Fuel Tax Credit Rebate Form Web How to claim the credit Any alternative fuel credit must first be claimed on Form 720 Schedule C to reduce your section 4041 taxable fuel liability for alternative fuel and

Web Form 8849 Claim for Refund of Excise Taxes to claim a periodic refund or Form 720 Quarterly Federal Excise Tax Return to claim a credit against your excise tax liability Web Fuel Tax Credits Reinstated and Extended Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and

Fuel Tax Credit Rebate Form

Fuel Tax Credit Rebate Form

https://data.formsbank.com/pdf_docs_html/224/2246/224675/page_1_thumb_big.png

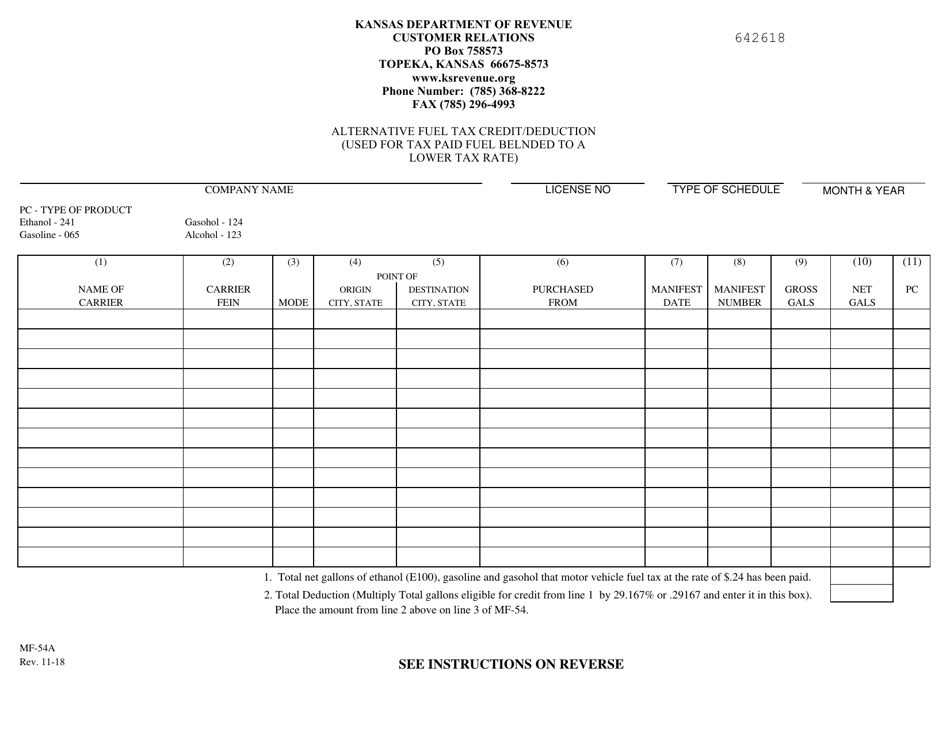

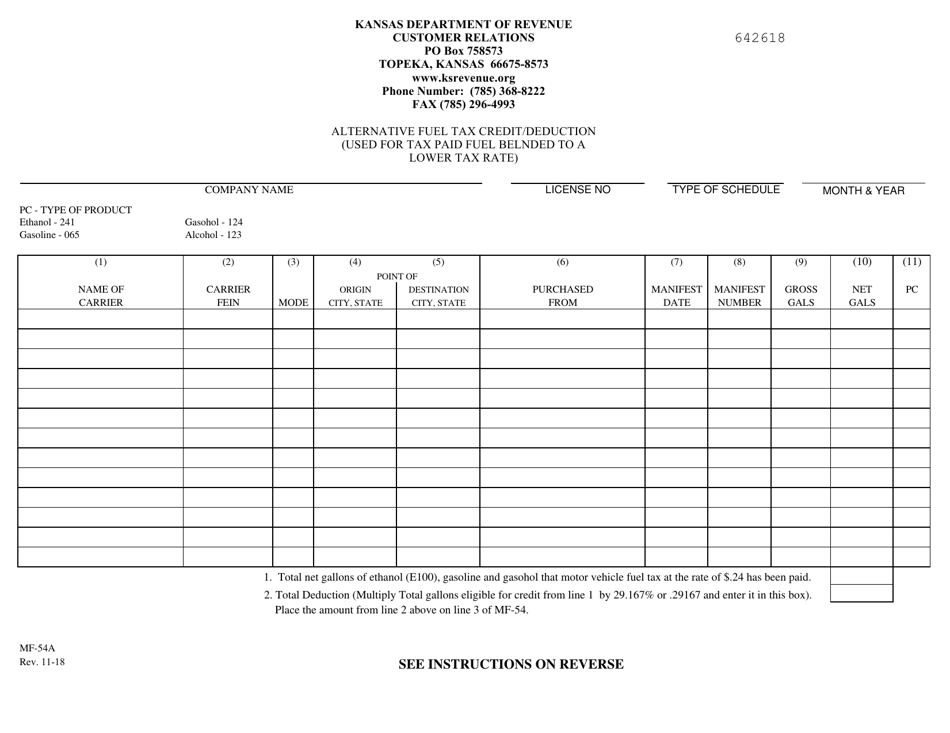

Form MF 54A Download Fillable PDF Or Fill Online Alternative Fuel Tax

https://data.templateroller.com/pdf_docs_html/1899/18997/1899742/form-mf-54a-alternative-fuel-tax-credit-deduction-kansas_print_big.png

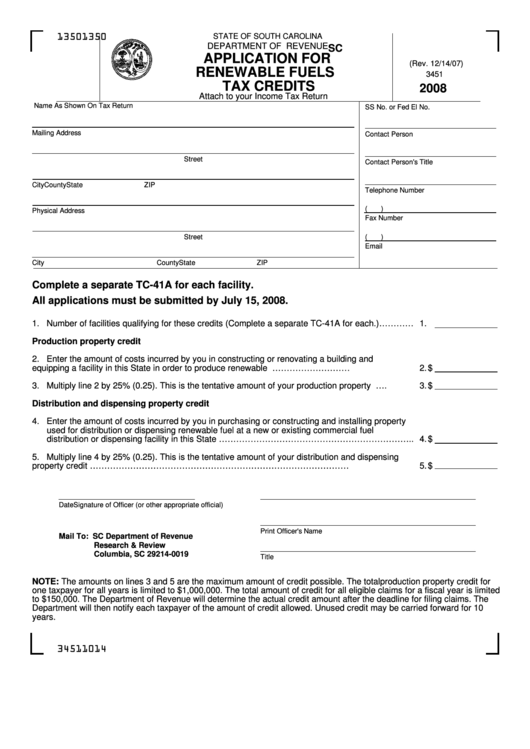

Form Sc Sch tc 41a Application For Renewable Fuels Tax Credits

https://data.formsbank.com/pdf_docs_html/259/2594/259403/page_1_thumb_big.png

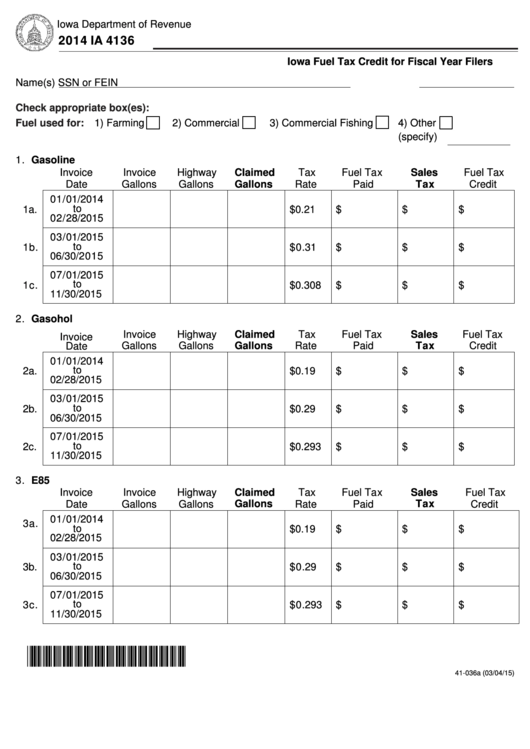

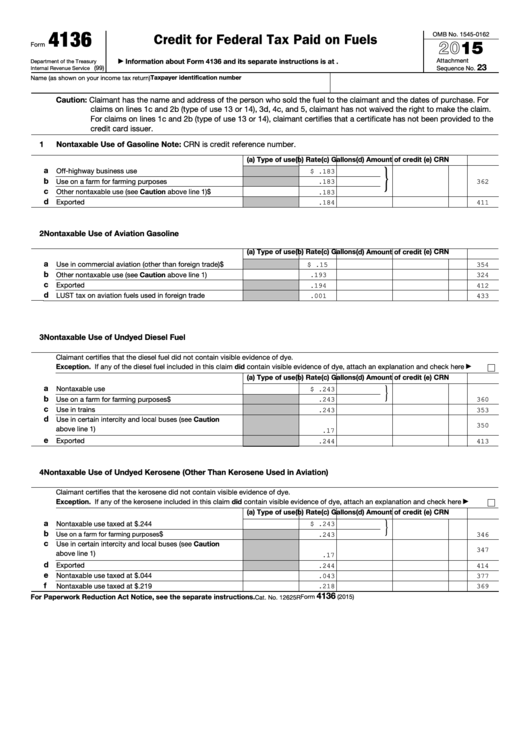

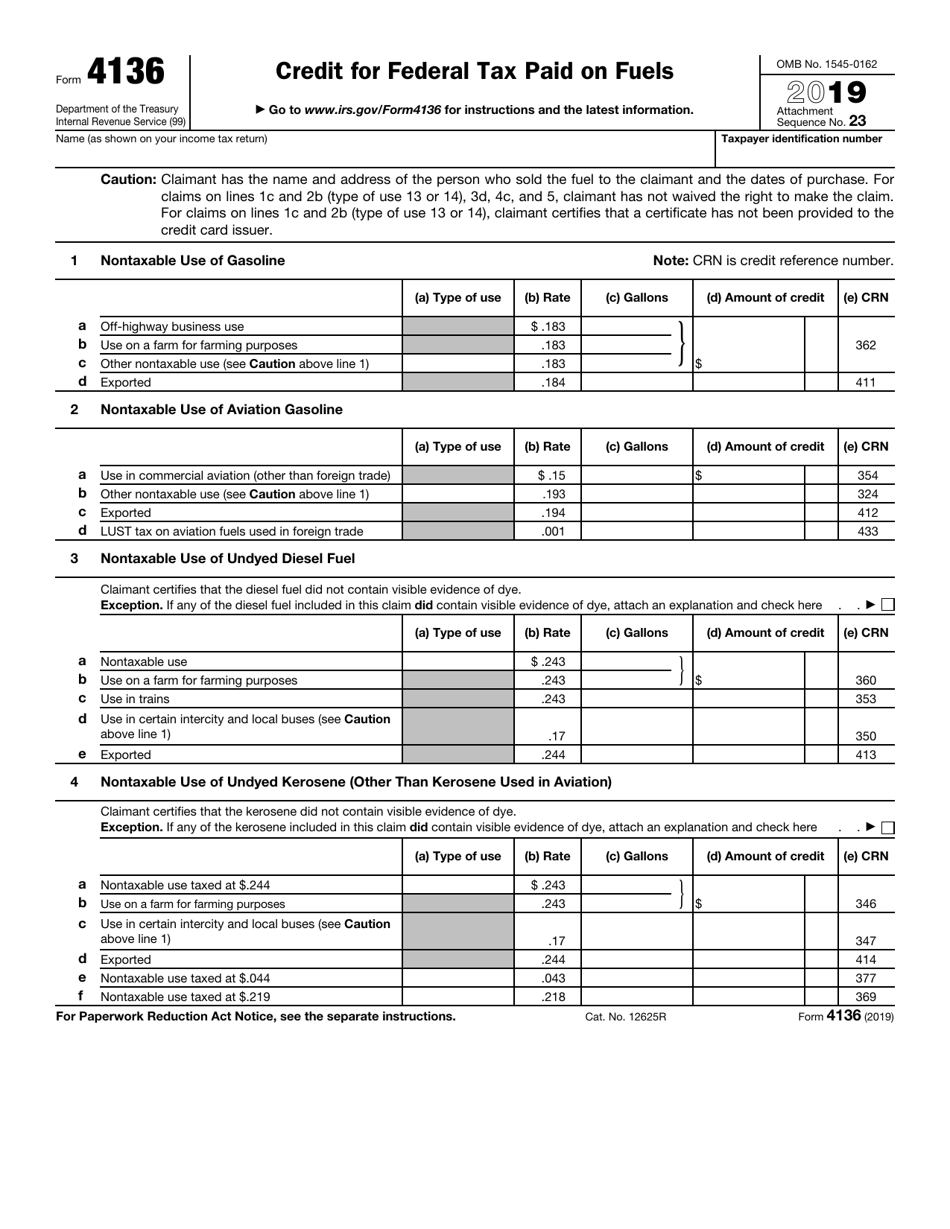

Web Information about Form 4136 Credit For Federal Tax Paid On Fuels including recent updates related forms and instructions on how to file Use Form 4136 to claim a credit Web 2 juin 2023 nbsp 0183 32 Certain uses of fuels are untaxed however and fuel users can get a credit for the taxes they ve paid by filing Form 4136 The one most familiar to taxpayers is probably the federal gas tax 18 4

Web 28 sept 2021 nbsp 0183 32 Fuel Tax Credit A federal subsidy that allows businesses to reduce their taxable income dollar for dollar based on specific types of fuel costs There are several types of fuel credits For Web 6 oct 2022 nbsp 0183 32 Section 6426 d allows a person who sells or uses alternative fuel for a motor vehicle or motorboat or in aviation to claim a 0 50 per gallon credit against their excise

Download Fuel Tax Credit Rebate Form

More picture related to Fuel Tax Credit Rebate Form

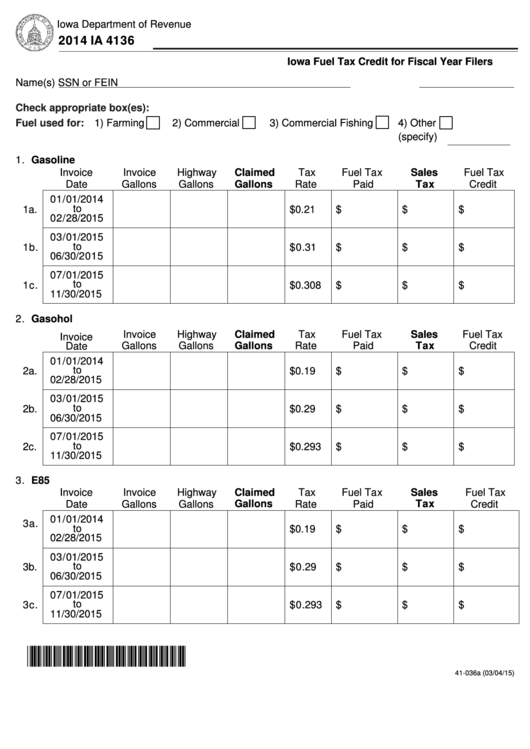

Form 4136 Credit For Federal Tax Paid On Fuels 2015 Free Download

https://www.formsbirds.com/formimg/tax-payment-forms/8076/form-4136-credit-for-federal-tax-paid-on-fuels-2015-l1.png

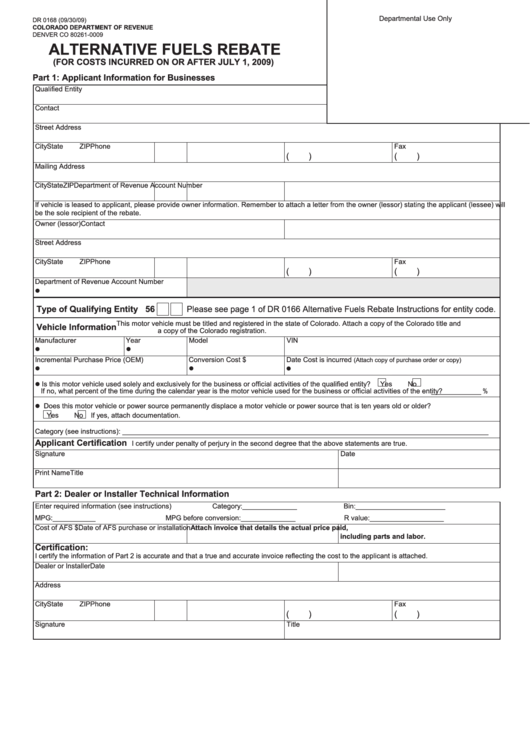

Form Dr 0168 Alternative Fuels Rebate 2009 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/172/1728/172849/page_1_thumb_big.png

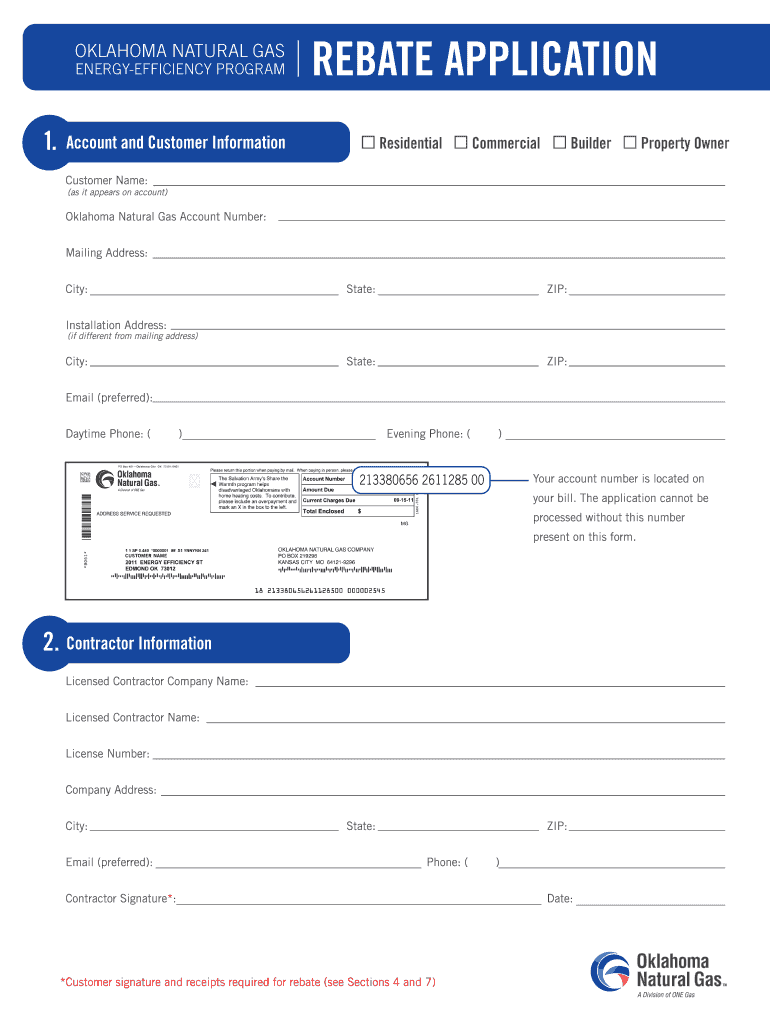

Ong Rebates Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/250/319/250319623/large.png

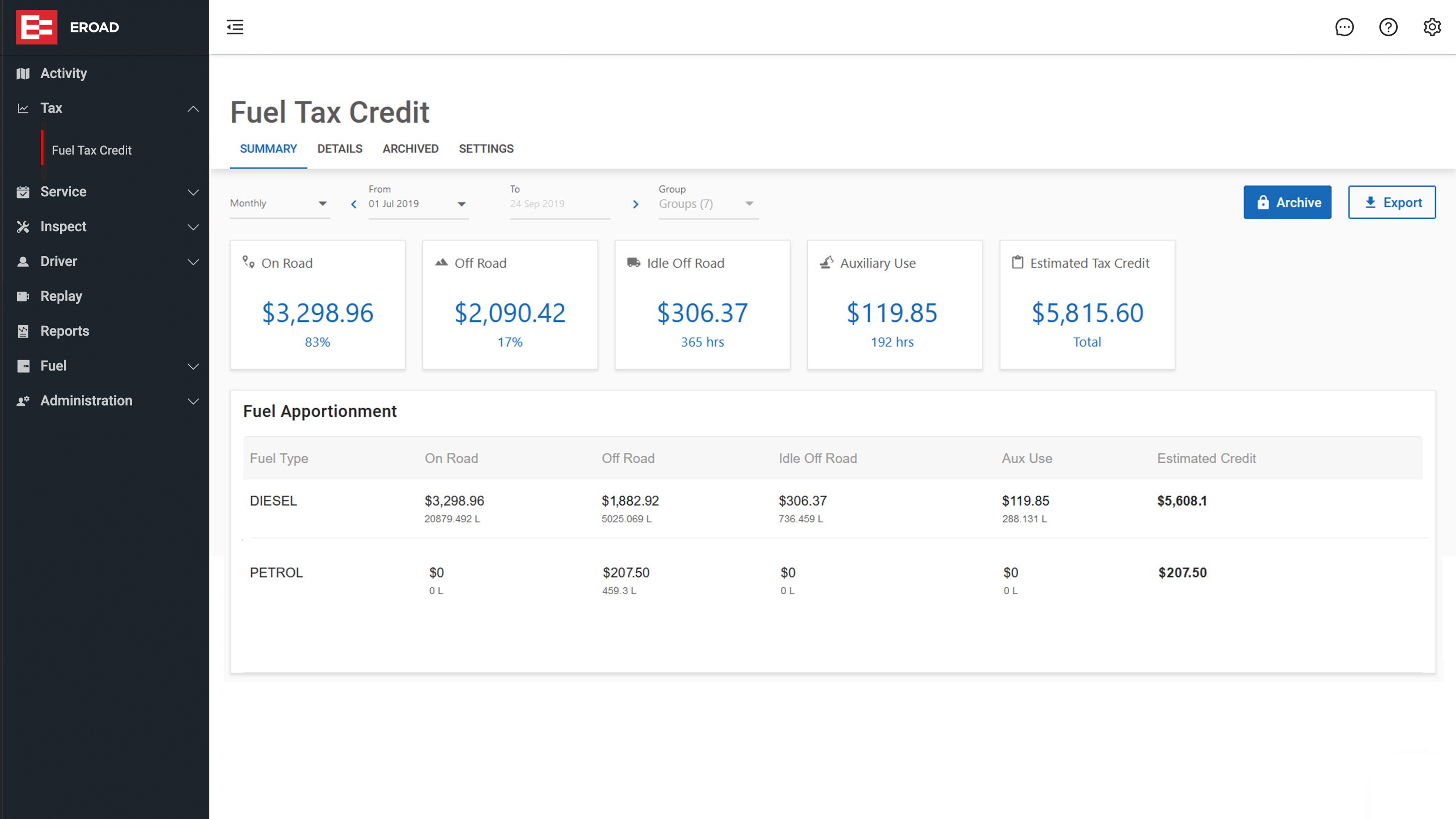

Web 7 mars 2023 nbsp 0183 32 Last Updated 7 March 2023 If your business uses fuel you may be able to claim credits for the fuel tax included in the price of the fuel Find out if you re eligible Web The calculator is quick and easy to use and will help you get your claim right If you claim under 10 000 in fuel tax credits in a year there are simpler ways to record and

Web NAT 15634 07 2021 How to work out your fuel tax credits Step 1 Work out the eligible quantity Work out how much fuel liquid or gaseous you acquired for each business Web If you re eligible for the fuel tax refund program for persons with disabilities you may receive a fuel tax refund of up to 500 each calendar year for a qualifying vehicle

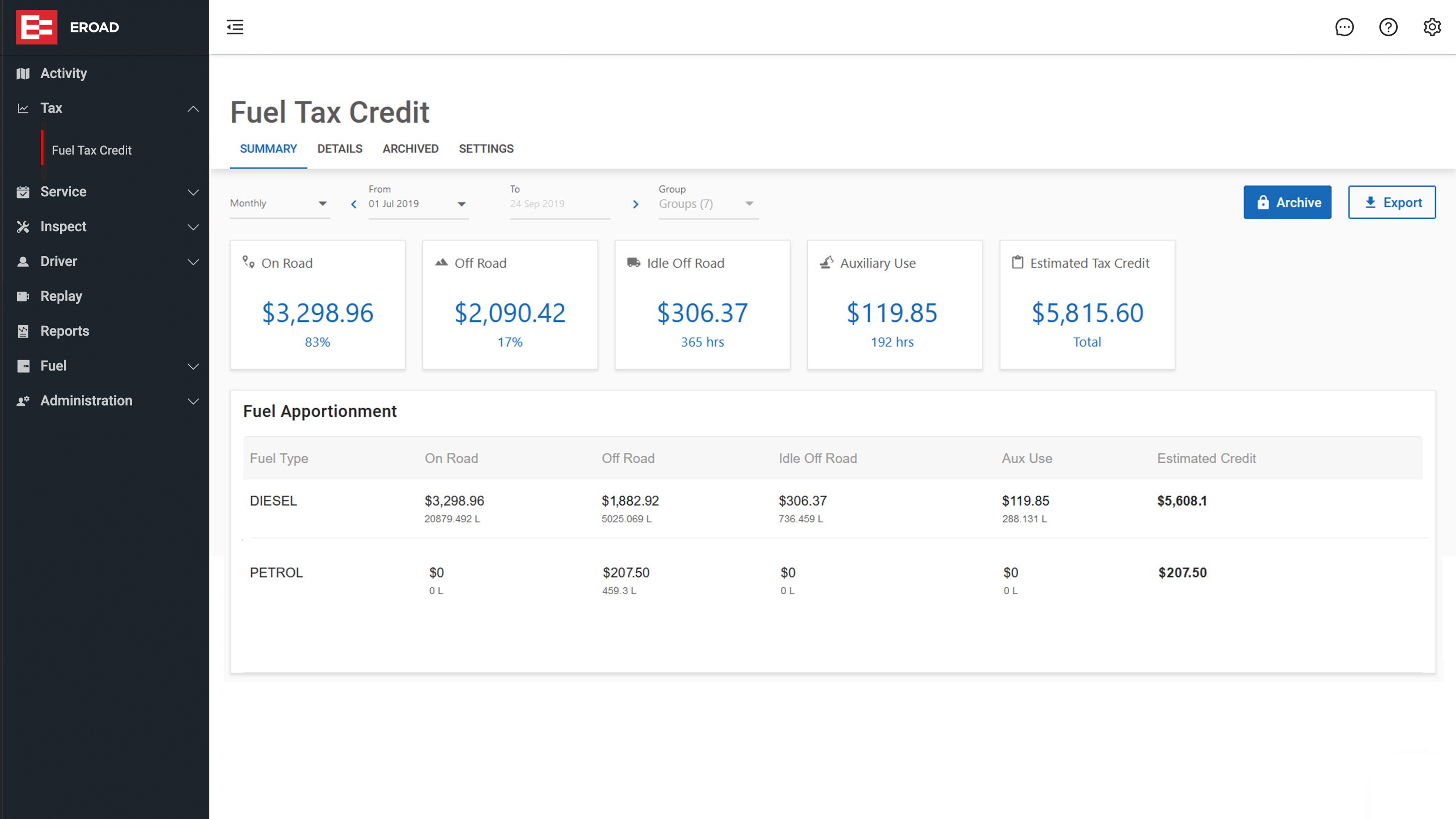

Automate Fuel Tax Credits And Unlock Higher FTC Rebates EROAD AU

https://www.eroad.com.au/wp-content/uploads/2019/12/FTC-Details-Slide-2.jpg

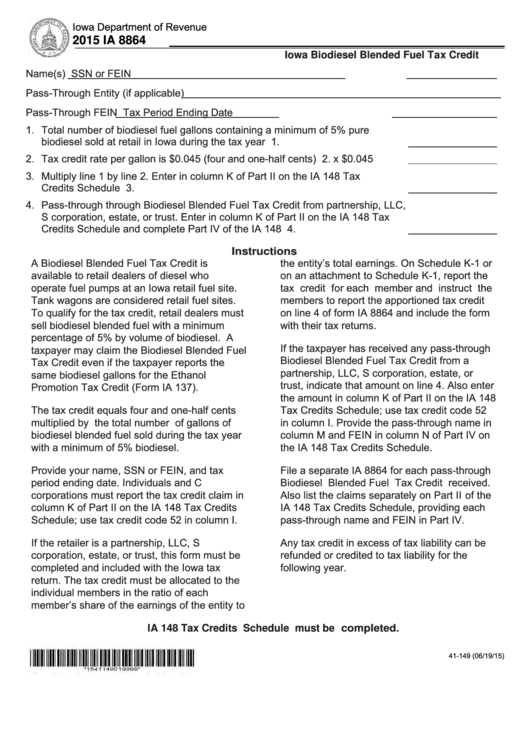

Fillable Form Ia 8864 Iowa Biodiesel Blended Fuel Tax Credit 2015

https://data.formsbank.com/pdf_docs_html/330/3304/330477/page_1_thumb_big.png

https://www.irs.gov/instructions/i4136

Web How to claim the credit Any alternative fuel credit must first be claimed on Form 720 Schedule C to reduce your section 4041 taxable fuel liability for alternative fuel and

https://www.irs.gov/pub/irs-pdf/i4136.pdf

Web Form 8849 Claim for Refund of Excise Taxes to claim a periodic refund or Form 720 Quarterly Federal Excise Tax Return to claim a credit against your excise tax liability

Fillable Form 4136 Printable Forms Free Online

Automate Fuel Tax Credits And Unlock Higher FTC Rebates EROAD AU

Fuel Tax Credits Calculation Worksheet

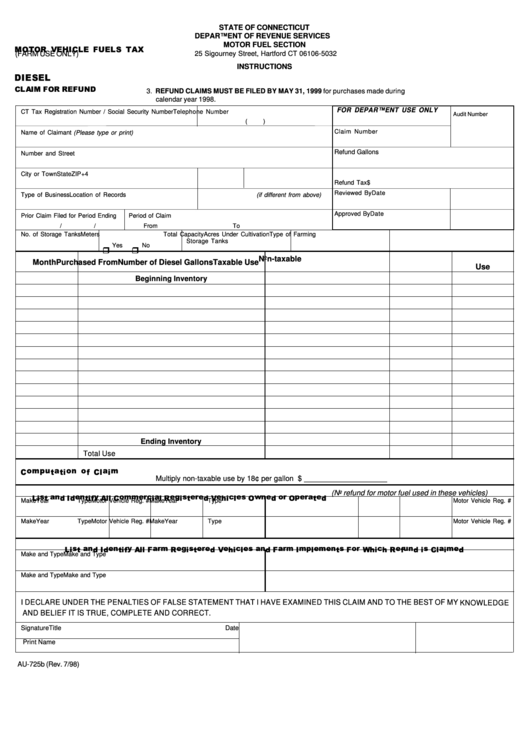

Fillable Form Au 725b Motor Vehicle Fuels Tax Farm Use Only

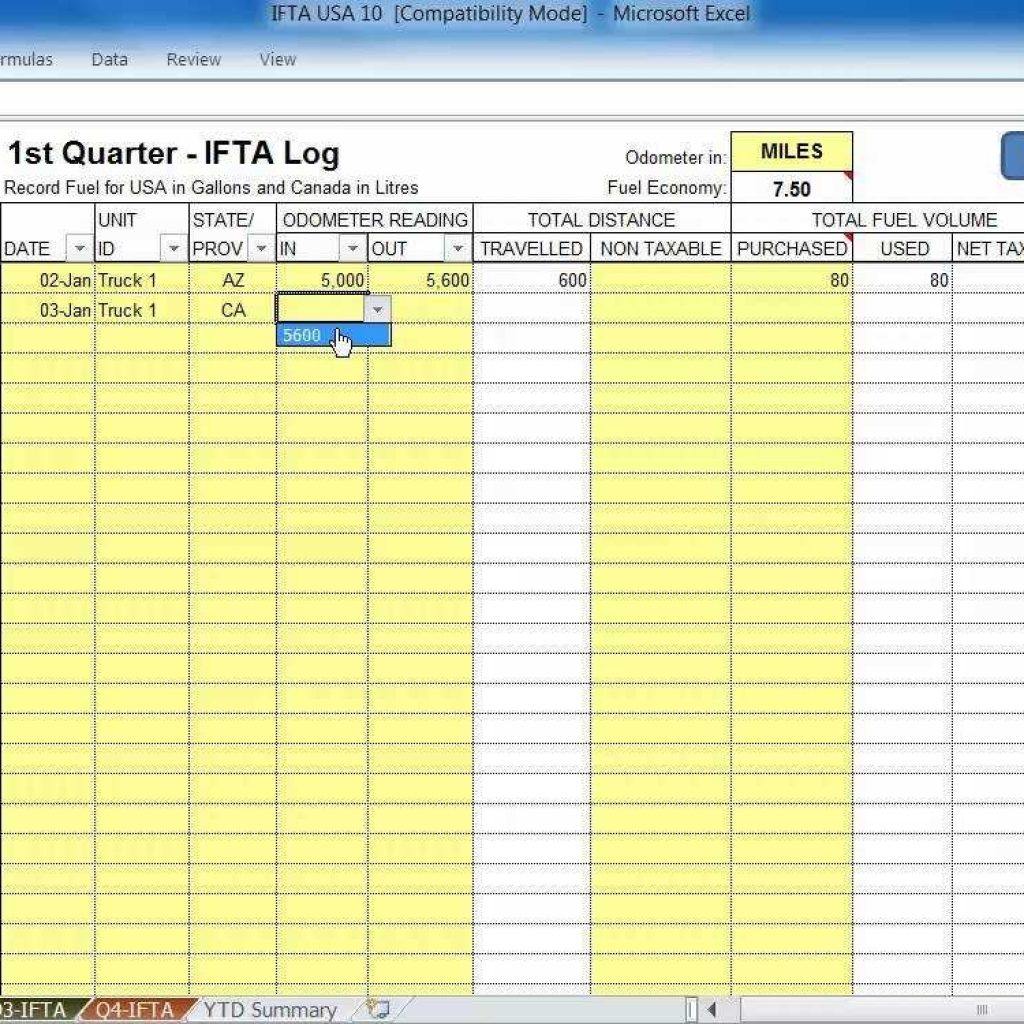

Ifta Fuel Tax Spreadsheet Spreadsheet Downloa Ifta Fuel Tax Spreadsheet

Here s How To Get A Refund For Missouri s Gas Tax Increase Howell

Here s How To Get A Refund For Missouri s Gas Tax Increase Howell

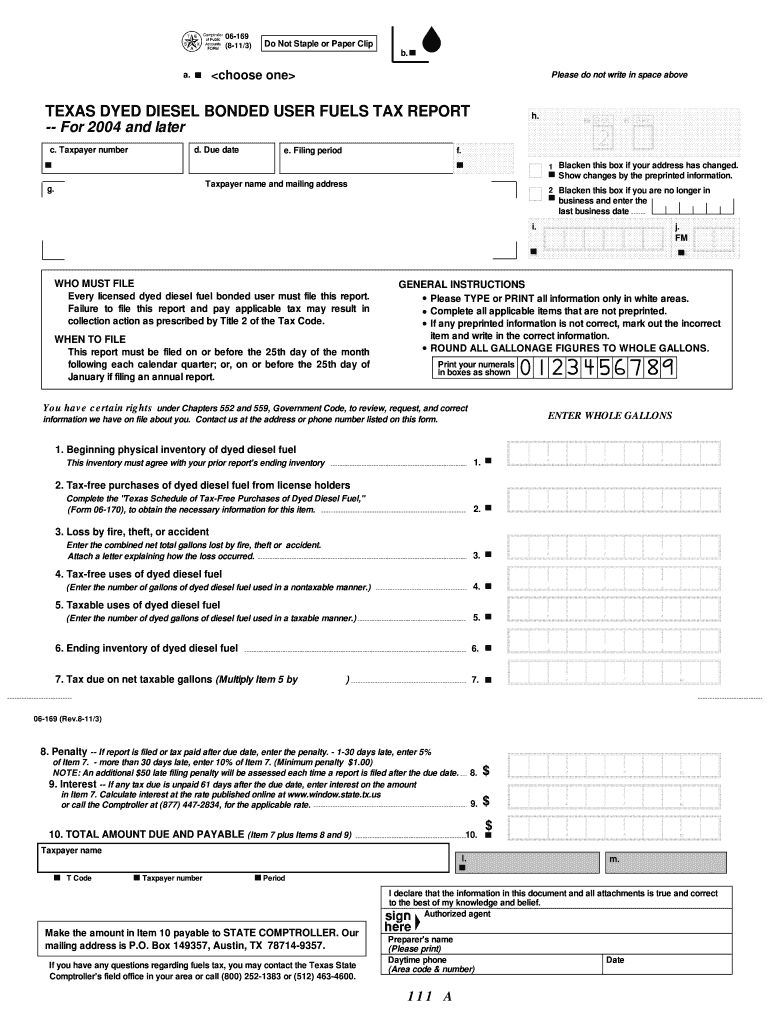

Texas Dyed Diesel Bonded User Fuels Tax Report Fill Out And Sign

REV 643 Motor Fuels Tax Reimbursement Claim Form In Truck

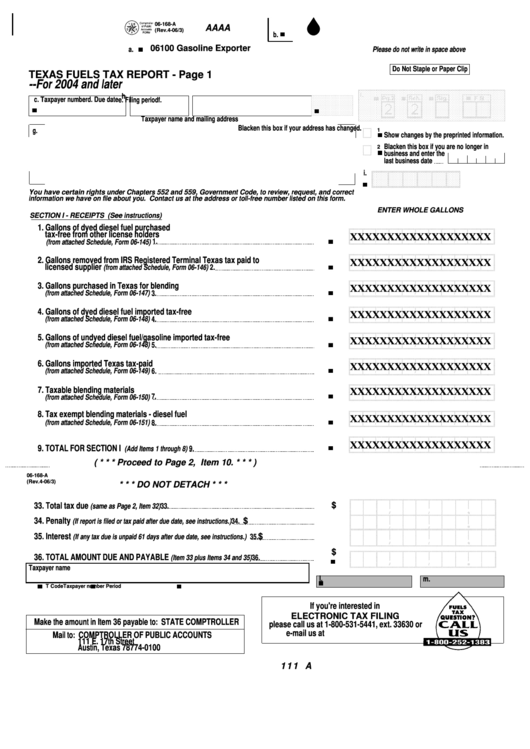

Fillable Form 06 168 Texas Fuels Tax Report 2004 Printable Pdf Download

Fuel Tax Credit Rebate Form - Web 28 sept 2021 nbsp 0183 32 Fuel Tax Credit A federal subsidy that allows businesses to reduce their taxable income dollar for dollar based on specific types of fuel costs There are several types of fuel credits For