Fuel Tax Rebates 2024 Current fuel tax credit rates For current fuel tax rates see From 1 July 2023 to 30 June 2024 includes rates from 1 July 2023 1 August 2023 and 5 February 2024 Past fuel tax credit

Check fuel tax credit rates for non businesses from 1 July 2023 to 30 June 2024 For more information on non profit organisations refer to Non profit emergency vehicles and Ontarians eligible for the rebate will receive rebates of 122 with an additional 61 for a second adult in the family and 30 50 for each child A family of four in Ontario

Fuel Tax Rebates 2024

Fuel Tax Rebates 2024

https://www.banlaw.com/wp-content/uploads/2021/12/who-can-claim-fuel-tax-credits-1024x763.jpg

Changes To Fuel Tax Credit Rates Cotchy

https://cotchy.com.au/wp/wp-content/uploads/2023/09/Fuel-tax-credits.png

Increase Tax Savings With The Fuel Tax Credit Landmark CPAs

https://www.landmarkcpas.com/wp-content/uploads/2022/12/Fuel-Tax-Credit-1024x640.jpg

Last Updated 18 January 2024 If your business uses fuel you may be able to claim credits for the fuel tax included in the price of the fuel Find out if you re eligible for fuel tax credits and Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and extended the following fuel tax credits through

The estimates are based on the assumptions that you travel 15 000 miles per year 55 under city driving conditions and 45 under highway conditions and that fuel costs 3 38 gallon for If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements

Download Fuel Tax Rebates 2024

More picture related to Fuel Tax Rebates 2024

Fuel Tax Credit Changes HTA

https://www.hta.com.au/wp-content/uploads/2022/05/Fuel-tax-credit-changes-1.png

Fuel Tax Application Edit Fill Sign Online Handypdf

https://handypdf.com/resources/formfile/htmls/gov1028/fuel-tax-application/bg3.png

Fuel Tax Credit Calculator Banlaw

https://www.banlaw.com/wp-content/uploads/2022/04/[email protected]

The Canada Carbon Rebate previously known as the Climate Action Incentive Payment returns fuel charge proceeds to Canadians through direct deposit or cheque every three months ensuring most households get more money back with lower income households benefiting the most All direct proceeds are returned in the province of origin In provinces where the federal fuel charge applies a family of four will receive up to 1 800 under the base Canada Carbon Rebate in 2024 25 In April 2024 residents of these

Federal Tax Credits for Plug in Electric and Fuel Cell Electric Vehicles Purchased in 2023 or After Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell electric That s 55 000 for cars wagons and hatchbacks and 80 000 for SUVs light trucks and vans that don t spin the scale past 14 000 pounds Not sure if your vehicle has

The Fuel Tax Is Defunct Innovation Is The Culprit RealClearEnergy

https://assets.realclear.com/images/50/502170_6_.jpg

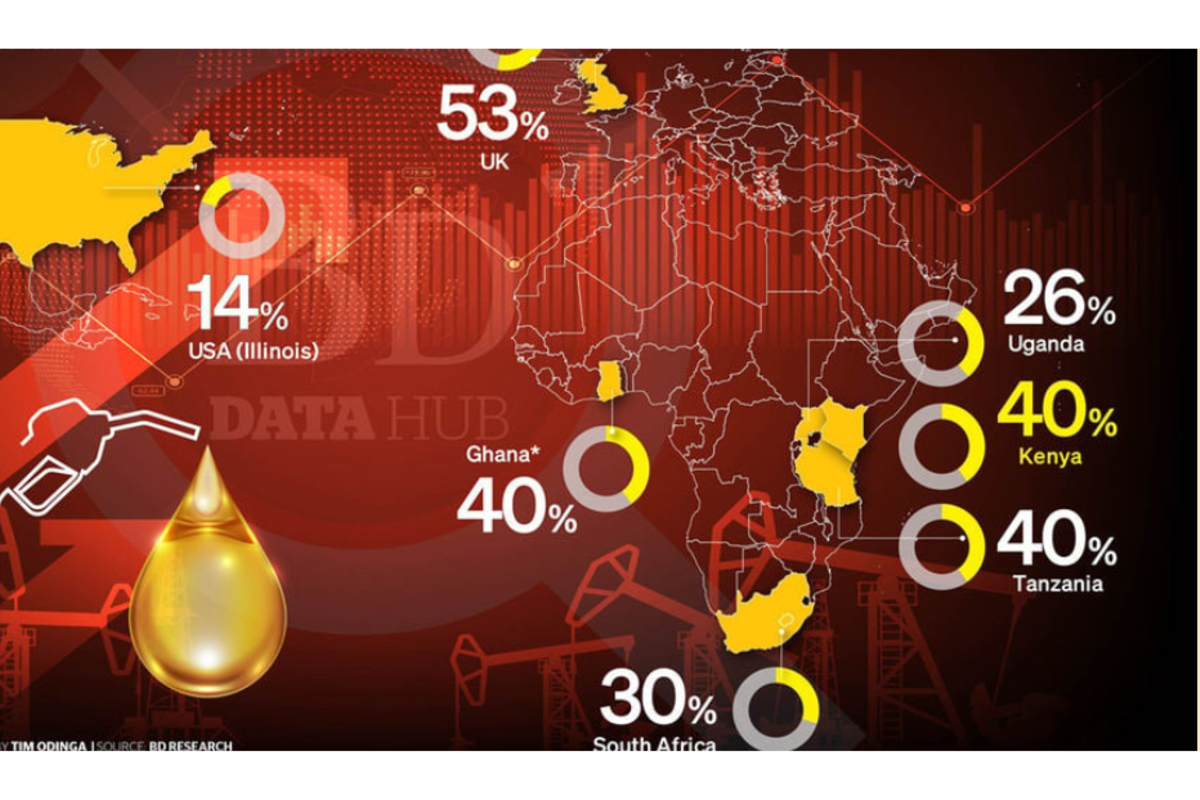

Tanzania And Kenya Collect Highest Taxes On Fuel The Citizen

https://www.thecitizen.co.tz/resource/image/4300098/landscape_ratio3x2/1200/800/2630f0fba82d61b6e8c1117daa1b38ef/Vn/fuel-tax.png

https://www.ato.gov.au/businesses-and...

Current fuel tax credit rates For current fuel tax rates see From 1 July 2023 to 30 June 2024 includes rates from 1 July 2023 1 August 2023 and 5 February 2024 Past fuel tax credit

https://www.ato.gov.au/businesses-and...

Check fuel tax credit rates for non businesses from 1 July 2023 to 30 June 2024 For more information on non profit organisations refer to Non profit emergency vehicles and

REDUCTION IN FUEL TAX CREDITS

The Fuel Tax Is Defunct Innovation Is The Culprit RealClearEnergy

As Fuel Tax Proceeds Plummet States Weigh Charging By The Mile Instead Of The Tank

IFTA Quarterly Fuel Tax Filing Payhip

Alberta To Pause Collection Of Provincial Fuel Tax To Help Consumers Shocked By High Prices

Webinar Fuel Tax Credits Scheme With KPMG Building A More Profitable And Sustainable Industry

Webinar Fuel Tax Credits Scheme With KPMG Building A More Profitable And Sustainable Industry

Ruto s Proposal To Reinstate The 16 Percent Fuel Tax Exposes His Doublespeak AfrinewsKE

Fuel Tax Credit Changes Selby Watson Co

The Fuel Tax Debate FleetOwner

Fuel Tax Rebates 2024 - Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in