Fuel Tax Credit Rebate Ato Web All fuel tax credit claimants need to apply the new rates for fuel acquired from 1 August To make it easier if your business claims less than 10 000 in the year you can use the

Web 7 mars 2023 nbsp 0183 32 1 Check if you re eligible for fuel tax credits Businesses can claim credits for the fuel tax excise or customs duty included in the price of fuel used in their Web 22 nov 2022 nbsp 0183 32 You can claim fuel tax credits for fuel you purchase manufacture or import for business use Work out if you are eligible for fuel tax credits with the ATO s Fuel tax

Fuel Tax Credit Rebate Ato

Fuel Tax Credit Rebate Ato

https://atotaxrates.info/wp-content/uploads/2019/01/rates-4feb2019.jpg

Automated Fuel Tax Credit Rebates YouTube

https://i.ytimg.com/vi/71ouIAuk9uU/maxresdefault.jpg

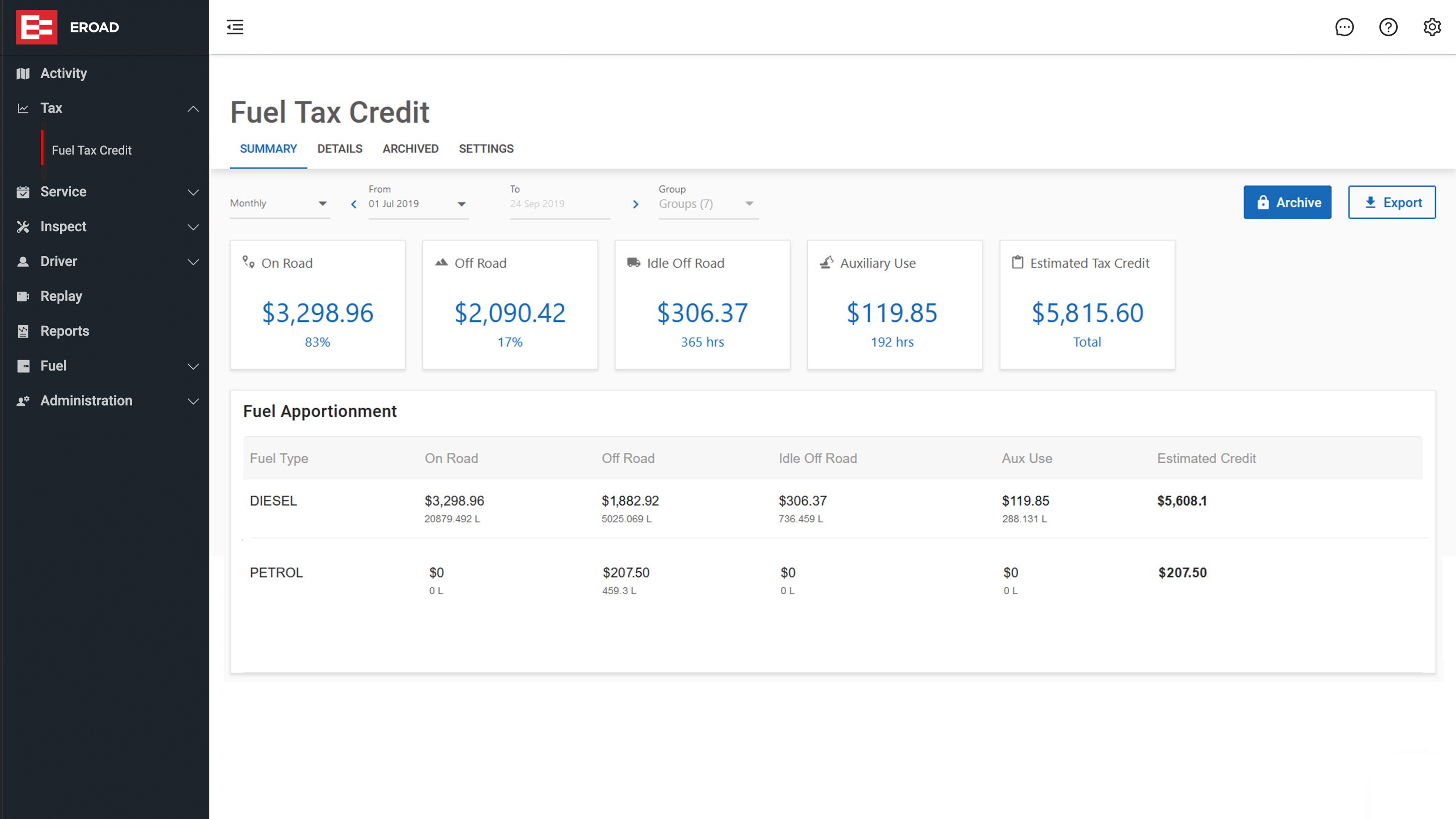

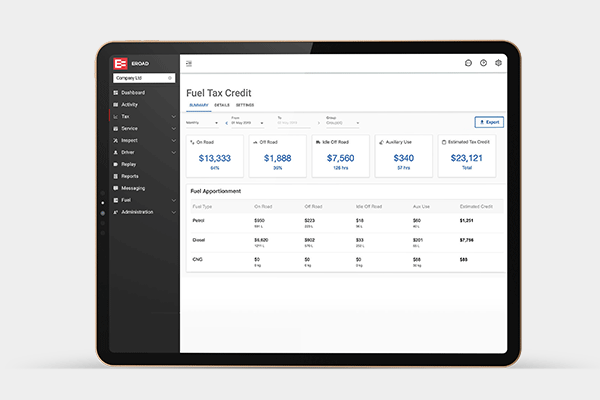

Automate Fuel Tax Credits And Unlock Higher FTC Rebates EROAD AU

https://www.eroad.com.au/wp-content/uploads/2019/12/FTC-Details-Slide-2.jpg

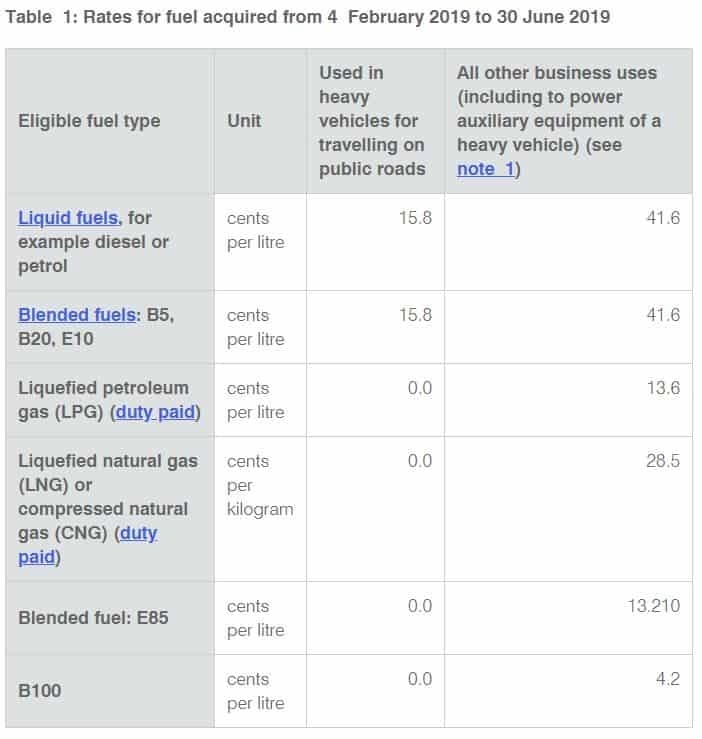

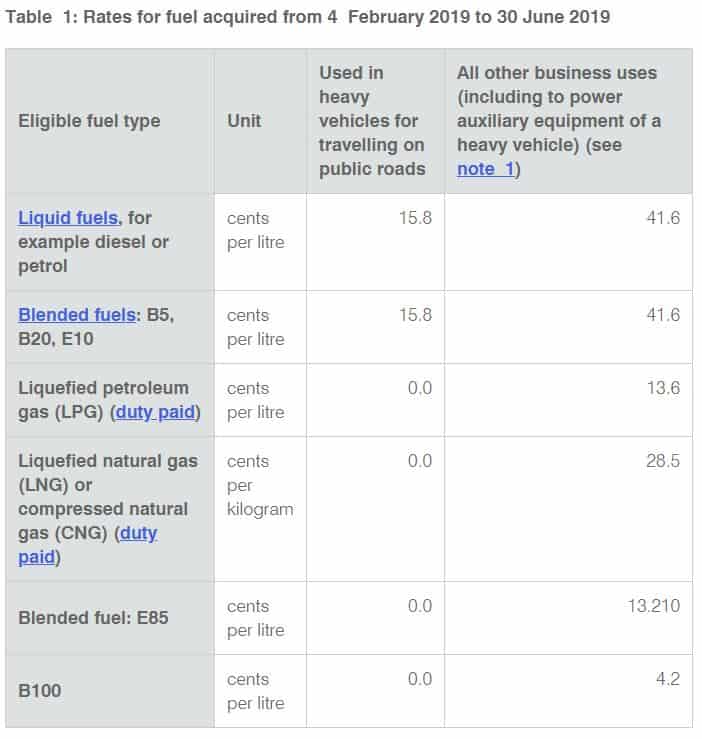

Web 21 juin 2022 nbsp 0183 32 1 Manual Process The simplest approach is to do everything manually Collect your heavy vehicle fuel receipts and assume all on road usage Then use the low Web Fuel Tax Rebates and Rates from the ATO It is important to be able to calculate the potential Fuel Tax Credit rebate available to your organisation for Petrol or Diesel used

Web 15 f 233 vr 2021 nbsp 0183 32 NatRoad has been working with the Australian Taxation Office ATO to find a simpler way for members to calculate their fuel tax rebate You can now use the basic Web 11 oct 2020 nbsp 0183 32 ATO Community Tax Professionals Lodging amp Reporting For Your Clients Fuel Tax Credit Income David88 Newbie 11 Oct 2020 For businesses operating on an

Download Fuel Tax Credit Rebate Ato

More picture related to Fuel Tax Credit Rebate Ato

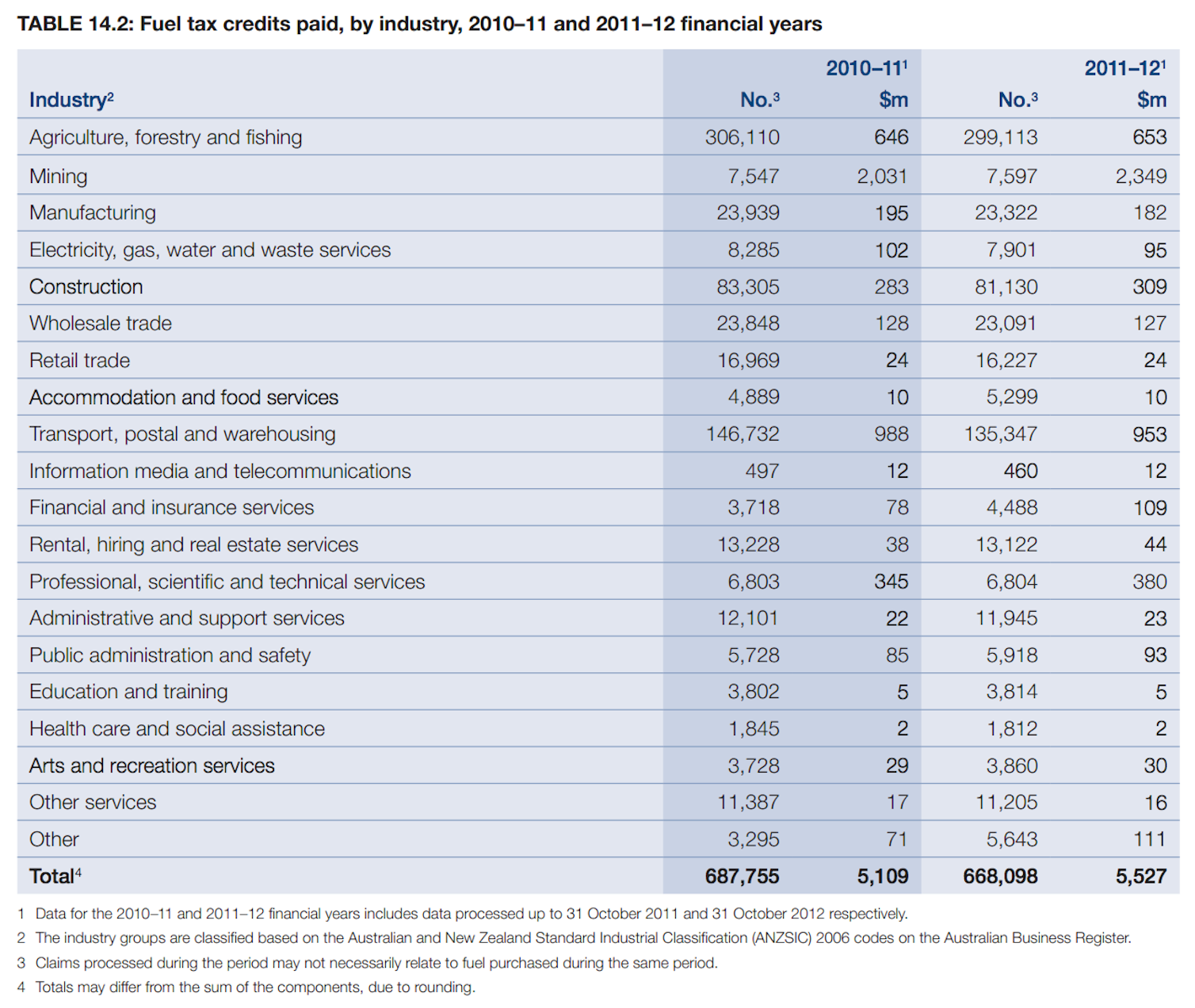

Government Digs Deep For Mining Company Tax Rebates The Australia

https://australiainstitute.org.au/wp-content/uploads/2021/07/Saved___dammed_-_Fuel_tax_credits_by_industry.png

Fuel Tax Credit Changes 2022 Aintree Group

https://aintreegroup.com.au/wp-content/uploads/2022/05/Screen-Shot-2022-05-12-at-12.04.03-pm.png

ATO Refunds Millions Of Dollars In Unclaimed Fuel Tax Credits

https://media.licdn.com/dms/image/C4E12AQHzEM2EDbsNpw/article-cover_image-shrink_600_2000/0/1520077231437?e=2147483647&v=beta&t=ho0Q4d83Yk32mfaLrK8xbaFwvh5kmi8A6jsKhu_I_jY

Web 21 juin 2022 nbsp 0183 32 You can claim tax credits when you use fuel for business activities The diesel fuel rebate rates depend on the use of the fuel You need to use the correct rates Web You can claim fuel tax credits for any taxable fuel you acquired manufactured or imported to use in your business Fuel is generally considered taxable fuel if an excise or excise

Web AMEC understands the need for more clarity and consistency into fuel tax credit claims but asserts the importance of ensuring any current or near term reforms of this system are Web 1 mars 2021 nbsp 0183 32 The ATO has recently released a simpler way to calculate fuel tax credits for diesel used in heavy vehicles If you claim less than 10 000 each year and use a heavy

Never Mine The Budget Here s The Fuel Tax Credit Scheme The

https://australiainstitute.org.au/wp-content/uploads/2022/03/table2.png

Fuel Tax Credit Atotaxrates info

https://atotaxrates.info/wp-content/uploads/2013/06/FTC-1Feb2017.jpg

https://www.ato.gov.au/.../GST-and-excise/Changes-to-fuel-tax-credit-rates

Web All fuel tax credit claimants need to apply the new rates for fuel acquired from 1 August To make it easier if your business claims less than 10 000 in the year you can use the

https://business.gov.au/finance/taxation/claim-fuel-tax-credits

Web 7 mars 2023 nbsp 0183 32 1 Check if you re eligible for fuel tax credits Businesses can claim credits for the fuel tax excise or customs duty included in the price of fuel used in their

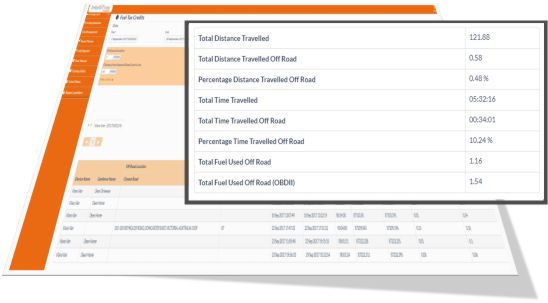

Calculating Fuel Tax Credits Using GPS Tracking Data IntelliTrac

Never Mine The Budget Here s The Fuel Tax Credit Scheme The

Calculating Fuel Tax Credits Using GPS Tracking Data IntelliTrac

EROAD Receives ATO Class Ruling For Its Fuel Tax Credits Solution

Fuel Tax Credit

Fuel Tax Credit Calculator Banlaw

Fuel Tax Credit Calculator Banlaw

ATO Common Fuel Tax Credit Errors

Viewpoints Should Fuel Tax Credits Be Cut In The Budget

ATO Fuel Tax Credits YouTube

Fuel Tax Credit Rebate Ato - Web Fuel Tax Rebates and Rates from the ATO It is important to be able to calculate the potential Fuel Tax Credit rebate available to your organisation for Petrol or Diesel used