Fuel Tax Credit Rules Information about fuel tax credits for business use of fuel Last updated 5 July 2021 Print or Download Fuel tax credits provide businesses with a credit for the fuel

Fuel tax credit rates You need to use the rate that applies on the date you acquired the fuel You can also use the fuel tax credit calculator to work out the Finance Taxation Claim fuel tax credits Last Updated 18 January 2024 If your business uses fuel you may be able to claim credits for the fuel tax included in

Fuel Tax Credit Rules

Fuel Tax Credit Rules

https://www.banlaw.com/wp-content/uploads/2021/12/who-can-claim-fuel-tax-credits-1024x763.jpg

What Is A Tax Credit Tax Credits Explained

https://media.valuethemarkets.com/img/Whatisataxcredit__685660f27b96fbc6e0edb67eb5c59039.jpg

Fuel Tax Credit Calculator Banlaw

https://www.banlaw.com/wp-content/uploads/2022/04/[email protected]

Overview The following tools will help you check if you re eligible for fuel tax credits and work out the amount of fuel tax credits you can claim Eligibility tool check if you can Proposed Rules for Technology Neutral Clean Electricity Incentives in the Inflation Reduction Act WASHINGTON Today the U S Department of the Treasury

Eligibility for fuel tax credits involves several criteria First the type of fuel used is crucial only specific fuels such as diesel gasoline and kerosene are eligible Yes The Government has provided a range of options which should ensure any operator who maintains the emission related components of their vehicle in a reasonable

Download Fuel Tax Credit Rules

More picture related to Fuel Tax Credit Rules

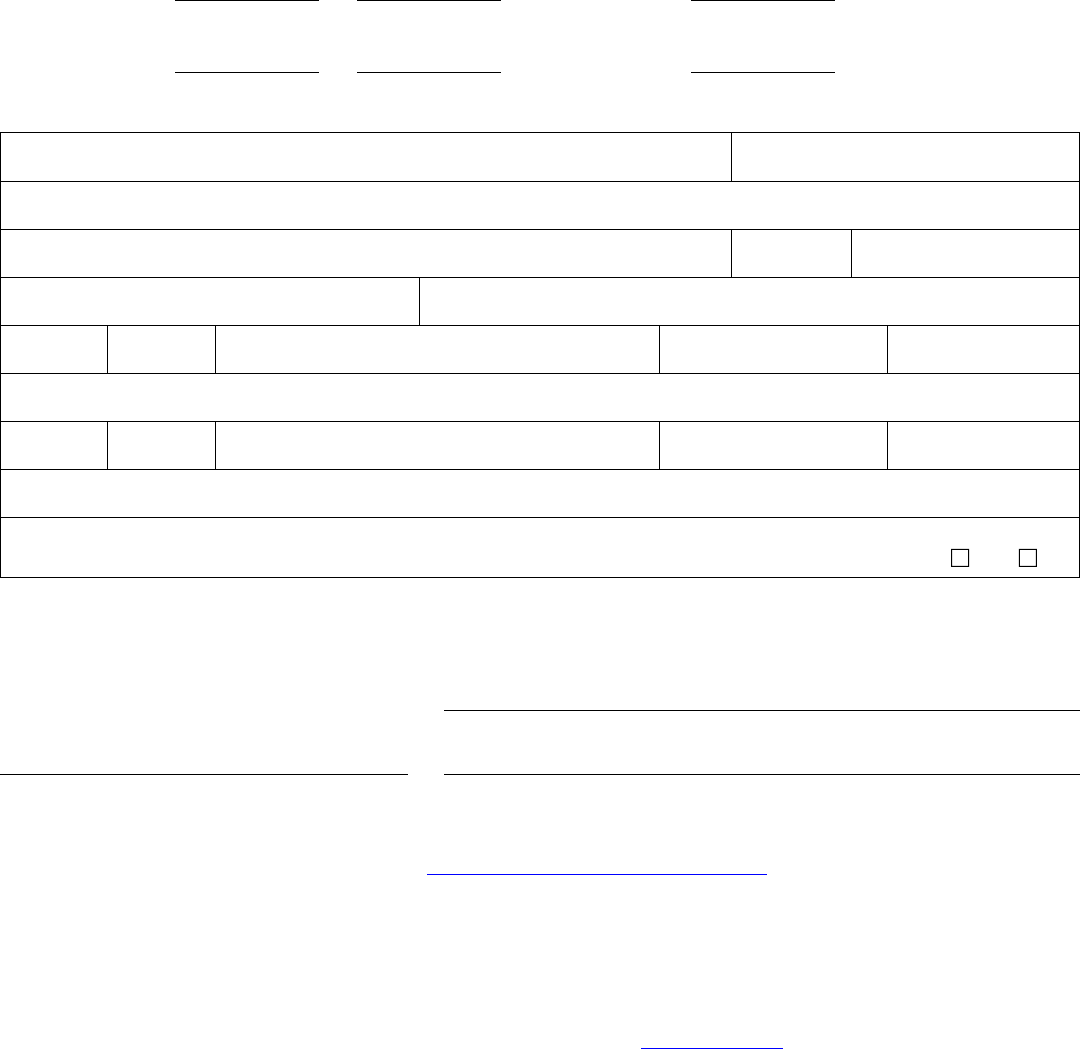

International Fuel Tax Agreement IFTA Tax Return Information And

https://www.signnow.com/preview/549/386/549386760/large.png

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/UBFLSPGCVKYTZ6W5NVXCLIVFTI.jpg)

Fuel Tax Cuts Will Increase Emissions But Government Still Plans To

https://www.nzherald.co.nz/resizer/jJs9PNjt4OjC6RNjR4mHjsogwgs=/1200x675/filters:quality(70)/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/UBFLSPGCVKYTZ6W5NVXCLIVFTI.jpg

Revamping The Federal EV Tax Credit Could Help Average Car Buyers

https://theicct.org/wp-content/uploads/2022/06/epv-us-tax-credit-fig-jun22.png

To claim fuel tax credits with Form 4136 you must Have paid federal excise taxes on fuels Have proof of tax amounts paid Have used fuels for nontaxable Generally eligible taxpayers may claim fuel taxes as a credit against income tax for the year in which the qualifying use occurred A claim for credit is made on the

In general only the ultimate user of a fuel is eligible for a credit for untaxed use In other words if you weren t the one who burned the fuel then you usually can t claim the Sec 4041 Sec 4041 levies an excise tax on the following fuel types Diesel Kerosene Alternative fuels Compressed natural gas and Fuels used in aviation The rate varies

Tax Credits ElectricVehicleSolar

https://static.wixstatic.com/media/d01121_9abd5528e3d5421198995c9f6da16436~mv2.png/v1/fit/w_2500,h_1330,al_c/d01121_9abd5528e3d5421198995c9f6da16436~mv2.png

https://hesabdarema.com/wp-content/uploads/2022/04/Tax-credit.jpg

https://www.ato.gov.au/.../fuel-schemes/fuel-tax-credits-business

Information about fuel tax credits for business use of fuel Last updated 5 July 2021 Print or Download Fuel tax credits provide businesses with a credit for the fuel

https://www.ato.gov.au/businesses-and...

Fuel tax credit rates You need to use the rate that applies on the date you acquired the fuel You can also use the fuel tax credit calculator to work out the

Tax Credit Universal Credit Impact Of Announced Changes House Of

Tax Credits ElectricVehicleSolar

Fuel Tax Credit Rates Have Increased Business Wise

Earned Income Tax Credit EITC Get My Payment IL

IFTA Quarterly Fuel Tax Filing Payhip

Fuel Tax Application Edit Fill Sign Online Handypdf

Fuel Tax Application Edit Fill Sign Online Handypdf

Fuel Tax Credit UPDATED JUNE 2022

Tax Reduction Company Inc

Individual Tax WEC CPA Blog

Fuel Tax Credit Rules - All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500