Fuel Tax Credit Rates May 2022 Reinstated and Extended Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and extended

April 27 2022 Tax If you are eligible to claim Fuel Tax Credits and lodge a quarterly BAS you may have to apply 3 different rates this quarter Fuel tax credit rates change regularly They are indexed twice a year in Fuel Tax Credit A federal subsidy that allows businesses to reduce their taxable income dollar for dollar based on specific types of fuel costs There are several types of fuel credits For

Fuel Tax Credit Rates May 2022

Fuel Tax Credit Rates May 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEijO1qAMs_napos3v0ETHe96cx_283MPXVZQXocehgFGkIZ6xTYr0RfHfLiwzClgt1pNmbyCoGSW95DXvx_9PPk5WwQI6RomoDtBDcEFIVgflW04uIRTkMDrLhIZsWQ-upuVniwQQasrHnIe-nOvNw5SD0rXmfOFwsR1N0ob2tG3q6cavZuiSNBND-j/s762/ftc.jpg

Fuel Tax Credit

https://bristax.com.au/wp-content/uploads/2023/06/fuel-tax-credit-bristax-tax-accountants-1.webp

Fuel Tax Credit Changes HTA

https://www.hta.com.au/wp-content/uploads/2022/05/Fuel-tax-credit-changes-1.png

The table below shows the new rates in cents per litre on fuel acquired from 30 March 2022 to 30 June 2022 Source ATO To ensure you can claim your credits you have to be registered for Goods and Recent changes to Fuel Tax Credits In July of 2022 the rates for biodiesel B100 were changed due to increased excise tax rates The tax rates excise and

The act which President Joe Biden signed into law on Aug 16 2022 intends to facilitate the administration s commitment to reducing economy wide On Sept 13 pursuant to the Inflation Reduction Act of 2022 IRA the IRS published Notice 2022 39 which provides rules that claimants must follow to make one

Download Fuel Tax Credit Rates May 2022

More picture related to Fuel Tax Credit Rates May 2022

Fuel Tax Credit Calculator Banlaw

https://www.banlaw.com/wp-content/uploads/2022/04/Artboard-1@2x-100-768x1024.jpg

Fuel Tax Credit Rates Have Changed Small Business Minder

https://www.ato.gov.au/uploadedImages/Content/SBIT/Newsroom/Articles/GST_and_excise/6g-Fuel-tax-credits_a.png

Fuel And Fuel Taxes Trucking Blogs ExpeditersOnline

https://www.expeditersonline.com/cms/uploads/2022-3rd-quarter-ifta-fuel-tax-rates-4-august-2022_001.png

What is the Fuel Tax Credit Rate The fuel tax credit rates are broken down according to the type of fuel used where equipment is driven and when the fuel was acquired The September 27 2022 The IRS has released procedures Notice 2022 39 for claiming the alternative fuel tax credits that were reinstated retroactively for 2022 The alternative

The federal government imposes taxes on a variety of fuels The one most familiar to taxpayers is probably the federal gas tax 18 4 cents gallon as of Fuel charge rates April 2023 to April 2030 The rates in Tables 1 and 2 reflect a pricing trajectory for each fuel type and combustible waste from April 1 2023 to

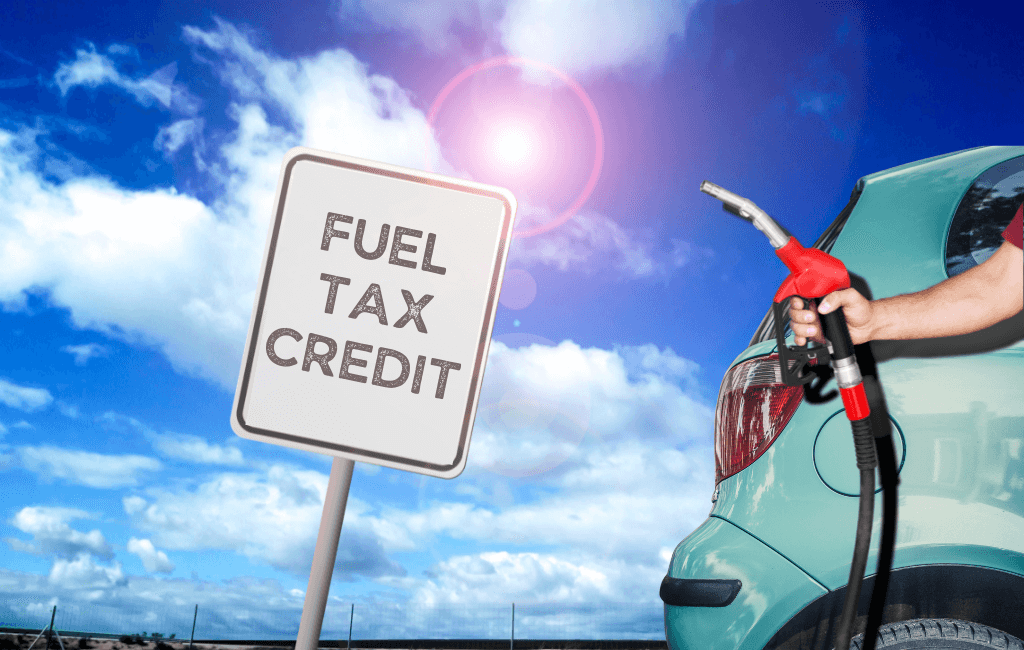

International Fuel Tax Agreement IFTA Tax Return Information And

https://www.signnow.com/preview/549/386/549386760/large.png

Tax Brackets Canada 2022 Filing Taxes

https://filingtaxes.ca/wp-content/uploads/2021/12/Screenshot_2.png

https://www. irs.gov /.../fuel-tax-credits

Reinstated and Extended Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and extended

https://www. linkadvisors.com.au /blog/tax/how-to...

April 27 2022 Tax If you are eligible to claim Fuel Tax Credits and lodge a quarterly BAS you may have to apply 3 different rates this quarter Fuel tax credit rates change regularly They are indexed twice a year in

Sentrika Blog Fuel Tax Credit Changes

International Fuel Tax Agreement IFTA Tax Return Information And

Gasoline And Diesel Tax Rates Rose In 13 States In 2023 Oklahoma

Add A New Fuel Tax Rate Agrimaster

R D Tax Credit Rates And Allowances 2023 WhisperClaims

Fuel Tax Credit Services KPMG AU

Fuel Tax Credit Services KPMG AU

Changes To Fuel Tax Credit Rates Paris Financial Accounting And

.png)

Fuel Tax Credit Rates Have Changed DG Business Services

Fuel Tax Credit Rate Increase Johansen Insurance Brokers Pty Ltd

Fuel Tax Credit Rates May 2022 - Page Last Reviewed or Updated 01 Feb 2024 Information about Form 4136 Credit For Federal Tax Paid On Fuels including recent updates related forms and instructions on