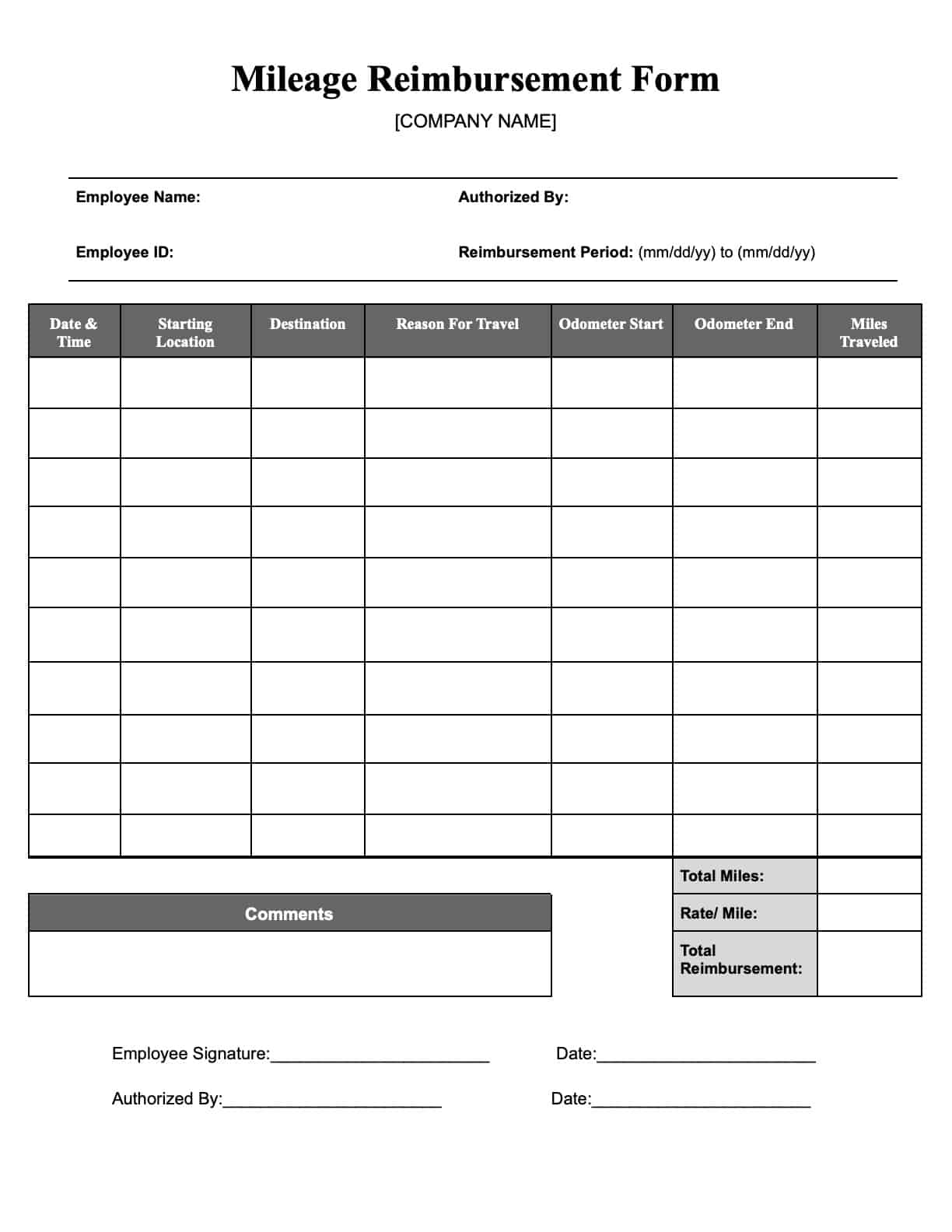

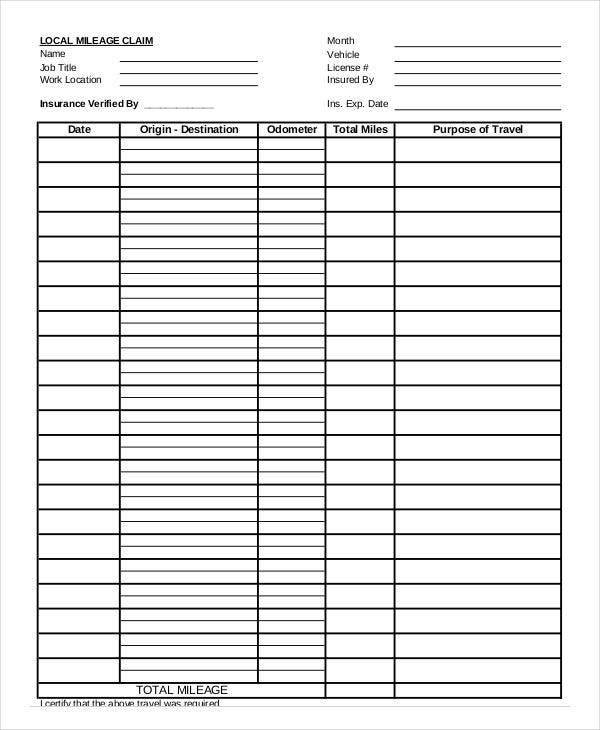

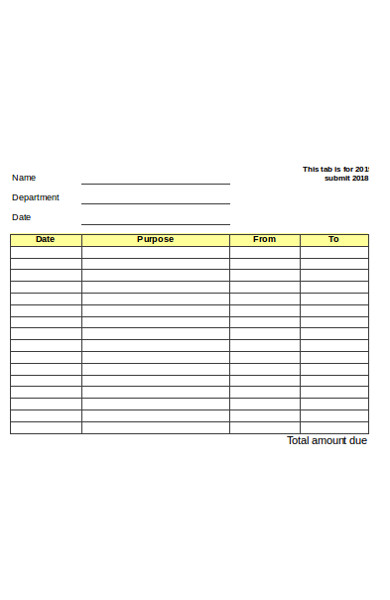

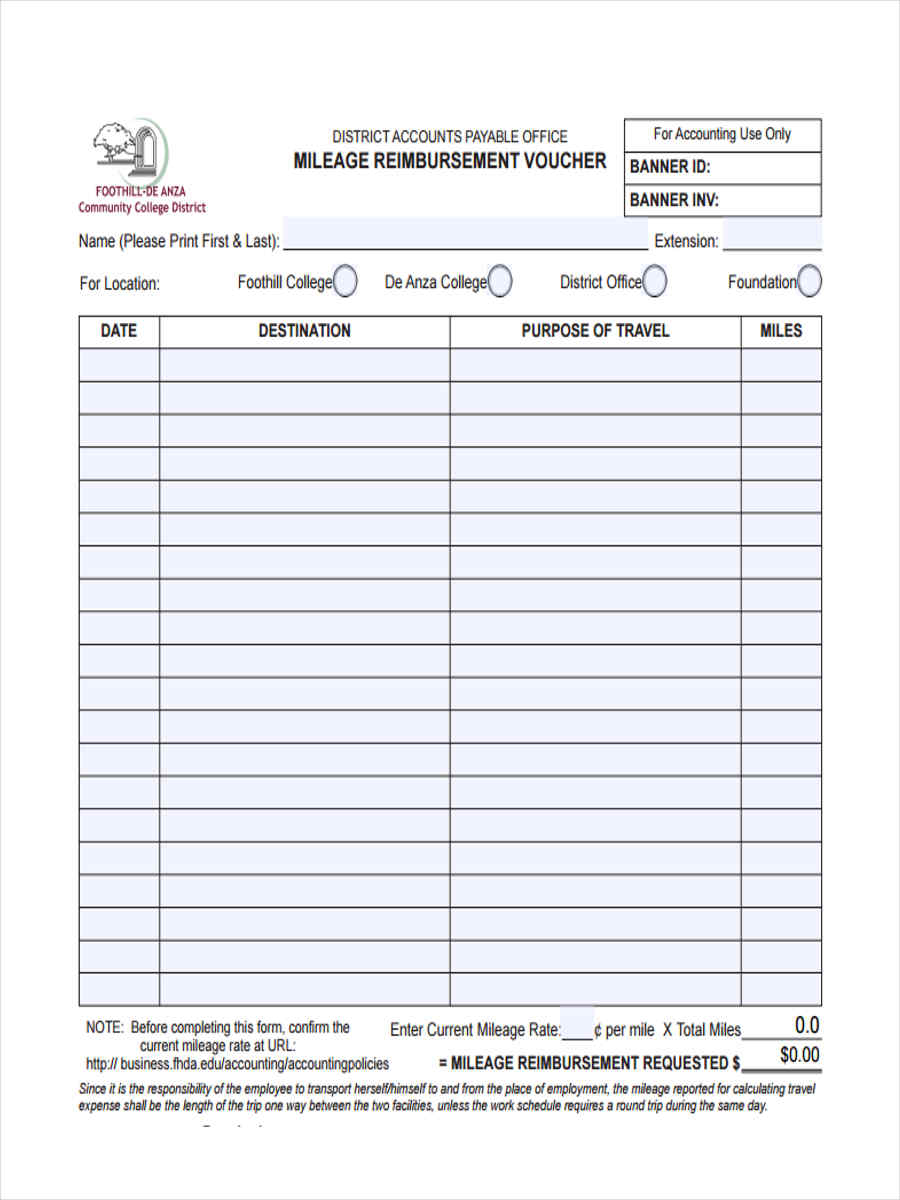

Gas Mileage Expense Report Template

https://4.bp.blogspot.com/-S55igTmLpoc/XLoD3DRIE5I/AAAAAAAABcE/Y_TPJDJfQ8wa91ZKkMY105GQApSR2qrsACLcBGAs/s1600/mileage%2Blog%2Bsample.png

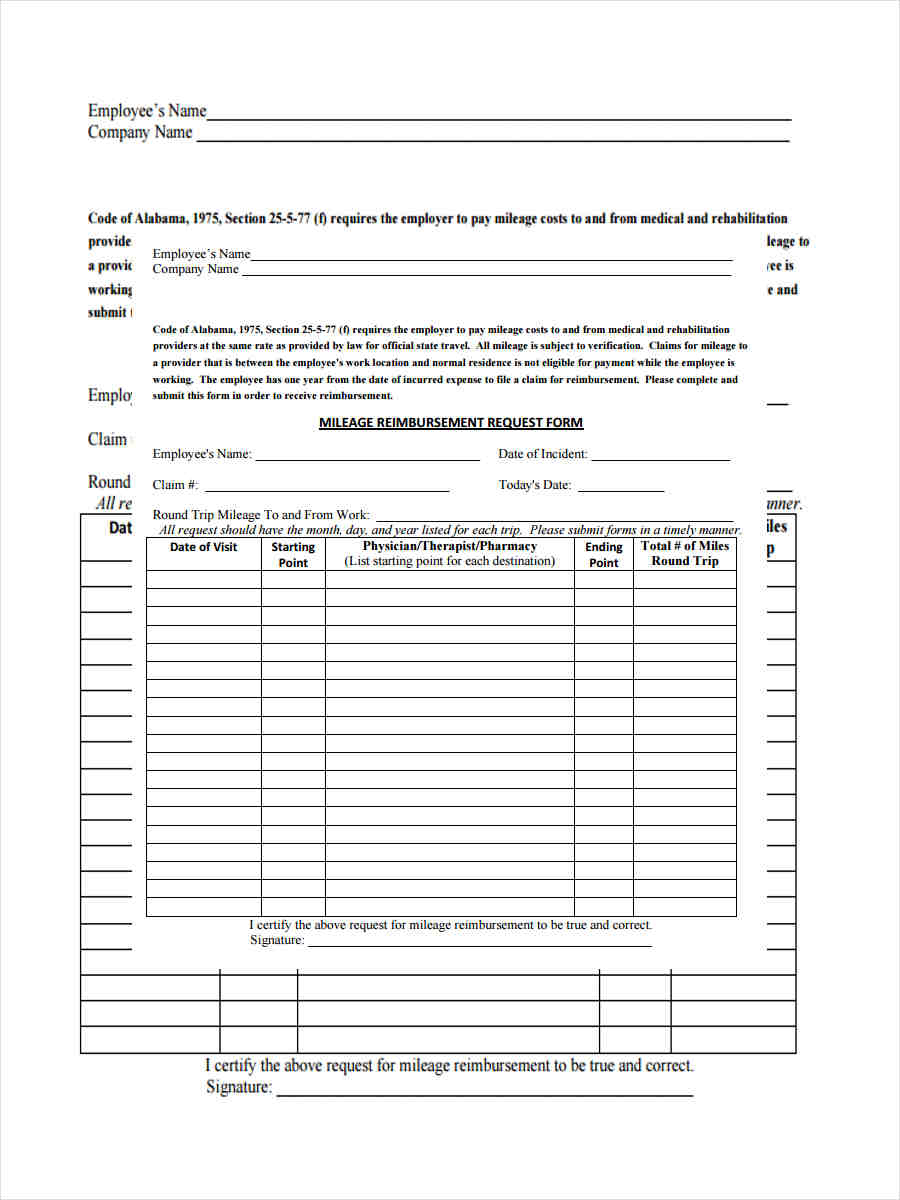

Travel Expense Reimbursement Form Template MS Excel Templates

https://www.thesmbguide.com/images/employee-mileage-reimbursement-form-1024x512-20181119.jpg

The Fixed and Variable Rate FAVR method combines a fixed monthly allowance for costs like insurance and registration and a variable rate that addresses variable costs The 2024 IRS standard mileage rates are 67 cents per mile for every business mile driven 14 cents per mile for charity and 21 cents per mile for moving or medical

For 2022 the business mileage rate is 58 5 cents per mile medical and moving expenses driving is 18 cents per mile and charitable driving is 14 cents per mile the same as last year As of July 2022 the standard mileage rate is 0 625 per mile For trips in 2022 that occurred from January to July the rate was 0 585 per mile Many employers

Download Fuel Reimbursement Rate

More picture related to Fuel Reimbursement Rate

Free Employee Reimbursement Form PDF Word EForms

https://i2.wp.com/eforms.com/images/2016/12/employee-reimbursement-form.png?w=2000&ssl=1

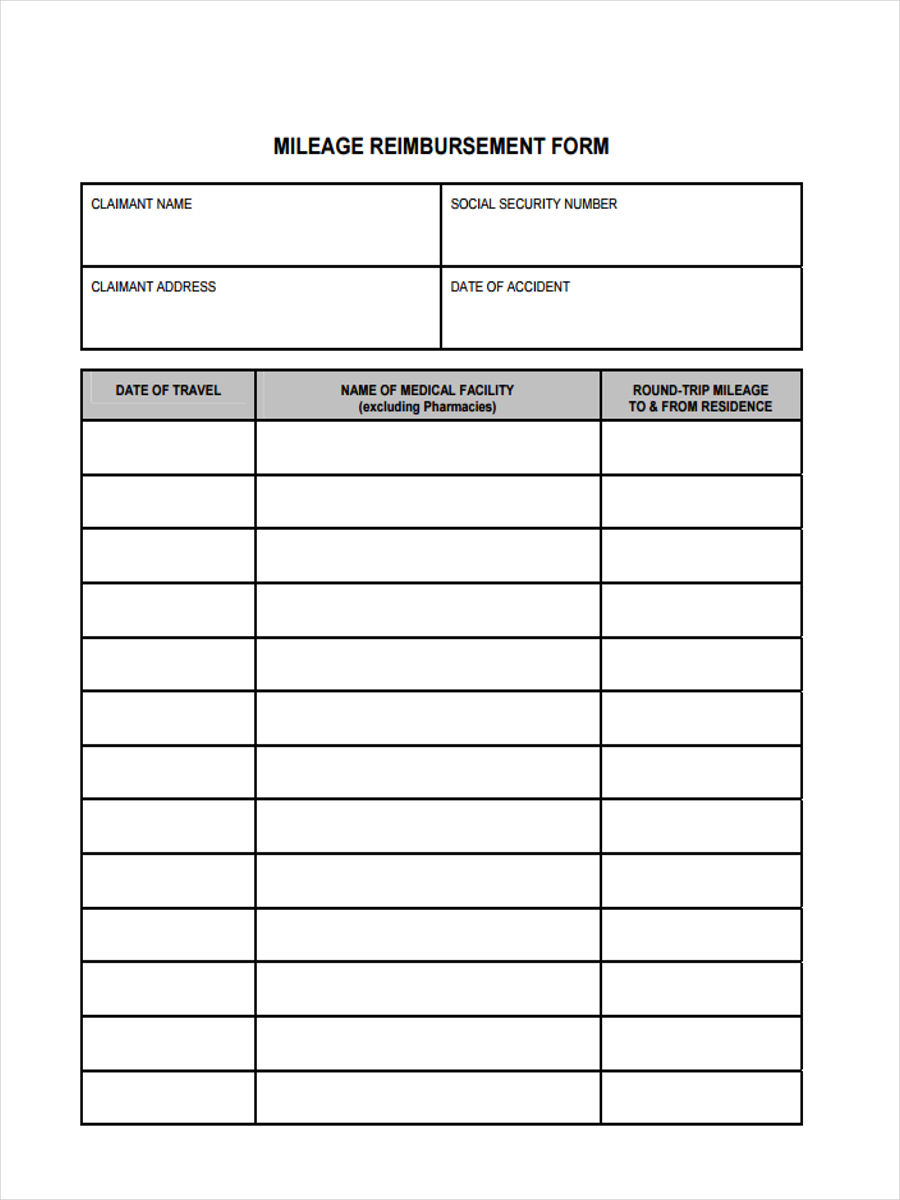

Mileage Claim Rate 2017 Malaysia Mileage Only Makes Up Around 75 Of

https://images.sampleforms.com/wp-content/uploads/2017/05/Workers-Compensation-Mileage.jpg

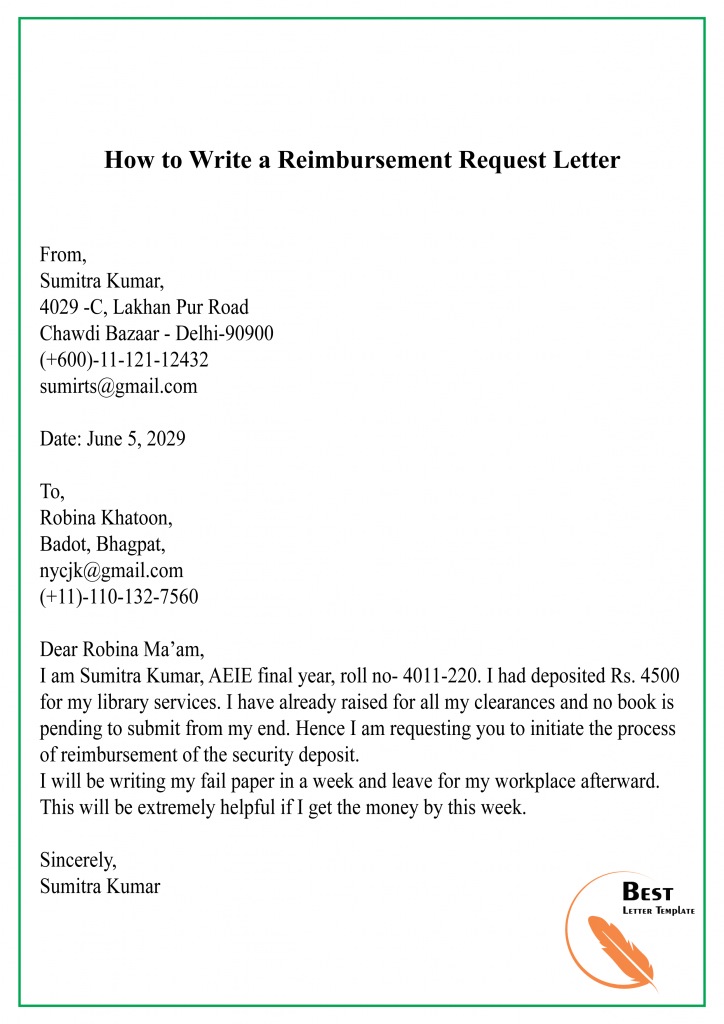

9 Mileage Reimbursement Template DocTemplates

https://images.sampletemplates.com/wp-content/uploads/2016/11/25164705/Mileage-Reimbursement-Form-in-PDF.jpg

Uses a rate that takes all your vehicle running expenses including registration fuel servicing and insurance and depreciation into account Rates Rates are reviewed You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical charitable business or moving You can

Due to current high gas prices the Internal Revenue Service IRS announced June 9 that it would increase the optional standard mileage rate for the final The IRS has increased the standard mileage rates to 65 5 cents per miles for business purposes in 2023 up from 58 5 cents in early 2022 and 62 5 cents in the

Mileage Reimbursement Form IRS Mileage Rate 2021

https://irs-mileage-rate.com/wp-content/uploads/2021/08/mileage-reimbursement-form-9-free-sample-example-1.jpg

Fuel Reimbursement Form 1 PDF

https://imgv2-2-f.scribdassets.com/img/document/651616478/original/9f9dcaaff7/1686278109?v=1

https://www.irs.gov/newsroom/irs-issues-standard...

WASHINGTON The Internal Revenue Service today issued the 2024 optional standard mileage rates used to calculate the deductible costs of operating an

https://www.irs.gov/newsroom/irs-increases-mileage...

For the final 6 months of 2022 the standard mileage rate for business travel will be 62 5 cents per mile up 4 cents from the rate effective at the start of the year The new rate

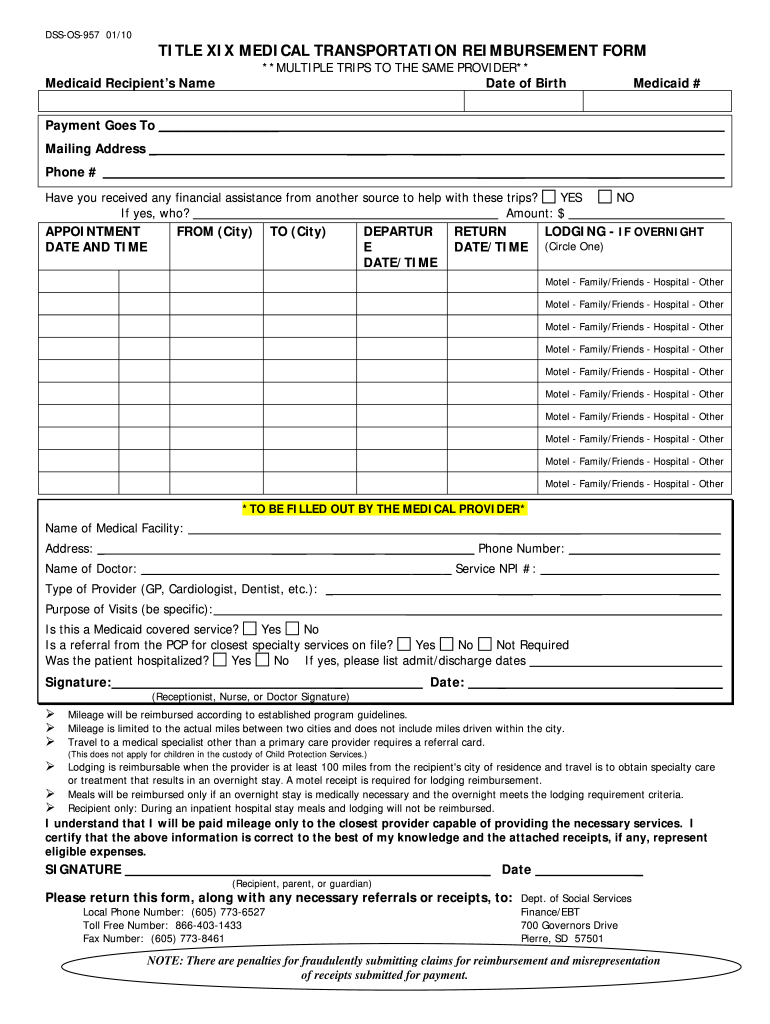

Medicaid Mileage Reimbursement Form 2020 2022 Fill And Sign Printable

Mileage Reimbursement Form IRS Mileage Rate 2021

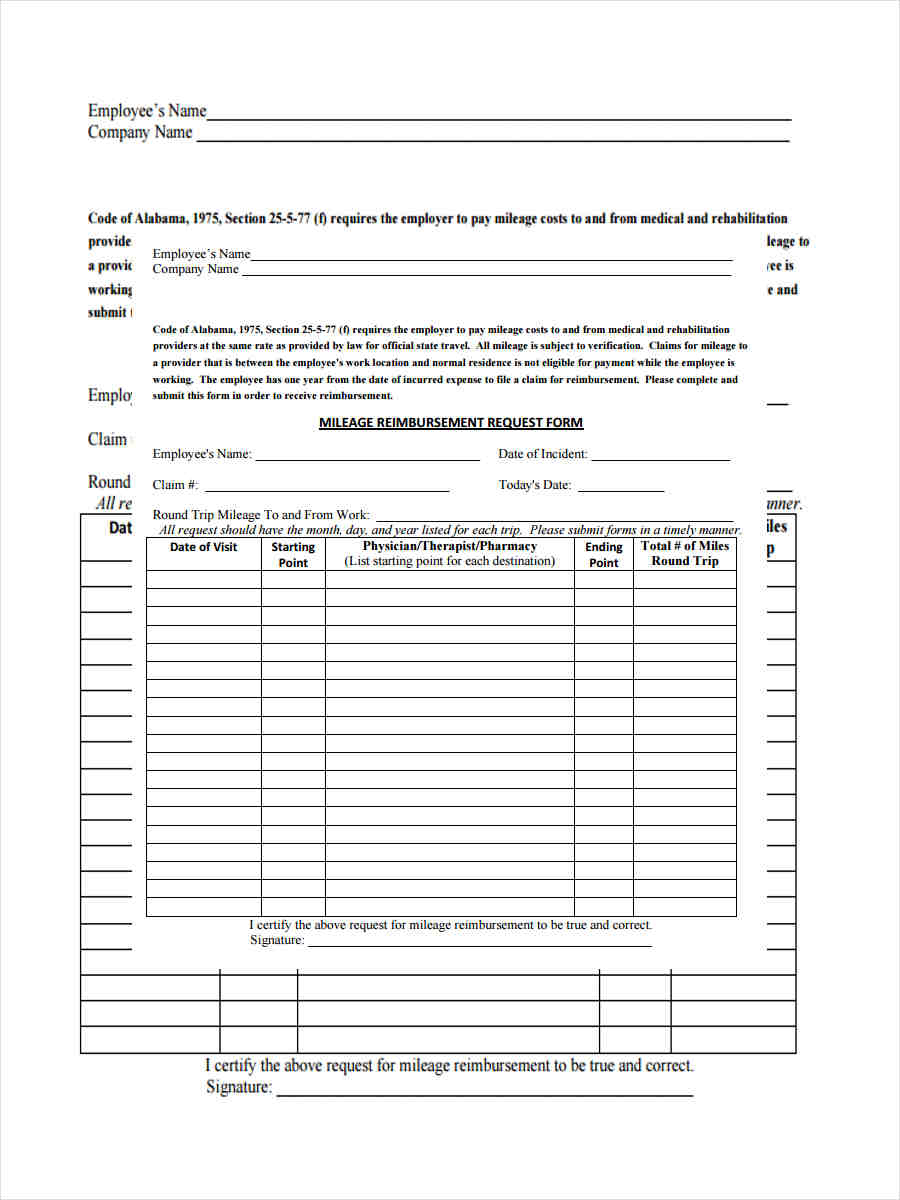

FREE 12 Mileage Reimbursement Forms In PDF Ms Word Excel

FREE 12 Mileage Reimbursement Forms In PDF Ms Word Excel

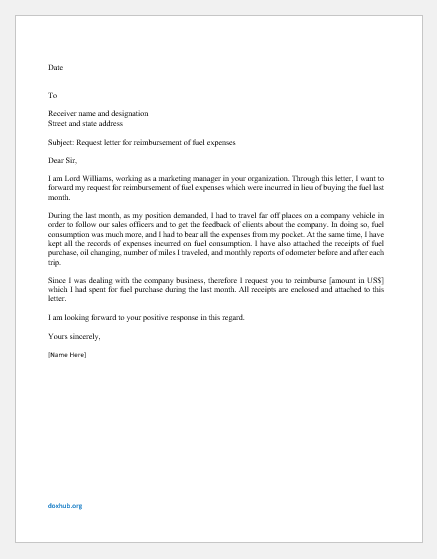

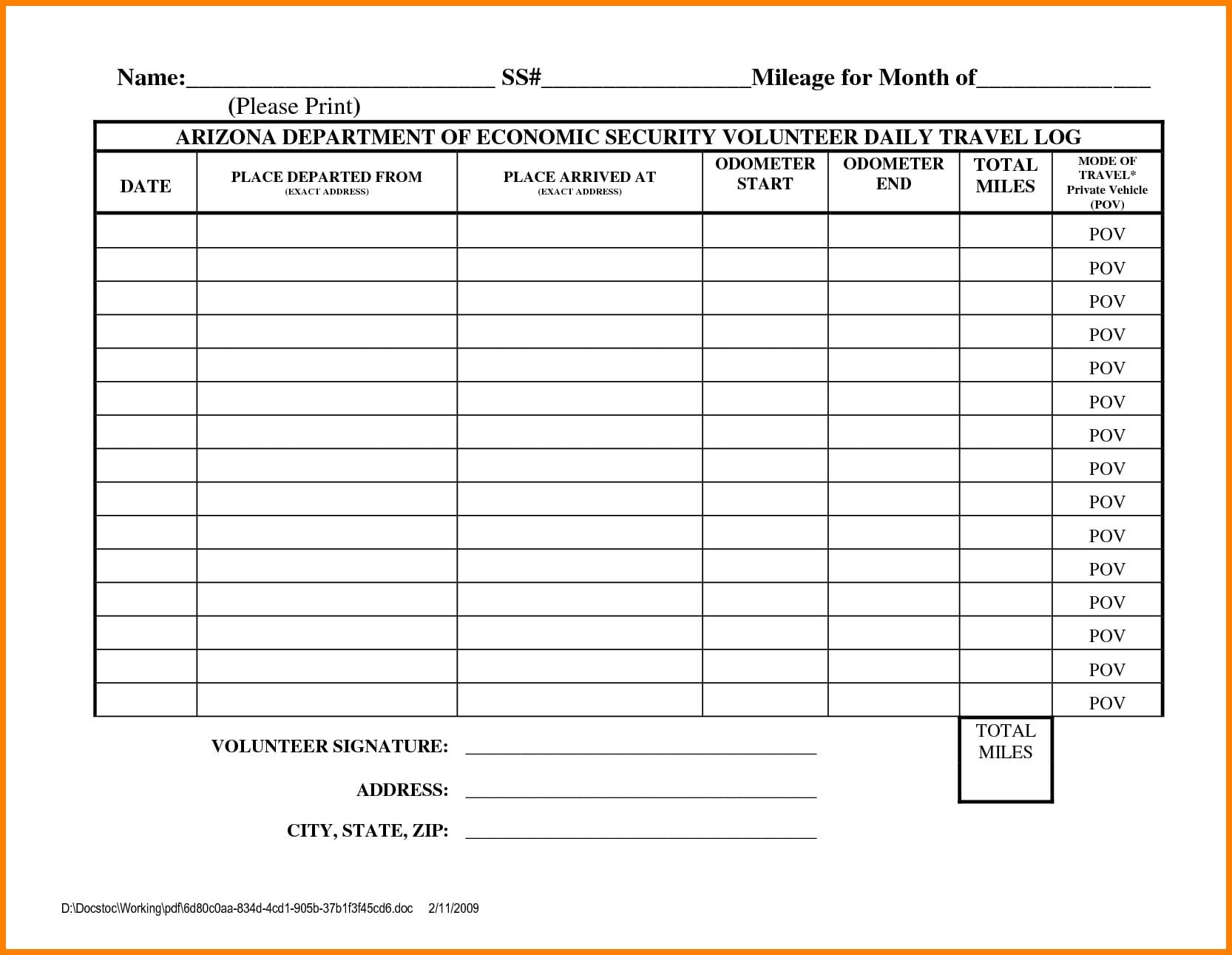

9 Reimbursement Request Letters For Various Reasons Document Hub

Mileage Reimbursement For Remote Employees IRS Mileage Rate 2021

Mileage Reimbursement For Remote Employees IRS Mileage Rate 2021

Wv Mileage Reimbursement Form With Attestation Fillable Printable

Simple Expense Reimbursement Form 1 Excelxo

How To Write A Memorandum Requesting Rental Allowance The Student

Fuel Reimbursement Rate - Standard mileage rate For 2023 the standard mileage rate for the cost of operating your car for business use is 65 5 cents 0 655 per mile Car expenses and use of the