Gaap Accounting For Credit Card Rebates Web 31 janv 2020 nbsp 0183 32 The Board decided that entities should follow the guidance in the model to determine instances when customer loyalty rewards programs are or are not

Web The consideration payable can be cash either in the form of rebates or upfront payments or could alternatively be a credit or some other form of incentive that reduces amounts Web Discounts and rebates can be offered to purchasers in a number of ways for example trade discounts settlement discounts volume based rebates and other rebates Accounting

Gaap Accounting For Credit Card Rebates

Gaap Accounting For Credit Card Rebates

https://study.com/cimages/videopreview/screen_shot_2013-10-24_at_9.24.57_pm_115378.jpg

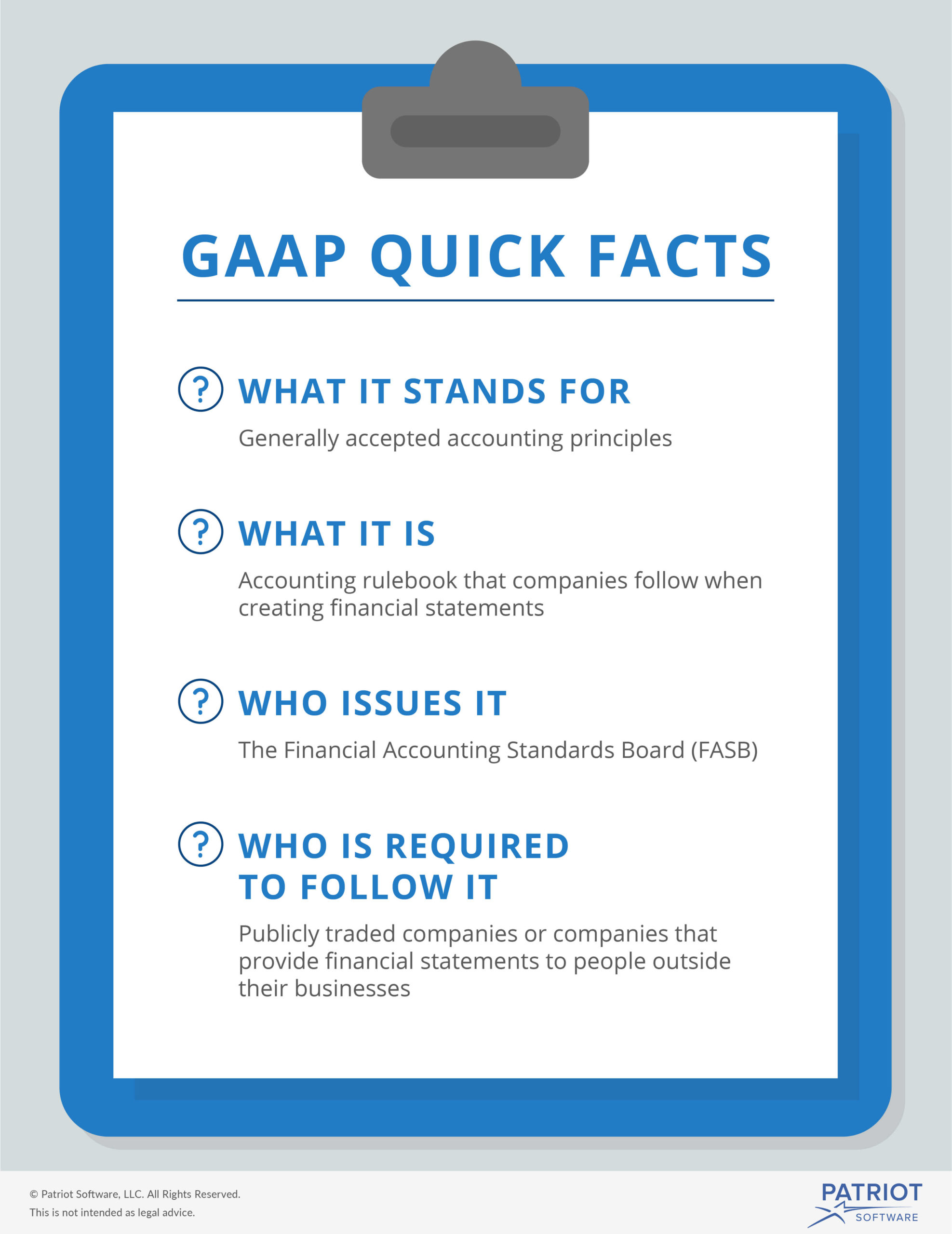

GAAP Accounting All You Need To Know Accounting Learn Accounting

https://i.pinimg.com/originals/0c/1d/6f/0c1d6f7f70d1f89a87dcf63588a75398.png

Your Guide To GAAP Generally Accepted Accounting Principles

https://www.patriotsoftware.com/wp-content/uploads/2020/01/GAAP-visual-scaled.jpg

Web Customer options option that does not provide a material right Manufacturer enters into an arrangement to provide machinery and 200 hours of consulting services to Retailer for Web 6 avr 2022 nbsp 0183 32 How to Account for Customer Rebates 6 How to Account for Vendor Rebates 7 How to Account for Unclaimed Rebates 8 How to Account for Coupons 9 How to Pay a Rebate to a Vendor 10 What

Web The credit card bill isn t reduced by 5K just the points balance is If you haven t already been tracking your points balance in your accounting software there isn t an entry for Web 12 mai 2014 nbsp 0183 32 Michael the GAAP guidance you are looking for is in ASC 605 50 45 2 If you have quot received or will receive an identifiable benefit goods or services in

Download Gaap Accounting For Credit Card Rebates

More picture related to Gaap Accounting For Credit Card Rebates

GAAP Accounting For Employee Retention Credit Guidelines

https://erctoday.com/wp-content/uploads/2023/03/gaap-accounting-for-employee-retention-credit.jpg

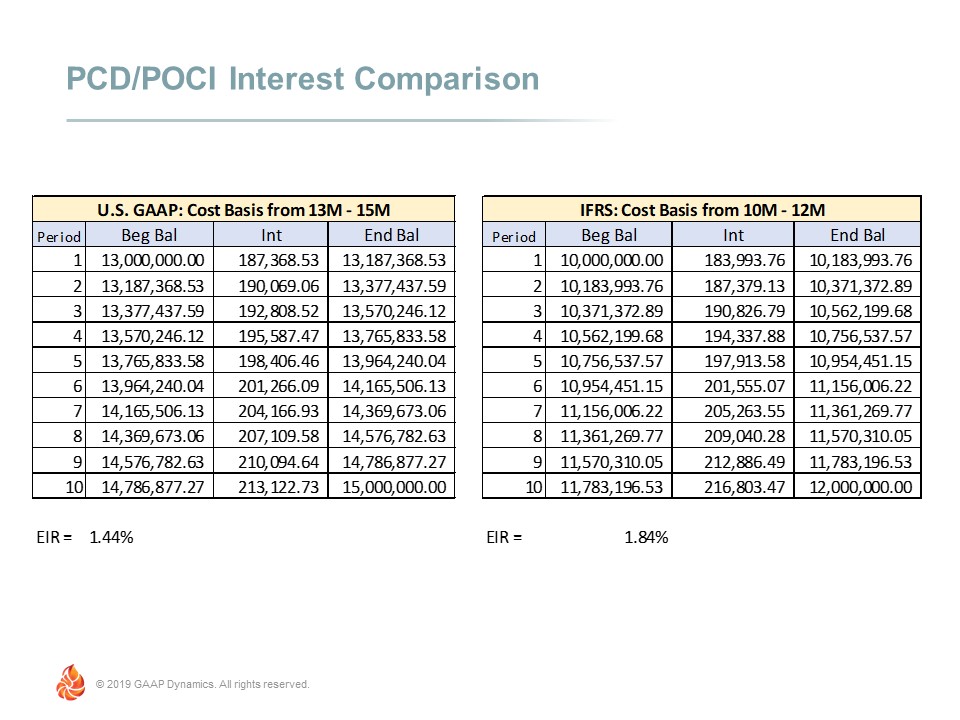

Credit Impaired Differences Between U S GAAP And IFRS GAAP Dynamics

https://www.gaapdynamics.com/Inline Image 3.jpg

Generally Accepted Accounting Principles GAAP YouTube

https://i.ytimg.com/vi/-STtswWbXCw/maxresdefault.jpg

Web 15 ao 251 t 2022 nbsp 0183 32 Accounting for Credit Card Rewards Posted on August 15 2022 If you re using a credit card to earn rewards for business purchases you ll need to account for these credit card rewards properly The IRS Web 13 There is no comprehensive guidance in U S GAAP on how to account for credit card reward programs 14 There is guidance in Subtopic 310 20 formerly FAS 91

Web Get advanced tips with our free guide Accounting for vendor rebates can either be complex or easy To make it easy many organisations leverage the aid of financial Web Revenue Changes for Rewards Programs With the adoption of Accounting Standards Update ASU 2014 09 Revenue from Contracts with Customers Topic 606

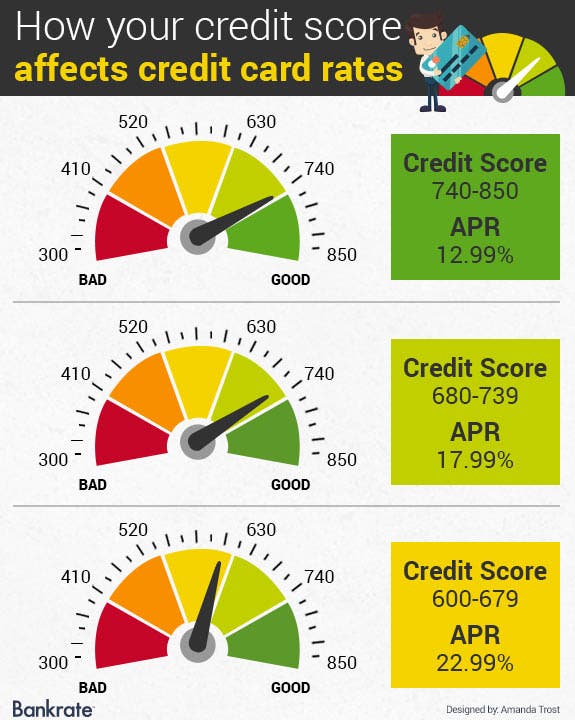

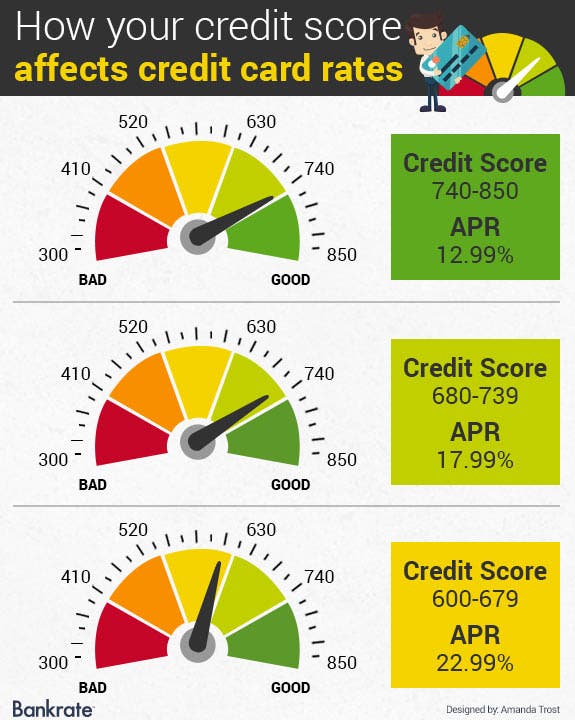

Credit Score Your Number Determines Your Cost To Borrow

https://media.brstatic.com/2017/09/25112227/debt-manage_how-your-credit-score-affects-credit-card-rates.jpg

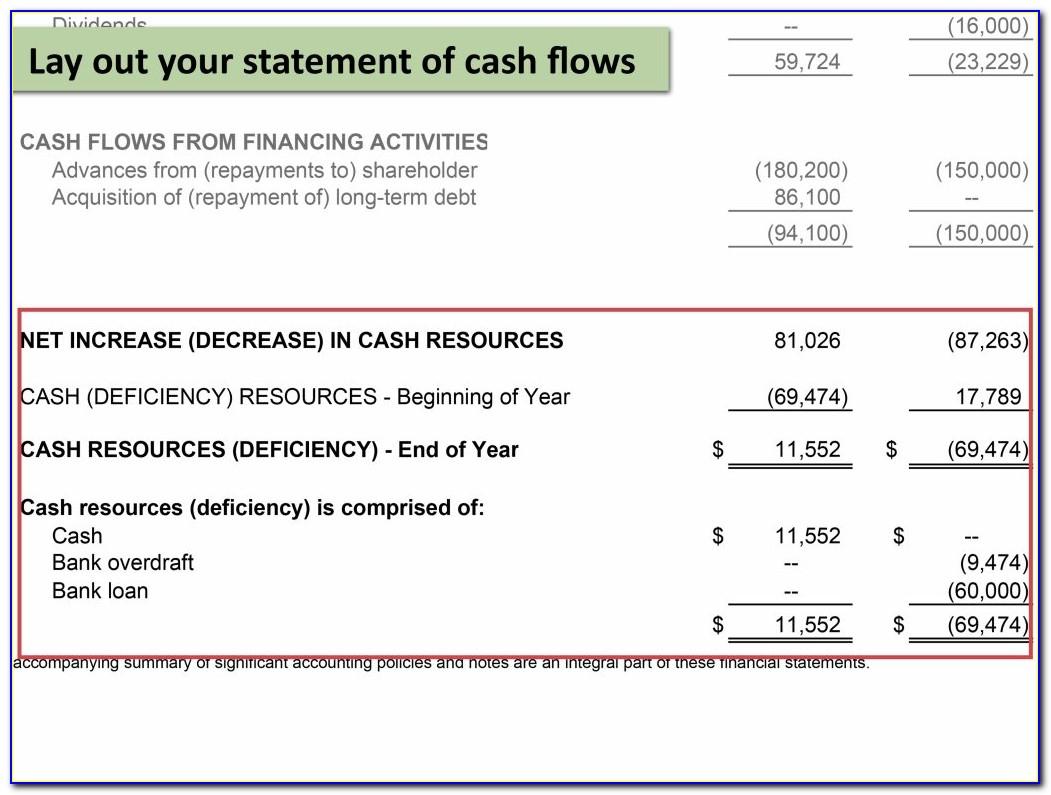

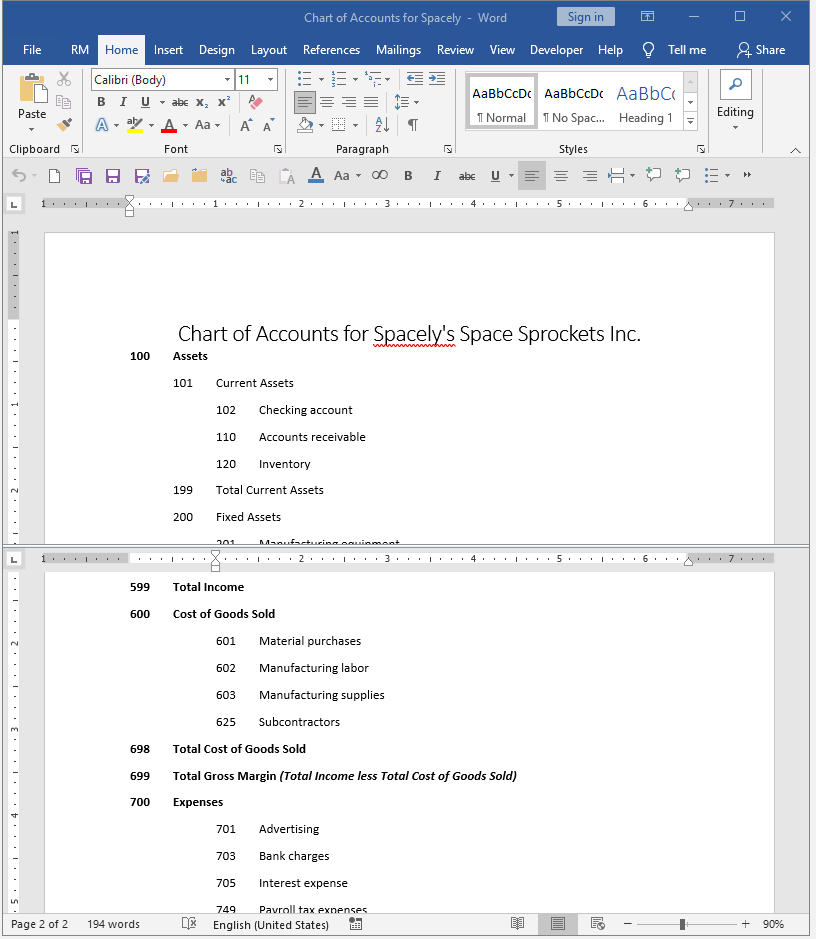

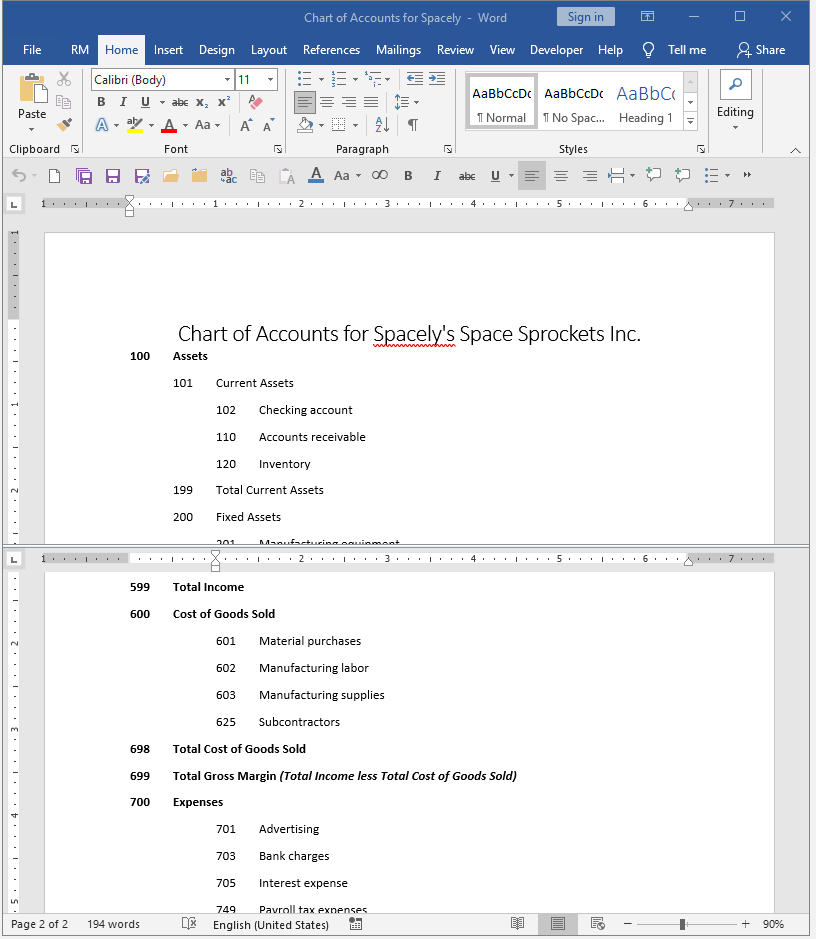

Us Gaap Financial Statements Format

https://soulcompas.com/wp-content/uploads/2019/10/us-gaap-financial-statements-format.jpg

https://viewpoint.pwc.com/dt/us/en/fasb_financial_accou/trg_revenue/...

Web 31 janv 2020 nbsp 0183 32 The Board decided that entities should follow the guidance in the model to determine instances when customer loyalty rewards programs are or are not

https://viewpoint.pwc.com/dt/us/en/pwc/accounting_guides/revenue_from...

Web The consideration payable can be cash either in the form of rebates or upfront payments or could alternatively be a credit or some other form of incentive that reduces amounts

Understanding Tax Credit Foss Co

Credit Score Your Number Determines Your Cost To Borrow

A Refresher On Accounting For Leases The CPA Journal

Rebate Apps The Krazy Coupon Lady Rebates Cellular Coupons

Mega Cashback For All A 2 9 TKX Rebate For Credit Debit Card Deposits

Perfect Accounting For Marketing Expenses Us Gaap Mcdonalds Financial

Perfect Accounting For Marketing Expenses Us Gaap Mcdonalds Financial

Rates Rates And More Rates Lessor Accounting Under ASC 842 GAAP

Pin On Abancommercials US Commercials Spots

Accounting For Rebates In Credit Card Statement CosmoLex Support

Gaap Accounting For Credit Card Rebates - Web 30 oct 2015 nbsp 0183 32 Use of card Debit Expense Account Where new purchases are to be coded Credit Asset Account Vendor Rebates If in the future a vendor were to send us a