Gaap Accounting For Rebates Received F accounting standards when dealing with rebates It is essential for financial professionals to carefully assess the nature of each rebate transaction considering the specific

I see GAAP guidance that VENDORS should record rebates as a reduction in their sales prices but how should those of us receiving them record them Should I offset my How to Account for Unclaimed Rebates How to Account for Coupons How to Pay a Rebate to a Vendor What is Inventory Rebate Accounting What are the

Gaap Accounting For Rebates Received

Gaap Accounting For Rebates Received

https://www.forbes.com/advisor/wp-content/uploads/2022/09/Image_-_GAAP_.jpeg.jpg

What Are Generally Accepted Accounting Principles GAAP

https://media.licdn.com/dms/image/C5612AQEEMulovYEVYg/article-cover_image-shrink_600_2000/0/1546665160912?e=2147483647&v=beta&t=9M8j-qpkUeaIOsMYV1758ChCf1yM7_Byp9SI4xx00Fc

/dotdash_Final_Other_Current_Assets_OCA_Dec_2020-01-1ef8bd75eff345e7ac48ba70fb718619.jpg)

Simple Gaap Accounting For Pass Through Expenses Accor Hotels Financial

https://www.investopedia.com/thmb/bgqqqjp_b3nnkk4XpliMIiXiZuo=/4755x3566/smart/filters:no_upscale()/dotdash_Final_Other_Current_Assets_OCA_Dec_2020-01-1ef8bd75eff345e7ac48ba70fb718619.jpg

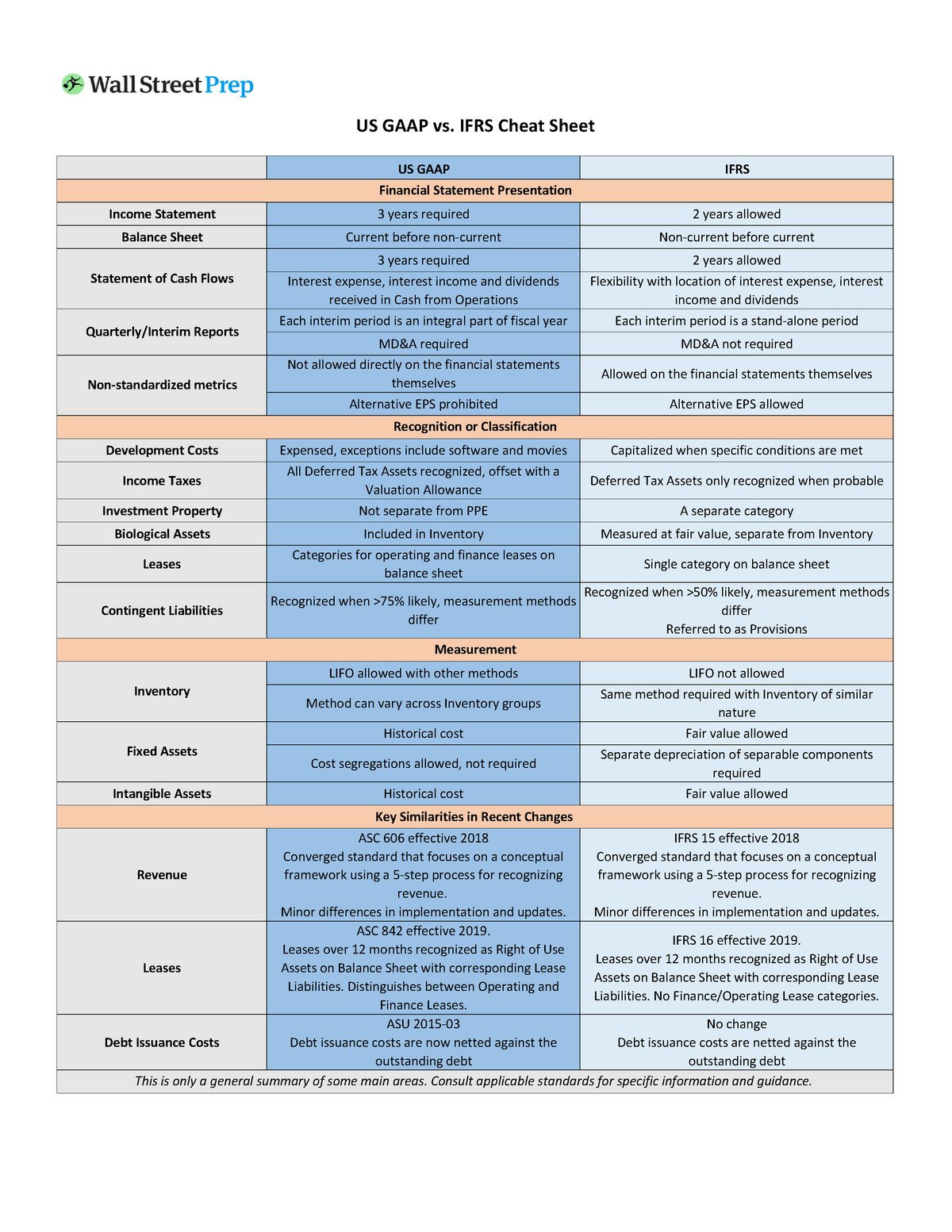

For example if the amounts received are to reimburse specific costs incurred it may be appropriate to offset the income against those costs in the statement of comprehensive 1 5 4 Vendor rebates ASC 705 20 provides accounting guidance on how a customer including a reseller of a vendor s products should account for cash consideration as

Accounting for customer rebates is crucial because rebates are also required to adhere to Generally Accepted Accounting Principles GAAP Beyond GAAP Sections such as ASC 606 10 25 and ASC 606 10 32 offer a window into the intricate process of identifying and measuring revenue from contracts with

Download Gaap Accounting For Rebates Received

More picture related to Gaap Accounting For Rebates Received

What Is GAAP Briefly Explain The Generally Accepted Accounting

https://i.ytimg.com/vi/VK6dhGfLI6M/maxresdefault.jpg

Introduction To Financial Accounting U S GAAP Adaptation Open

https://open.umn.edu/rails/active_storage/blobs/redirect/eyJfcmFpbHMiOnsibWVzc2FnZSI6IkJBaHBBcG9JIiwiZXhwIjpudWxsLCJwdXIiOiJibG9iX2lkIn19--4bf1d007a424cf53ee482f5455de5a752c25563e/DauderisAnnandMarchand-IntroFA-USGAAP-2021A-Thumbnail.png

US GAAP vs Usgaap Vs Ifrs US GAAP Vs IFRS Cheat Sheet US GAAP IFRS

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/b1c74ded0bc495ae63f20f79ae41a91d/thumb_1200_1553.png

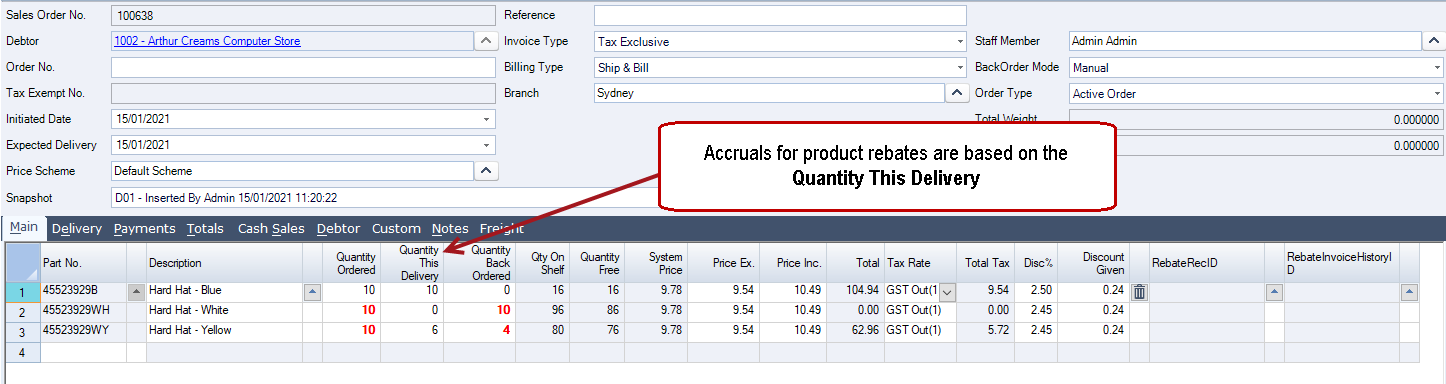

Under the point of sale method the rebate is recognized at the time a company recognizes revenue on sales of drugs into the channel that are expected to be resold to Organizations must have complete confidence in their rebate accruals process and develop a structured and rules based approach to rebate accounting forecasting

Th customers The standard issued as ASU 2014 092 by the FASB and as IFRS 15 by the IASB outlines a single comprehensive model for entities to use in accounting for Discover how incentX streamlines rebate accounting with seamless ERP integration for smarter business finance management

Big GAAP Vs Little GAAP Generally Accepted Accounting Principles For

https://blog.cmp.cpa/hubfs/Big GAAP vs Small GAAP Generally Accepted Accounting Principles for Small Businesses-1.jpg#keepProtocol

RECONCILIATION OF GAAP TO NON GAAP FINANCIAL MEASURES Q12022 Matterport

https://matterport.com/sites/default/files/images/Screen Shot 2022-05-10 at 1.55.25 PM.png

https://insights.enable.com/hubfs/dl/wp/Enable...

F accounting standards when dealing with rebates It is essential for financial professionals to carefully assess the nature of each rebate transaction considering the specific

https://www.proformative.com/questions/accounting...

I see GAAP guidance that VENDORS should record rebates as a reduction in their sales prices but how should those of us receiving them record them Should I offset my

GAAP Importance And Limitation Invyce

Big GAAP Vs Little GAAP Generally Accepted Accounting Principles For

The Importance Of GAAP Financial Statements PKF Mueller

:max_bytes(150000):strip_icc()/heirarchy-of-gaap_final-b93b52ed0f414650a920785b0f0c986b.png)

Hierarchy Of GAAP Meaning Organization Requirements

Gaap Generally Accepted Accounting Principles Concept With Big Word Or

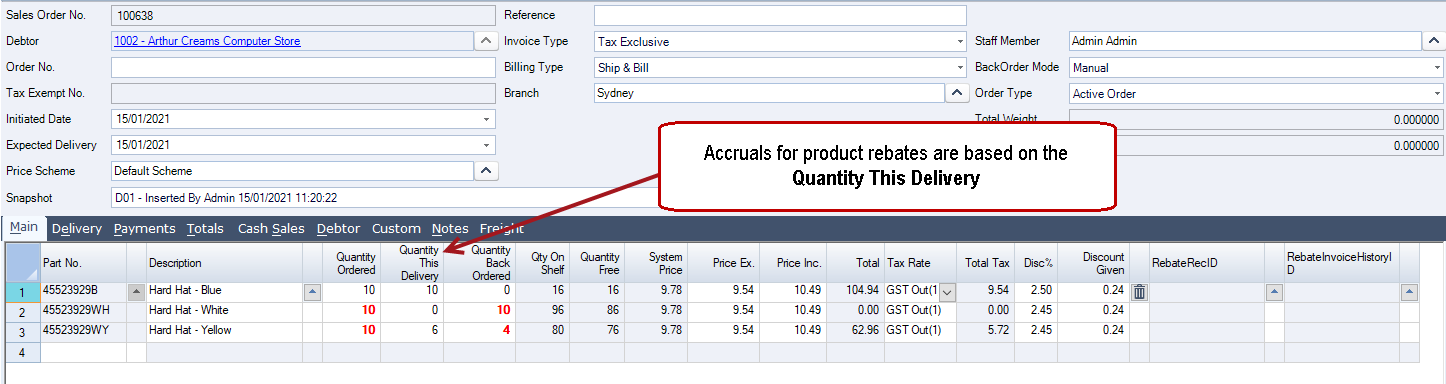

Rebates Rebate Accruals JIWA Training

Rebates Rebate Accruals JIWA Training

Manual Grant Writing And Grant Seeking Training GAAP Grants

:max_bytes(150000):strip_icc()/gaap.asp-Final-fcd73bc9aa6a4833bcb7f2bfe8bd3208.png)

GAAP Understanding It And The 10 Key Principles Donnelley Financial

Inventory Rebate Accounting Understanding The Basics Enable

Gaap Accounting For Rebates Received - This issue considers how a purchaser accounts for discounts and rebates when buying inventory What s the issue Discounts and rebates can be offered to