Fuel Tax Rebates Australia Web All fuel tax credit claimants need to apply the new rates for fuel acquired from 1 August To make it easier if your business claims less than 10 000 in the year you can use the rate

Web 7 mars 2023 nbsp 0183 32 1 Check if you re eligible for fuel tax credits Businesses can claim credits for the fuel tax excise or customs duty included in the price of fuel used in their business Web 22 nov 2022 nbsp 0183 32 Fuel Tax Credits provide businesses who have purchased fuel for their business with a credit for the tax that is included in the price of fuel Open Application

Fuel Tax Rebates Australia

Fuel Tax Rebates Australia

http://industry.eiu.com/asset_images/1622440146.gif

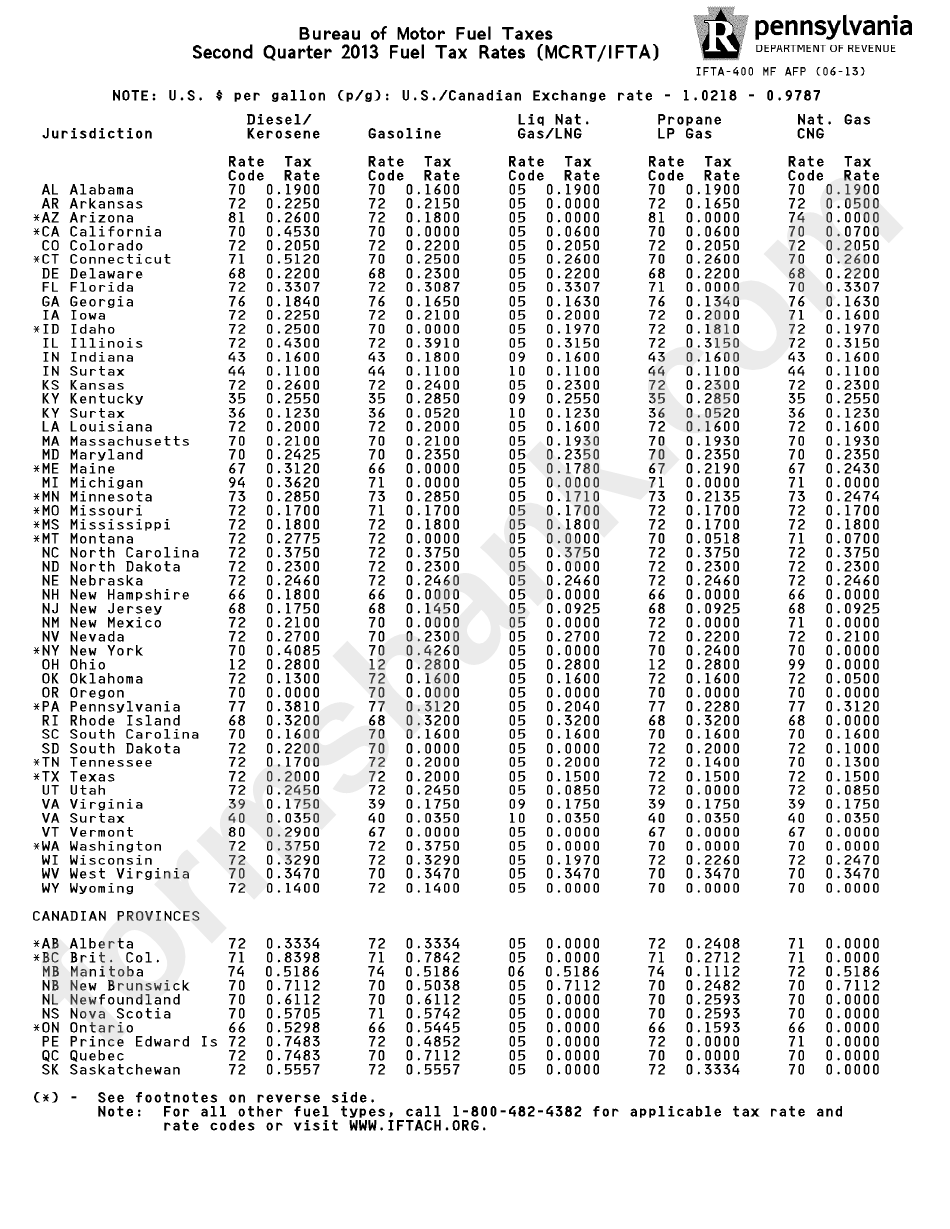

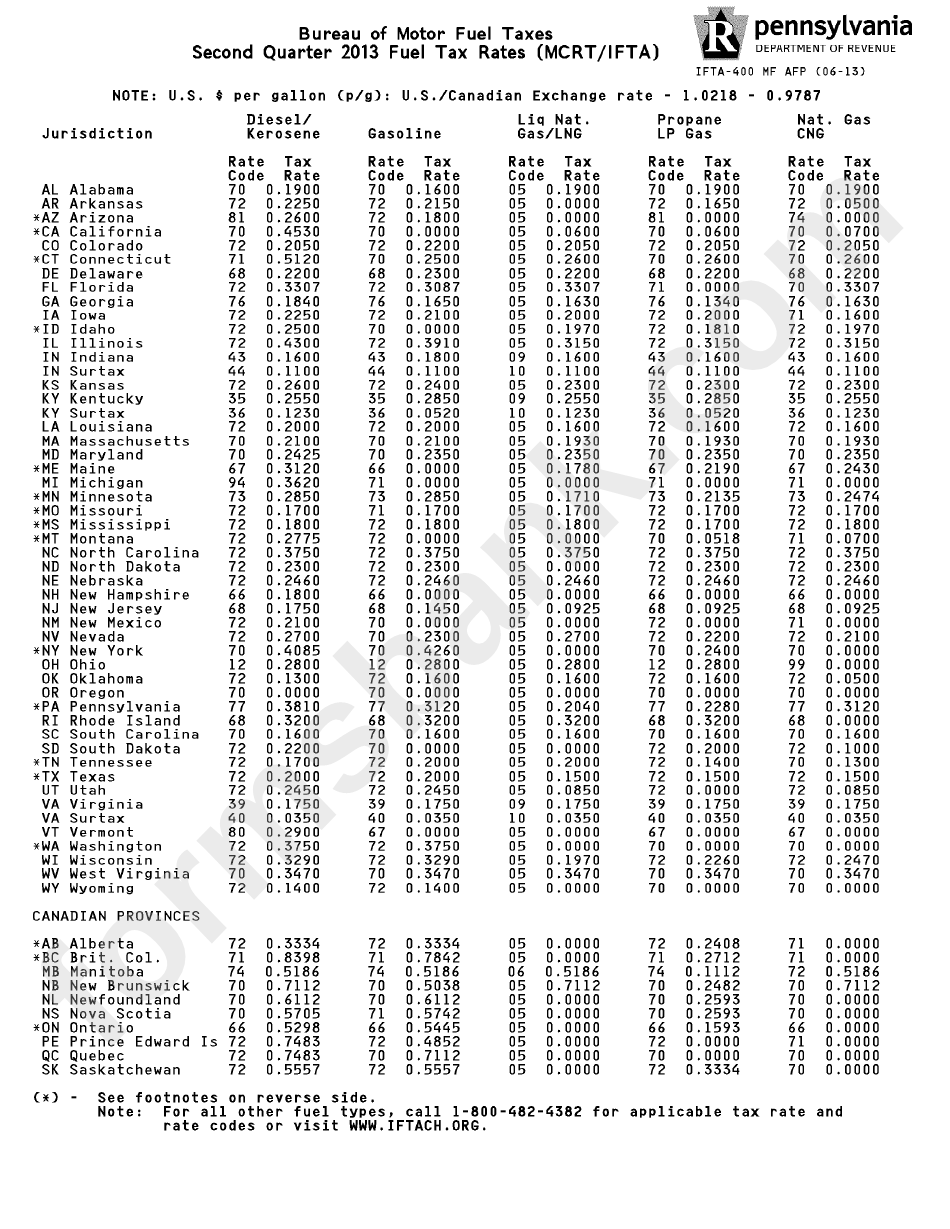

Form Ifta 400 Mf Afp Second Quarter 2013 Fuel Tax Rates Mcrt ifta

https://data.formsbank.com/pdf_docs_html/334/3340/334002/page_1_bg.png

Piedmont Natural Gas Rebates Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/14/944/14944825/large.png

Web Both taxes are levied by the federal government In Australia the GST currently 10 is applied on top of the fuel excise tax In some cases businesses may be entitled to Web 13 mai 2021 nbsp 0183 32 For the 2021 22 year Fuel Tax Credits will cost the Government a hefty 8 billion the biggest fossil fuel subsidy in Australia By 2024 25 it is estimated to grow to

Web 26 sept 2022 nbsp 0183 32 abc au news australians back to paying full price on petrol excise drive 101345220 The discount on fuel in Australia will end on September 29 when the government reinstates the fuel excise Web Yes The Government has provided a range of options which should ensure any operator who maintains the emission related components of their vehicle in a reasonable manner

Download Fuel Tax Rebates Australia

More picture related to Fuel Tax Rebates Australia

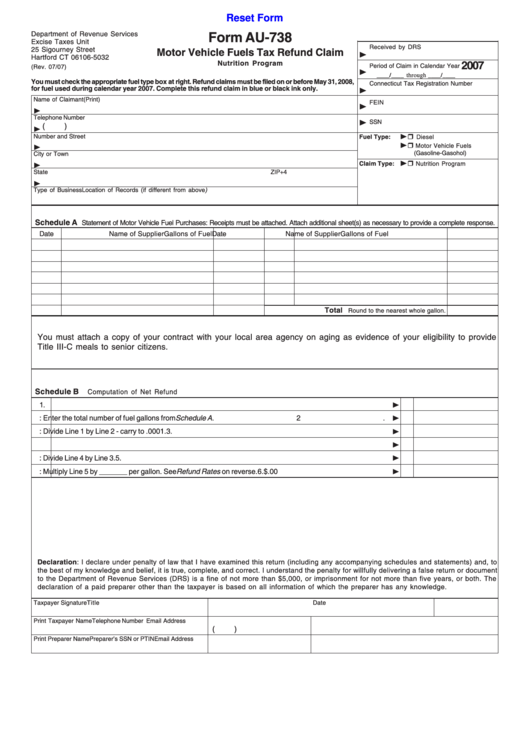

Fillable Form Au 738 Motor Vehicle Fuels Tax Refund Claim 2007

https://data.formsbank.com/pdf_docs_html/197/1973/197370/page_1_thumb_big.png

Activate Full Budget Fuel Tax Rebate Agrimaster

https://support.agrimaster.com.au/hc/en-us/article_attachments/202928626/1.JPG

NSW Government Demands PM To Scrap Carbon Tax And Give Rebates

http://resources0.news.com.au/images/2011/04/13/1226038/724828-carbon-tax.jpg

Web 6 avr 2022 nbsp 0183 32 News 6 April 2022 Much attention has been given to the 2022 Budget measure of temporarily halving of the fuel excise for petrol and diesel from 44 2 Web 31 mars 2022 nbsp 0183 32 Budget papers show the fuel tax credit scheme will cost 7 7 billion in 2022 23 expected to rise to 10 7 billion in 2025 26 Using ATO tax statistics from 2019 20 it

Web 11 nov 2021 nbsp 0183 32 In simple terms fuel tax credits provide businesses with a rebate for the fuel tax paid at the bowser or pump in order to run heavy vehicles light vehicles machinery Web To learn more about how we could help you claim fuel tax rebates in the property and construction industry contact your local RSM office Related Insights Putting Tier 2

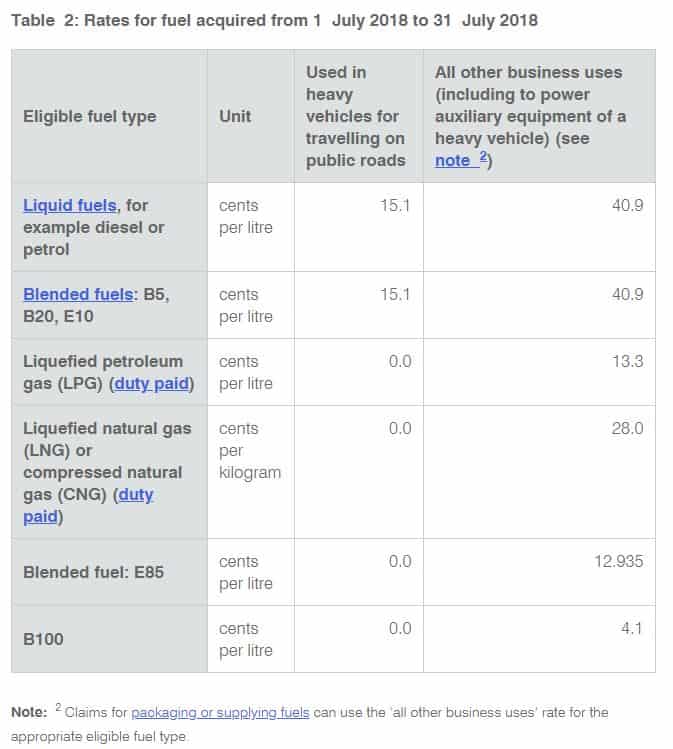

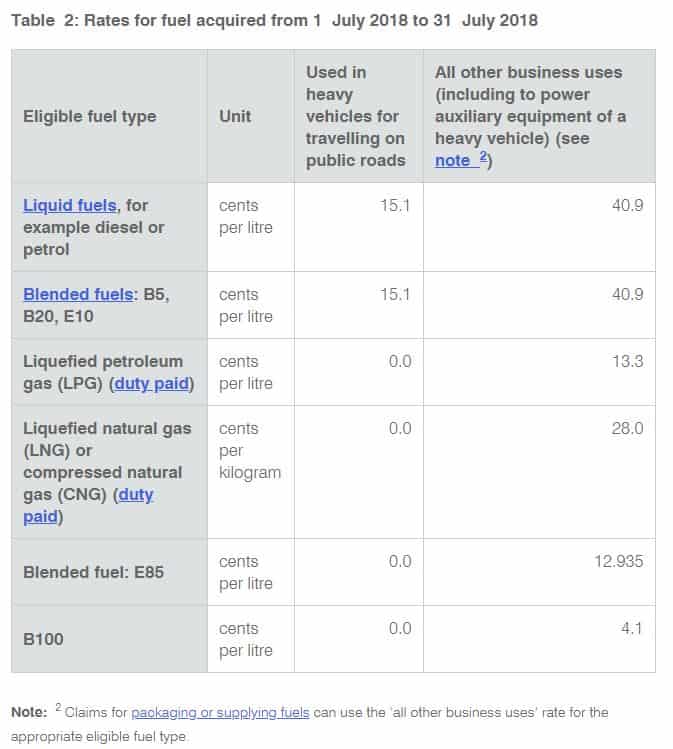

Fuel Tax Credit Atotaxrates info

https://atotaxrates.info/wp-content/uploads/2018/08/1jul2018.jpg

The Latest Disability News

https://files.constantcontact.com/0a7f39ae001/4d7aeb5f-851a-4cd2-b93c-076e5f681833.png

https://www.ato.gov.au/.../GST-and-excise/Changes-to-fuel-tax-credit-rates

Web All fuel tax credit claimants need to apply the new rates for fuel acquired from 1 August To make it easier if your business claims less than 10 000 in the year you can use the rate

https://business.gov.au/finance/taxation/claim-fuel-tax-credits

Web 7 mars 2023 nbsp 0183 32 1 Check if you re eligible for fuel tax credits Businesses can claim credits for the fuel tax excise or customs duty included in the price of fuel used in their business

Motor Fuels Tax Section F

Fuel Tax Credit Atotaxrates info

How To Record A Fuel Tax Rebate YouTube

Vehicle Excise Tax Calculator RhiannaMylie

Understanding IFTA Fuel Tax Trucking Blogs ExpeditersOnline

This Is An Attachment Of 2023 LG Rebates Printable Rebate Form From

This Is An Attachment Of 2023 LG Rebates Printable Rebate Form From

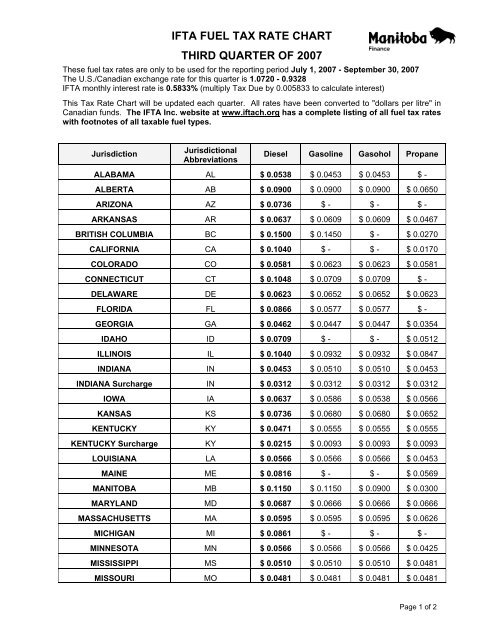

IFTA FUEL TAX RATE CHART

Activate Full Budget Fuel Tax Rebate Agrimaster

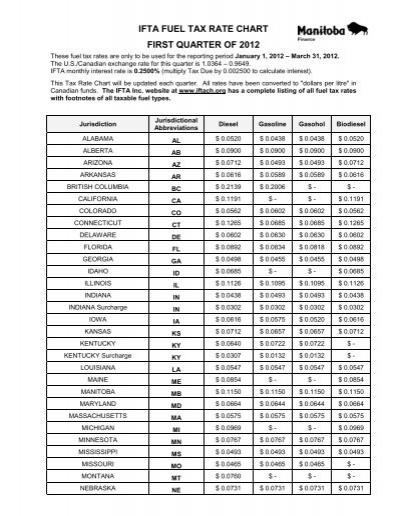

IFTA FUEL TAX RATE CHART FIRST QUARTER OF 2012

Fuel Tax Rebates Australia - Web 13 mai 2021 nbsp 0183 32 For the 2021 22 year Fuel Tax Credits will cost the Government a hefty 8 billion the biggest fossil fuel subsidy in Australia By 2024 25 it is estimated to grow to