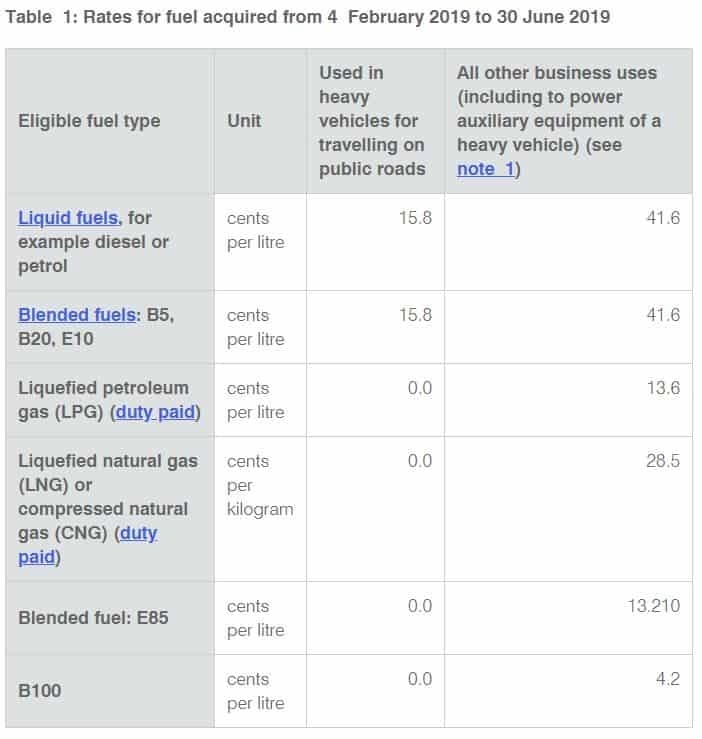

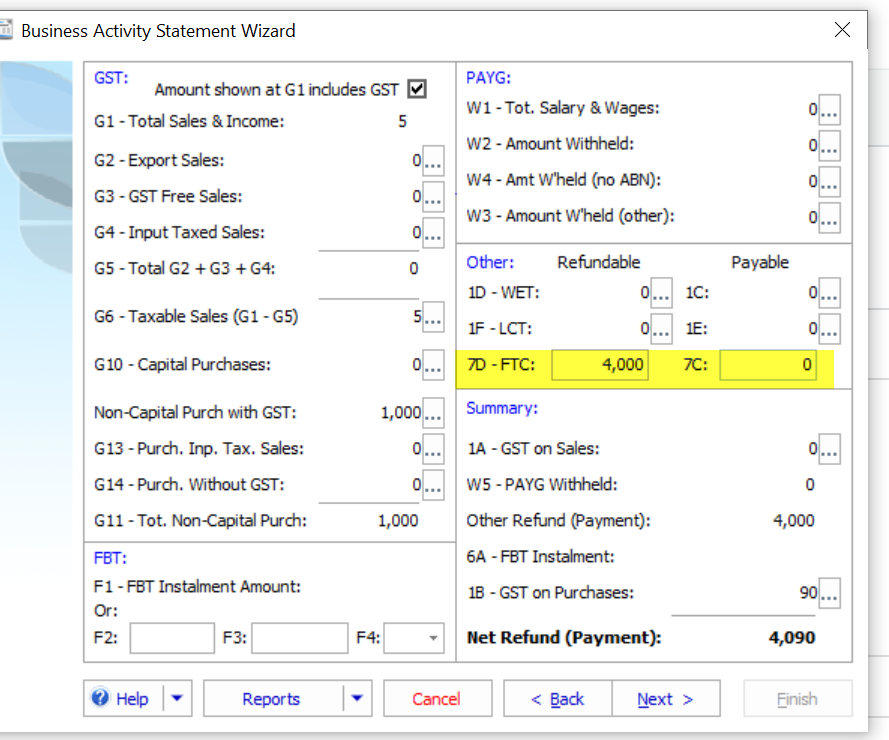

Fuel Tax Credit Rebate Rates Web Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and extended the following fuel tax credits

Web All fuel tax credit claimants need to apply the new rates for fuel acquired from 1 August To make it easier if your business claims less than 10 000 in the year you can use the Web 7 mars 2023 nbsp 0183 32 Last Updated 7 March 2023 If your business uses fuel you may be able to claim credits for the fuel tax included in the price of the fuel Find out if you re eligible

Fuel Tax Credit Rebate Rates

Fuel Tax Credit Rebate Rates

https://atotaxrates.info/wp-content/uploads/2019/01/rates-4feb2019.jpg

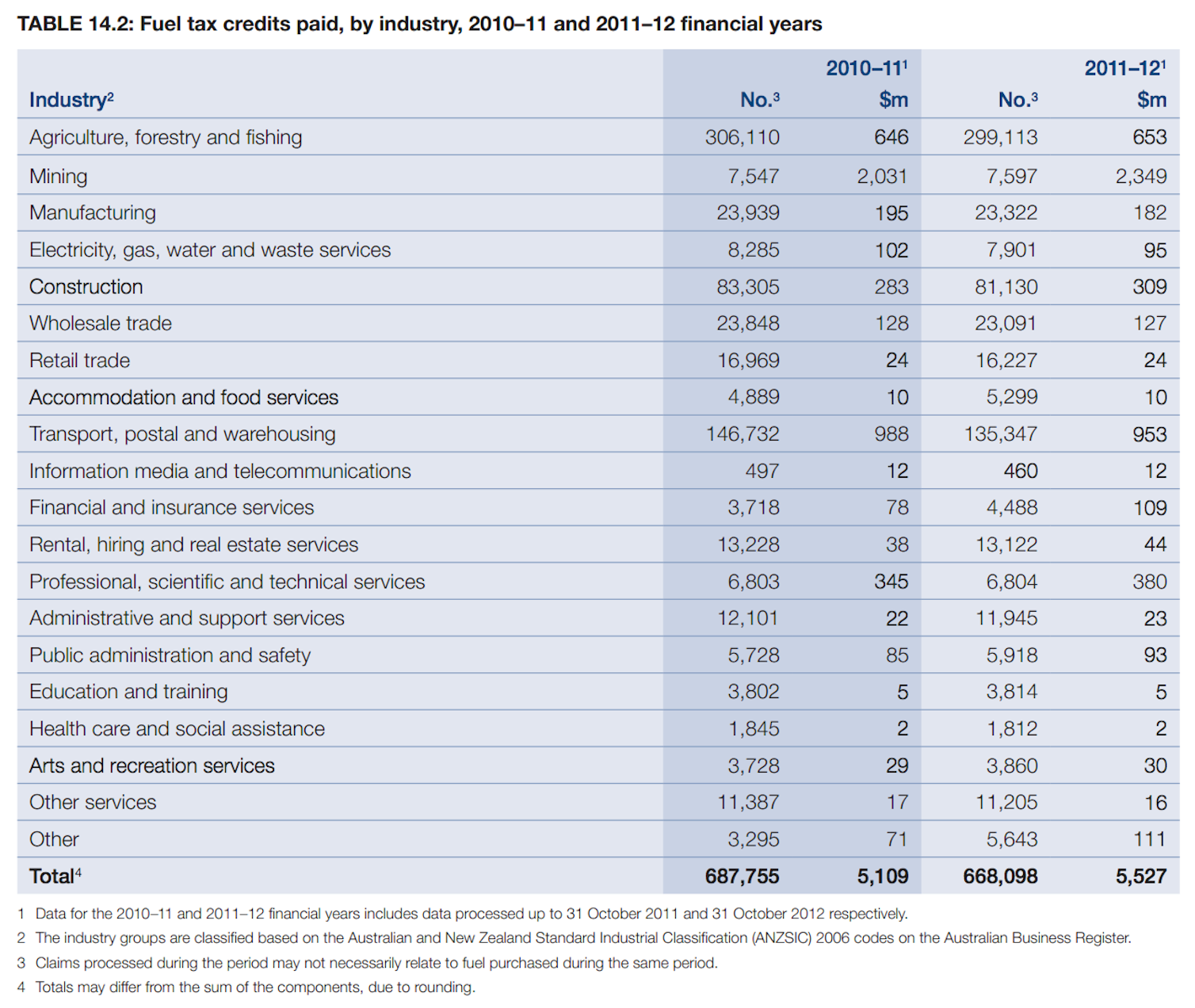

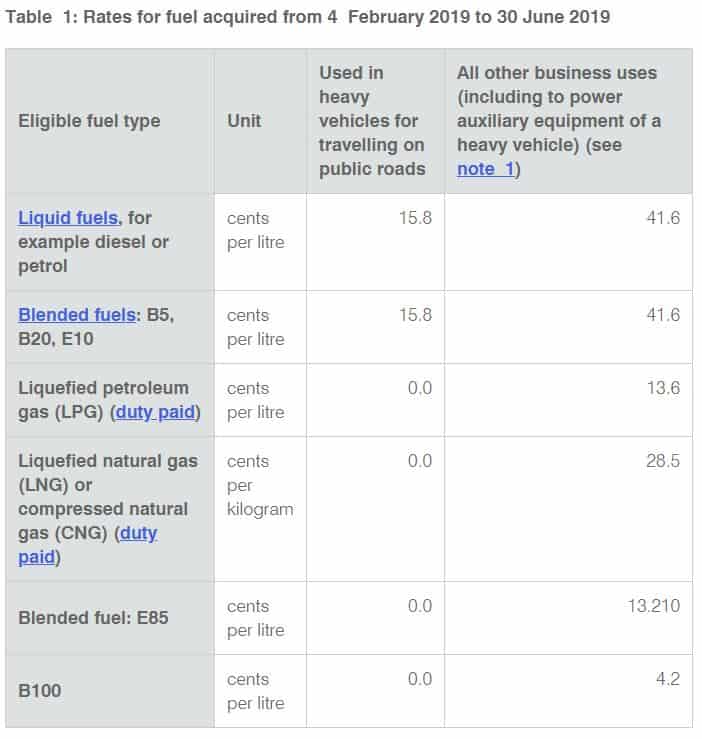

Viewpoints Should Fuel Tax Credits Be Cut In The Budget

https://images.theconversation.com/files/47595/original/3cfp2vcz-1398993376.jpg?ixlib=rb-1.1.0&q=30&auto=format&w=754&h=636&fit=crop&dpr=2

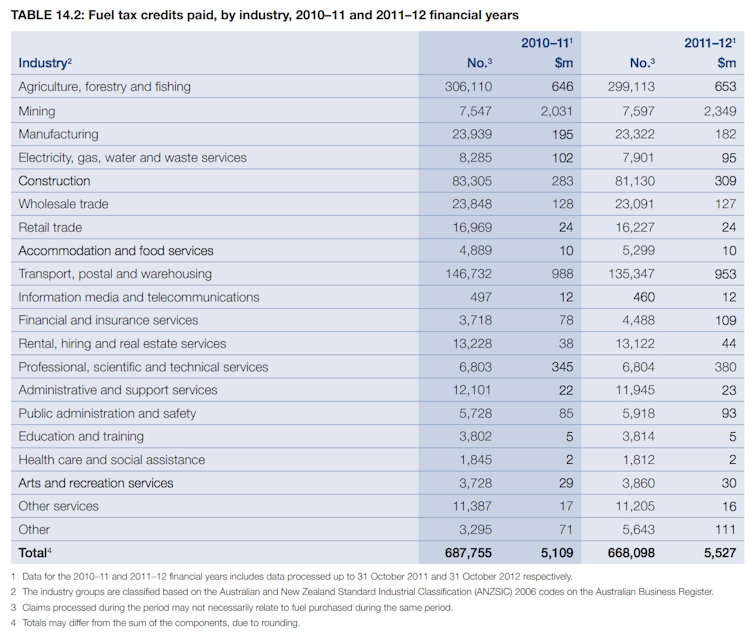

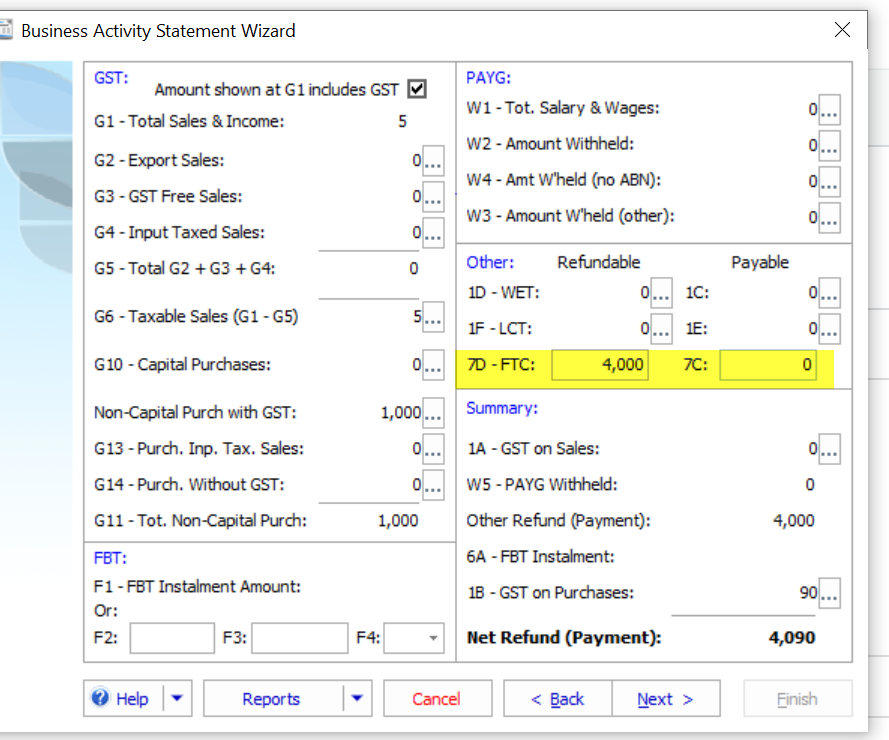

Fuel Tax Credit Atotaxrates info

https://atotaxrates.info/wp-content/uploads/2013/06/FTC-1Feb2017.jpg

Web Credit for Federal Tax Paid on Fuels Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted Future Developments Web 6 avr 2022 nbsp 0183 32 Much attention has been given to the 2022 Budget measure of temporarily halving of the fuel excise for petrol and diesel from 44 2 cents litre to 22 1 cents Less

Web The updated February 2023 Fuel Tax Credit rates are as follows per the ATO website Fuel Acquired 1 February 2023 30 June 2023 What records are required to claim Fuel Tax Credits Businesses must keep Web Breaker box 4 000 limit Electric wiring 2 500 limit Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you

Download Fuel Tax Credit Rebate Rates

More picture related to Fuel Tax Credit Rebate Rates

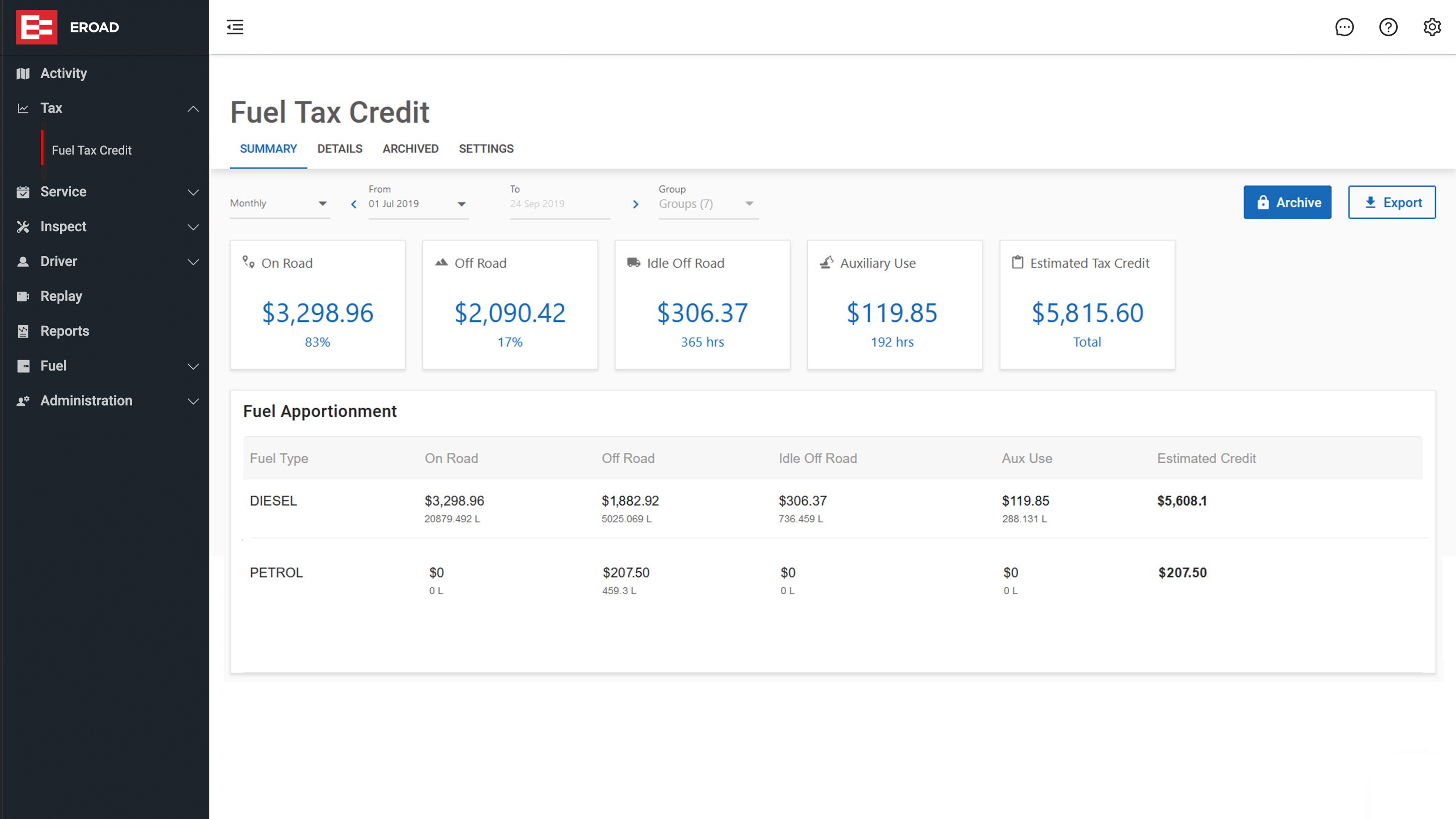

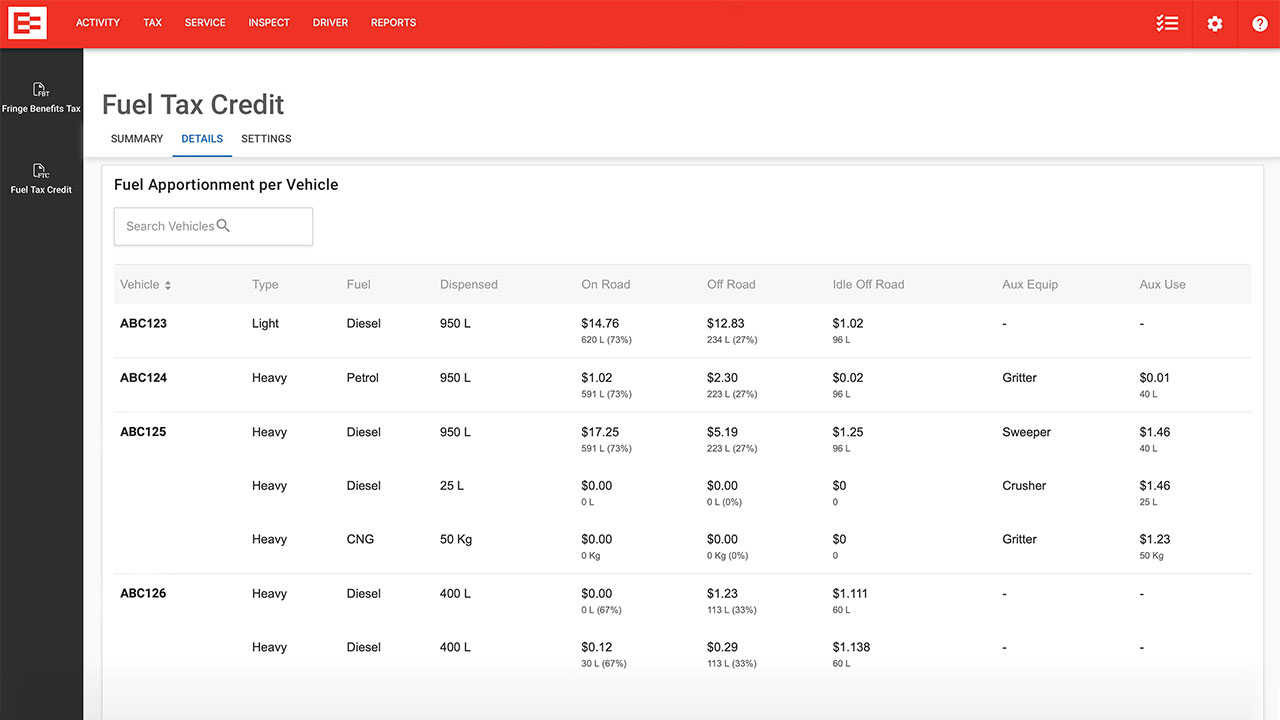

Automate Fuel Tax Credits And Unlock Higher FTC Rebates EROAD AU

https://www.eroad.com.au/wp-content/uploads/2019/12/FTC-Details-Slide-2.jpg

Fuel Tax Credits FTC Rebates EROAD

https://www.eroad.com.au/wp-content/uploads/2019/12/FTC-Details-Slide-1.jpg

Fuel Tax Credit Changes 2022 Aintree Group

https://aintreegroup.com.au/wp-content/uploads/2022/05/Screen-Shot-2022-05-12-at-12.04.03-pm.png

Web Fuel Tax Rebates and Rates from the ATO It is important to be able to calculate the potential Fuel Tax Credit rebate available to your organisation for Petrol or Diesel used Web The Fuel Tax Act 2006 establishes a mechanism for the collection of the Road User Charge by reducing the fuel tax credit on each litre of fuel used by eligible heavy vehicle

Web There are also a number of various grants and incentive schemes involving tax credits and rebates that generally apply to businesses or industries that rely heavily on the use of Web 21 juin 2022 nbsp 0183 32 1 Manual Process The simplest approach is to do everything manually Collect your heavy vehicle fuel receipts and assume all on road usage Then use the low

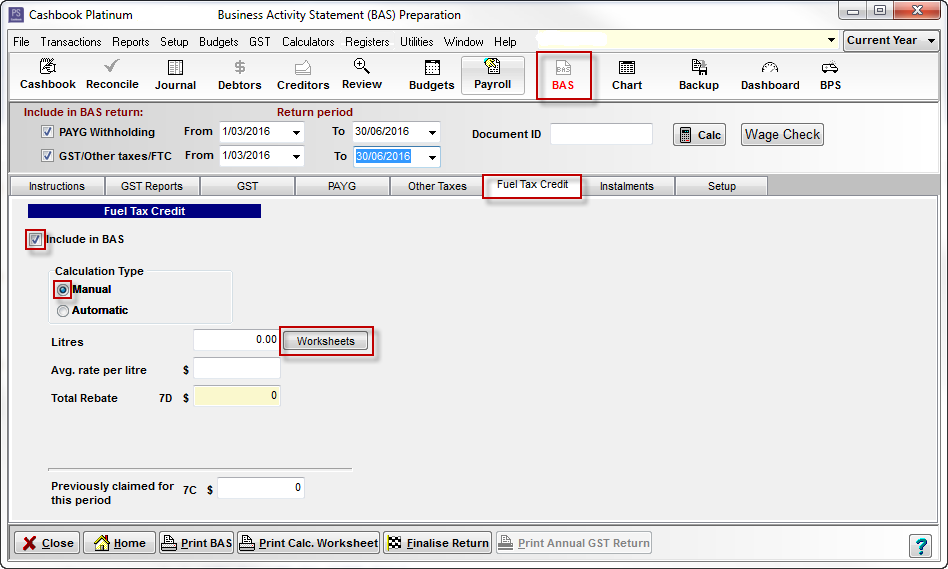

BAS How To Enter Fuel Tax Credits Exalt

https://exalt.zendesk.com/hc/article_attachments/360002468136/mceclip0.png

And The Award For Biggest Fossil Fuel Subsidy Goes To The Fuel Tax

https://australiainstitute.org.au/wp-content/uploads/2021/05/FFS-1.png

https://www.irs.gov/.../small-businesses-self-employed/fuel-tax-credits

Web Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and extended the following fuel tax credits

https://www.ato.gov.au/.../GST-and-excise/Changes-to-fuel-tax-credit-rates

Web All fuel tax credit claimants need to apply the new rates for fuel acquired from 1 August To make it easier if your business claims less than 10 000 in the year you can use the

Add A New Fuel Tax Rate Agrimaster

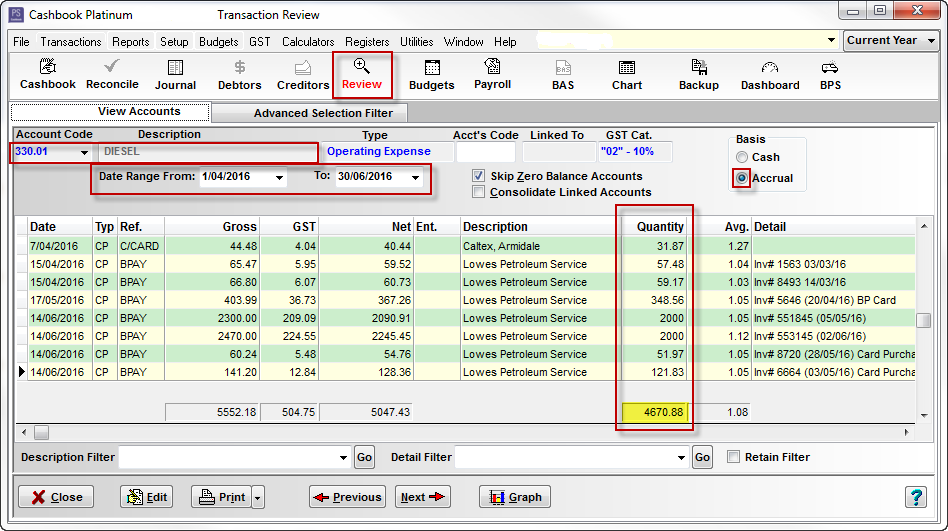

BAS How To Enter Fuel Tax Credits Exalt

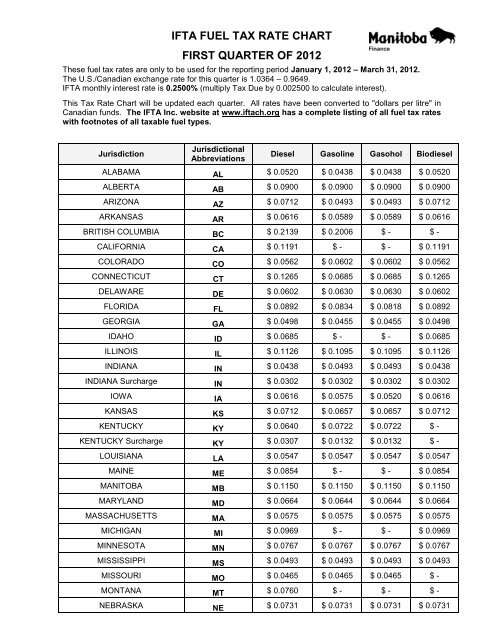

IFTA FUEL TAX RATE CHART FIRST QUARTER OF 2012

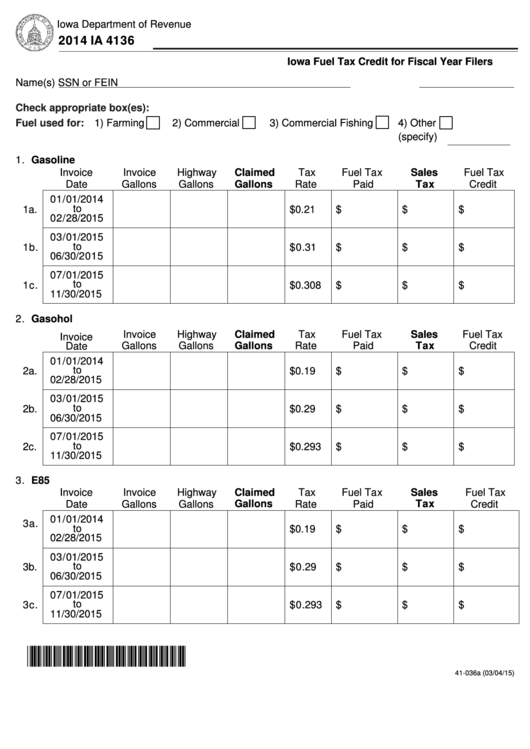

Fillable Form Ia 4136 Fuel Tax Credit For Fiscal Year Filers 2014

Fuel Tax Credits Calculation Worksheet

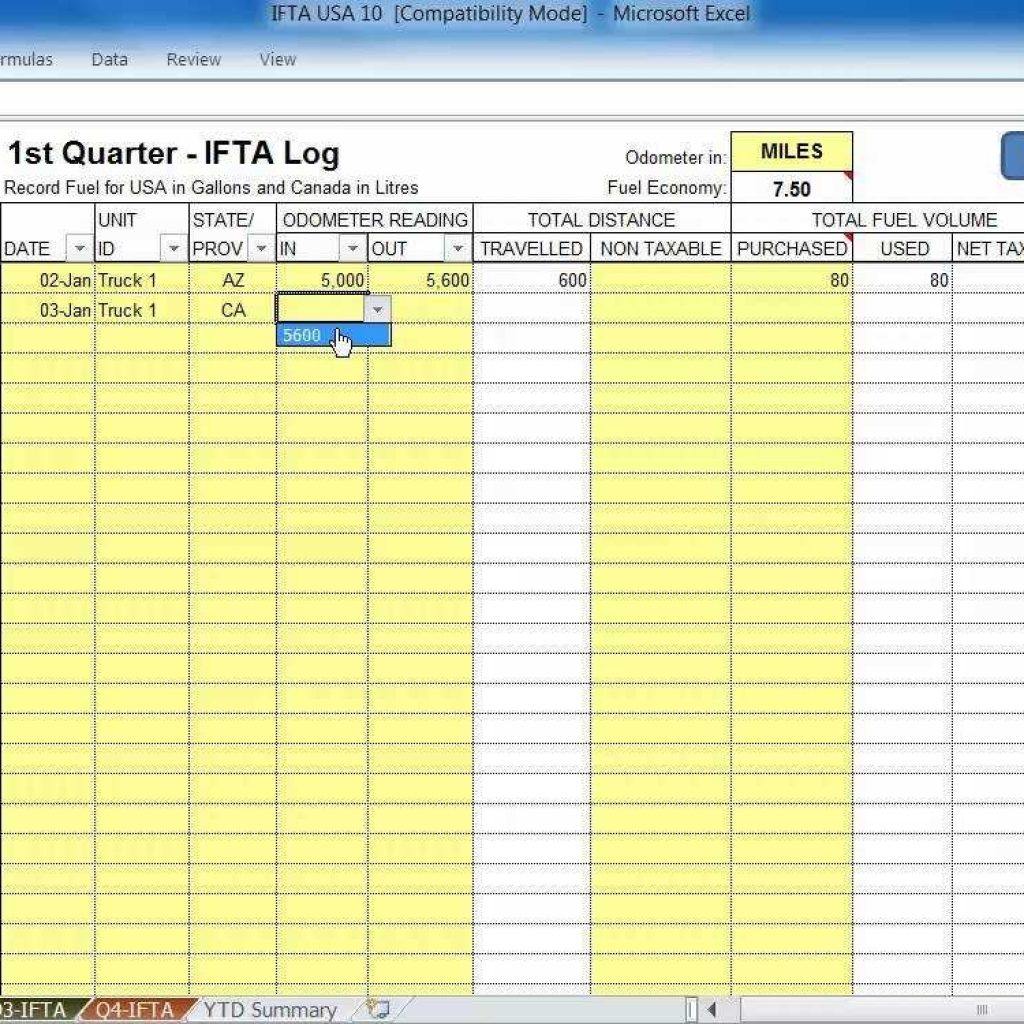

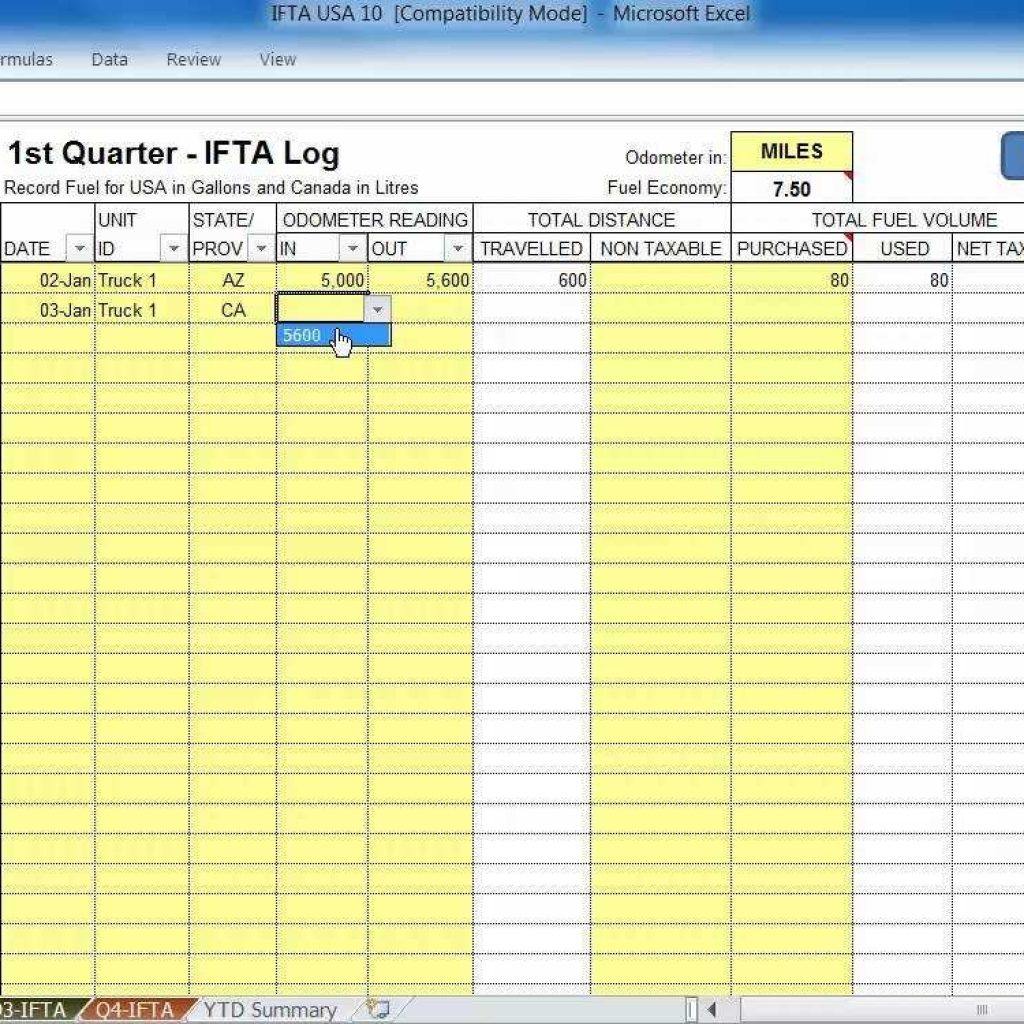

Ifta Fuel Tax Spreadsheet Db excel

Ifta Fuel Tax Spreadsheet Db excel

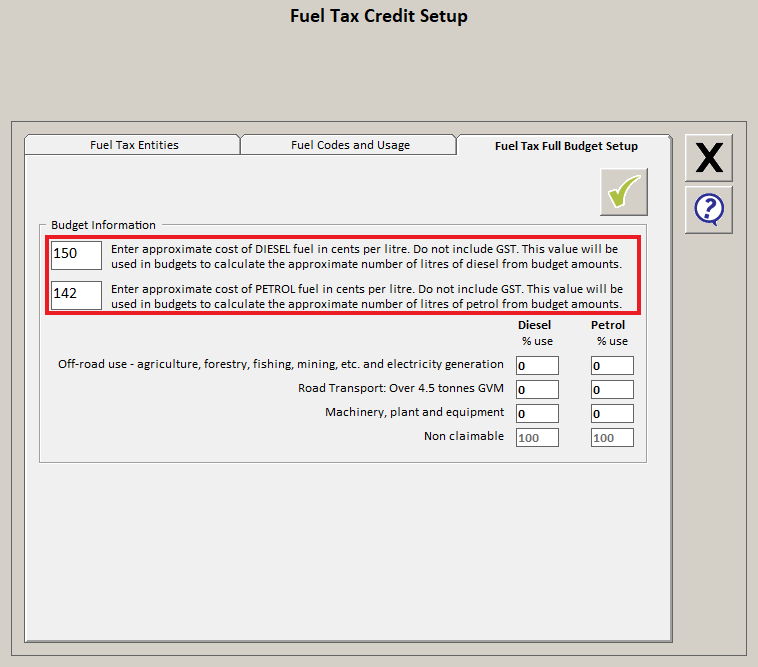

Setting Up Fuel Tax Rebate Single Entity Agrimaster

Fuel Tax Credits Calculation Worksheet

National Budget Speech 2022 SimplePay Blog

Fuel Tax Credit Rebate Rates - Web Fuel savings are a combination of deducting your fuel business expense and receiving a fuel tax refund credit For example if a gallon of fuel costs 1 00 and your effective tax