Fuel Tax Credit Rebate Web Fuel Tax Credits Reinstated and Extended Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and

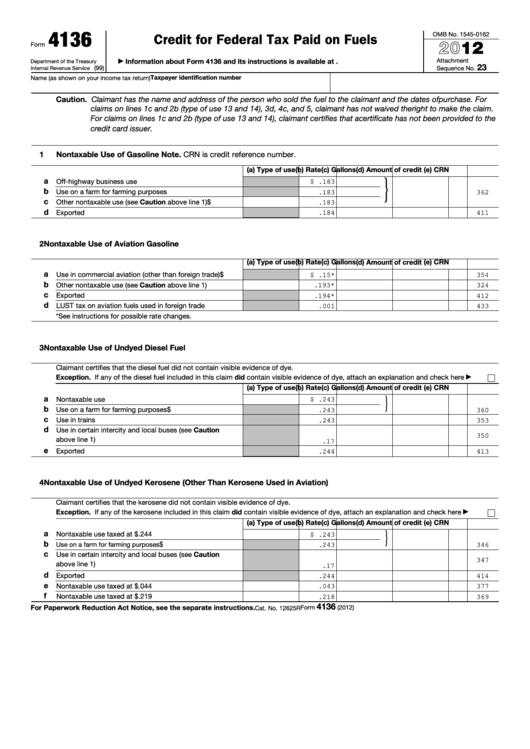

Web A credit for exporting dyed fuels or gasoline blendstocks Substainable aviation fuel SAF credit Attach Form 4136 to your tax return Instead of waiting to claim an annual credit Web 6 oct 2022 nbsp 0183 32 On Sept 13 pursuant to the Inflation Reduction Act of 2022 IRA the IRS published Notice 2022 39 which provides rules that claimants must follow to make one

Fuel Tax Credit Rebate

Fuel Tax Credit Rebate

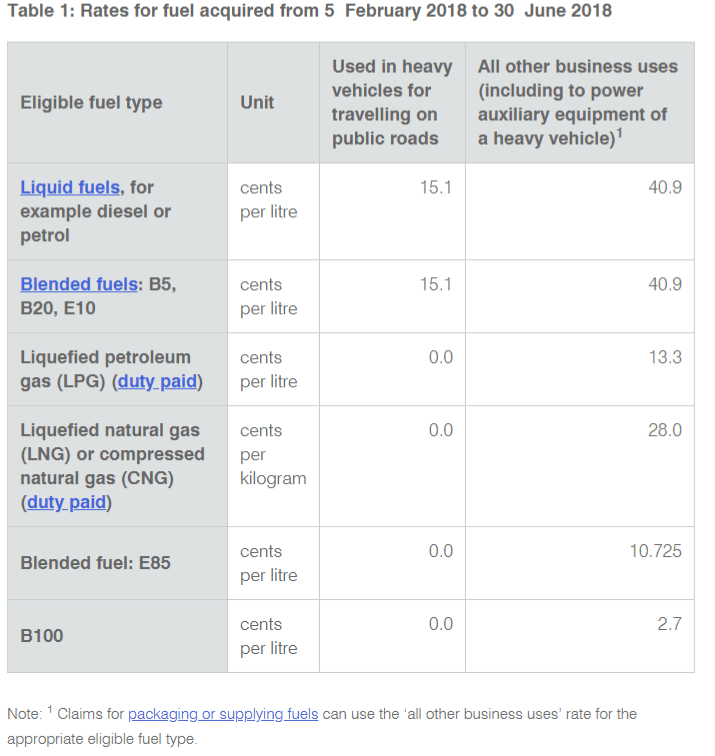

https://atotaxrates.info/wp-content/uploads/2018/02/hoZSxv1.png

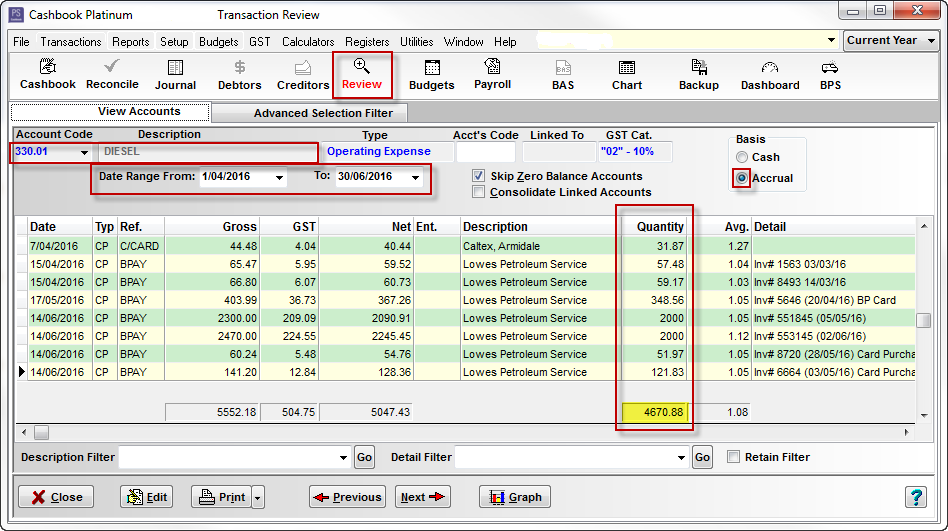

Automated Fuel Tax Credit Rebates YouTube

https://i.ytimg.com/vi/71ouIAuk9uU/maxresdefault.jpg

Fuel Tax Credit Atotaxrates info

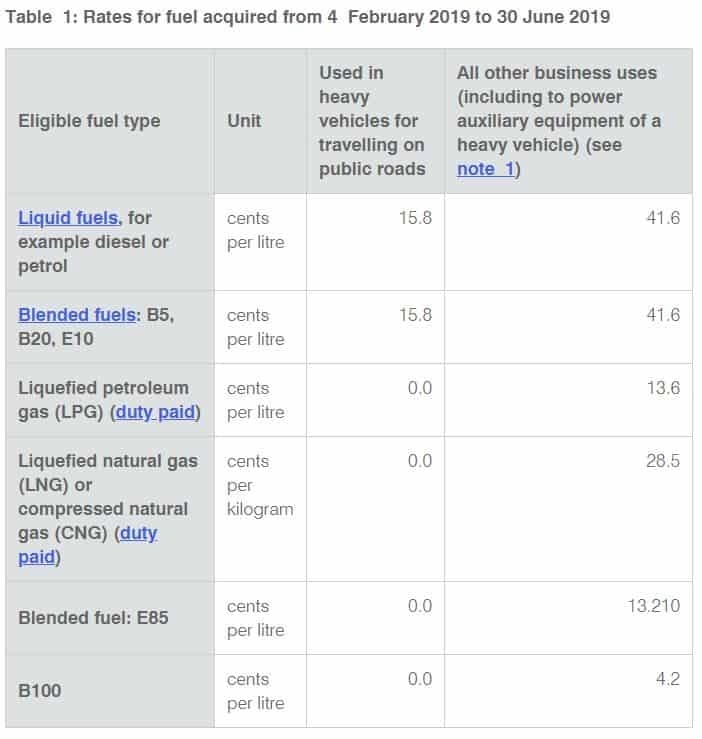

https://atotaxrates.info/wp-content/uploads/2019/01/rates-4feb2019.jpg

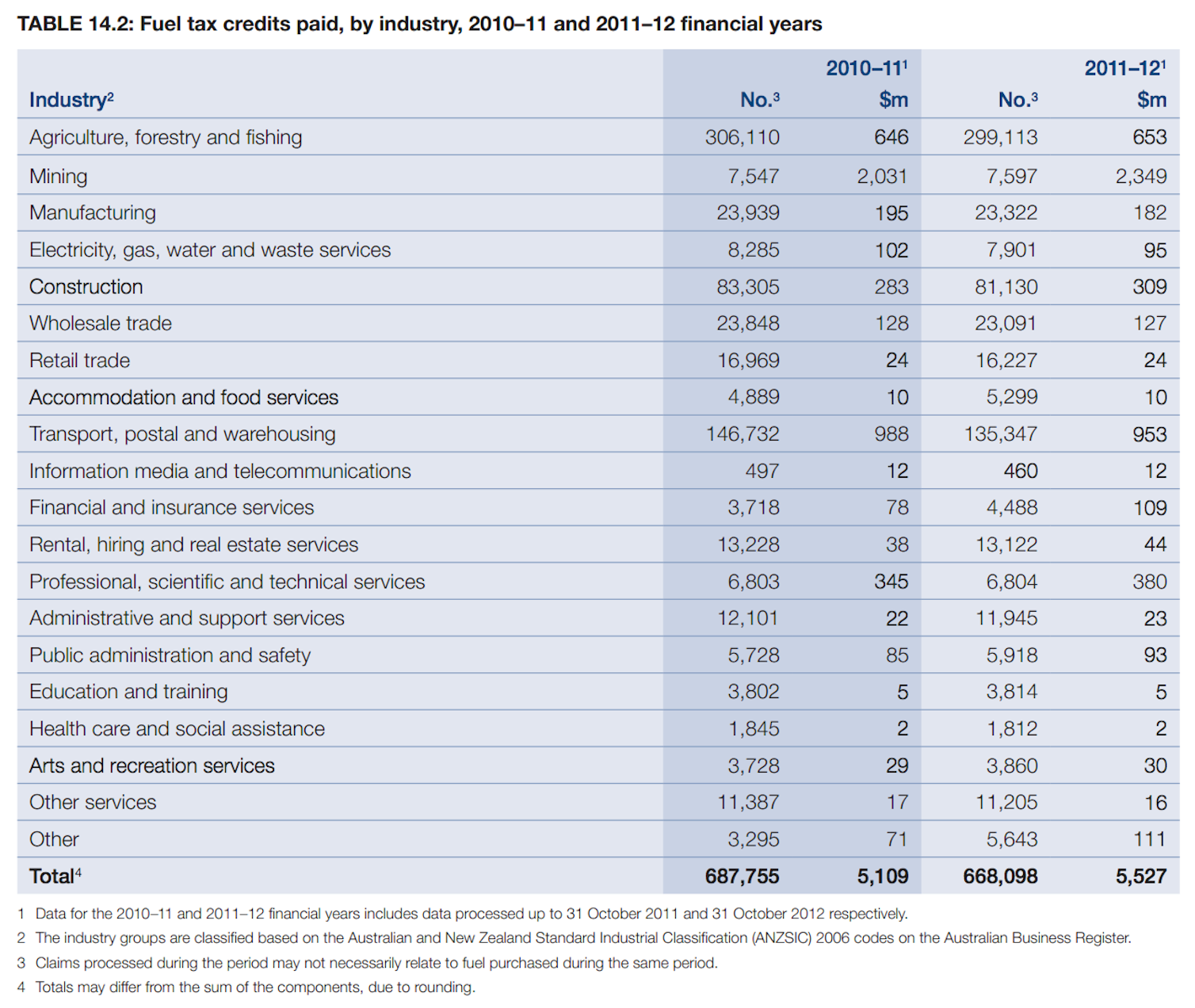

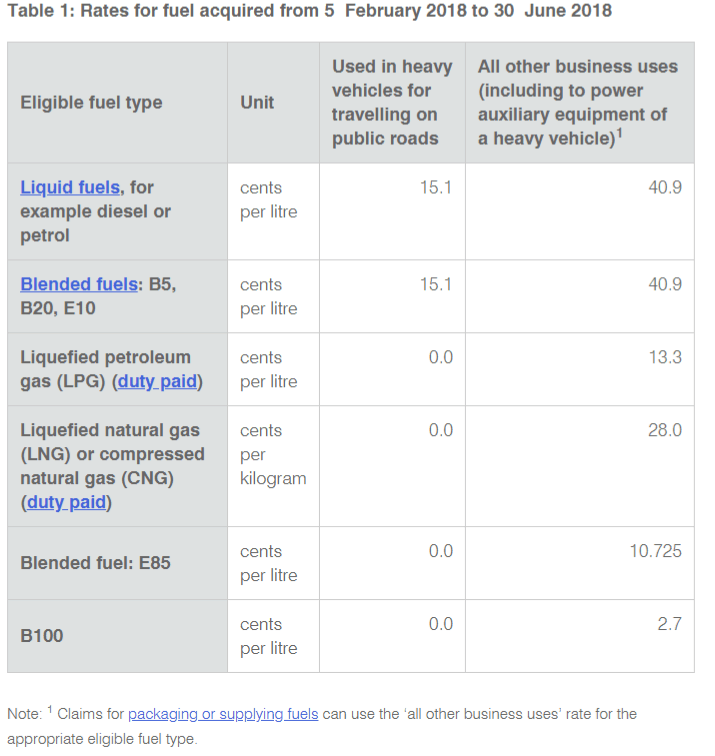

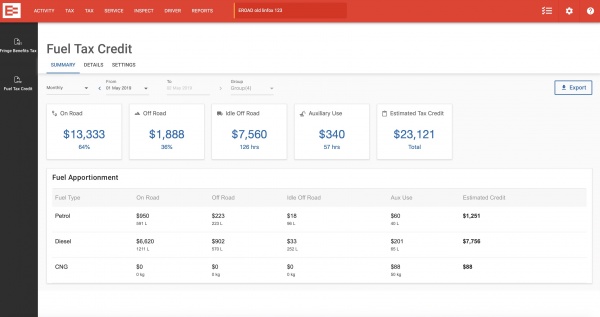

Web 7 mars 2023 nbsp 0183 32 Find out if you re eligible for fuel tax credits and how to make a claim 1 Check if you re eligible for fuel tax credits Businesses can claim credits for the fuel tax Web 11 nov 2021 nbsp 0183 32 In simple terms fuel tax credits provide businesses with a rebate for the fuel tax paid at the bowser or pump in order to run heavy vehicles light vehicles machinery plant and equipment Excise or

Web Information about Form 4136 Credit For Federal Tax Paid On Fuels including recent updates related forms and instructions on how to file Use Form 4136 to claim a credit Web 8 mai 2021 nbsp 0183 32 The tax rebate is 42 7c a litre and costs the federal government 7 8bn a year In a report released this week the Australia Institute found the fuel tax credit scheme

Download Fuel Tax Credit Rebate

More picture related to Fuel Tax Credit Rebate

Viewpoints Should Fuel Tax Credits Be Cut In The Budget

https://images.theconversation.com/files/47595/original/3cfp2vcz-1398993376.jpg?ixlib=rb-1.1.0&q=30&auto=format&w=754&h=636&fit=crop&dpr=2

Fillable Form 4136 Credit For Federal Tax Paid On Fuels 2012

https://data.formsbank.com/pdf_docs_html/337/3378/337878/page_1_thumb_big.png

BAS How To Enter Fuel Tax Credits Exalt

https://exalt.zendesk.com/attachments/token/R5kpFc8P9Pv3j1LbrOGBnvJGB/?name=inline622998097.png

Web Get a tax credit of up to 7 500 for new vehicles purchased in or after 2023 Pre Owned Plug in and Fuel Cell Electric Vehicles Purchased in or after 2023 Get a credit of up to Web Fuel tax credits are assessable income and should be disclosed in the tax return as assessable government industry payments They are also treated as installment

Web relevant IRS documents and consult a tax professional Tax Credit Values LNG1 0 50 per diesel gallon equivalent DGE CNG2 0 50 per gasoline gallon equivalent GGE Web 27 oct 2022 nbsp 0183 32 The fuel tax credit rebate is one of the top 20 most expensive programs rebating the fuel excise tax to businesses that consume diesel off public roads For 2022

Fuel Tax Credits MYOB AccountRight MYOB Help Centre

http://help.myob.com/wiki/download/attachments/9340523/journal.PNG?version=2&modificationDate=1480472857000&api=v2

Is There An Energy Tax Credit For 2023 Facts You Didn T Know

https://stimulusmag.com/wp-content/uploads/2022/12/will-there-be-an-energy-tax-credit-for-2023-1.png

https://www.irs.gov/.../small-businesses-self-employed/fuel-tax-credits

Web Fuel Tax Credits Reinstated and Extended Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and

https://www.irs.gov/pub/irs-pdf/i4136.pdf

Web A credit for exporting dyed fuels or gasoline blendstocks Substainable aviation fuel SAF credit Attach Form 4136 to your tax return Instead of waiting to claim an annual credit

Fuel Tax Credits

Fuel Tax Credits MYOB AccountRight MYOB Help Centre

:max_bytes(150000):strip_icc()/FuelTaxCredit4-3V1-3b25b99dc86b458a877911fb8fea6c80.png)

Fuel Tax Credit Definition

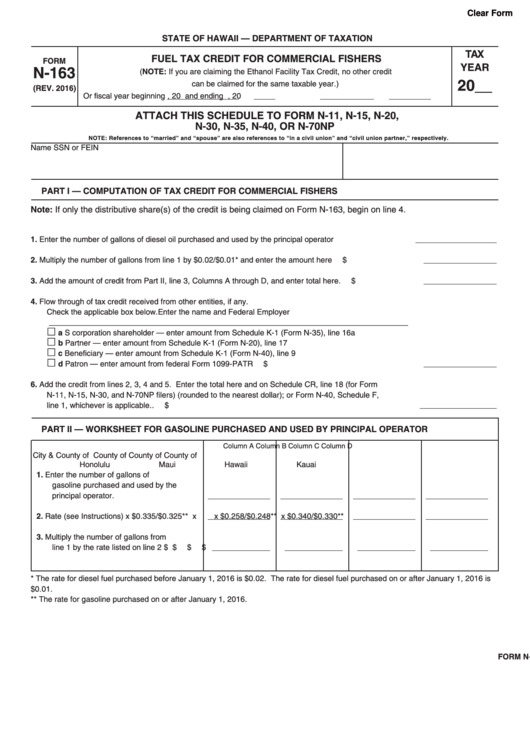

Fillable Form N 163 Fuel Tax Credit Printable Pdf Download

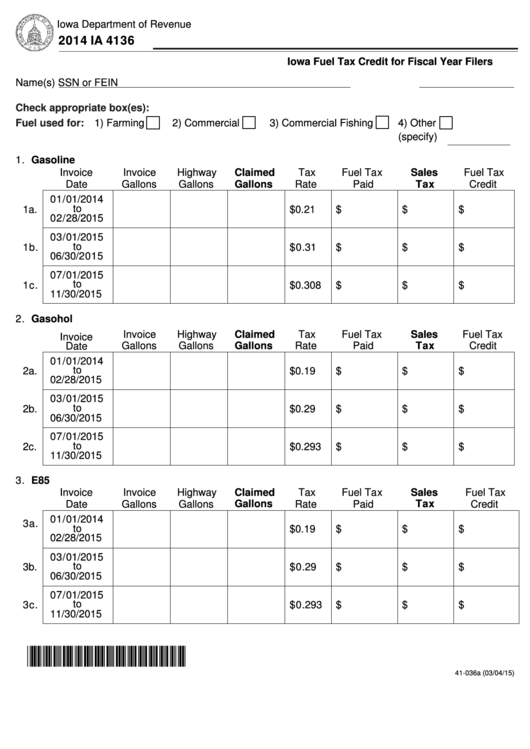

Fillable Form Ia 4136 Fuel Tax Credit For Fiscal Year Filers 2014

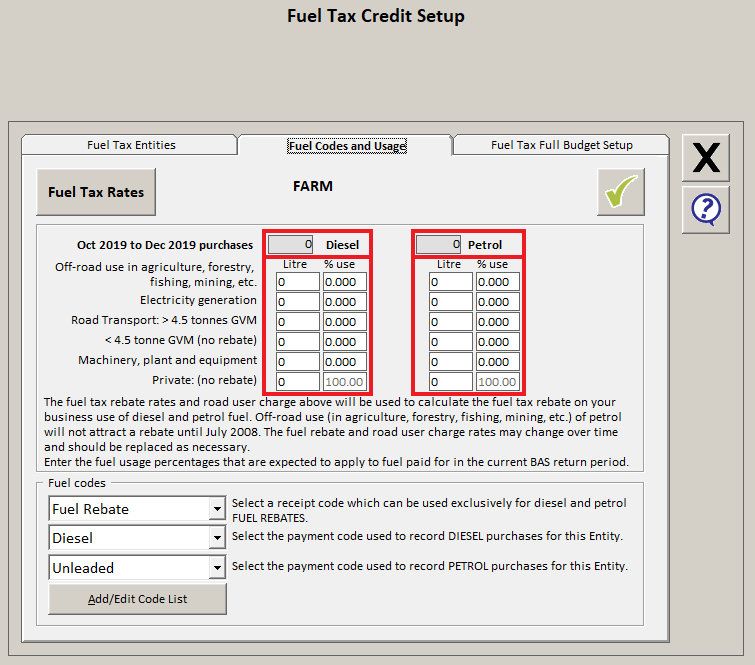

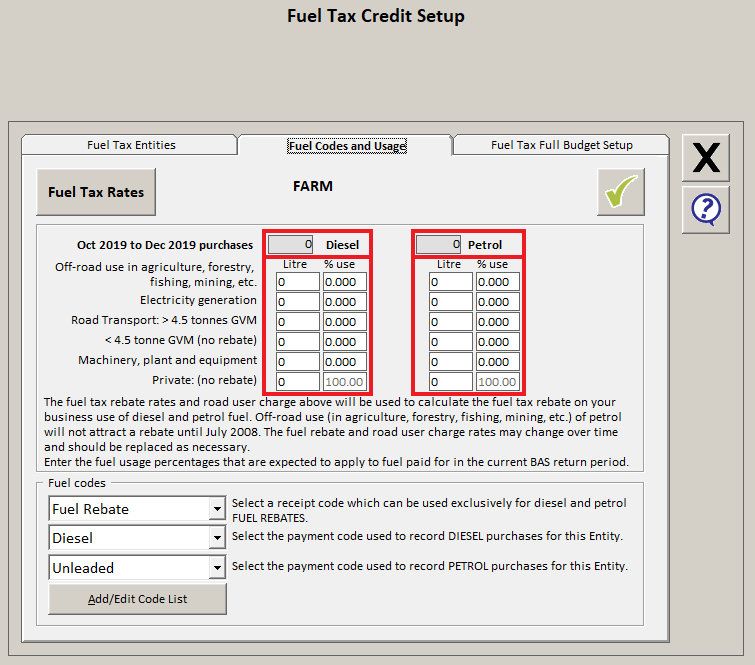

Setting Up Fuel Tax Rebate Single Entity Agrimaster

Setting Up Fuel Tax Rebate Single Entity Agrimaster

Fuel Tax Credit

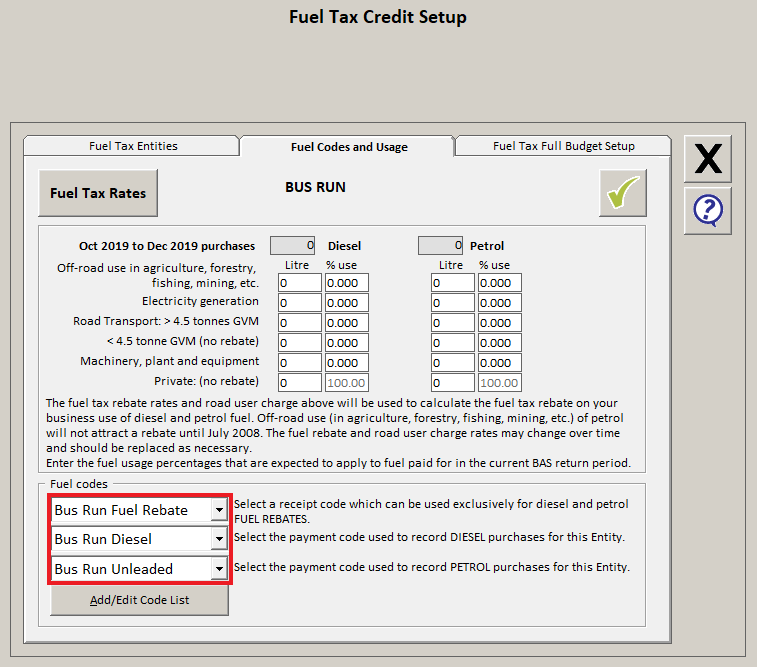

Setting Up Fuel Tax Rebate Multiple Entities Agrimaster

Fuel Tax Credits Calculation Worksheet

Fuel Tax Credit Rebate - Web The Notice does not impact 2018 and 2019 refundable income tax credit claims under IRC Section 34 a for biodiesel mixtures and alternative fuel sold or used during those