Fuel Tax Credit Calculation Sheet The fuel tax credit calculator helps you work out the fuel tax credit amount to report on your business activity statement BAS adjustments for fuel tax credits from a previous BAS From 30 March 2022 until 28 September 2022 the fuel tax credit rate temporarily reduced

Use this worksheet to help you calculate your fuel tax credits and claim them on your BAS You must be registered for GST and fuel tax credits before you can claim Use this worksheet to help you calculate your fuel tax credits and claim them on your business activity statement BAS You must be registered for goods and services tax GST and fuel tax credits before you can claim

Fuel Tax Credit Calculation Sheet

Fuel Tax Credit Calculation Sheet

https://www.banlaw.com/wp-content/uploads/2021/12/who-can-claim-fuel-tax-credits-1024x763.jpg

Fuel Tax Credit Eligibility Form 4136 How To Claim

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEijO1qAMs_napos3v0ETHe96cx_283MPXVZQXocehgFGkIZ6xTYr0RfHfLiwzClgt1pNmbyCoGSW95DXvx_9PPk5WwQI6RomoDtBDcEFIVgflW04uIRTkMDrLhIZsWQ-upuVniwQQasrHnIe-nOvNw5SD0rXmfOFwsR1N0ob2tG3q6cavZuiSNBND-j/s762/ftc.jpg

Fuel Tax Credit Calculator Banlaw

https://www.banlaw.com/wp-content/uploads/2022/04/[email protected]

1 Check if you re eligible for fuel tax credits Businesses can claim credits for the fuel tax excise or customs duty included in the price of fuel used in their business activities You can claim for taxable fuel that you purchase manufacture or import Just make sure it s used in your business Taxable fuels include liquid fuels fuel blends FUEL TAX CREDITS CALCULATION WORKSHEET BUSINESS ACTIVITY STATEMENT PERIOD TO FUEL TAX CREDIT RATES FOR LIQUID FUELS A heavy vehicle is a vehicle with a gross vehicle mass GVM greater than 4 5 tonnes Diesel vehicles acquired before 1 July 2006 can equal 4 5 tonnes

There are three steps to calculate your fuel tax credits using our Worksheet Step 1 Work out your eligible quantities Work out how much fuel liquid or gaseous you acquired for each business activity Step 2 Check which rate applies for the fuel Use the rate that applied when you acquired the fuel including fuel used in heavy vehicles The fuel tax credit is a calculation of No of eligible litres x cents per litre rate The cents per litre rate is generally the rate applicable on the date of purchase however there are a number of exceptions which allow simplified calculations

Download Fuel Tax Credit Calculation Sheet

More picture related to Fuel Tax Credit Calculation Sheet

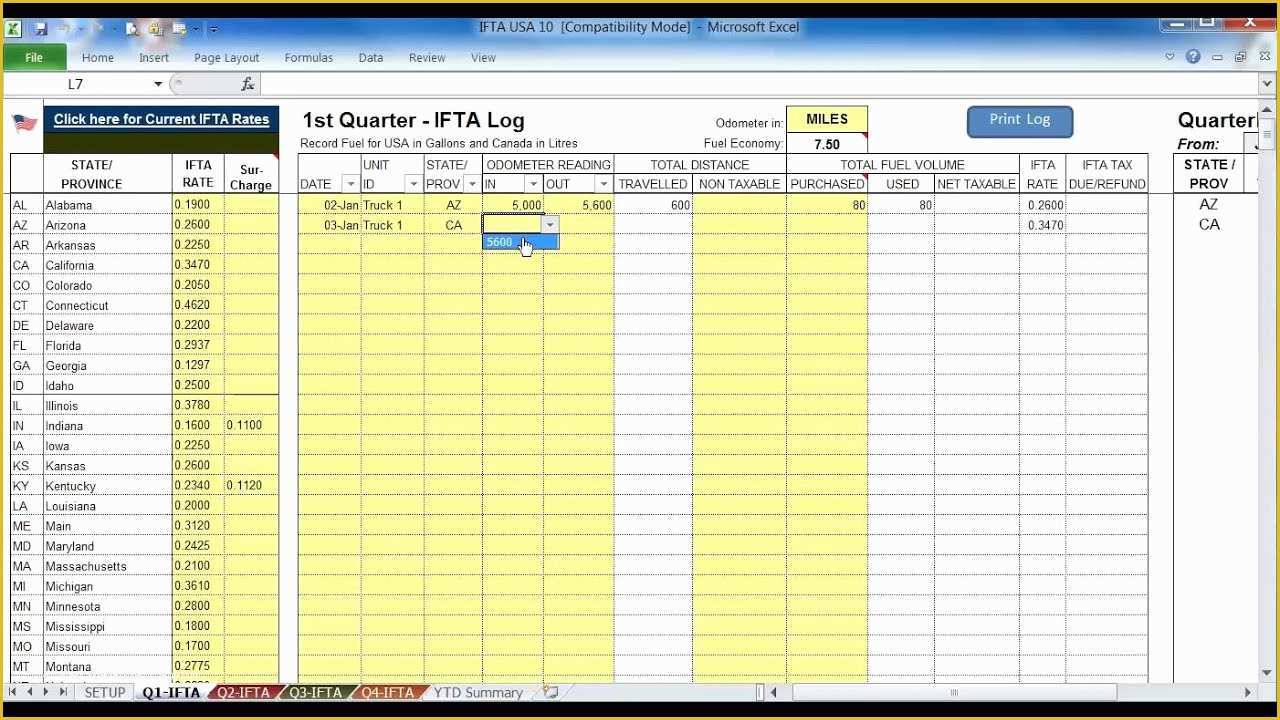

Ifta Spreadsheet Template Free Free Printable Templates

https://www.heritagechristiancollege.com/wp-content/uploads/2019/05/ifta-spreadsheet-template-free-of-ifta-fuel-tax-software-usa-truckers-for-up-to-10-trucks-of-ifta-spreadsheet-template-free.jpg

Fuel Tax Credit Calculation

https://i2.wp.com/atotaxrates.info/wp-content/uploads/2013/06/ftc-1aug2017.jpg

Fuel Tax Credit Calculation Worksheet

https://i2.wp.com/data.formsbank.com/pdf_docs_html/128/1280/128053/page_1_thumb_big.png

ELIGIBLE FUEL TYPE TOTAL FUEL ACQUISTIONS BUSINESS FUEL USE TOTAL BUISNESS USE OF ELIGIBLE FUEL RATE FUEL TAX CREDIT AMOUNT i Amount must be converted into dollars LITRES LITRES CENTS PER LITRE a b c a b 100 EXAMPLE Diesel 10 250 Eligible forestry activities 8 250 46 0 3 795 00 FUEL TAX CREDITS CALCULATION WORKSHEET BUSINESS ACTIVITY STATEMENT PERIOD TO FUEL TAX CREDIT RATES FOR LIQUID FUELS A heavy vehicle is a vehicle with a gross vehicle mass GVM greater than 4 5 tonnes Diesel vehicles acquired before 1 July 2006 can equal 4 5 tonnes Business use Eligible liquid fuel Rate for fuel

[desc-10] [desc-11]

Fuel Tax Credit Calculation

https://i2.wp.com/community.myob.com/t5/image/serverpage/image-id/11834iB7606D3D9C908ADE?v=v2

Fuel Tax Credit Calculator CairenAbsalat

https://i.pinimg.com/736x/89/79/57/89795702af255dbba2d134a53e547353.jpg

https://www.ato.gov.au/calculators-and-tools/fuel-tax-credit-tools

The fuel tax credit calculator helps you work out the fuel tax credit amount to report on your business activity statement BAS adjustments for fuel tax credits from a previous BAS From 30 March 2022 until 28 September 2022 the fuel tax credit rate temporarily reduced

https://www.ato.gov.au/.../fuel-tax-credits-calculation-worksheet

Use this worksheet to help you calculate your fuel tax credits and claim them on your BAS You must be registered for GST and fuel tax credits before you can claim

Ifta Spreadsheet Template Free PRINTABLE TEMPLATES

Fuel Tax Credit Calculation

What Is The Fuel Tax Credit LiveWell

Automatic Fuel Tax Credit Calculation

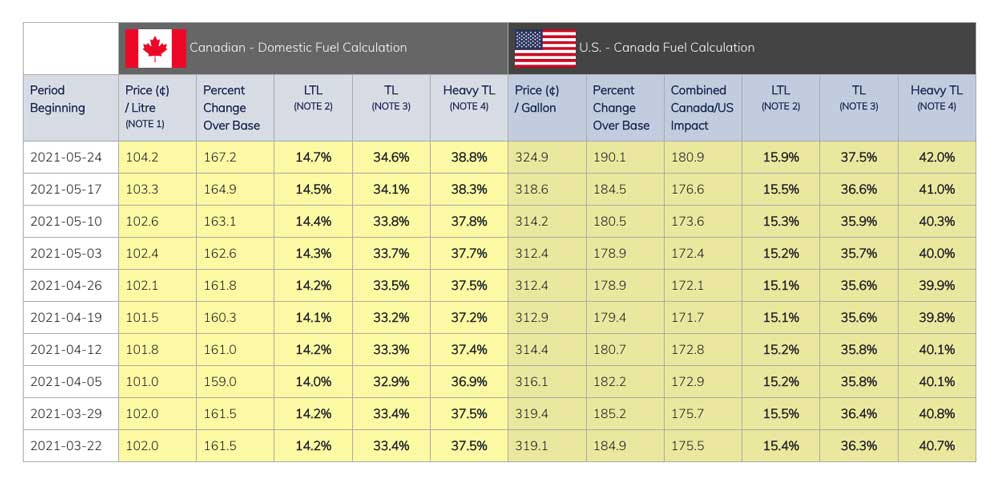

How Does The Fuel Surcharge Work Brimich Logistics

Ifta Fuel Tax Spreadsheet For Tax Worksheet Excel New Fuel Tax

Ifta Fuel Tax Spreadsheet For Tax Worksheet Excel New Fuel Tax

.png#keepProtocol)

Fuel Tax Credits New Credit Rates Update February 2023

Fuel Tax Credits Making Adjustments And Correcting Errors

Never Mine The Budget Here s The Fuel Tax Credit Scheme The

Fuel Tax Credit Calculation Sheet - [desc-13]