Fuel Tax Rebate Australia Web All fuel tax credit claimants need to apply the new rates for fuel acquired from 1 August To make it easier if your business claims less than 10 000 in the year you can use the rate

Web 7 mars 2023 nbsp 0183 32 Taxation Claim fuel tax credits Last Updated 7 March 2023 If your business uses fuel you may be able to claim credits for the fuel tax included in the price Web 22 nov 2022 nbsp 0183 32 Fuel Tax Credits Fuel tax credits for businesses that use fuel Last Updated 22 November 2022 Fuel Tax Credits provide businesses who have purchased

Fuel Tax Rebate Australia

Fuel Tax Rebate Australia

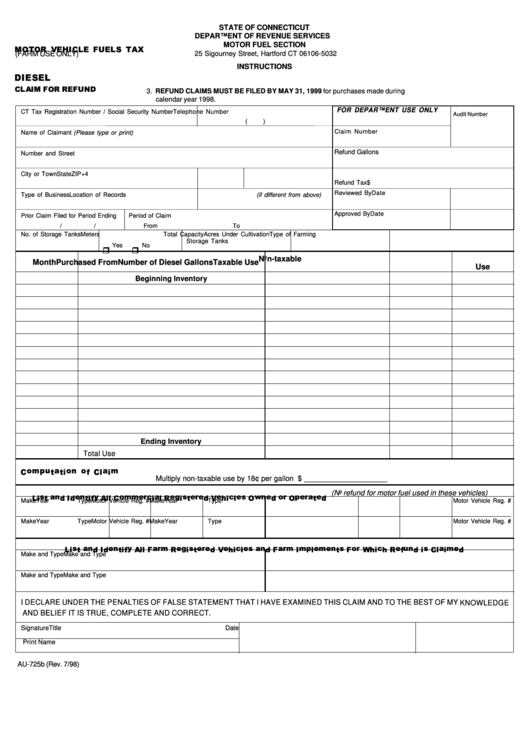

https://data.formsbank.com/pdf_docs_html/174/1749/174934/page_1_thumb_big.png

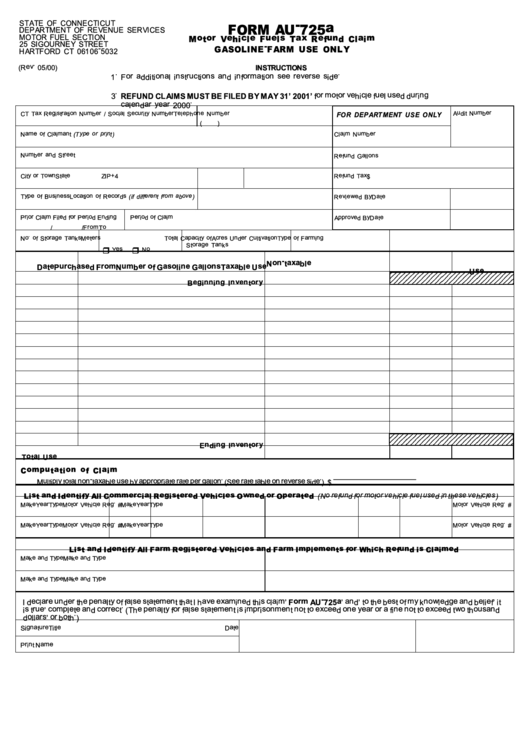

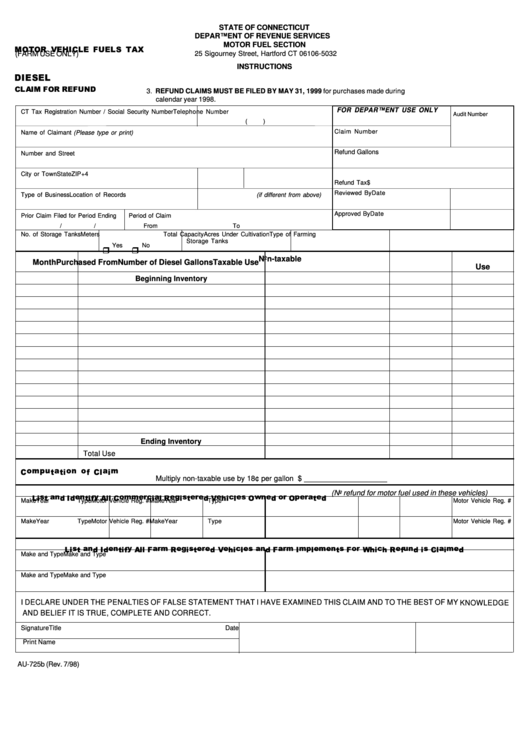

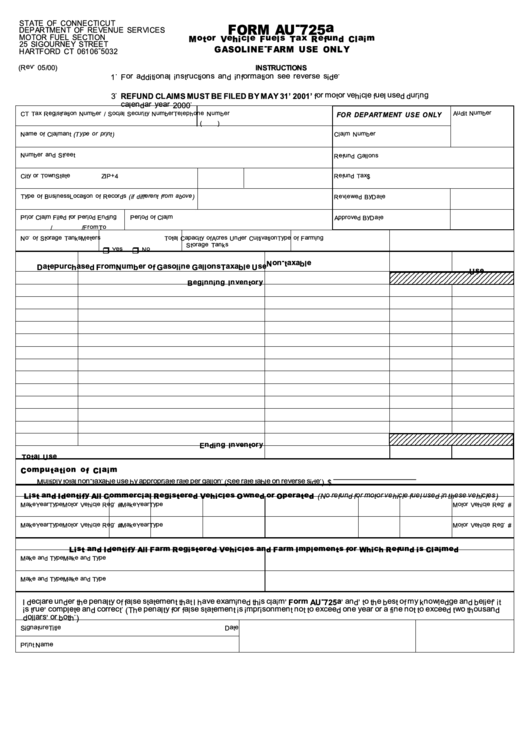

Fillable Form Au 725b Motor Vehicle Fuels Tax Farm Use Only

https://data.formsbank.com/pdf_docs_html/319/3191/319130/page_1_thumb_big.png

Piedmont Natural Gas Rebates Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/14/944/14944825/large.png

Web 26 sept 2022 nbsp 0183 32 It meant the money we give to the government when filling up with petrol or diesel was halved from 44 2 cents per litre to 22 1 cents per litre So what s going to happen when we re back to paying full price Web Both taxes are levied by the federal government In Australia the GST currently 10 is applied on top of the fuel excise tax In some cases businesses may be entitled to

Web 6 avr 2022 nbsp 0183 32 6 April 2022 Much attention has been given to the 2022 Budget measure of temporarily halving of the fuel excise for petrol and diesel from 44 2 cents litre to 22 1 Web Fuel tax credit for heavy diesel vehicles Fuel tax credits frequently asked questions Listen Relating to Fuel Tax Credits How many of the environmental criteria do I need to

Download Fuel Tax Rebate Australia

More picture related to Fuel Tax Rebate Australia

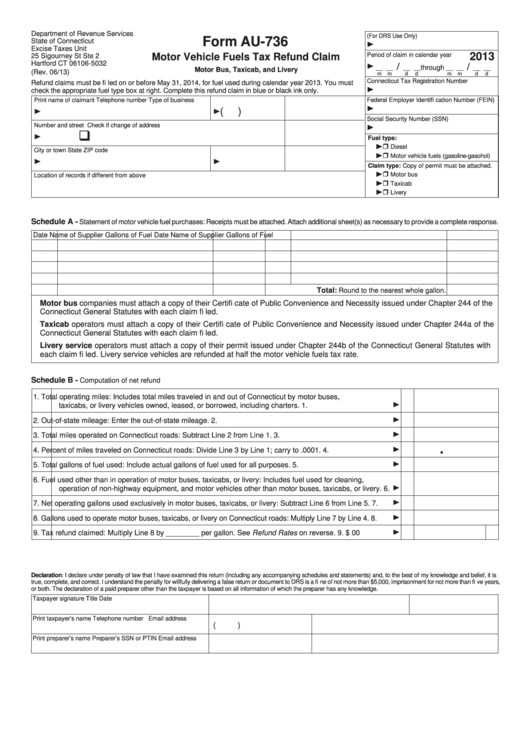

Fillable Form Au 736 Motor Vehicle Fuels Tax Refund Claim Printable

https://data.formsbank.com/pdf_docs_html/320/3209/320954/page_1_thumb_big.png

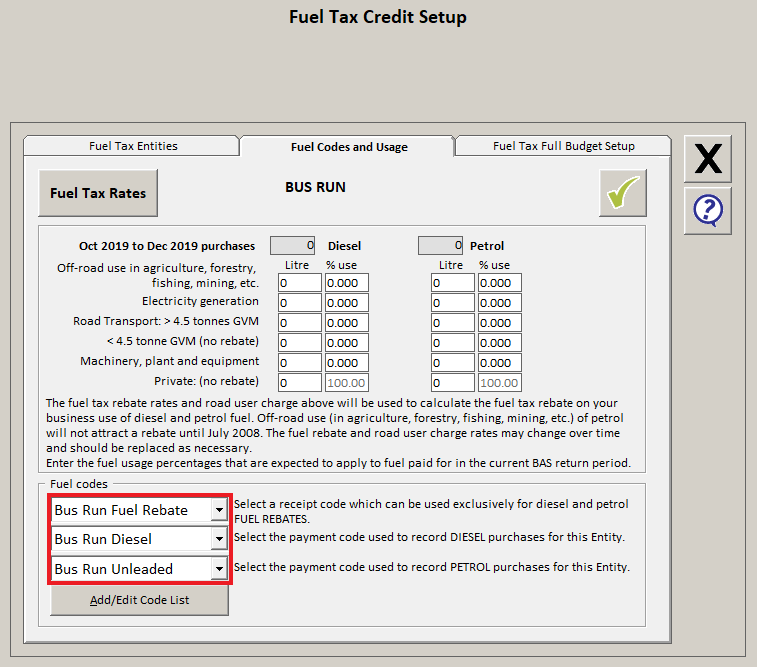

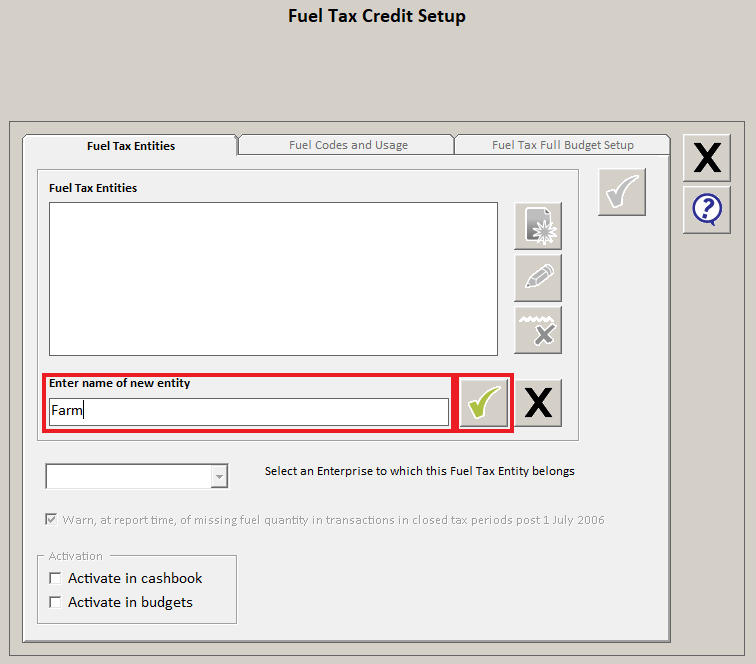

Setting Up Fuel Tax Rebate Multiple Entities Agrimaster

https://support.agrimaster.com.au/hc/article_attachments/360002821755/fueltaxmulti13.png

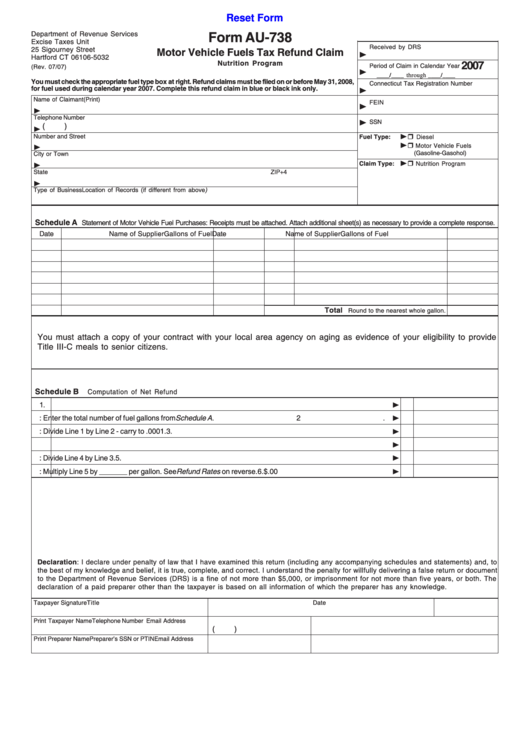

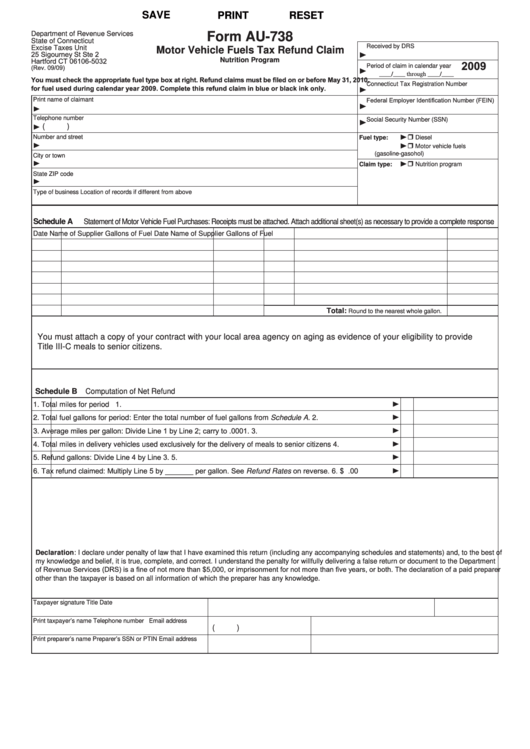

Fillable Form Au 738 Motor Vehicle Fuels Tax Refund Claim 2007

https://data.formsbank.com/pdf_docs_html/197/1973/197370/page_1_thumb_big.png

Web 21 juin 2022 nbsp 0183 32 The retail price of fuel sold in Australia includes a fuel tax When you use fuel for specific business purposes you can claim this tax back as a fuel tax credit Fuels eligible for fuel tax credit include petrol Web 13 mai 2021 nbsp 0183 32 The fuel tax credit scheme May 13 2021 by Audrey Quicke Climate amp Energy Economics The Federal Government collects around 42c for every litre of petrol

Web 31 mars 2022 nbsp 0183 32 Budget papers show the fuel tax credit scheme will cost 7 7 billion in 2022 23 expected to rise to 10 7 billion in 2025 26 Using ATO tax statistics from 2019 20 it Web What is a fuel excise Australia s fuel excise is a tax applied to all petrol and diesel fuel sold at service stations throughout the country It s a flat tax which until Tuesday s

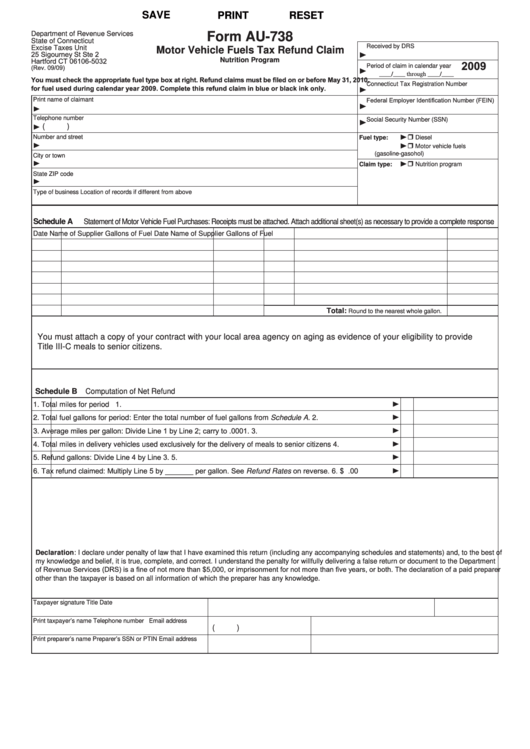

Fillable Form Au 738 Motor Vehicle Fuels Tax Refund Claim 2009

https://data.formsbank.com/pdf_docs_html/172/1728/172896/page_1_thumb_big.png

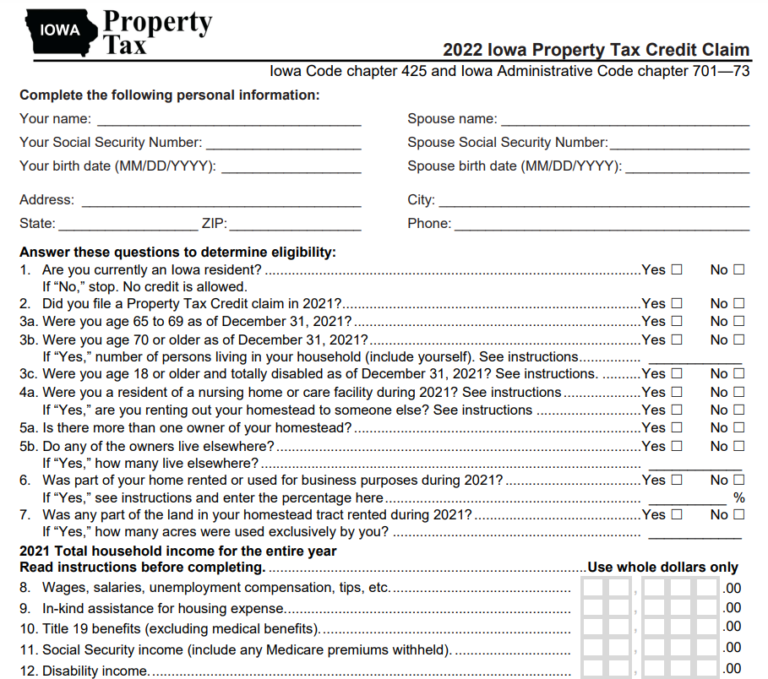

This Is An Attachment Of 2023 LG Rebates Printable Rebate Form From

https://www.freerebate.net/wp-content/uploads/2023/02/this-is-an-attachment-of-iowa-energy-rebates-printable-rebate-form-from-bayer-rebates-2023-post.png

https://www.ato.gov.au/.../GST-and-excise/Changes-to-fuel-tax-credit-rates

Web All fuel tax credit claimants need to apply the new rates for fuel acquired from 1 August To make it easier if your business claims less than 10 000 in the year you can use the rate

https://business.gov.au/finance/taxation/claim-fuel-tax-credits

Web 7 mars 2023 nbsp 0183 32 Taxation Claim fuel tax credits Last Updated 7 March 2023 If your business uses fuel you may be able to claim credits for the fuel tax included in the price

P G Printable Rebate Form

Fillable Form Au 738 Motor Vehicle Fuels Tax Refund Claim 2009

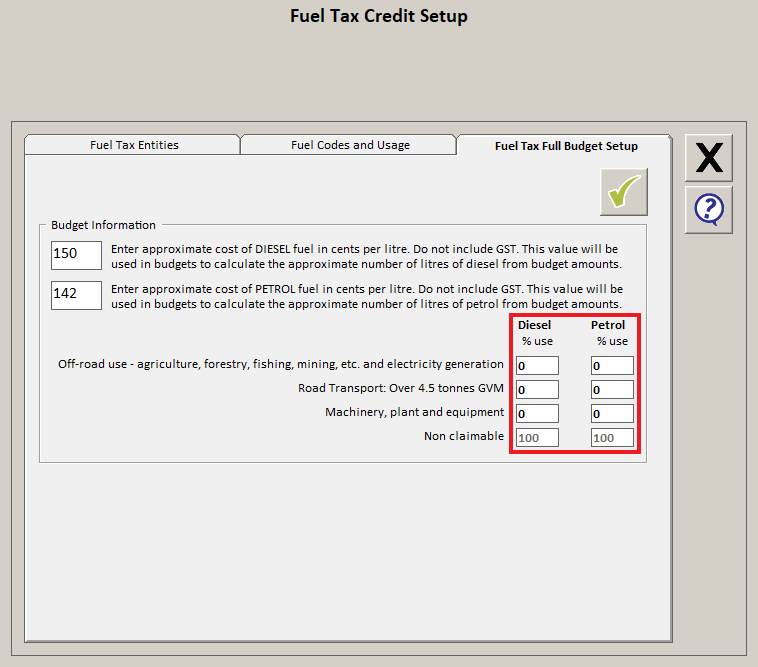

Activate Full Budget Fuel Tax Rebate Agrimaster

Activate Full Budget Fuel Tax Rebate Agrimaster

Reporting Fuel Tax Rebate Agrimaster

The Latest Disability News

The Latest Disability News

Setting Up Fuel Tax Rebate Single Entity Agrimaster

Setting Up Fuel Tax Rebate Single Entity Agrimaster

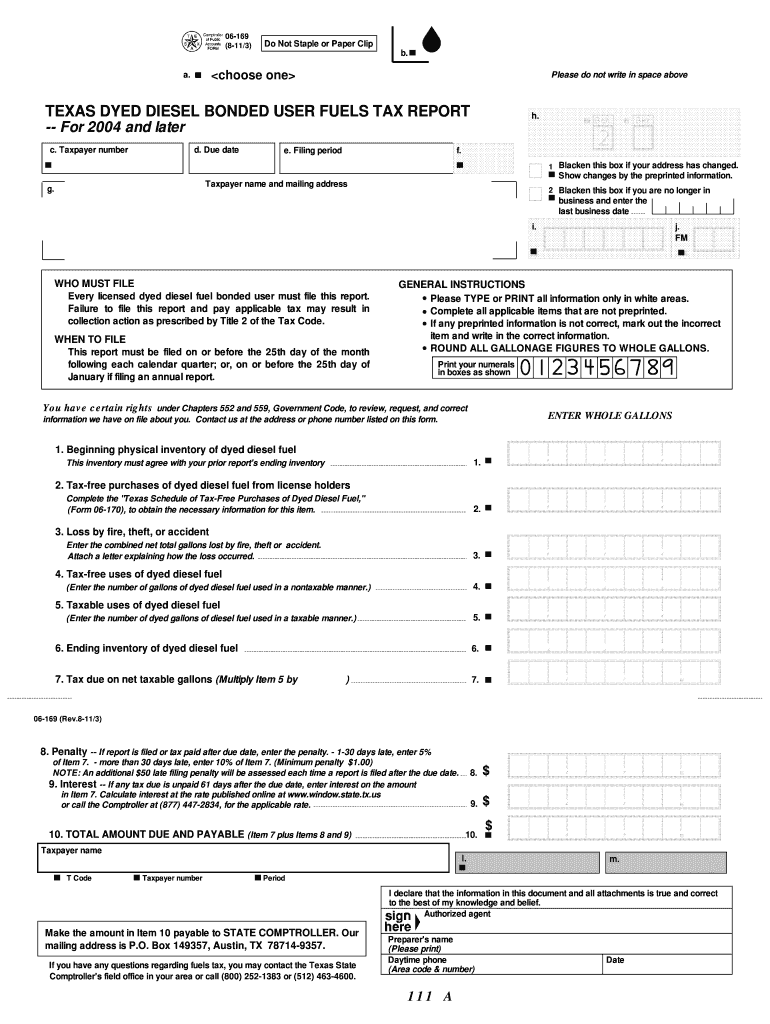

06 169 Fill Out Sign Online DocHub

Fuel Tax Rebate Australia - Web 8 mai 2021 nbsp 0183 32 The tax rebate is 42 7c a litre and costs the federal government 7 8bn a year In a report released this week the Australia Institute found the fuel tax credit scheme