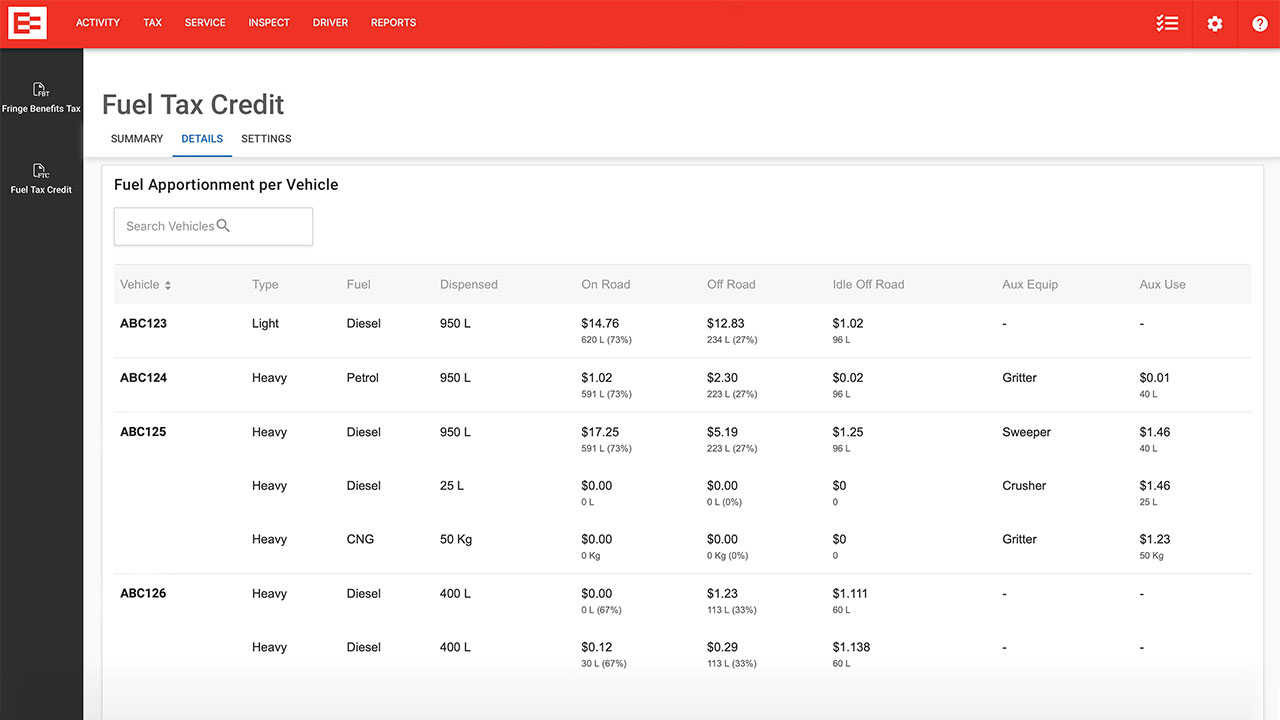

Fuel Tax Credit Rebate Amount Web Fuel tax credits business Fuel tax credits provide businesses with a credit for the fuel tax excise or customs duty that s included in the price of fuel used in machinery plant

Web Overview The following tools will help you check if you re eligible for fuel tax credits and work out the amount of fuel tax credits you can claim Eligibility tool check if you can Web 7 mars 2023 nbsp 0183 32 Taxation Claim fuel tax credits Last Updated 7 March 2023 If your business uses fuel you may be able to claim credits for the fuel tax included in the

Fuel Tax Credit Rebate Amount

Fuel Tax Credit Rebate Amount

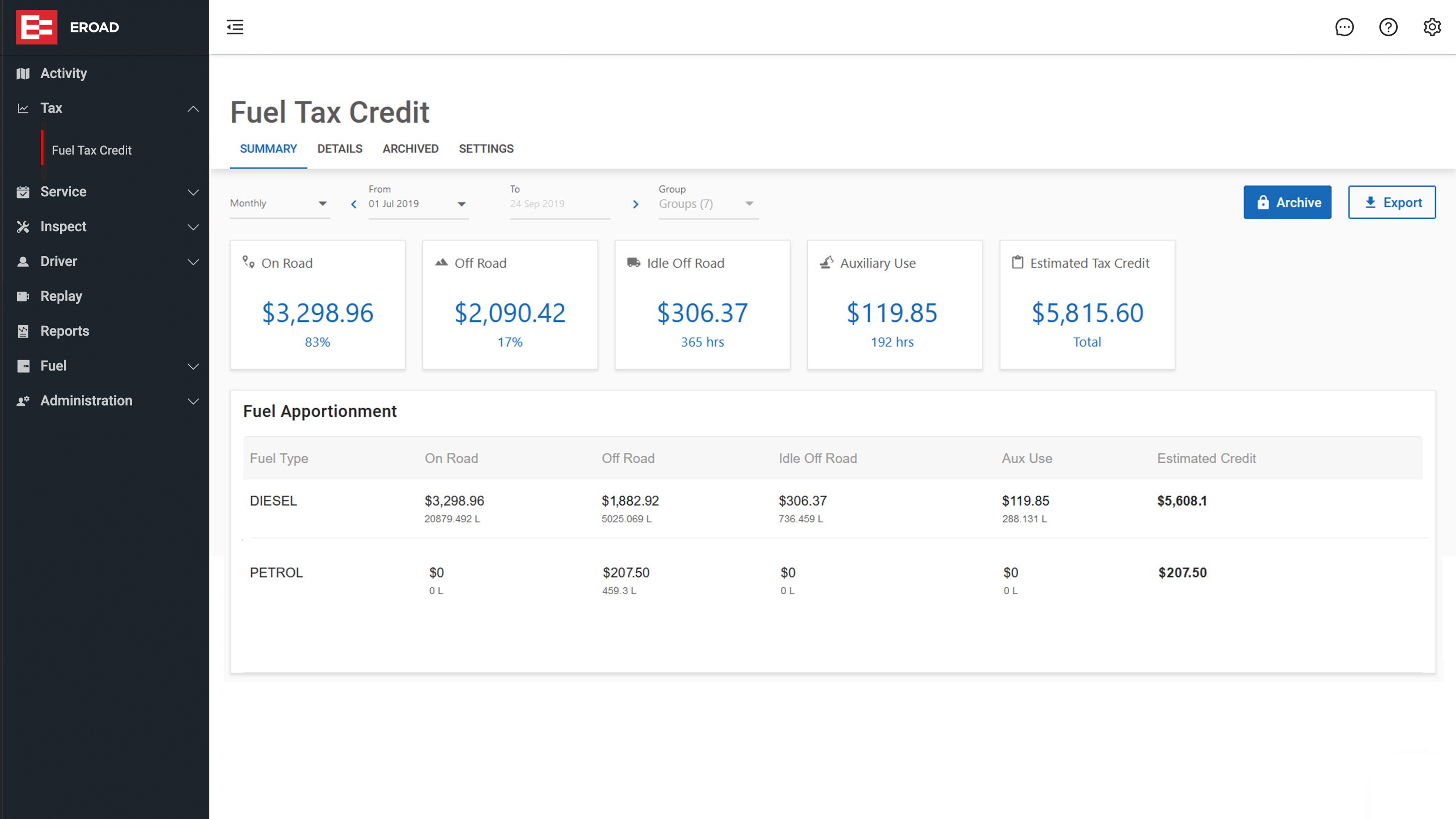

https://www.eroad.com.au/wp-content/uploads/2019/12/FTC-Details-Slide-2.jpg

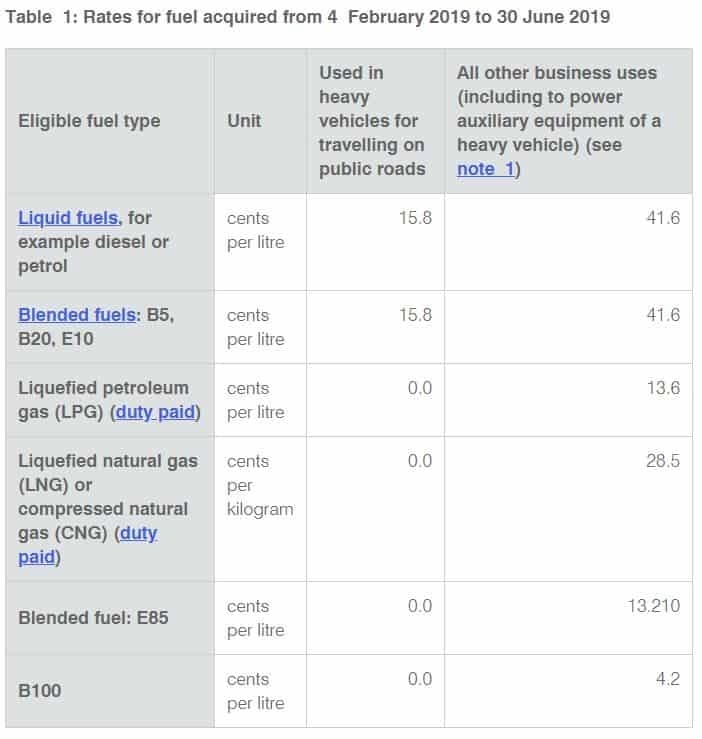

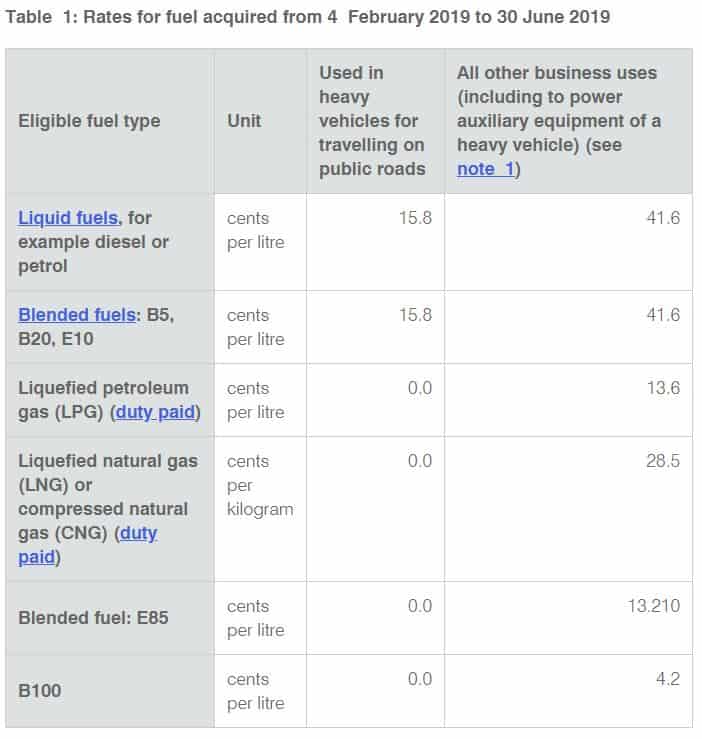

Fuel Tax Credit Atotaxrates info

http://atotaxrates.info/wp-content/uploads/2019/01/rates-4feb2019.jpg

Fuel Tax Credit Atotaxrates info

https://atotaxrates.info/wp-content/uploads/2013/06/FTC-1Feb2017.jpg

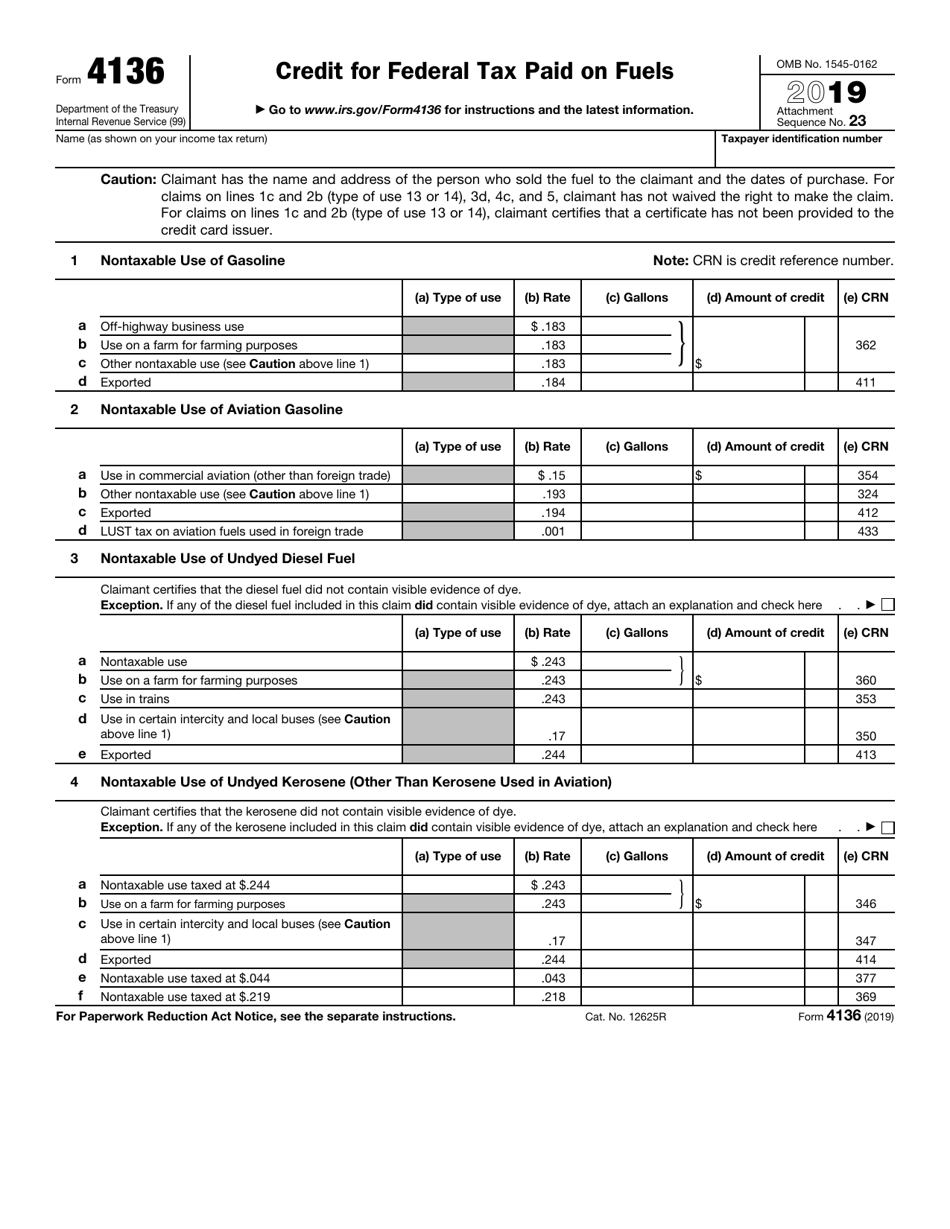

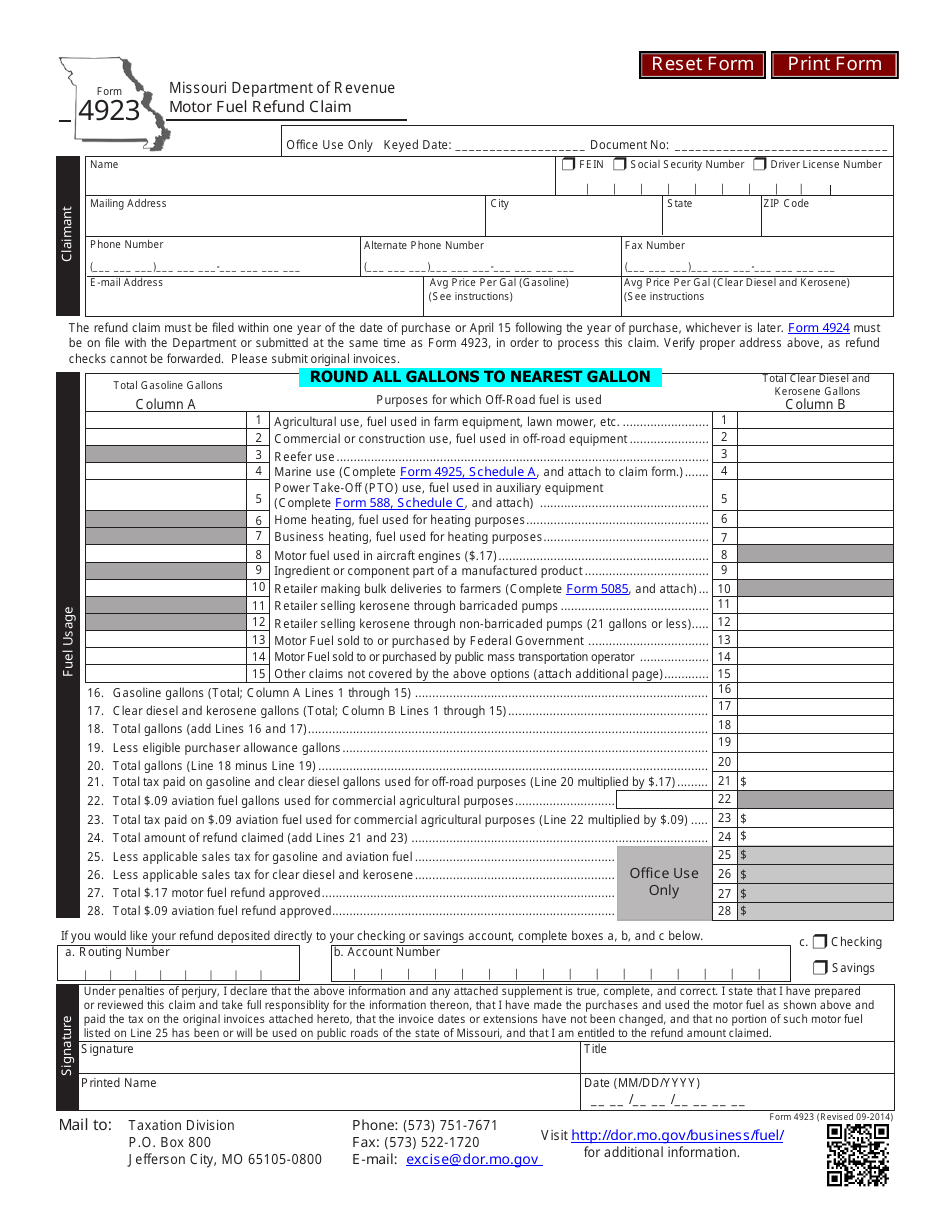

Web 2 juin 2023 nbsp 0183 32 The one most familiar to taxpayers is probably the federal gas tax 18 4 cents gallon as of 2021 which pays for road projects across the country Certain uses of fuels are untaxed however and fuel users can Web The amount you can claim is shown in box es 237 of your 2022 T5013 slip if the partnership is required to file a T5013 Partnership Information Return or in a letter if the

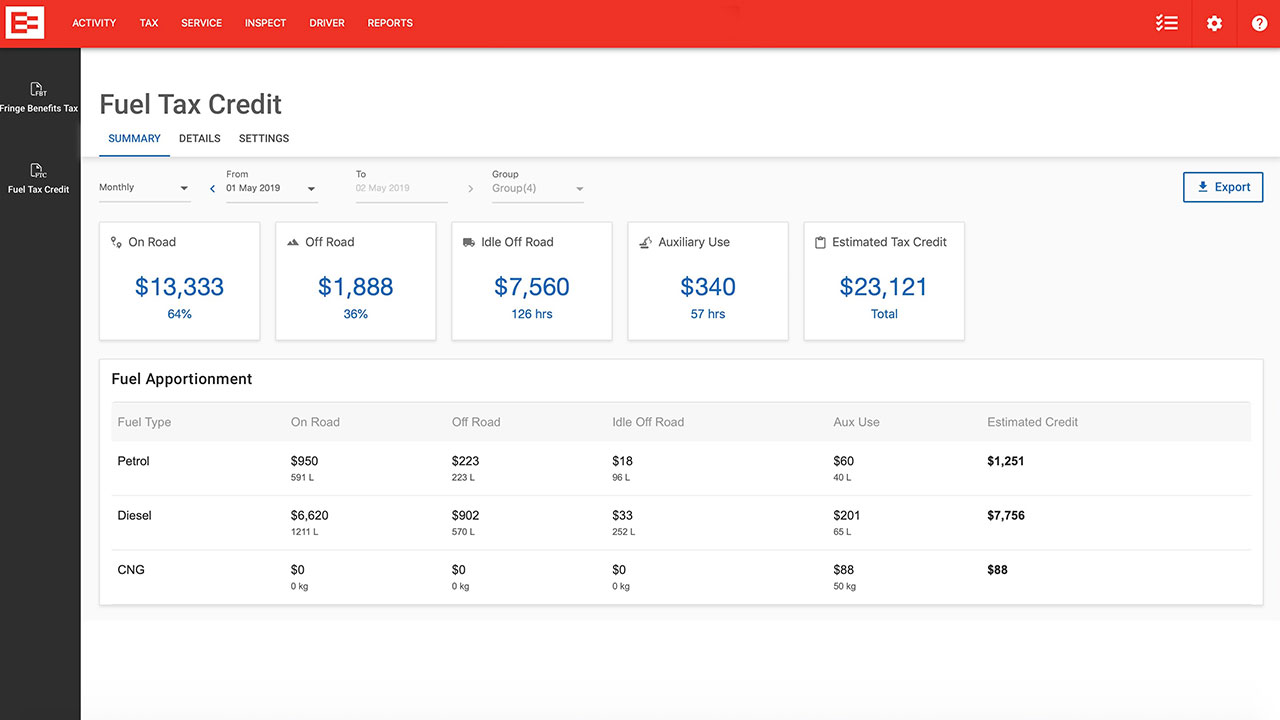

Web 11 nov 2021 nbsp 0183 32 If you claim less than 10 000 in fuel tax credits per year the easiest and safest way to get your claims right is to use one of the following methods The basic method for heavy vehicles which Web That s approximately 23 00 than the standard on road rate And despite light vehicles not being entitled to claim on road FTC you can claim up to 42 7 cents per litre if they operate in off road areas That could add up

Download Fuel Tax Credit Rebate Amount

More picture related to Fuel Tax Credit Rebate Amount

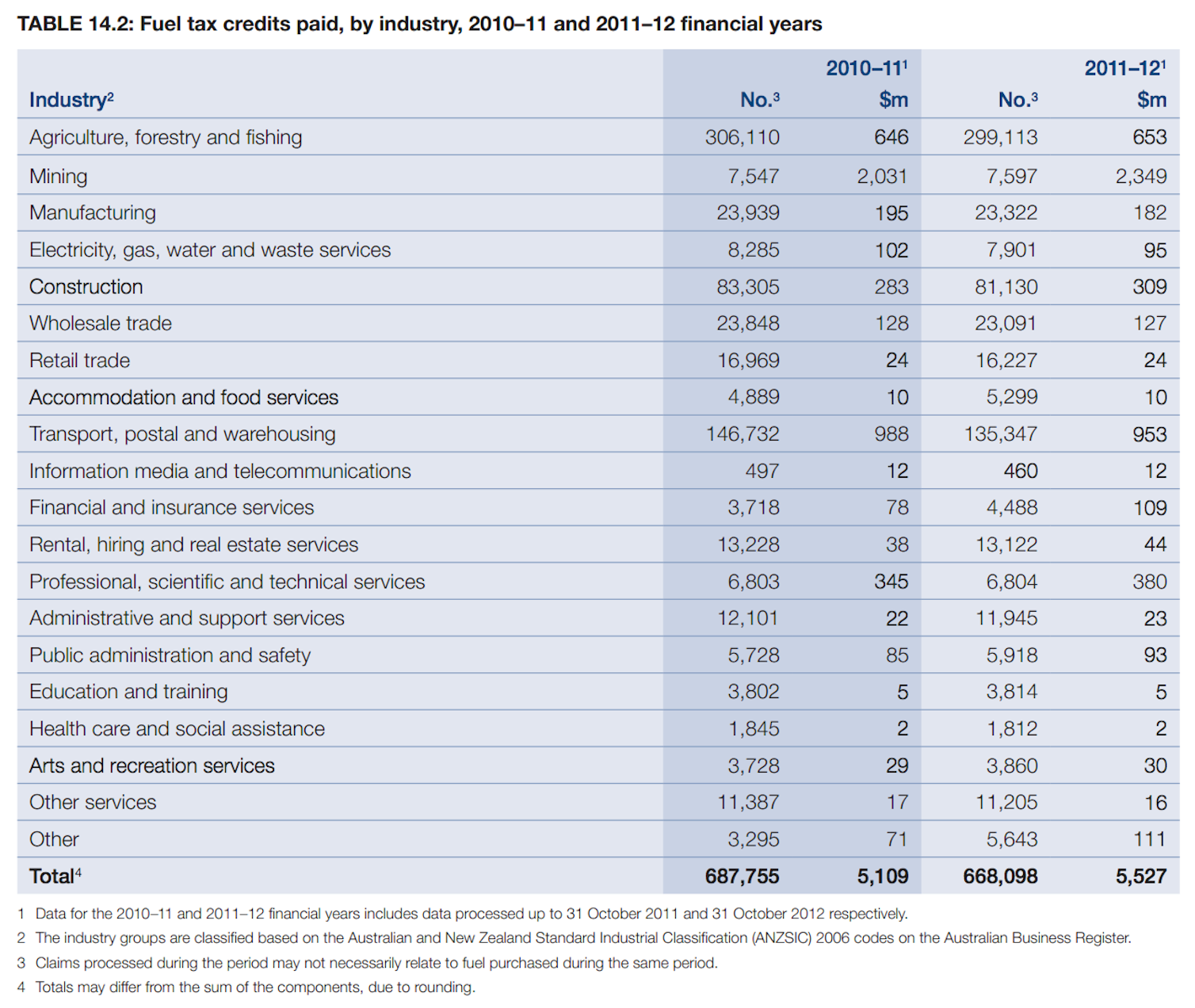

Viewpoints Should Fuel Tax Credits Be Cut In The Budget

https://images.theconversation.com/files/47595/original/3cfp2vcz-1398993376.jpg?ixlib=rb-1.1.0&q=30&auto=format&w=754&h=636&fit=crop&dpr=2

Never Mine The Budget Here s The Fuel Tax Credit Scheme The

https://australiainstitute.org.au/wp-content/uploads/2022/03/table2.png

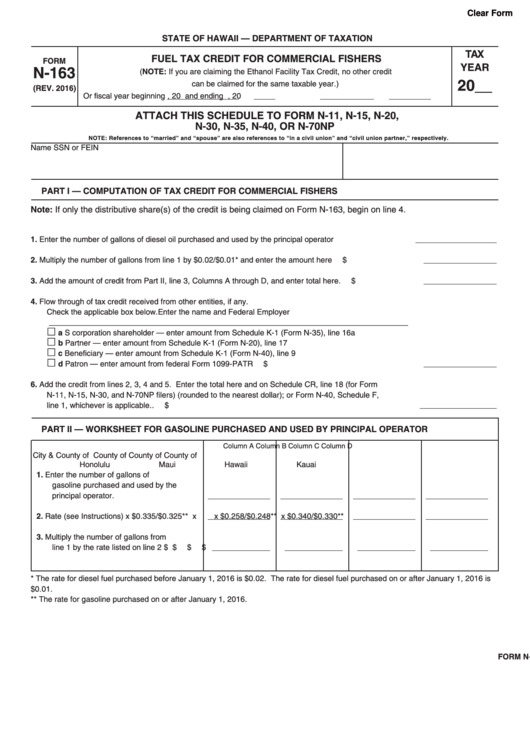

Fillable Form N 163 Fuel Tax Credit Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/128/1280/128053/page_1_thumb_big.png

Web 6 avr 2022 nbsp 0183 32 6 April 2022 Much attention has been given to the 2022 Budget measure of temporarily halving of the fuel excise for petrol and diesel from 44 2 cents litre to 22 1 Web 27 oct 2022 nbsp 0183 32 Australia Institute October 2022 Budget Wrap For a bread and butter budget there are some pretty beefy subsidies for fossil fuels The fuel tax credit rebate is one of the top 20 most expensive

Web Get a tax credit of up to 7 500 for new vehicles purchased in or after 2023 Pre Owned Plug in and Fuel Cell Electric Vehicles Purchased in or after 2023 Get a credit of up to Web The updated February 2023 Fuel Tax Credit rates are as follows per the ATO website Fuel Acquired 1 February 2023 30 June 2023 What records are required to claim Fuel

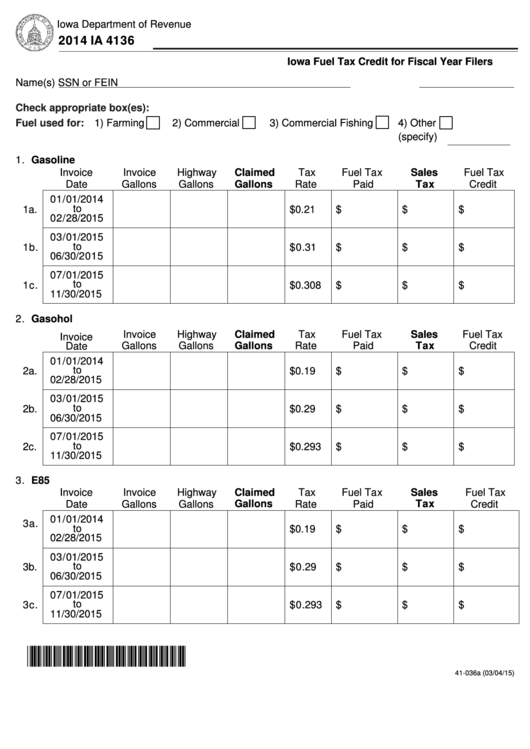

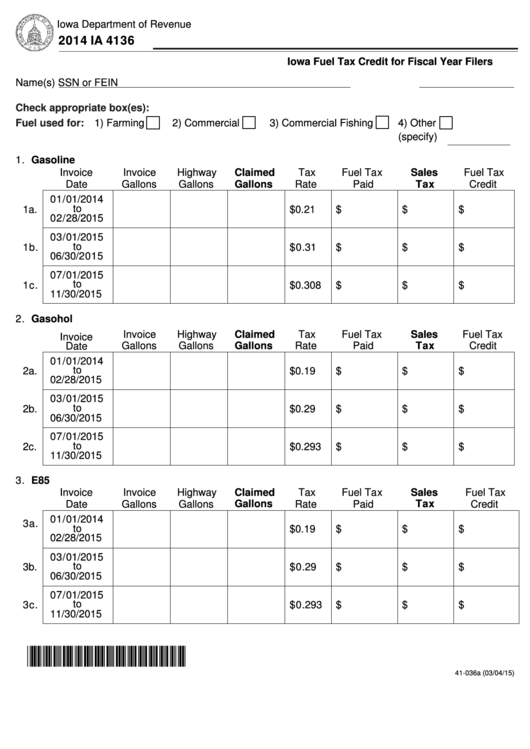

Fillable Form Ia 4136 Fuel Tax Credit For Fiscal Year Filers 2014

https://data.formsbank.com/pdf_docs_html/224/2246/224675/page_1_thumb_big.png

Government Digs Deep For Mining Company Tax Rebates The Australia

https://australiainstitute.org.au/wp-content/uploads/2021/07/Saved___dammed_-_Fuel_tax_credits_by_industry.png

https://www.ato.gov.au/Business/Fuel-schemes/Fuel-tax-credits---busin…

Web Fuel tax credits business Fuel tax credits provide businesses with a credit for the fuel tax excise or customs duty that s included in the price of fuel used in machinery plant

https://www.ato.gov.au/Calculators-and-tools/Fuel-tax-credit-tools

Web Overview The following tools will help you check if you re eligible for fuel tax credits and work out the amount of fuel tax credits you can claim Eligibility tool check if you can

Fuel Tax Credit Changes 2022 Aintree Group

Fillable Form Ia 4136 Fuel Tax Credit For Fiscal Year Filers 2014

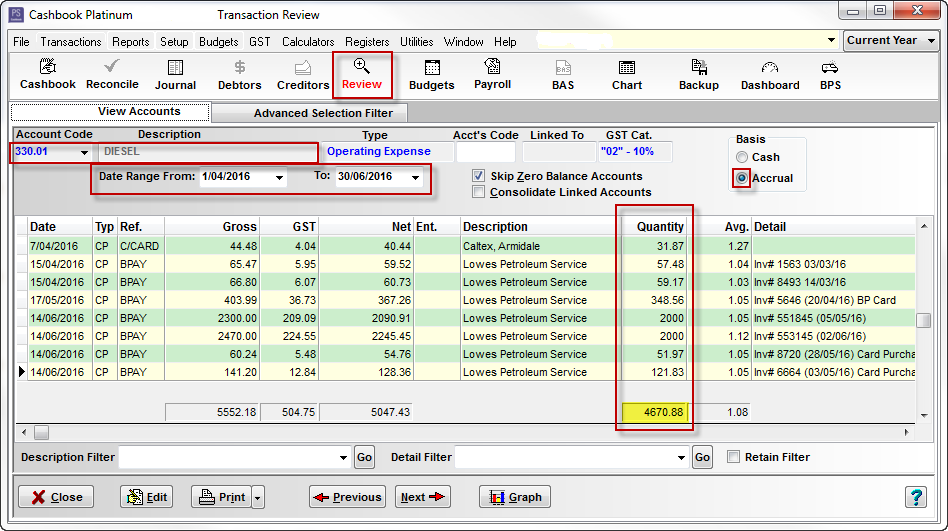

Fuel Tax Credits FTC Rebates EROAD

Fuel Tax Credits Calculation Worksheet

Military Journal Missouri 500 Tax Refund If The Total Amount Of

How The Drive Clean Rebate Works NYSERDA

How The Drive Clean Rebate Works NYSERDA

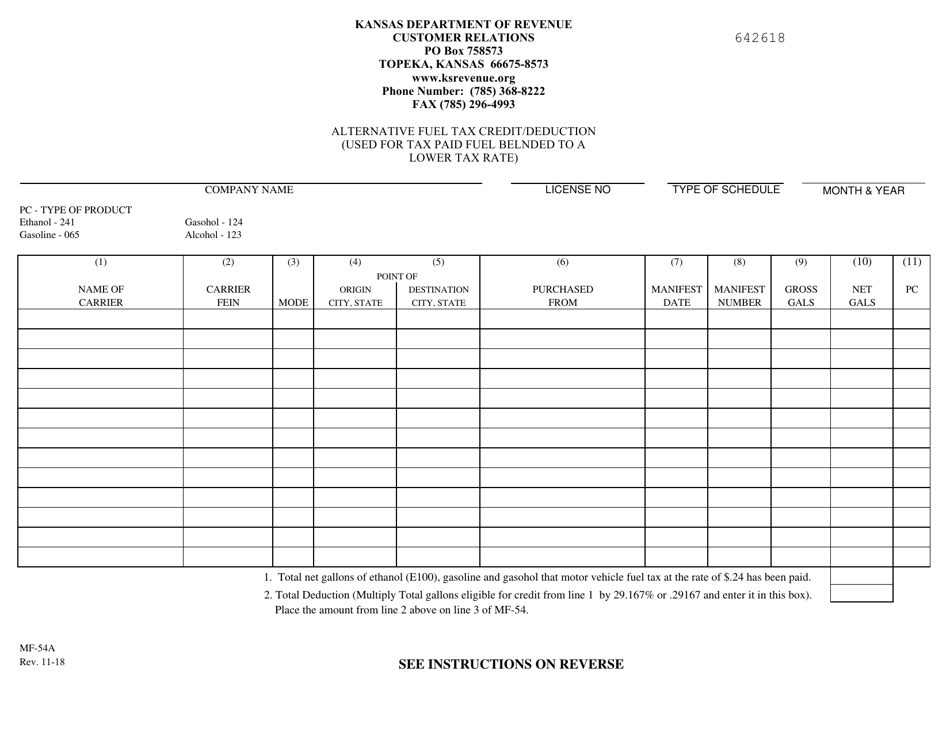

Form MF 54A Download Fillable PDF Or Fill Online Alternative Fuel Tax

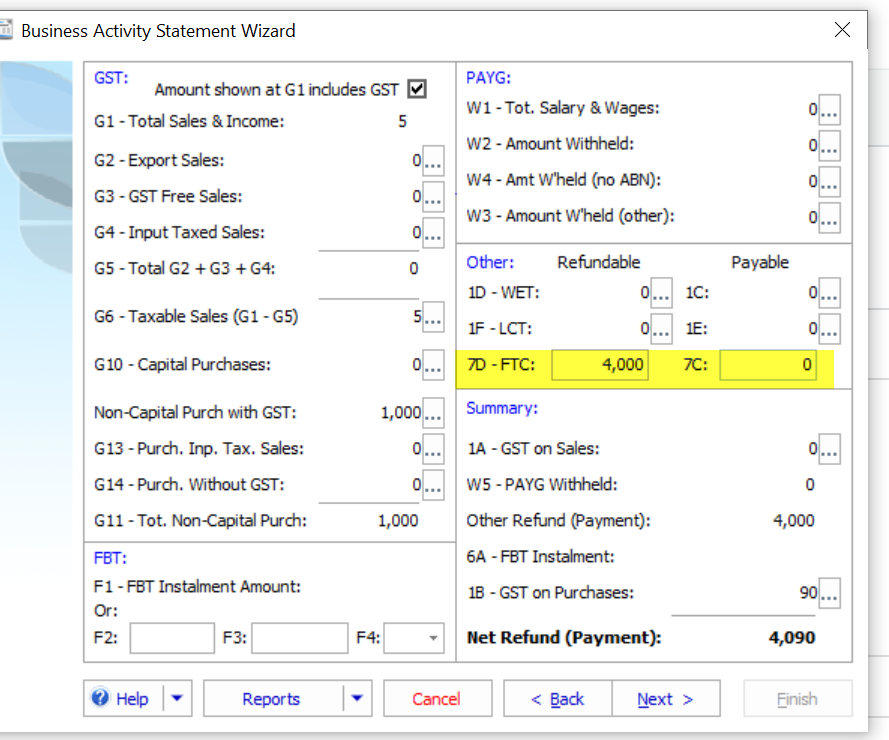

BAS How To Enter Fuel Tax Credits Exalt

Fuel Tax Credits Calculation Worksheet

Fuel Tax Credit Rebate Amount - Web Federal Tax Credits for Plug in Electric and Fuel Cell Electric Vehicles Purchased in 2023 or After Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell