Fuel Tax Rebate Ato Web All fuel tax credit claimants need to apply the new rates for fuel acquired from 1 August To make it easier if your business claims less than 10 000 in the year you can use the rate

Web Fuel tax credits calculation worksheet Use this worksheet to help you calculate your fuel tax credits and claim them on your business activity statement BAS You must be Web 7 mars 2023 nbsp 0183 32 1 Check if you re eligible for fuel tax credits Businesses can claim credits for the fuel tax excise or customs duty included in the price of fuel used in their business

Fuel Tax Rebate Ato

Fuel Tax Rebate Ato

https://www.howellcountynews.com/sites/default/files/field/image/afront-gas rebate.jpg

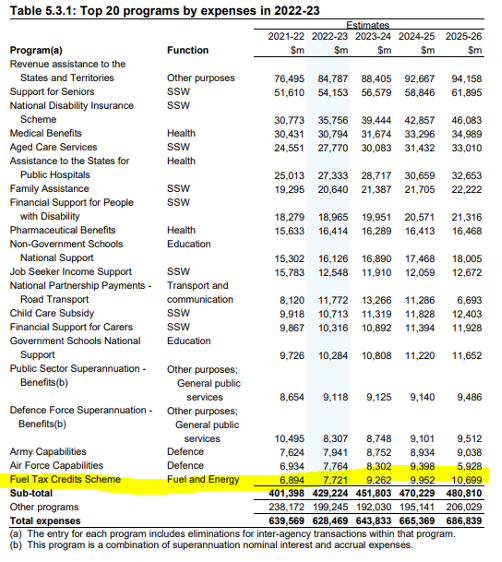

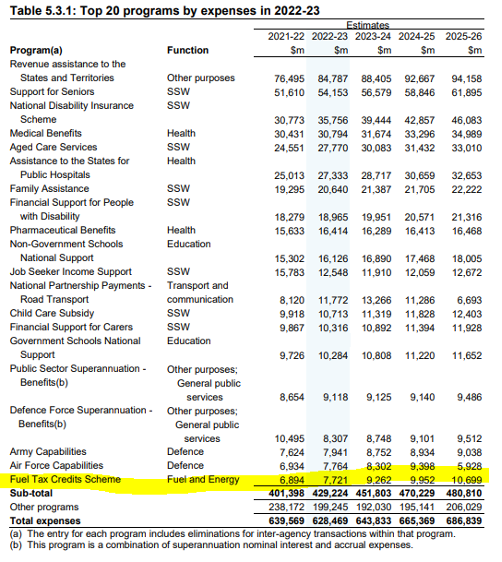

Never Mine The Budget Here s The Fuel Tax Credit Scheme The

https://australiainstitute.org.au/wp-content/uploads/2022/03/table2.png

Fuel Tax Credit Atotaxrates info

https://atotaxrates.info/wp-content/uploads/2019/01/rates-4feb2019.jpg

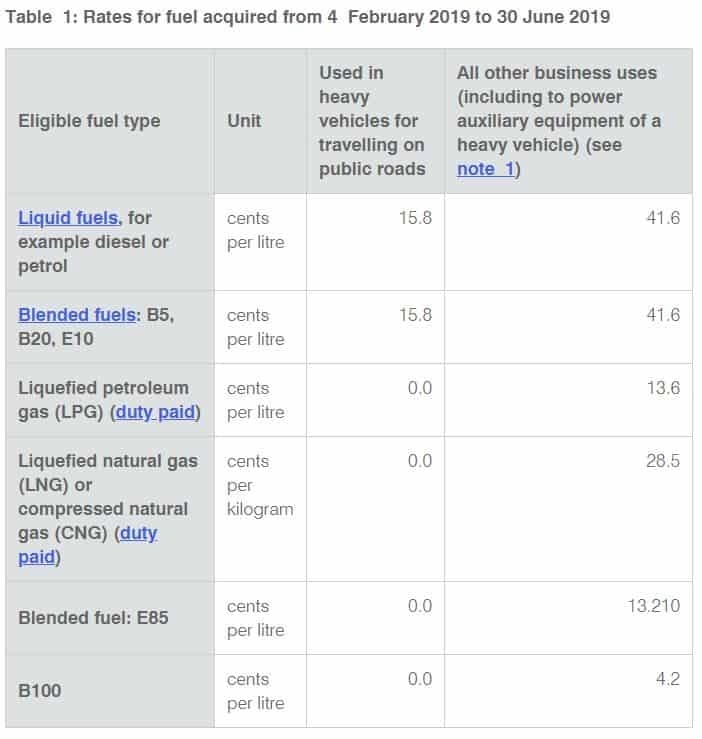

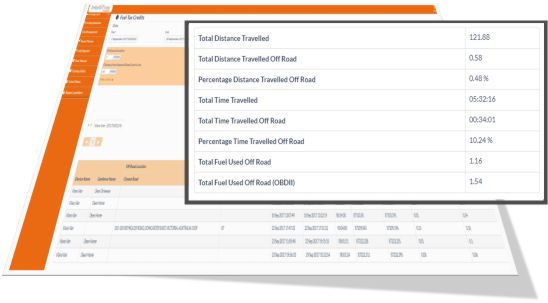

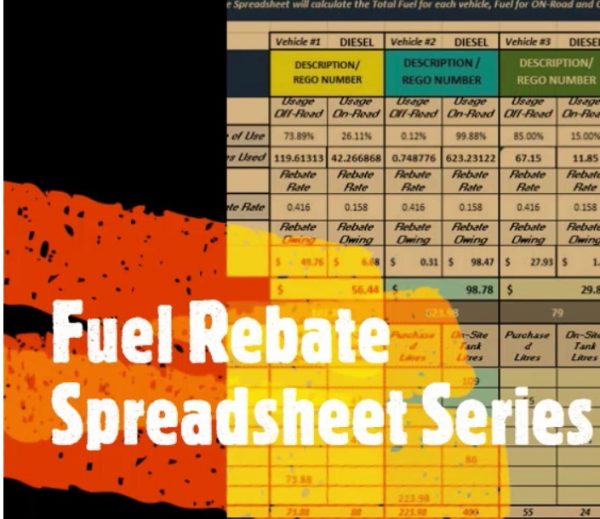

Web The calculator is quick and easy to use and will help you get your claim right If you claim under 10 000 in fuel tax credits in a year there are simpler ways to record and calculate Web 22 nov 2022 nbsp 0183 32 plant equipment heavy vehicles light vehicles travelling off public roads or on private roads Tax credits are available based on the fuel tax credit rate when you

Web 28 juil 2023 nbsp 0183 32 The fuel tax credit is a calculation of No of eligible litres x cents per litre rate The cents per litre rate is generally the rate applicable on the date of purchase Web You can claim fuel tax credits for the fuel you use in packaging or supplying fuel including packaging certain fuels in containers of 20 litres or less filling transport LPG

Download Fuel Tax Rebate Ato

More picture related to Fuel Tax Rebate Ato

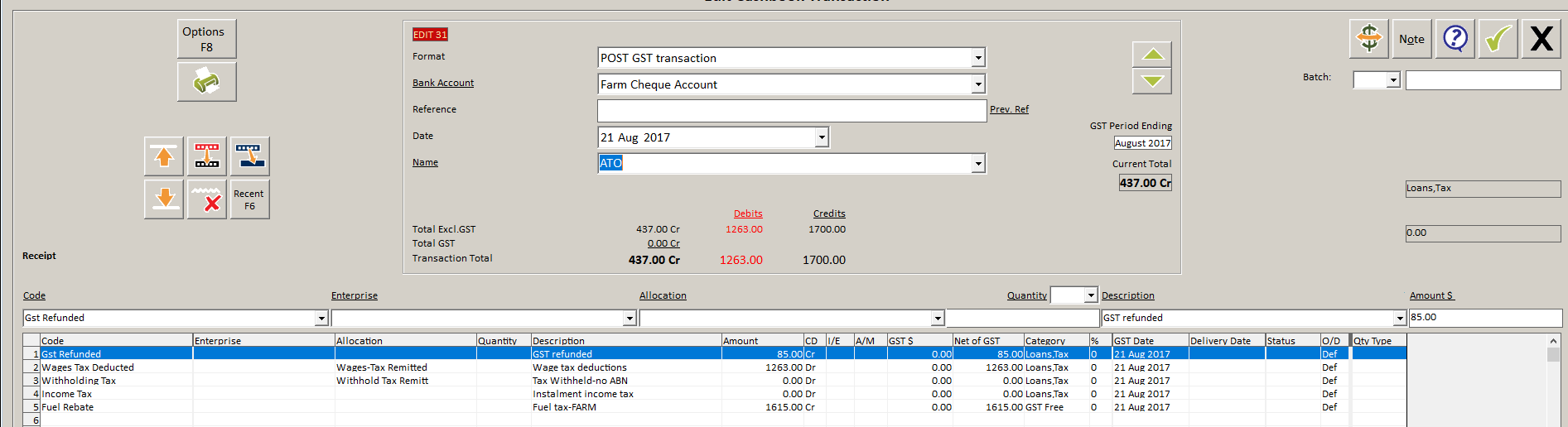

How To Record A Fuel Tax Rebate YouTube

https://i.ytimg.com/vi/Tc3tx70o3CM/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgZShlMA8=&rs=AOn4CLAr6O11zrpddv_hG-iJQCss1UIp4w

Calculating Fuel Tax Credits Using GPS Tracking Data IntelliTrac

https://www.intellitrac.com.my/images/pics/FTCReport570x310.jpg

Courses Chews Learning Space

https://chewslearningspace.com/wp-content/uploads/2020/05/Fuel-Rebate-Series-Spreadsheet-600x519.jpg

Web Keeping accurate records helps you to correctly claim all the fuel tax credits you are entitled to If you can t support your claims with adequate records you may have to repay all or Web Fuel tax related measures in the 2023 24 Budget include increasing the Heavy Vehicle Road User Charge rate from 27 2 cents per litre of diesel by six per cent per year over

Web 21 juin 2011 nbsp 0183 32 In 2009 10 the ATO collected over 253 billion in tax superannuation and excise revenue and incurred expenses of some 3 billion 2 The ATO is also Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed

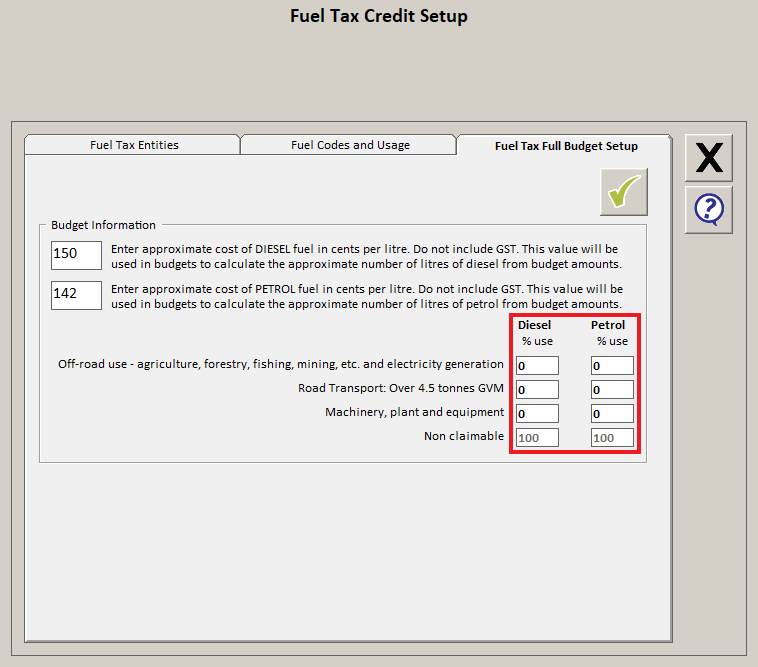

Activate Full Budget Fuel Tax Rebate Agrimaster

https://support.agrimaster.com.au/hc/en-us/article_attachments/202928626/1.JPG

Fuel Tax Credits MYOB AccountRight MYOB Help Centre

http://help.myob.com/wiki/download/attachments/9340523/journal.PNG?version=2&modificationDate=1480472857000&api=v2

https://www.ato.gov.au/.../GST-and-excise/Changes-to-fuel-tax-credit-rates

Web All fuel tax credit claimants need to apply the new rates for fuel acquired from 1 August To make it easier if your business claims less than 10 000 in the year you can use the rate

https://www.ato.gov.au/uploadedFiles/Content/ITX/download…

Web Fuel tax credits calculation worksheet Use this worksheet to help you calculate your fuel tax credits and claim them on your business activity statement BAS You must be

Activate Full Budget Fuel Tax Rebate Agrimaster

Activate Full Budget Fuel Tax Rebate Agrimaster

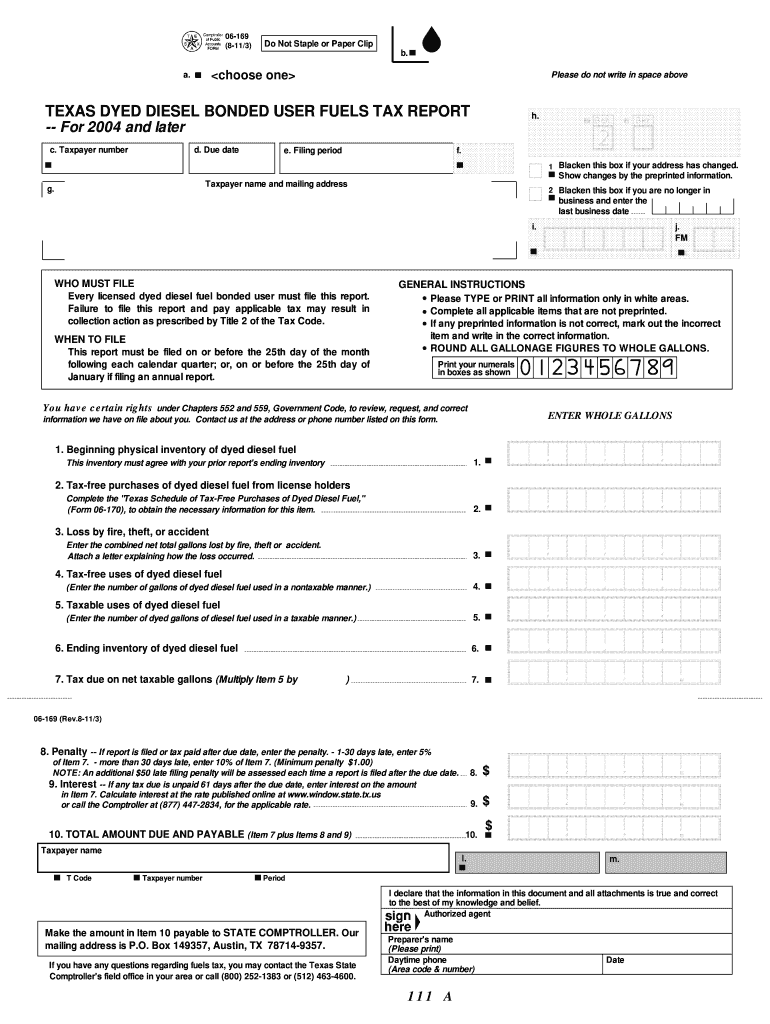

06 169 Fill Out Sign Online DocHub

Setting Up Fuel Tax Rebate Single Entity Agrimaster

Singapore Will Not Cut Fuel Duties Or Provide Road Tax Rebates

Piedmont Natural Gas Rebates Fill Online Printable Fillable Blank

Piedmont Natural Gas Rebates Fill Online Printable Fillable Blank

Record GST Payments And ATO Refunds Agrimaster

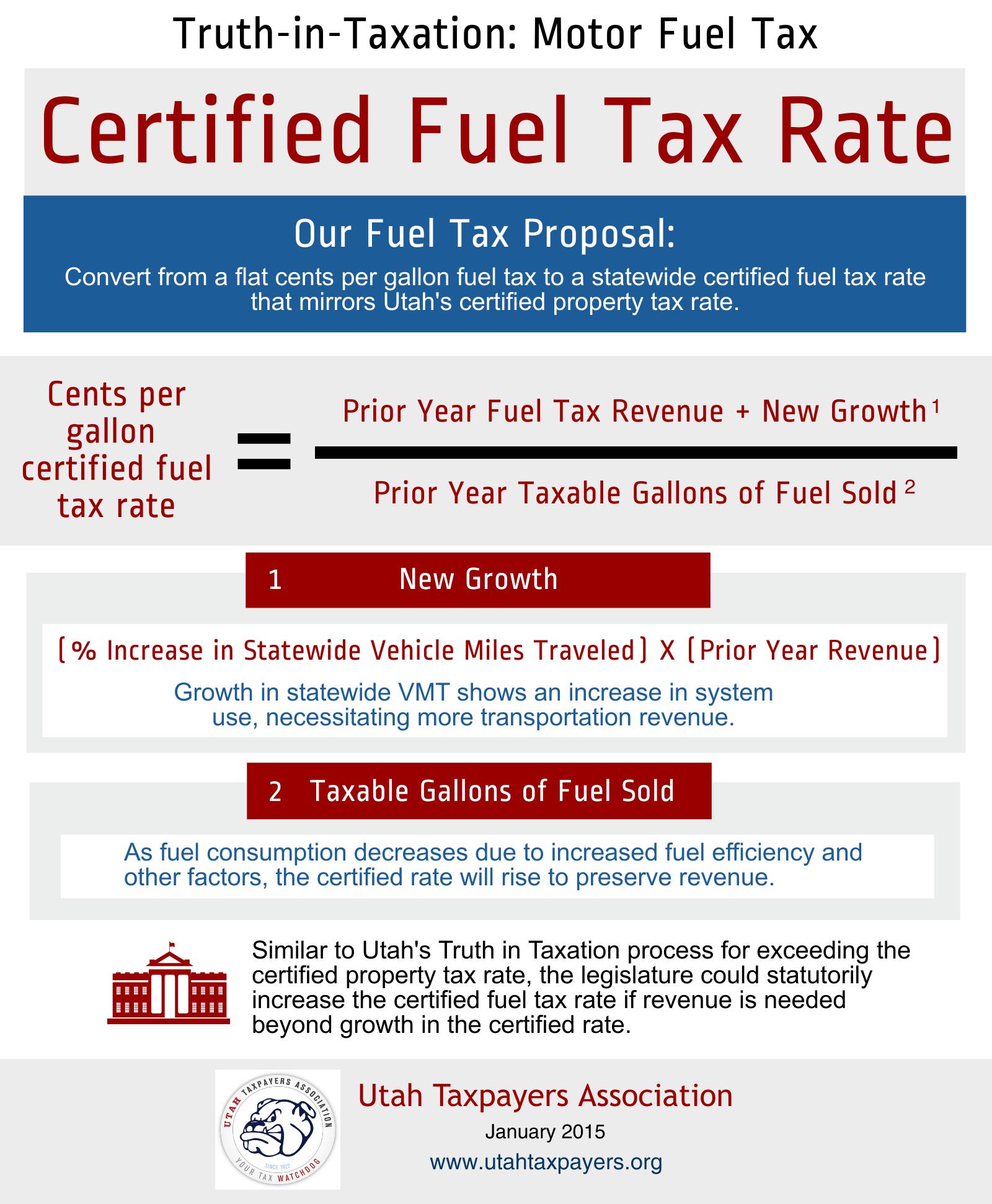

Truth in Taxation For The Motor Fuel Tax Utah Taxpayers

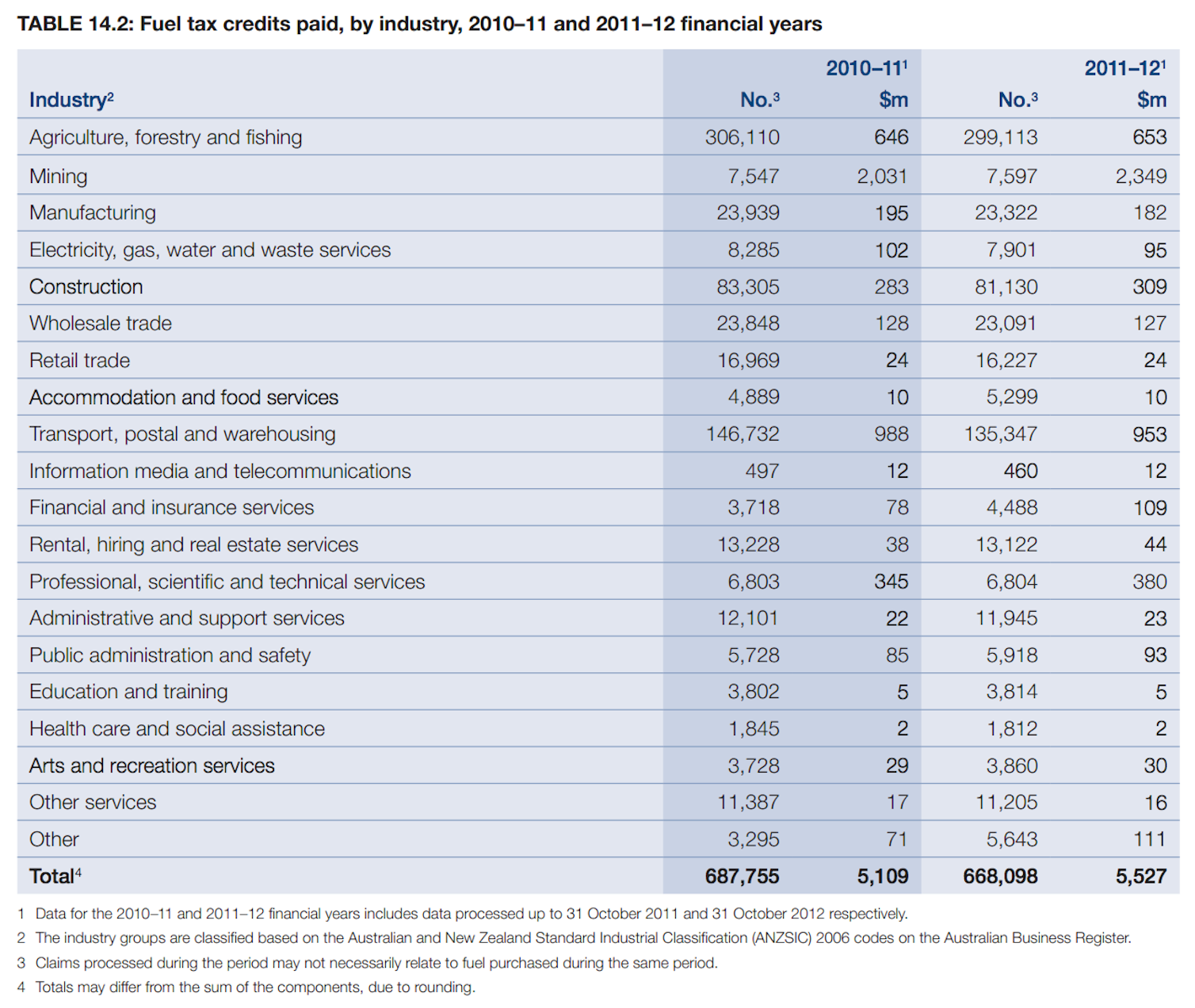

Viewpoints Should Fuel Tax Credits Be Cut In The Budget

Fuel Tax Rebate Ato - Web The calculator is quick and easy to use and will help you get your claim right If you claim under 10 000 in fuel tax credits in a year there are simpler ways to record and calculate