Fuel Tax Rebate Rates 2023 Currently the road user charge reduces fuel tax credits for gaseous fuels to nil Check the fuel tax credit rates from 1 July 2024 to 30 June 2025 for business

Check the fuel tax credit rates for non businesses from 1 July 2023 to 30 June 2024 If your business uses fuel you may be able to claim credits for the fuel tax included in the price of the fuel Find out if you re eligible for fuel tax credits and how to

Fuel Tax Rebate Rates 2023

Fuel Tax Rebate Rates 2023

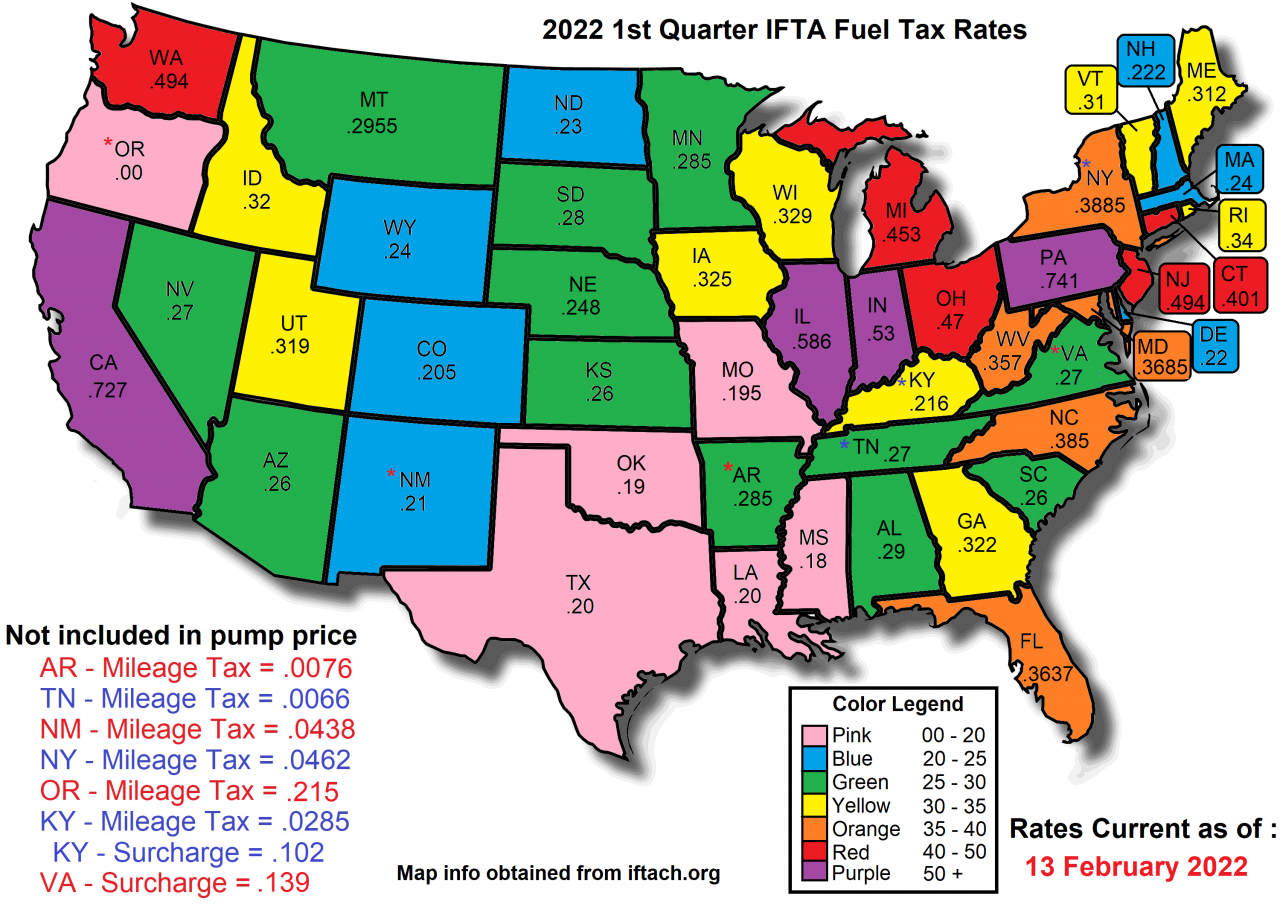

https://www.expeditersonline.com/cms/uploads/2022-1st-quarter-ifta-fuel-tax-rates-13-february-2022.png

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

Georgia Income Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Georgia-Tax-Rebate-2023-768x683.png

These changes are effective for fuel sold or used after December 31 2022 The Inflation Reduction Act of 2022 retroactively extended several fuel tax credits The latest tax rates and information on eligibility to claim Fuel Tax Credits following February 2023 CPI index increases

You can claim fuel tax credits for fuel you purchase manufacture or import for business use Work out if you are eligible for fuel tax credits with the ATO s fuel tax credit In 2023 European gas and diesel taxes have mostly returned to the rates in place before the Russia Ukraine war The European Union EU requires Member States to levy a minimum excise duty of 0 36

Download Fuel Tax Rebate Rates 2023

More picture related to Fuel Tax Rebate Rates 2023

About Us Money Back Fuel

https://moneybackfuel.co.nz/wp-content/uploads/2019/10/fuel-tax-petrol-claim-back-refund-nationwide-scaled.jpg

Union Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates

https://www.gconnect.in/gc22/wp-content/uploads/2023/02/Finance-Bill-2023-1536x806.jpg

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/585/571/585571881/large.png

Temporary changes to fuel excise duty charges The government temporarily reduced fuel excise duty by 25 cents a litre in March 2022 This reduction ended on 30 June 2023 Fuel Tax Changes Fuel tax related measures in the 2023 24 Budget include increasing the Heavy Vehicle Road User Charge rate from 27 2 cents per litre of diesel

Updated tables for period from 1 July 2023 Updated tables for period from 1 July 2022 Budget 2022 measure Temporary rate reduction Fuel excise is temporarily halved for By the end of this year a portion of fuel charge proceeds from 2019 20 through 2023 24 will be returned to approximately 600 000 Canadian controlled private

This Is An Attachment Of Iowa Energy Rebates Printable Rebate Form From

https://www.freerebate.net/wp-content/uploads/2023/02/this-is-an-attachment-of-iowa-energy-rebates-printable-rebate-form-from-bayer-rebates-2023-post.png

Nearly Two third Of The Price You Pay For Petrol Goes To Centre And States

https://akm-img-a-in.tosshub.com/indiatoday/images/bodyeditor/202102/gfx_1_0-1200x6000.jpg?bFPNU4YsbDHeTq7krCIhp6qfQz13S.ns

https://www.ato.gov.au › ... › rates-business

Currently the road user charge reduces fuel tax credits for gaseous fuels to nil Check the fuel tax credit rates from 1 July 2024 to 30 June 2025 for business

https://www.ato.gov.au › ... › rates-non-business

Check the fuel tax credit rates for non businesses from 1 July 2023 to 30 June 2024

4923 H 2014 2024 Form Fill Out And Sign Printable PDF Template

This Is An Attachment Of Iowa Energy Rebates Printable Rebate Form From

Senior Citizen Income Tax Calculation 2021 22 Excel Calculator

RBAW Marine Fuel Tax Refund

Rates 2023 Sandbaggerz Driving Range

Royal Mail Postage Rates 2023 Effective From Today

Royal Mail Postage Rates 2023 Effective From Today

Rates 2024 The Letting Company

Missouri s Motor Fuel Tax Should You Claim A Refund Smith Patrick CPAs

How To Use Your Carbon Tax Rebate To Lower Your Taxes and Save The

Fuel Tax Rebate Rates 2023 - In 2023 European gas and diesel taxes have mostly returned to the rates in place before the Russia Ukraine war The European Union EU requires Member States to levy a minimum excise duty of 0 36