Fuel Tax Rebate Amount Web 10 juil 2023 nbsp 0183 32 Published on 10 July 2023 From 1er september 2023 you can ask for the monthly refund of the CTBT You will still be able to ask if you want a refund every

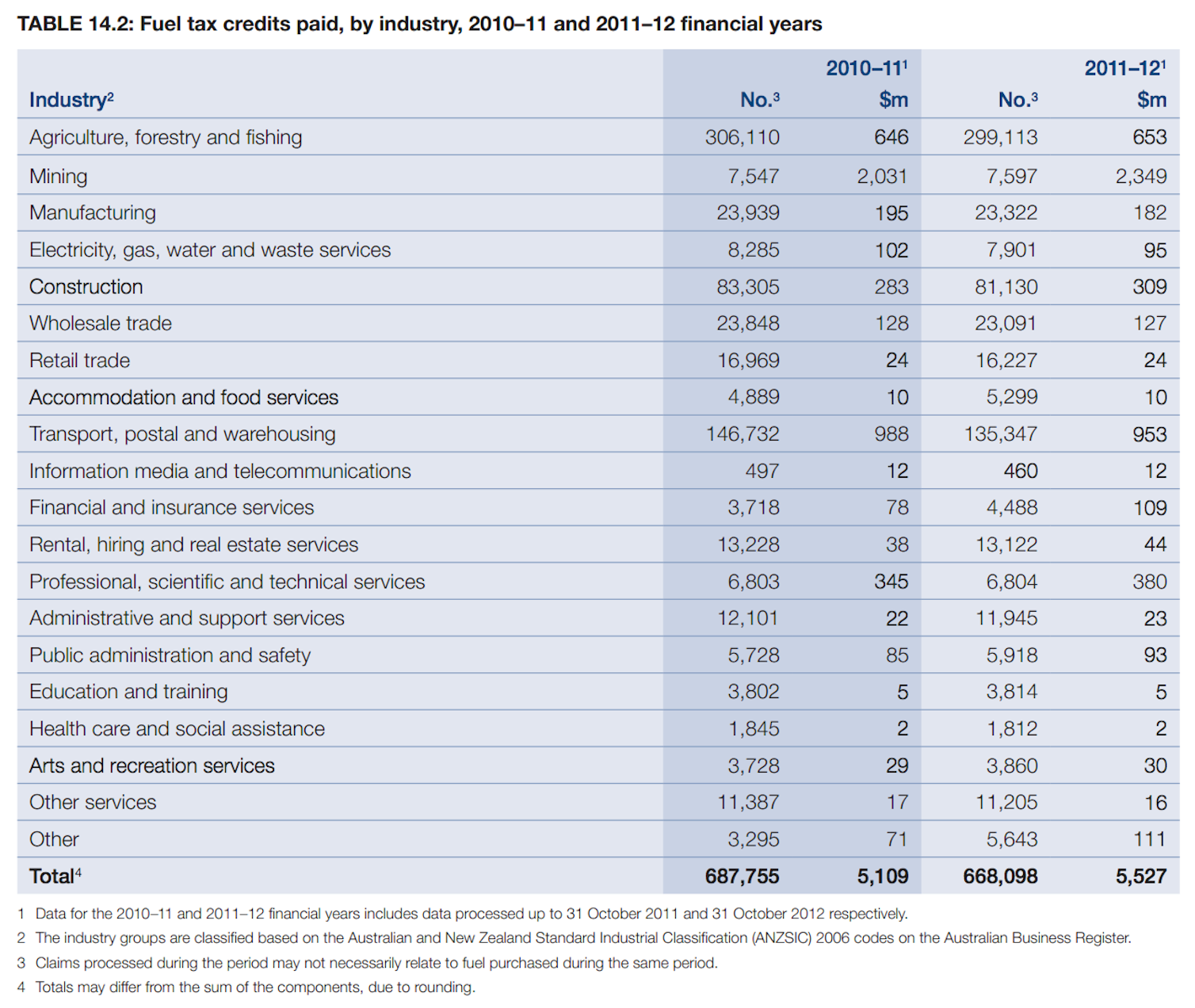

Web 1 juil 2015 nbsp 0183 32 Fuel tax credit rates The following tables contain the fuel tax credit rates for businesses from 1 July 2021 to 30 June 2022 The fuel tax credit calculator includes the Web Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and extended the following fuel tax credits

Fuel Tax Rebate Amount

Fuel Tax Rebate Amount

https://www.pdffiller.com/preview/14/944/14944825/large.png

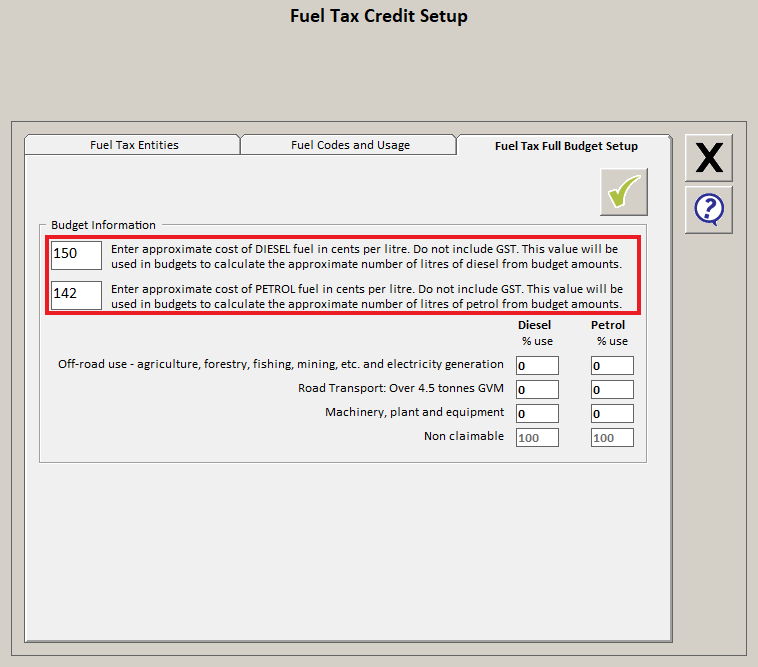

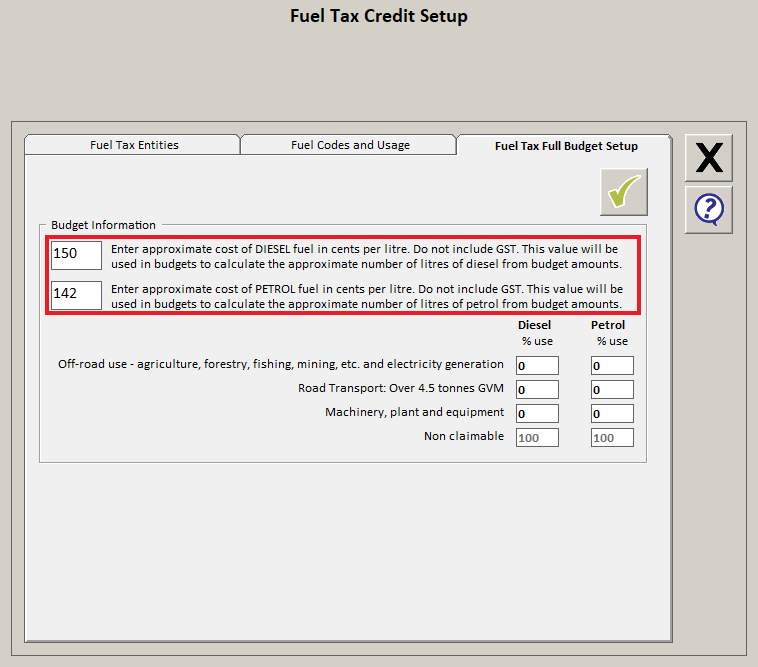

Setting Up Fuel Tax Rebate Single Entity Agrimaster

https://support.agrimaster.com.au/hc/article_attachments/360002822615/fueltaxmulti15.png

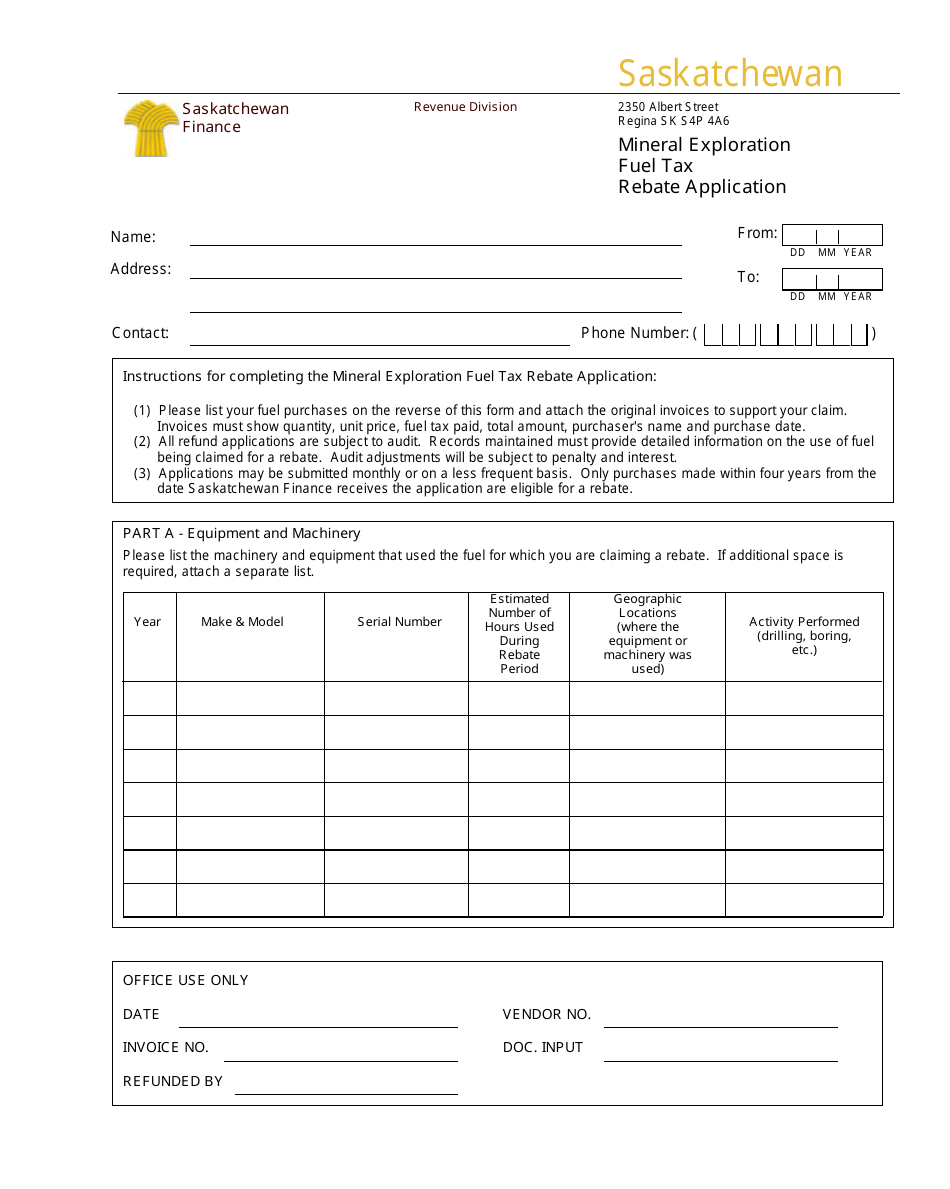

Saskatchewan Canada Mineral Exploration Fuel Tax Rebate Application

https://data.templateroller.com/pdf_docs_html/1872/18722/1872203/mineral-exploration-fuel-tax-rebate-application-saskatchewan-canada_print_big.png

Web Calculating eligible fuel quantities There are a variety of methods and measures to help you work out how much fuel is eligible for fuel tax credits Find out about Methods to help Web 6 avr 2022 nbsp 0183 32 Much attention has been given to the 2022 Budget measure of temporarily halving of the fuel excise for petrol and diesel from 44 2 cents litre to 22 1 cents Less

Web 7 mars 2023 nbsp 0183 32 Last Updated 7 March 2023 If your business uses fuel you may be able to claim credits for the fuel tax included in the price of the fuel Find out if you re eligible for Web Federal budget 2022 For 6 months from April 1 to October 1 the fuel excise was lowered or cut by 50 by the federal budget 2022 to 22 1c per litre for all road fuels 1 2 3

Download Fuel Tax Rebate Amount

More picture related to Fuel Tax Rebate Amount

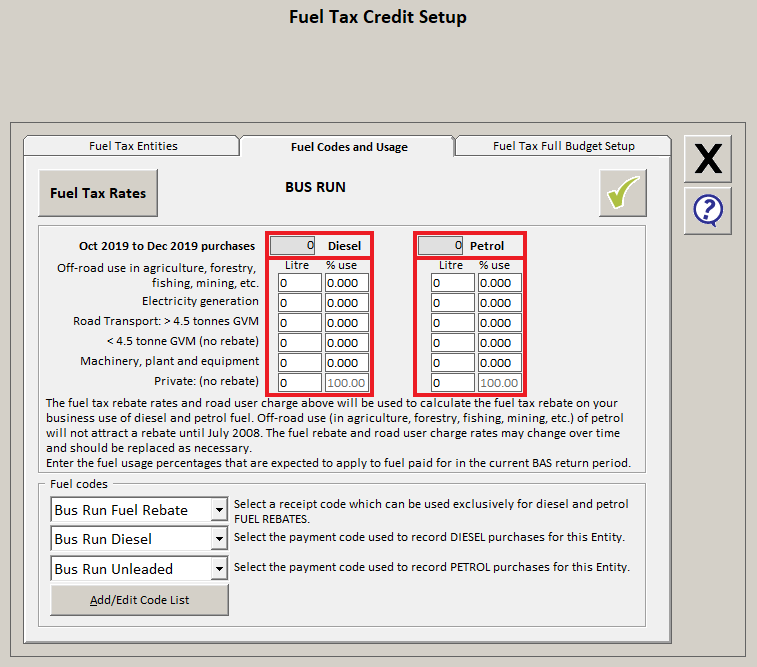

Setting Up Fuel Tax Rebate Multiple Entities Agrimaster

https://support.agrimaster.com.au/hc/article_attachments/360002912996/fueltaxmulti14_2.png

Reporting Fuel Tax Rebate Agrimaster

https://support.agrimaster.com.au/hc/article_attachments/360002878975/fuelrebatereport.PNG

Vehicle Excise Tax Calculator DeenahZikra

https://tipexcise.com/wp-content/uploads/2019/06/tip5.png

Web 11 nov 2021 nbsp 0183 32 If you claim less than 10 000 in fuel tax credits per year the easiest and safest way to get your claims right is to use one of the following methods The basic method for heavy vehicles which calculates your off Web Fuel Tax Credits are claimed on your Business Activity Statement and you may make a claim within four years of purchasing the fuel The amount of credit changes every six months February amp August with current Fuel

Web 27 oct 2022 nbsp 0183 32 The fuel tax credit rebate is one of the top 20 most expensive programs rebating the fuel excise tax to businesses that consume diesel off public roads For 2022 Web If your business uses vehicles off road for travel idling or operating auxiliary equipment such as compressors refrigeration units farming or hydraulic machinery you could

Reporting Fuel Tax Rebate Agrimaster

https://support.agrimaster.com.au/hc/article_attachments/360002970516/gstfull2.PNG

Viewpoints Should Fuel Tax Credits Be Cut In The Budget

https://images.theconversation.com/files/47595/original/3cfp2vcz-1398993376.jpg?ixlib=rb-1.1.0&q=30&auto=format&w=754&h=636&fit=crop&dpr=2

https://entreprendre.service-public.fr/vosdroits/F31222?lang=en

Web 10 juil 2023 nbsp 0183 32 Published on 10 July 2023 From 1er september 2023 you can ask for the monthly refund of the CTBT You will still be able to ask if you want a refund every

https://www.ato.gov.au/Business/Fuel-schemes/Fuel-tax-credits...

Web 1 juil 2015 nbsp 0183 32 Fuel tax credit rates The following tables contain the fuel tax credit rates for businesses from 1 July 2021 to 30 June 2022 The fuel tax credit calculator includes the

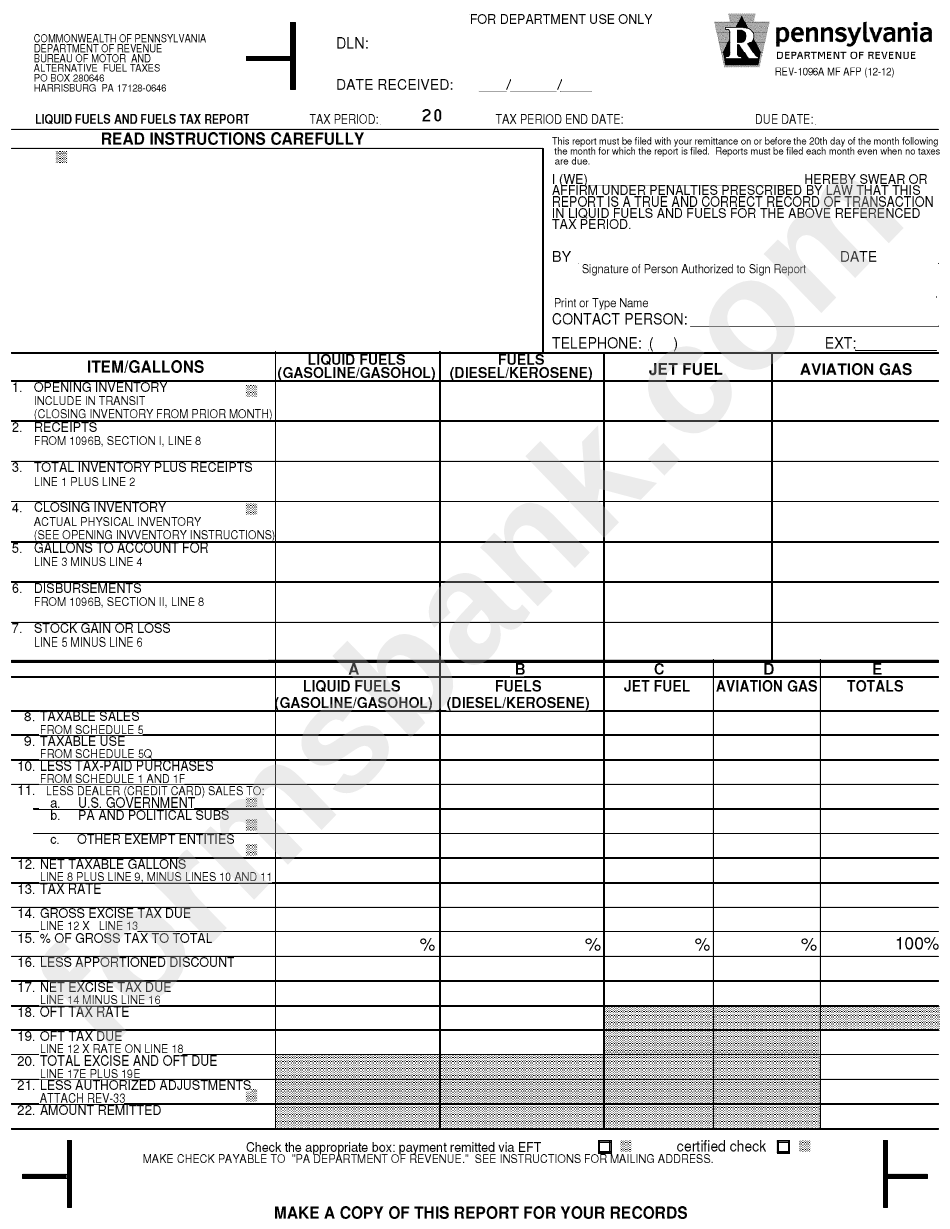

Liquid Fuels And Fuels Tax Report Form Printable Pdf Download

Reporting Fuel Tax Rebate Agrimaster

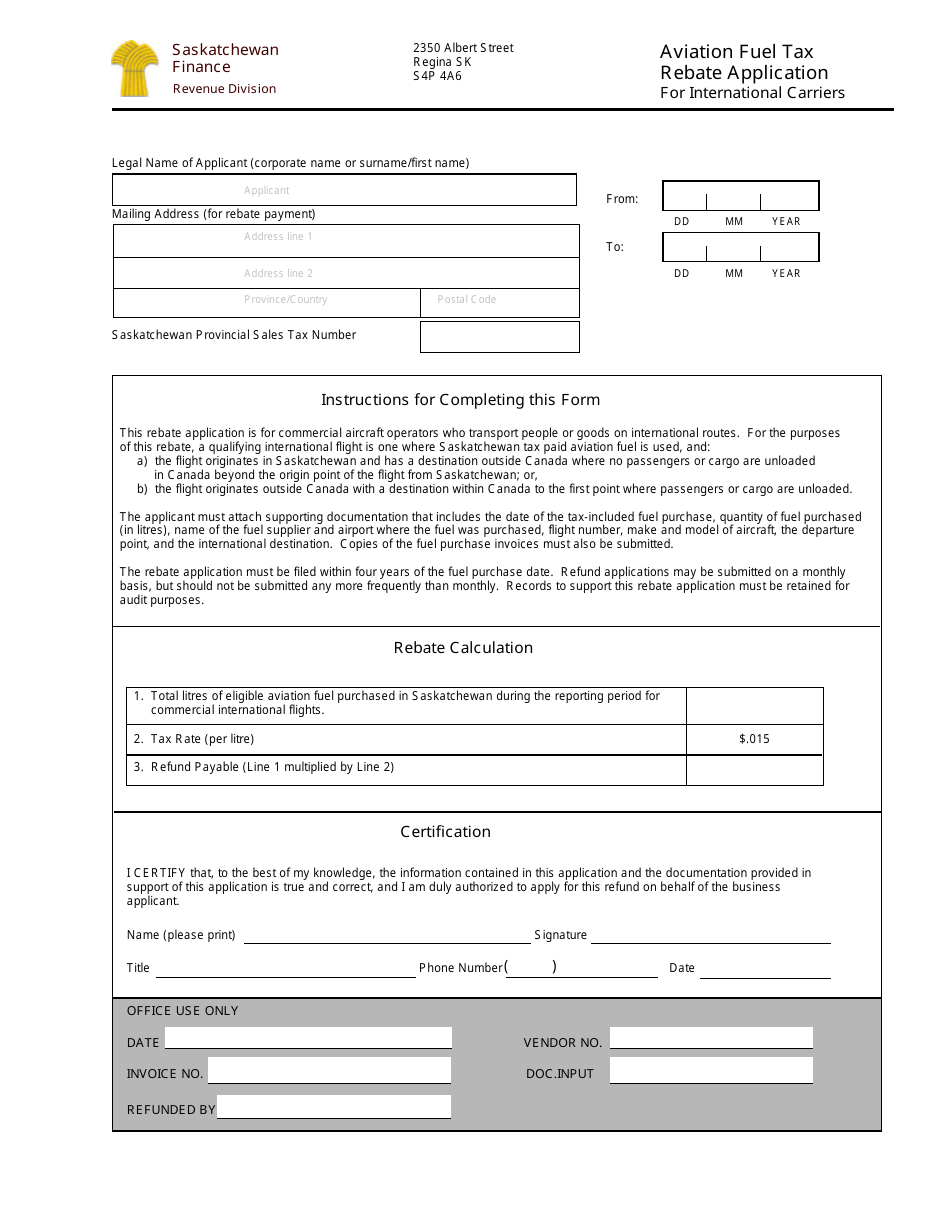

Saskatchewan Canada Aviation Fuel Tax Rebate Application For

REV 643 Motor Fuels Tax Reimbursement Claim Form In Truck

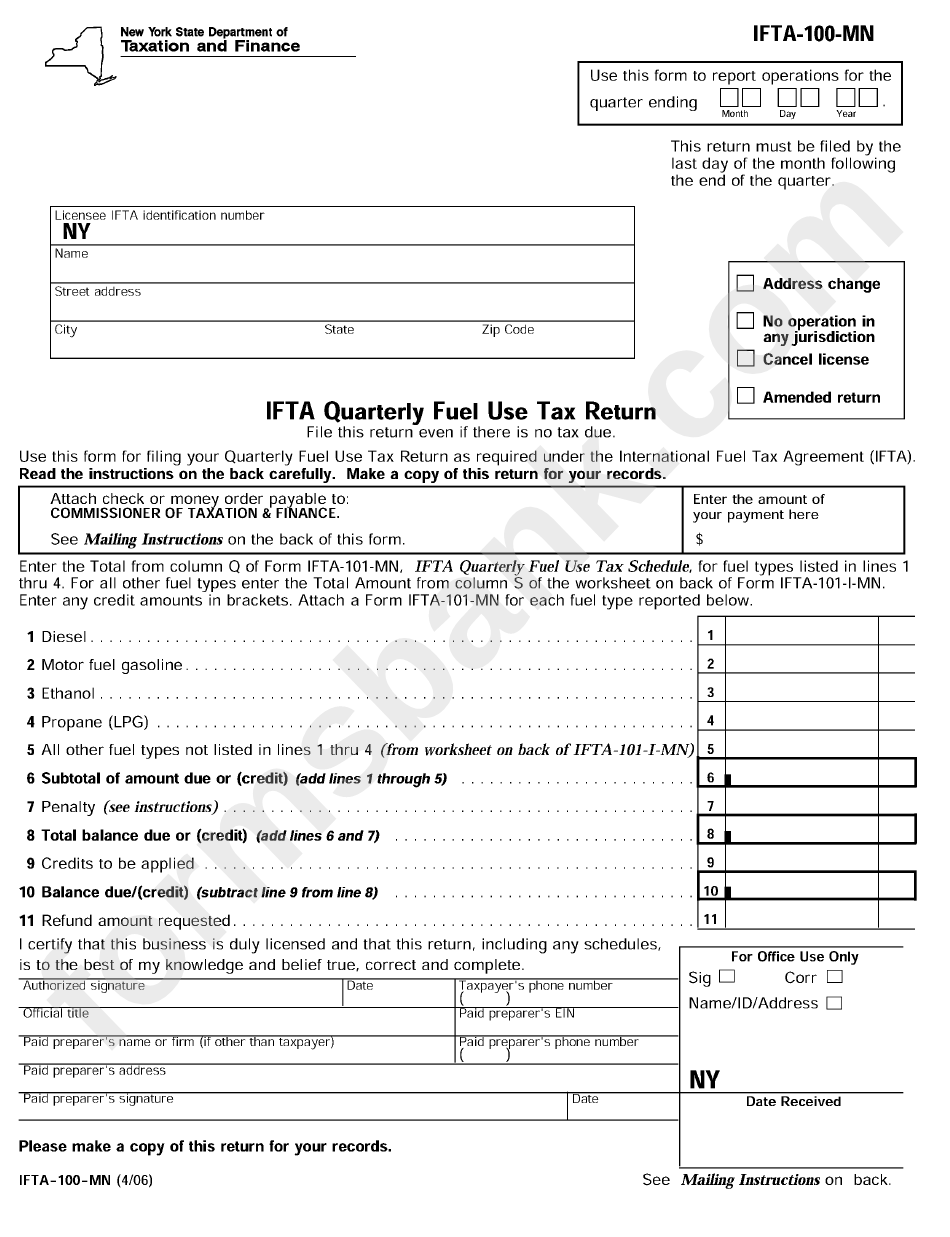

Form Ifta 100 Mn Ifta Quarterly Fuel Use Tax Return Printable Pdf

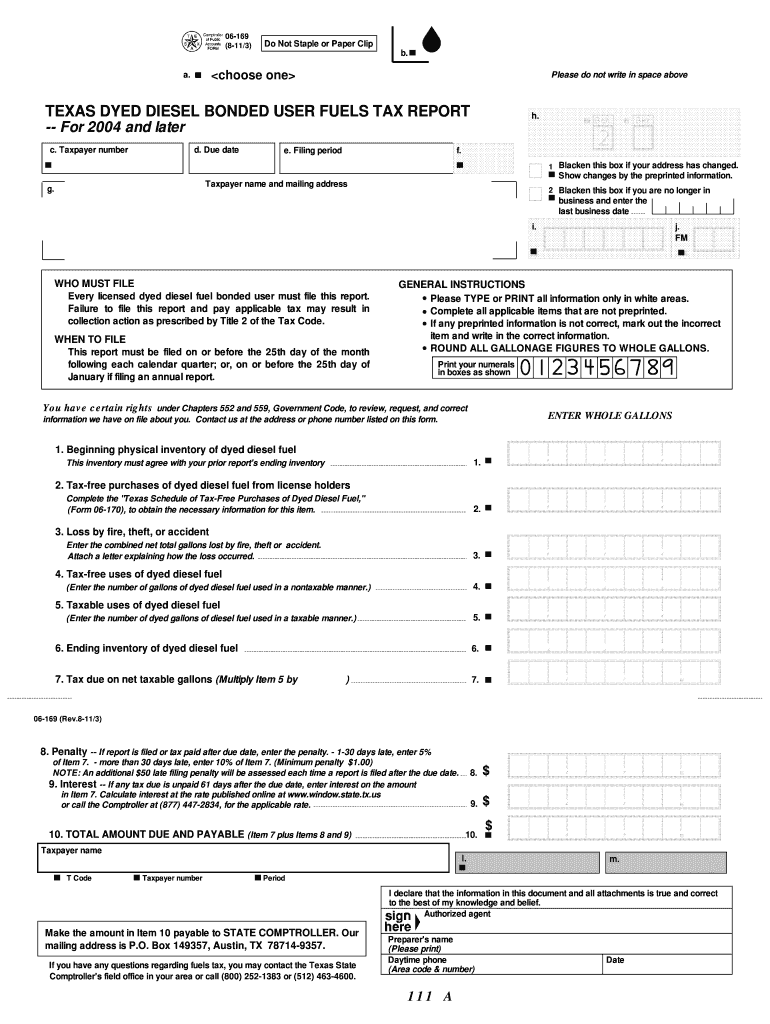

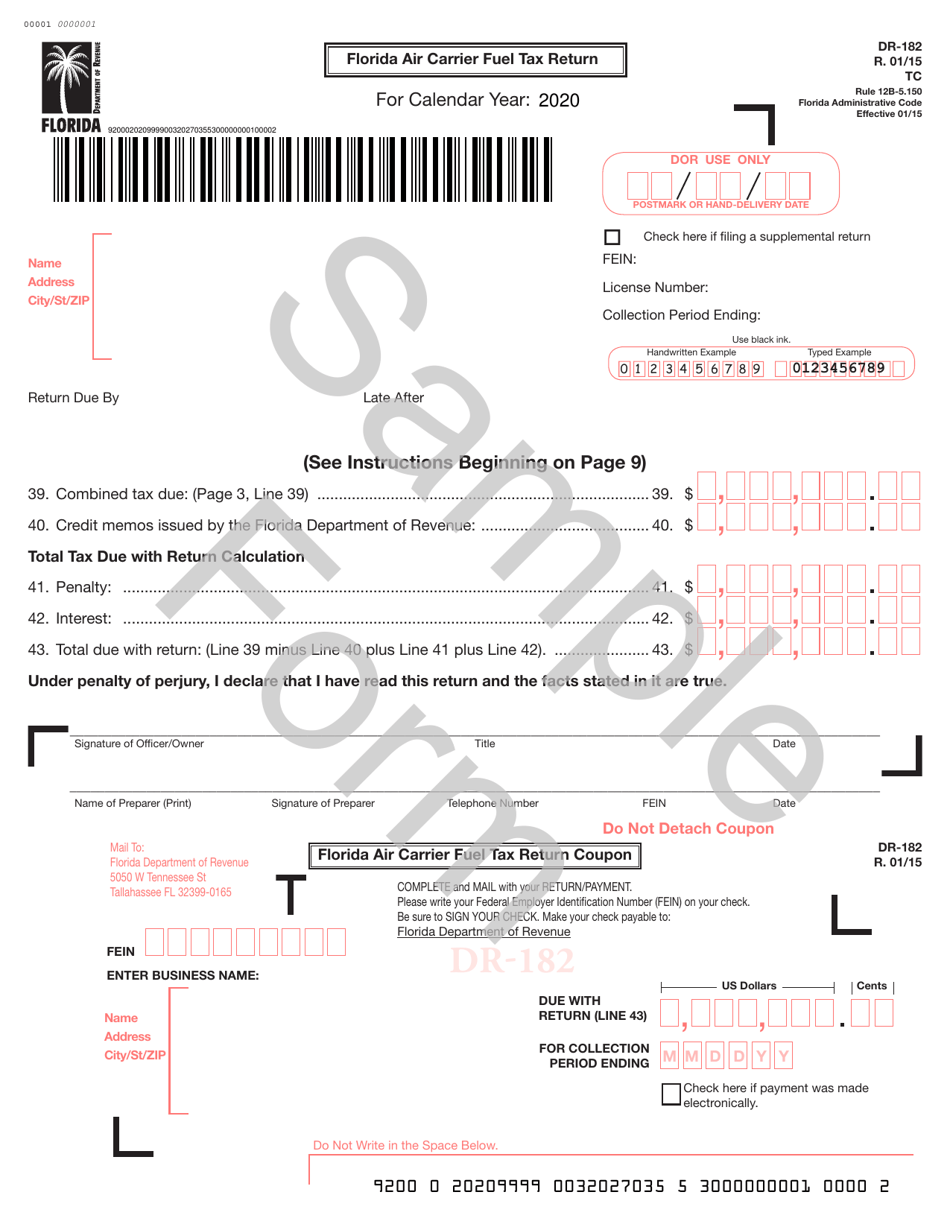

06 169 Fill Out Sign Online DocHub

06 169 Fill Out Sign Online DocHub

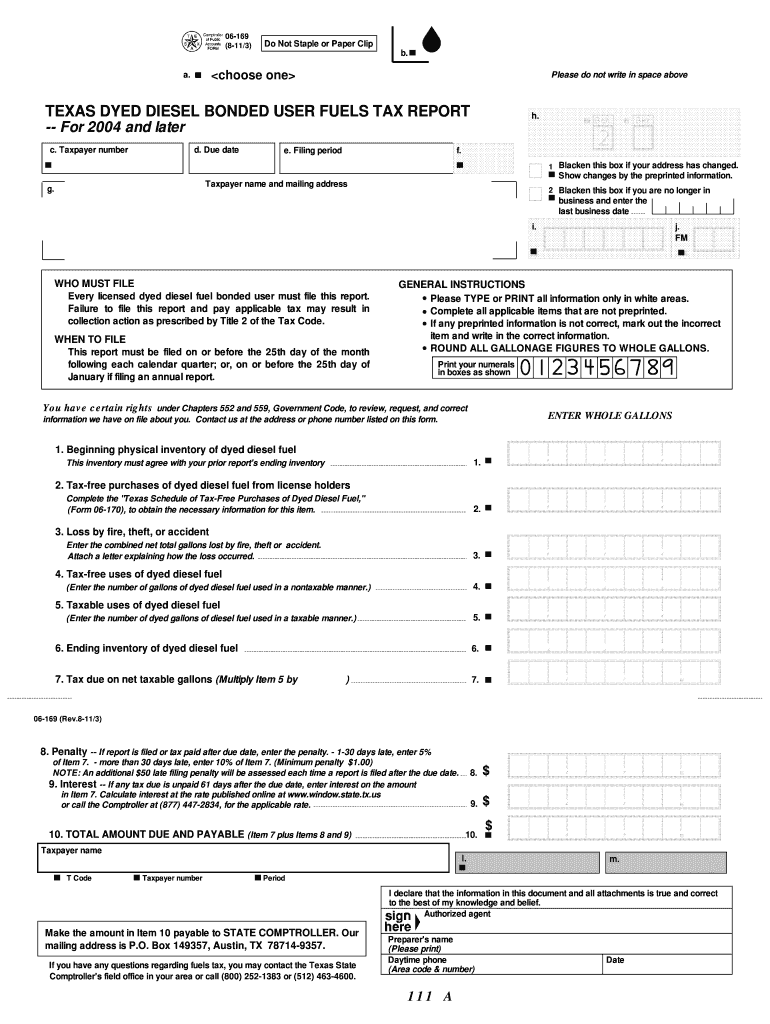

Activate Full Budget Fuel Tax Rebate Agrimaster

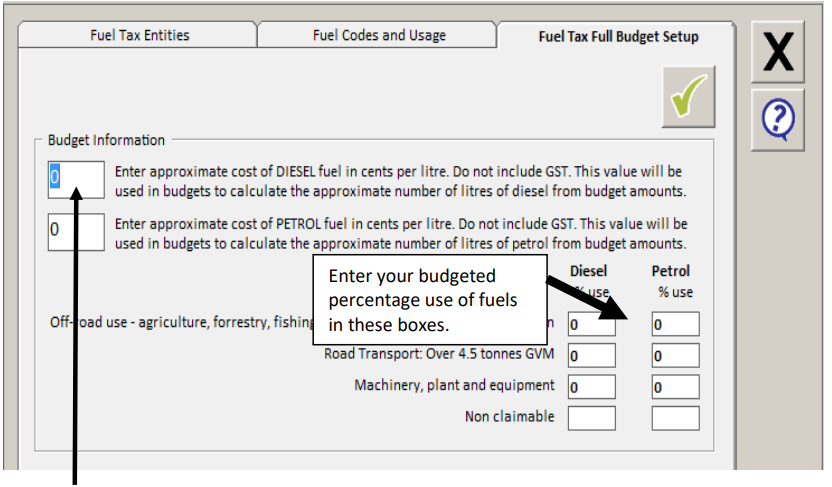

Form Dr 182 Download Printable Pdf Or Fill Online Florida Air Carrier

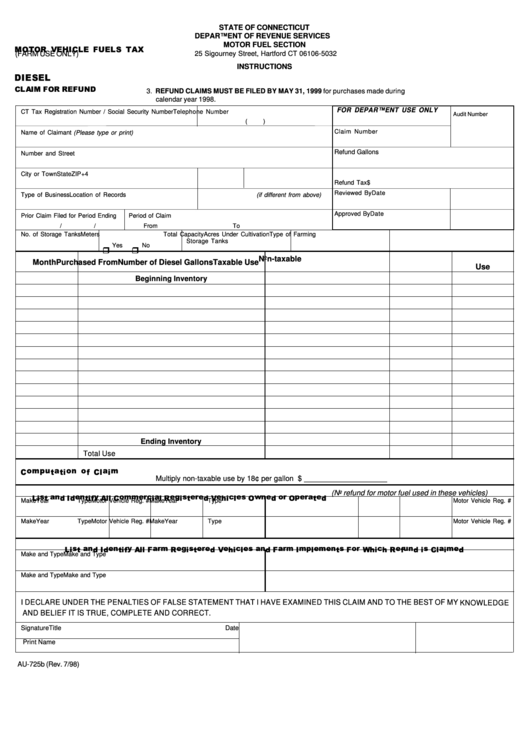

Fillable Form Au 725b Motor Vehicle Fuels Tax Farm Use Only

Fuel Tax Rebate Amount - Web 7 mars 2023 nbsp 0183 32 Last Updated 7 March 2023 If your business uses fuel you may be able to claim credits for the fuel tax included in the price of the fuel Find out if you re eligible for