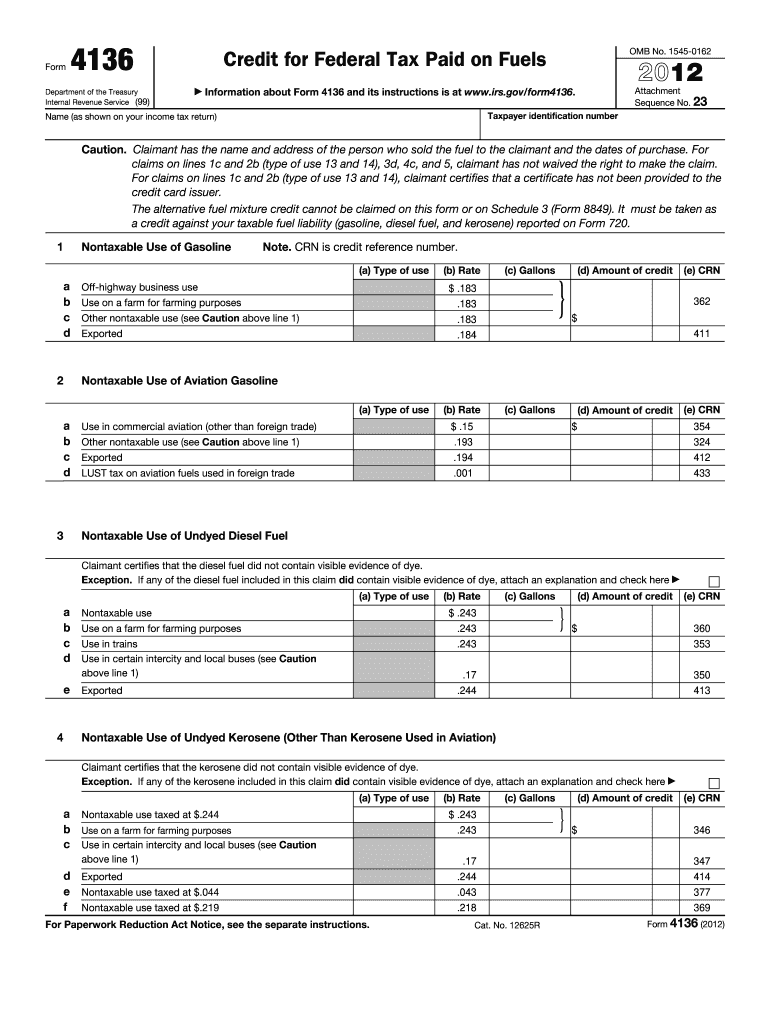

Fuel Tax Credit Form Instructions Attach Form 4136 to your tax return Instead of waiting to claim an annual credit on Form 4136 you may be able to file Form 8849 Claim for Refund of Excise Taxes to claim a periodic

Information about Form 4136 Credit For Federal Tax Paid On Fuels including recent updates related forms and instructions on how to file Use Form 4136 to claim a credit for certain Learn how to claim the tax credit for federal tax paid on fuel using Form 4136 Get instructions on filing and claiming the credit for diesel and alternative fuels Use Form

Fuel Tax Credit Form Instructions

Fuel Tax Credit Form Instructions

https://sandandstone.cmpavic.asn.au/wp-content/uploads/2020/02/tax1-595x1024.jpg

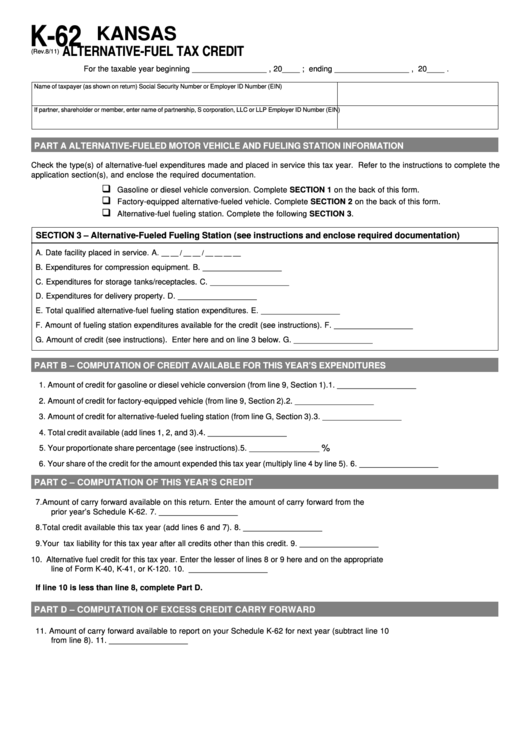

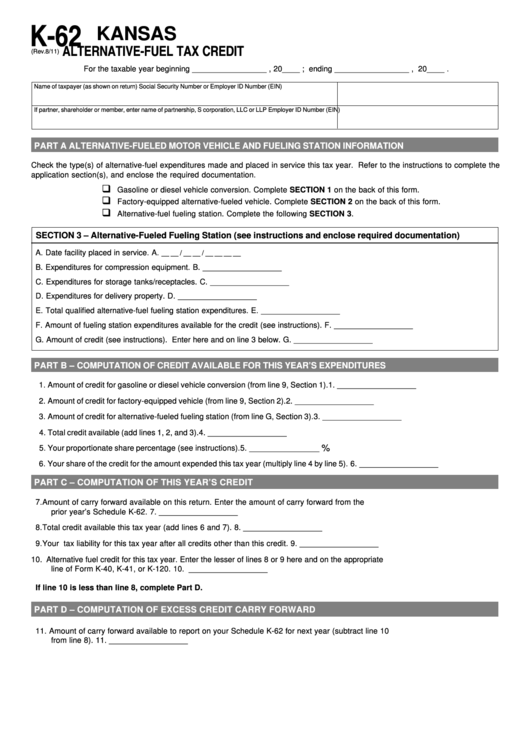

Schedule K 62 Alternative Fuel Tax Credit Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/320/3203/320397/page_1_thumb_big.png

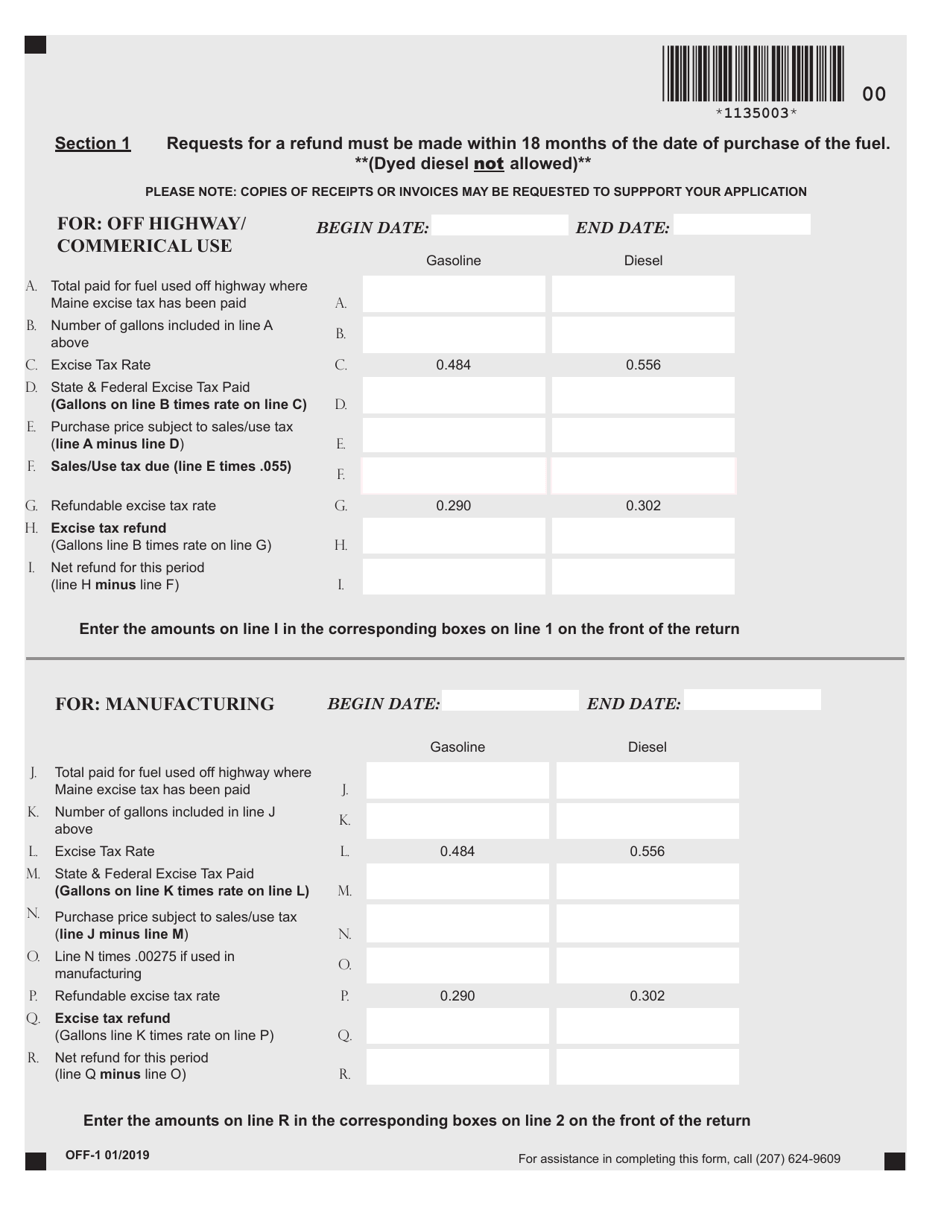

Form OFF 1 Download Fillable PDF Or Fill Online Special Fuel And

https://data.templateroller.com/pdf_docs_html/2018/20184/2018436/page_2_thumb_950.png

Learn how to use Form 4136 to claim fuel tax credits Understand eligibility the filing process and common mistakes to avoid to maximize tax savings The IRS has released updated guidance Notice 2024 74 for determining eligibility for the new clean fuel production credit under Section 45Z that is scheduled to take effect in

Form 4136 allows taxpayers to claim a credit for certain federal excise taxes paid on fuels including gasoline diesel fuel and alternative fuels like liquefied petroleum gas LPG compressed natural gas CNG and This guide will walk through everything you need to know to claim the fuel tax credit from understanding eligibility rules to step by step instructions for filling out Form 4136 You ll also learn how to use TurboTax to seamlessly

Download Fuel Tax Credit Form Instructions

More picture related to Fuel Tax Credit Form Instructions

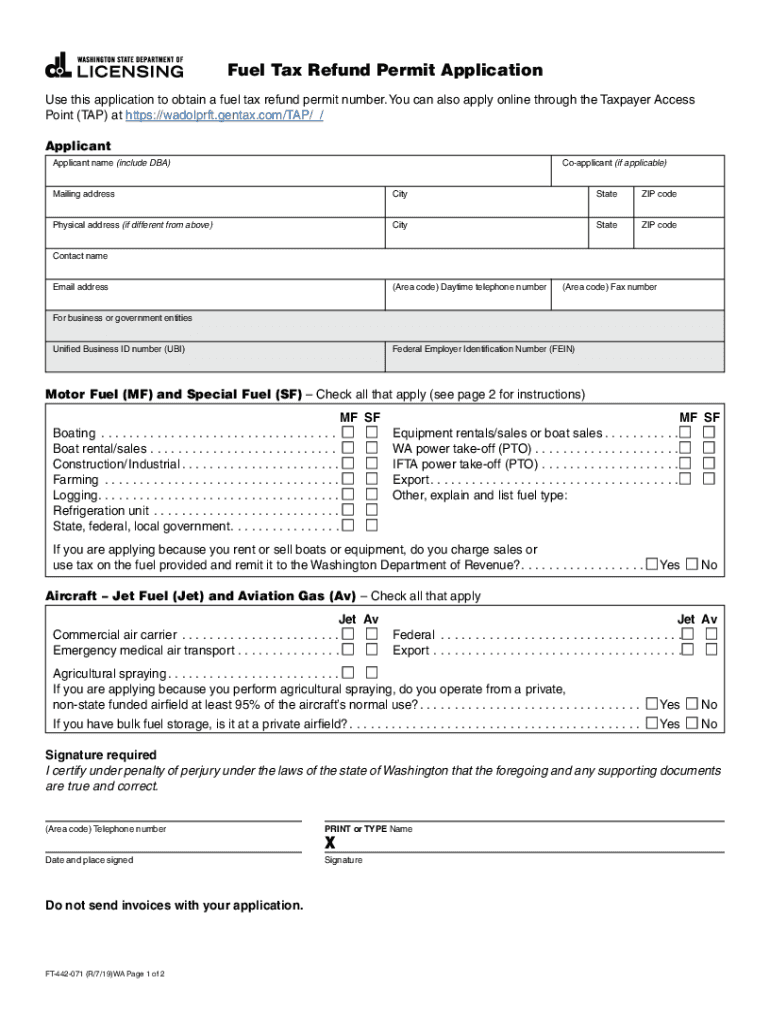

Wa Tap Login 2019 2024 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/562/271/562271615/large.png

Fuel Tax Credit UPDATED JUNE 2022

https://telematics-australia.com/wp-content/uploads/2020/06/Fuel-Tax-Credits.png

Credit For Federal Tax Paid On Fuels IRS Gov Fill Out And Sign

https://www.signnow.com/preview/6/954/6954663/large.png

The Credit for Federal Tax Paid on Fuels Fuel Tax Credit is a program that lets some businesses reduce their taxable income dollar for dollar based on specific types of fuel costs Department of the Treasury Internal Revenue Service Credit for Federal Tax Paid on Fuels Go to www irs gov Form4136 for instructions and the latest information OMB No 1545 0162

IRS Form 4136 Credit for Federal Tax Paid on Fuels enables certain taxpayers to claim a fuel credit depending on the type of fuels used and the type of business use the credit If your business uses gasoline or diesel fuel you may earn a tax credit Learn more about excise tax credit for fuel and get tax answers at H R Block

Fuel Tax Credits Making Adjustments And Correcting Errors

https://s2.studylib.net/store/data/018257804_1-9f4c7a6f1251e4d521bfd5d6b8ddc277-768x994.png

Record keeping Requirements For Fuel Tax IFTA YouTube

https://i.ytimg.com/vi/StF85GsCcYM/maxresdefault.jpg

https://www.irs.gov › pub › irs-pdf

Attach Form 4136 to your tax return Instead of waiting to claim an annual credit on Form 4136 you may be able to file Form 8849 Claim for Refund of Excise Taxes to claim a periodic

https://www.irs.gov › forms-pubs

Information about Form 4136 Credit For Federal Tax Paid On Fuels including recent updates related forms and instructions on how to file Use Form 4136 to claim a credit for certain

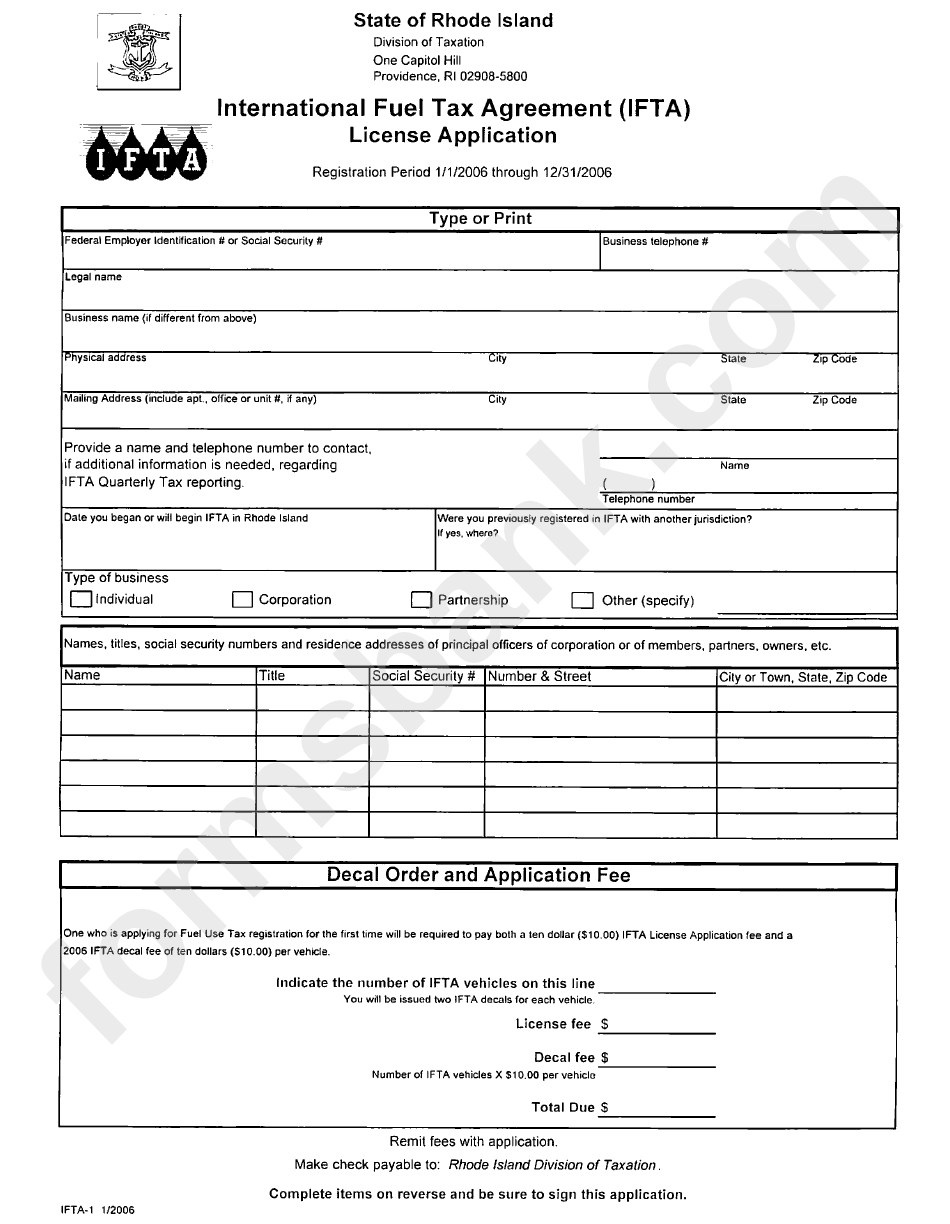

International Fuel Tax Agreement License Application Form Printable

Fuel Tax Credits Making Adjustments And Correcting Errors

Gas Station Receipt Template

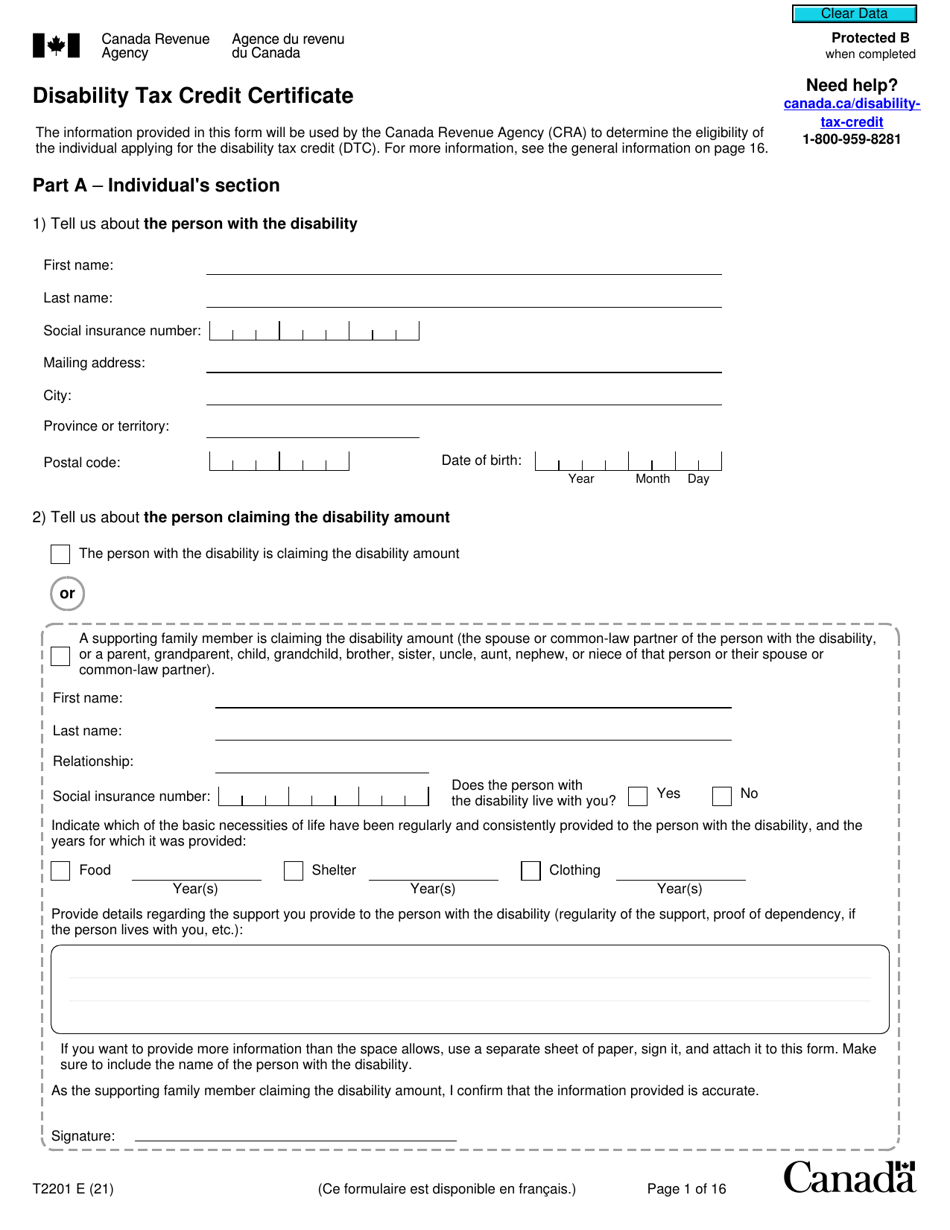

Form T2201 Download Fillable PDF Or Fill Online Disability Tax Credit

Fuel Tax Credit PS Support

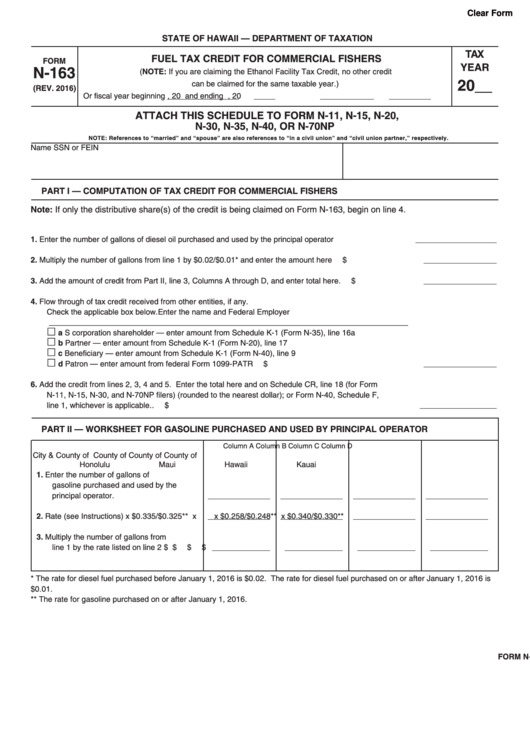

Fillable Form N 163 Fuel Tax Credit Printable Pdf Download

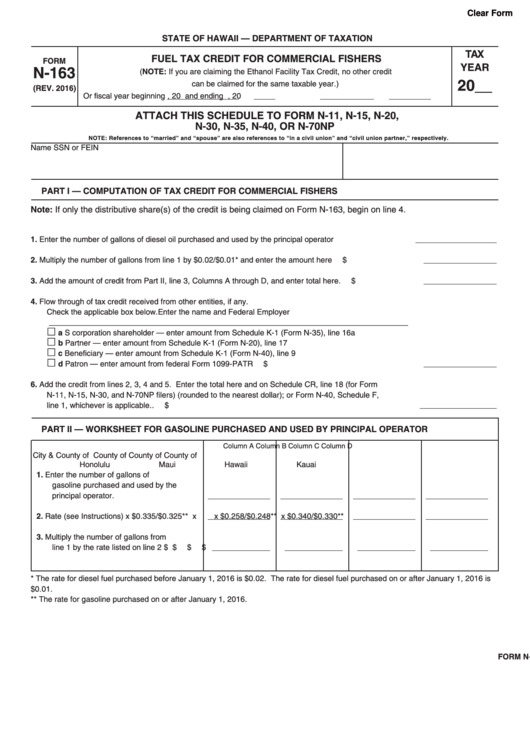

Fillable Form N 163 Fuel Tax Credit Printable Pdf Download

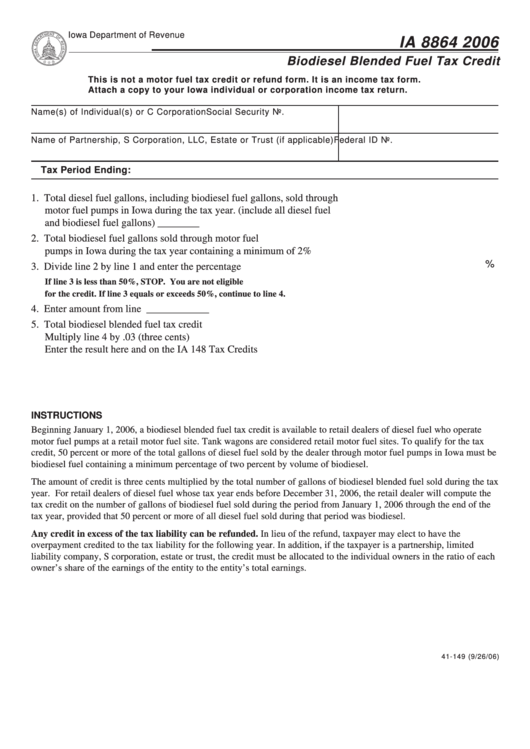

Form 41 149 Biodiesel Blended Fuel Tax Credit Printable Pdf Download

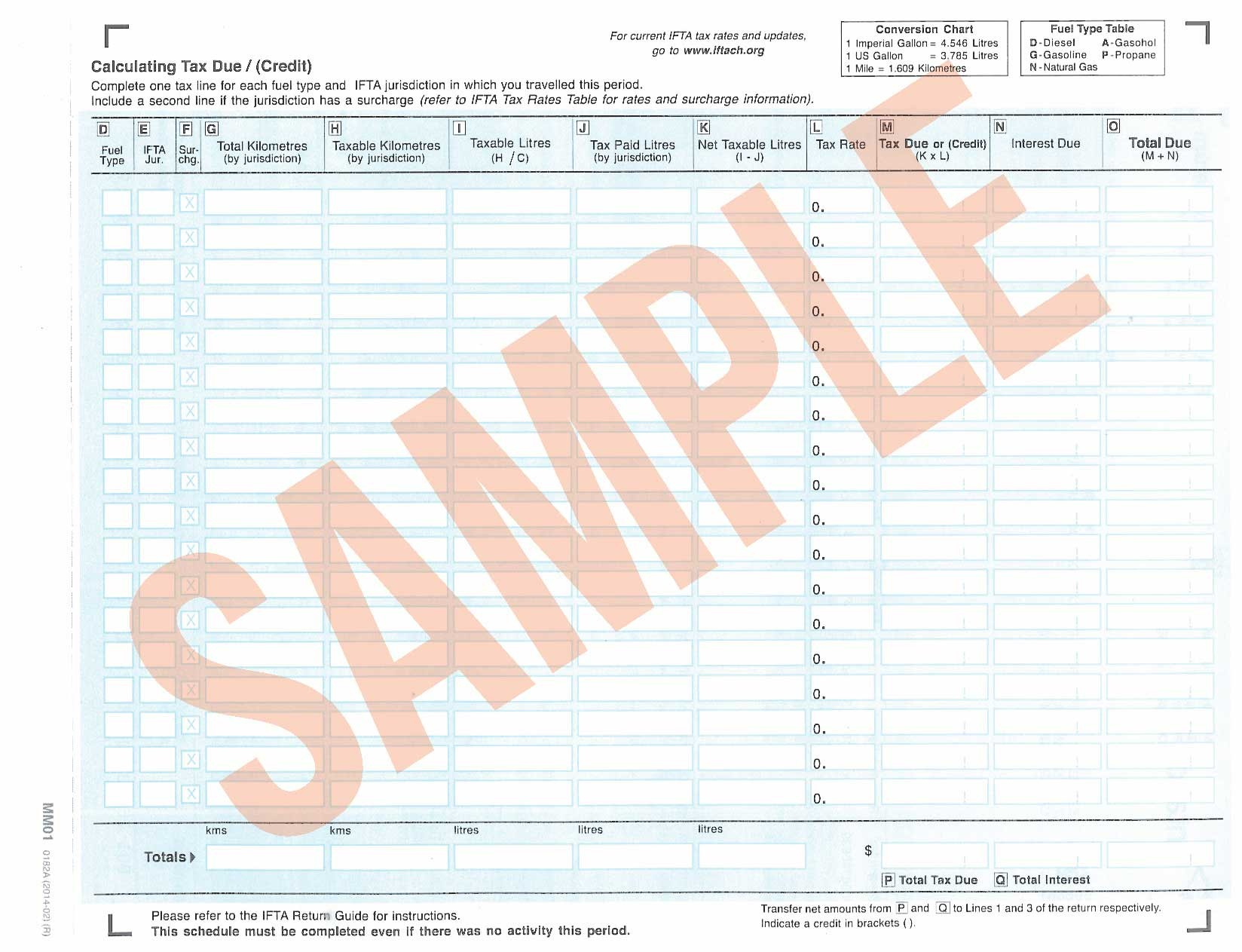

Bc Ifta Fuel Tax Form Universal Network

Ifta Fuel Tax Spreadsheet With Example Of Ifta Spreadsheet

Fuel Tax Credit Form Instructions - See the Form 720 instructions Do not claim a refund on Form 8849 for any amount for which you have filed or will file a claim on Schedule C Form 720 or Form 4136 Alcohol fuel mixture