Full Tax Credit Method Both the tax exemption and the tax credit method can be divided in two different systems the full exemption and the exemption with progression full credit and ordinary credit

60 rowsUnder the credit methods State R retains the right to tax the total income of the A Full Credit Method When the tax is paid in the source country the resident country provides credit for the tax paid in source country without placing any restrictions on the same B Ordinary Credit method This method is adopted

Full Tax Credit Method

Full Tax Credit Method

https://www.alliantgroup.com/wp-content/uploads/2022/05/web-photo_aglogo-04-scaled-1.jpg

Giving Tax Credit Where Credit Is Due

https://www.chevyhardcore.com/image/2023/12/giving-tax-credit-where-credit-is-due-2023-12-29_09-27-16_080592.jpg

Setc Tax Credit Calculator 1099 Expert

https://1099.expert/wp-content/uploads/2023/12/image-title-Generate-high-resolution-53153.png

CREDIT METHOD State R includes the income earned in State S for computing total tax liability in State R out of which credit is given for taxes paid in State S Two approaches Full credit 3 2 Credit method The credit method means that foreign source income is taxed by the country of residence but any tax paid in the foreign country is deducted This produces

This document discusses methods for eliminating double taxation including exemption and credit methods It provides examples comparing the tax burden under different double taxation relief methods such as full exemption Full credit method and the limited tax credit method The full credit method value of dividend tax is 980 The value of the limited tax deduction credit method on

Download Full Tax Credit Method

More picture related to Full Tax Credit Method

Tax Deduction Vs Tax Credit What s The Difference With Table

https://www.diffzy.com/wordpress/wp-content/uploads/2023/06/difference-between-tax-deduction-and-tax-credit.jpg

Simplifying The Complexities Of R D Tax Credits TriNet

https://images.contentstack.io/v3/assets/blt9ccc5b591c9e2640/blt64bfb078a74eaa48/643963cd9074ca2928c792b6/RD-Tax-Credits-thumbnail.jpg

Tax Credit Universal Credit Impact Of Announced Changes House Of

https://commonslibrary.parliament.uk/wp-content/uploads/2015/11/IDS.jpg

The full credit method is rarely used most countries using the credit method provide relief for juridical double taxation and grant ordinary credit relief for foreign taxes Calculation of limits on foreign tax credits the way domestic laws embrace DTAs and the territorial scope of DTAs and to correct some oversights in the first edition

There are several methods of avoiding international double taxation of which we only discuss two methods namely the tax exemption method and the tax credit method FTC Calculated on doubly taxed income at the Indian rate of income tax or the rate of tax of the foreign country whichever is lower rate determined by dividing the amount of Indian

Self employed Tax Credit Calculator Archives 1099 Expert

https://1099.expert/wp-content/uploads/2023/12/image-title-Generate-high-resolution-25058.png

https://hesabdarema.com/wp-content/uploads/2022/04/Tax-credit.jpg

https://repub.eur.nl › pub

Both the tax exemption and the tax credit method can be divided in two different systems the full exemption and the exemption with progression full credit and ordinary credit

https://www.action15-mli.net › ...

60 rowsUnder the credit methods State R retains the right to tax the total income of the

Saver s Tax Credit 2022 Credit

Self employed Tax Credit Calculator Archives 1099 Expert

Tax Management Consulting

Earned Income Tax Credit Claims Are Less Likely After IRS Audits

House Lawmakers Scrutinize Pandemic era Employee Retention Tax Credit

Freelance Accounting Personal Tax Services

Freelance Accounting Personal Tax Services

Tax Financial Accounting Solutions

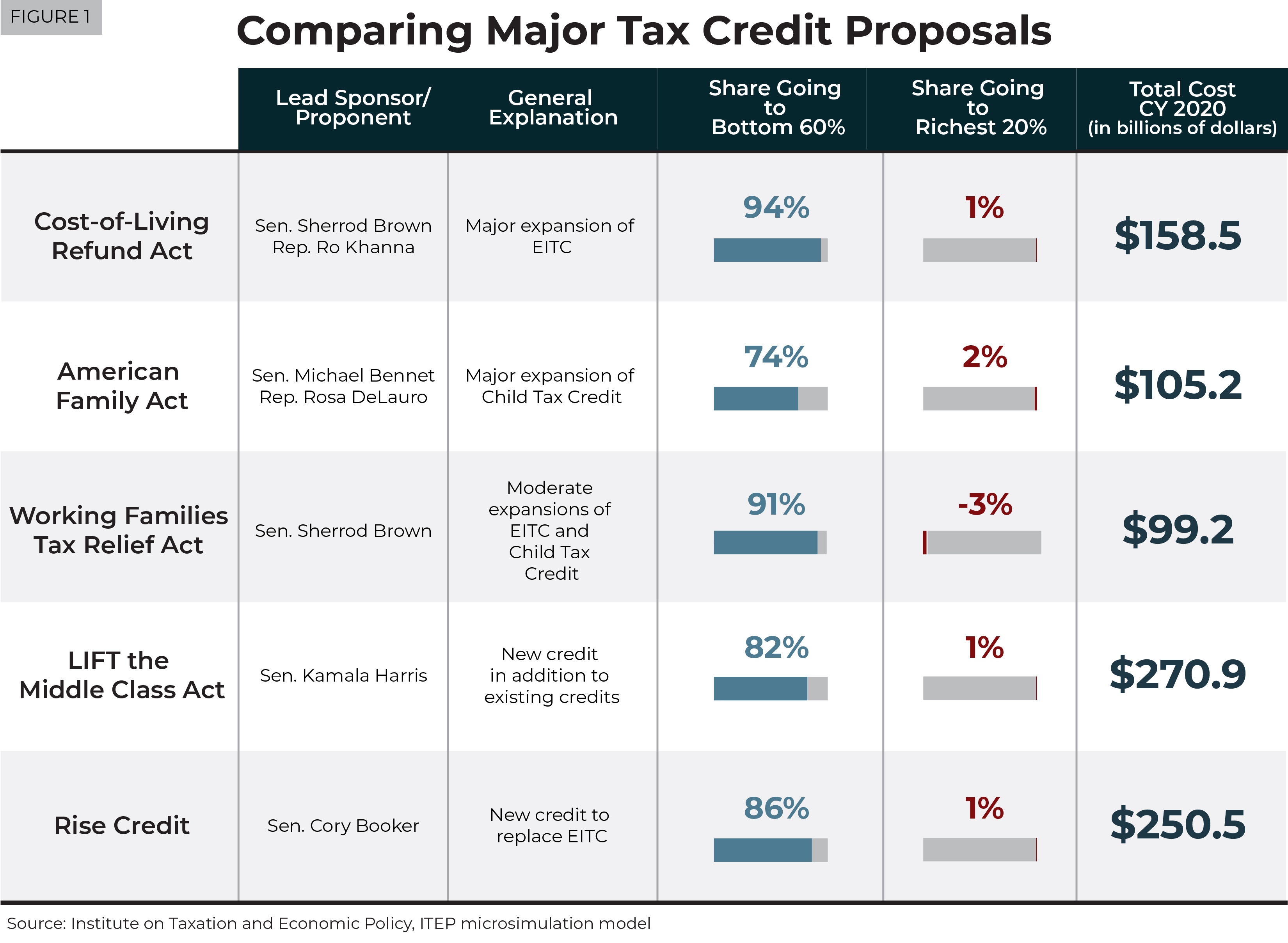

Understanding Five Major Federal Tax Credit Proposals Common Dreams

Earned Income Tax Credit Parameters 1979 1998 Download Table

Full Tax Credit Method - This method ensures that the tax payer gets full credit for the taxes paid in Country of Source and has to pay only the difference between Country of Residence tax and Country of Source tax