Fuel Tax Credit Form 2023 General Instructions Purpose of Form Use Form 4136 to claim the following The biodiesel or renewable diesel mixture credit The alternative fuel credit A credit for certain

Information about fuel tax credits for business use of fuel Last updated 5 July 2021 Print or Download Fuel tax credits provide businesses with a credit for the fuel tax excise Certain uses of fuels are untaxed however and fuel users can get a credit for the taxes they ve paid by filing Form 4136 TABLE OF CONTENTS Untaxed uses of fuels Who

Fuel Tax Credit Form 2023

Fuel Tax Credit Form 2023

https://www.accountancygroup.com.au/wp-content/uploads/fuel-tax.jpg

Fuel Tax Credit Calculator Banlaw

https://www.banlaw.com/wp-content/uploads/2022/04/[email protected]

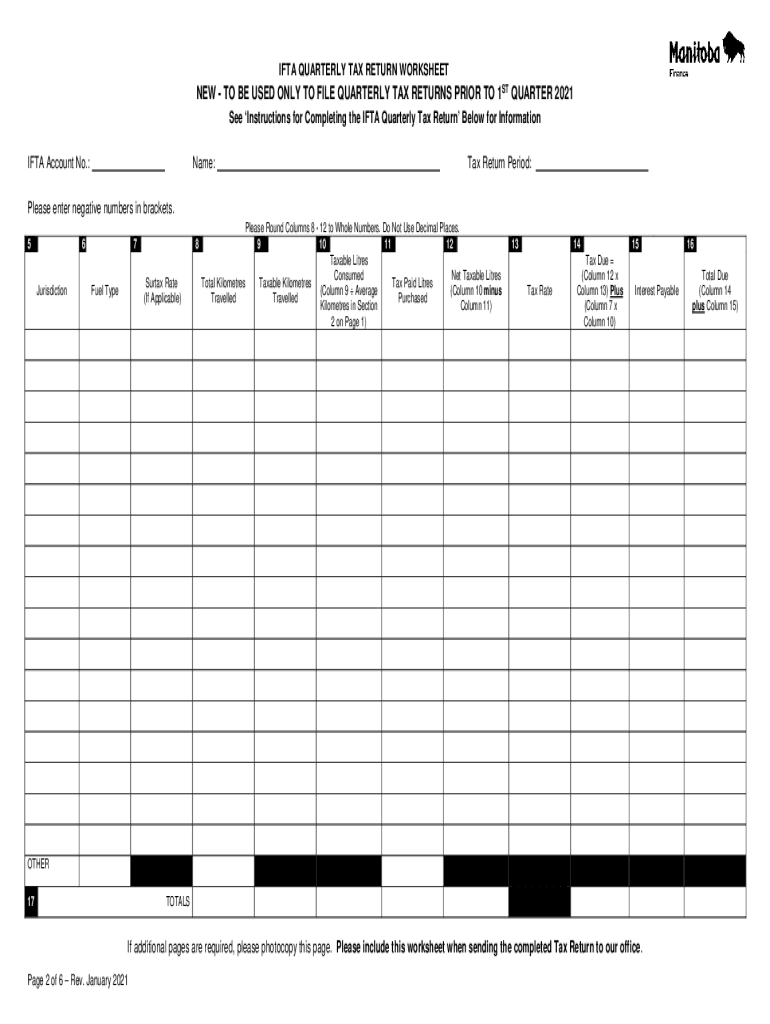

Ifta Reporting 2021 2024 Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/541/629/541629965/large.png

You can now claim refundable alternative fuel credits for the first three quarters of 2022 by filing Form 8849 Schedule 3 before April 11 2023 If your business uses fuel you may be able to claim credits for the fuel tax included in the price of the fuel Find out if you re eligible for fuel tax credits and how to

Here are the steps to take to claim the credit Visit fueleconomy gov select the appropriate option in the delivery date drop down menu and review whether the IRS Form 4136 Credit for Federal Tax Paid on Fuels enables certain taxpayers to claim a fuel credit depending on the type of fuels used and the type of business use the credit is claimed for

Download Fuel Tax Credit Form 2023

More picture related to Fuel Tax Credit Form 2023

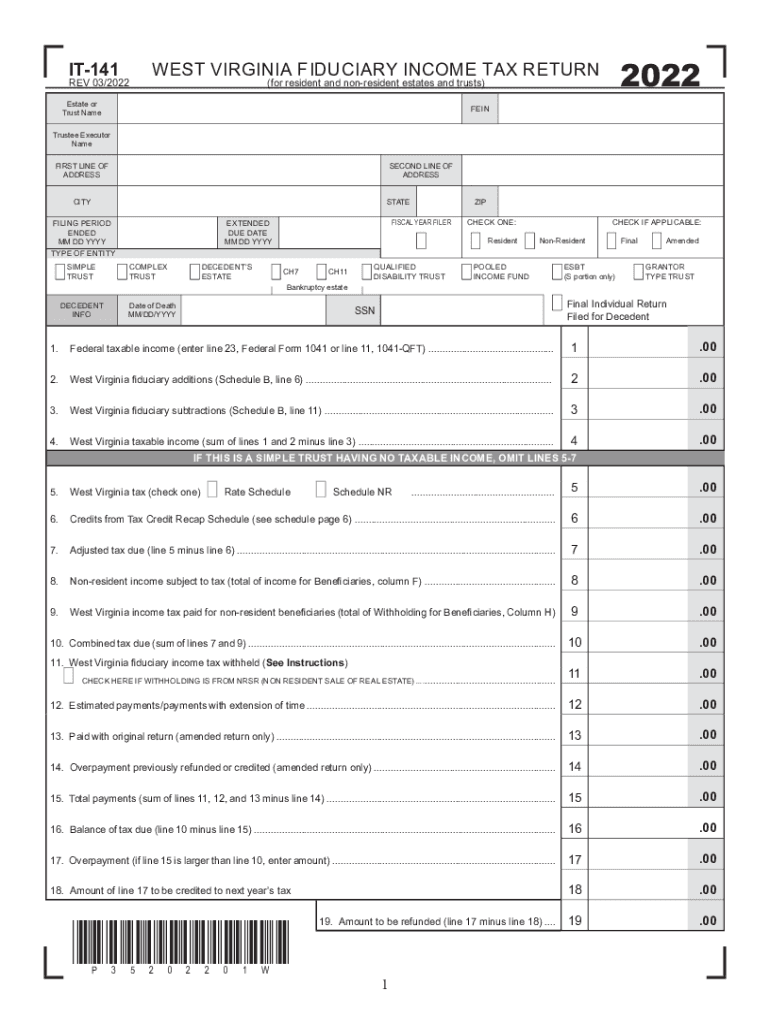

Income Tax Virginia 2022 2024 Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/626/980/626980480/large.png

Fuel Tax Credit Changes 2022 Aintree Group

https://aintreegroup.com.au/wp-content/uploads/2022/05/Screen-Shot-2022-05-12-at-12.04.03-pm.png

Fuel Tax Credit 2023 2024

https://www.zrivo.com/wp-content/uploads/2023/06/Fuel-Tax-Credit.jpg

All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500 Learn how to claim fuel tax credits on Form 4136 and maximize tax savings Understand eligibility criteria clean fuels tax credit alternative fuel vehicle

Companies that sell or use alternative fuels in their trade or business could benefit from the one time claim for alternative fuels excise tax credits One time claims Purpose of Form Use Form 4136 to claim the following The biodiesel or renewable diesel mixture credit The alternative fuel credit A credit for certain nontaxable uses or sales

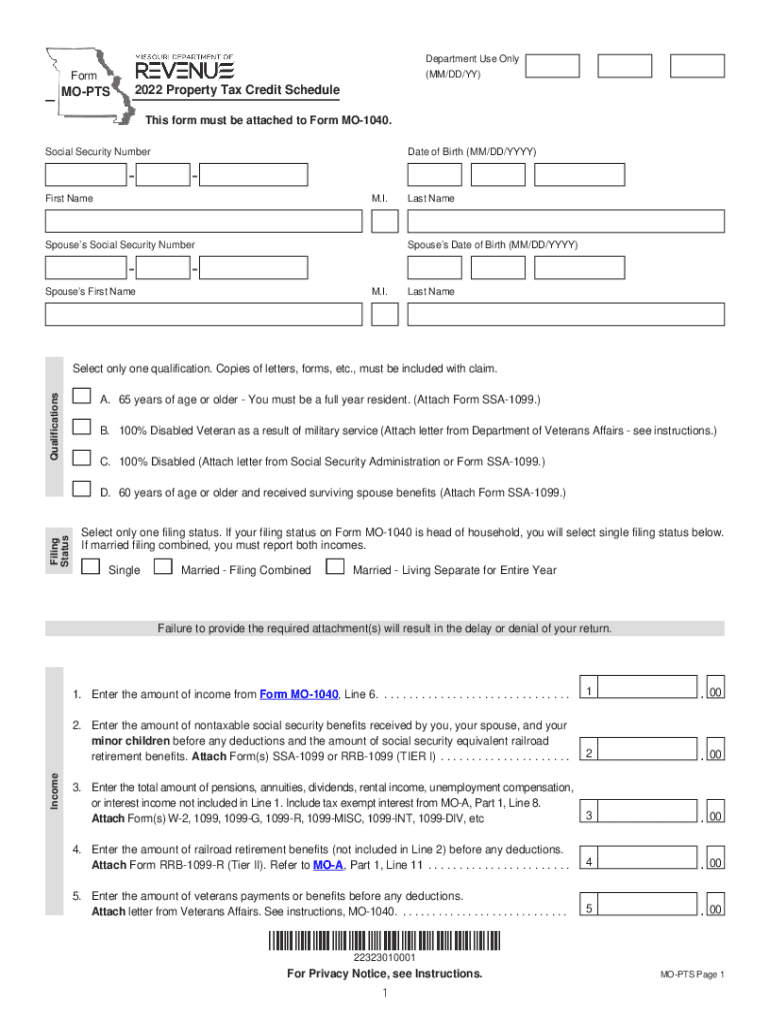

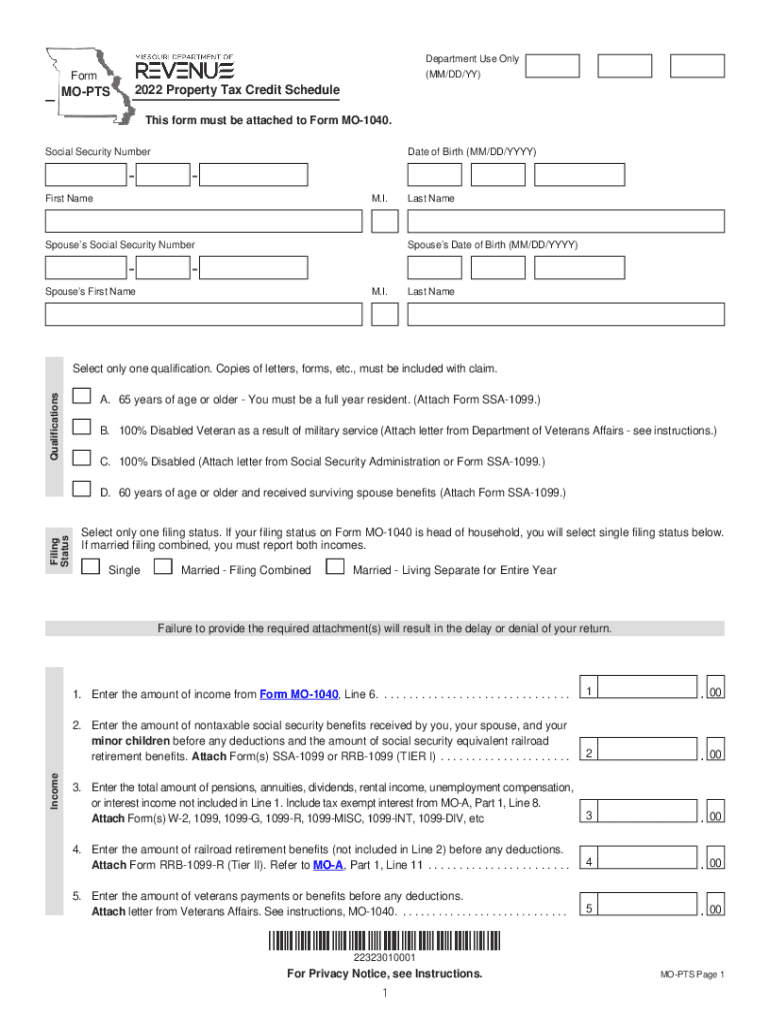

Missouri Property Tax Credit Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/623/237/623237583/large.png

Gasoline And Diesel Tax Rates Rose In 13 States In 2023 Oklahoma

https://www.eia.gov/todayinenergy/images/2023.02.23/main.svg

https://www.irs.gov/instructions/i4136

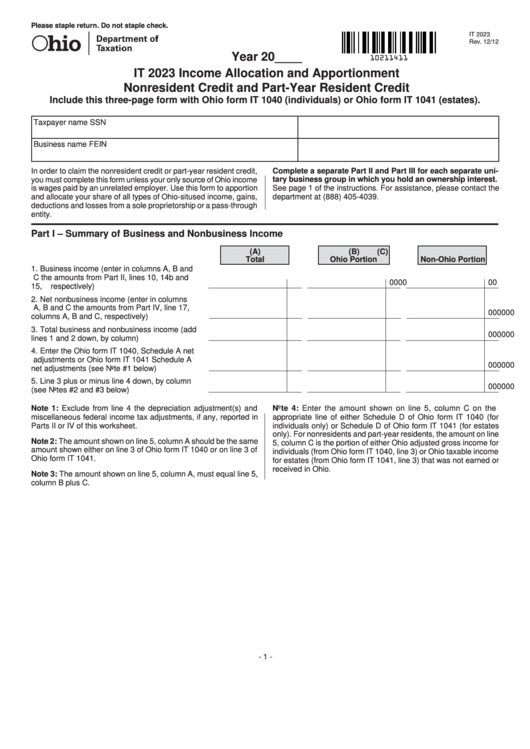

General Instructions Purpose of Form Use Form 4136 to claim the following The biodiesel or renewable diesel mixture credit The alternative fuel credit A credit for certain

https://www.ato.gov.au/.../fuel-schemes/fuel-tax-credits-business

Information about fuel tax credits for business use of fuel Last updated 5 July 2021 Print or Download Fuel tax credits provide businesses with a credit for the fuel tax excise

How To Claim Fuel Tax Credits And Reduce Your Business Expenses In 2023

Missouri Property Tax Credit Form Fill Out Sign Online DocHub

Fuel Tax Credit Confusion Cause For Regional Angst Prime Mover Magazine

Alternative Fuel Tax Credit 2022 Fill Online Printable Fillable

2023 Investment Declaration Form Fillable Printable Pdf And Forms

.png#keepProtocol)

Fuel Tax Credits New Credit Rates Update February 2023

.png#keepProtocol)

Fuel Tax Credits New Credit Rates Update February 2023

What Is The Fuel Tax Credit LiveWell

Fuel Tax Credit Calculation

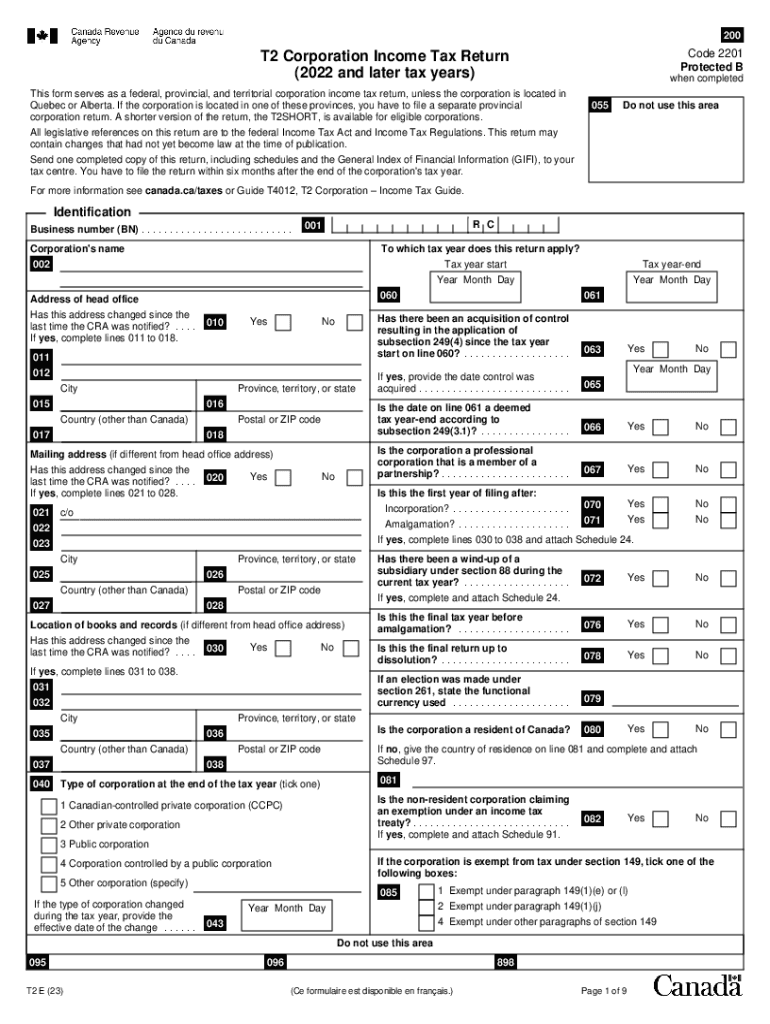

T 2 2023 2024 Form Fill Out And Sign Printable PDF Template

Fuel Tax Credit Form 2023 - Form 4136 Fuel Tax Credit To see which fuel credits are still available go to IRS Instructions for Form 4136 Credit for Federal Tax Paid on Fuels Go to IRS Publication