Gas Mileage Tax Deduction Calculator Steps to Claim the Deduction 1 Keep accurate records to support your claim You must either keep track of your vehicle expenses or keep a mileage log 2 Report

17 rowsFind standard mileage rates to calculate the deduction for using your car for Use the provided HMRC mileage claim calculator to determine how much you can receive in reimbursement for your business driving To calculate this you will need the number of miles you have

Gas Mileage Tax Deduction Calculator

Gas Mileage Tax Deduction Calculator

https://www.ssacpa.com/wp-content/uploads/2021/12/aaaa-graphic-12-21.jpg

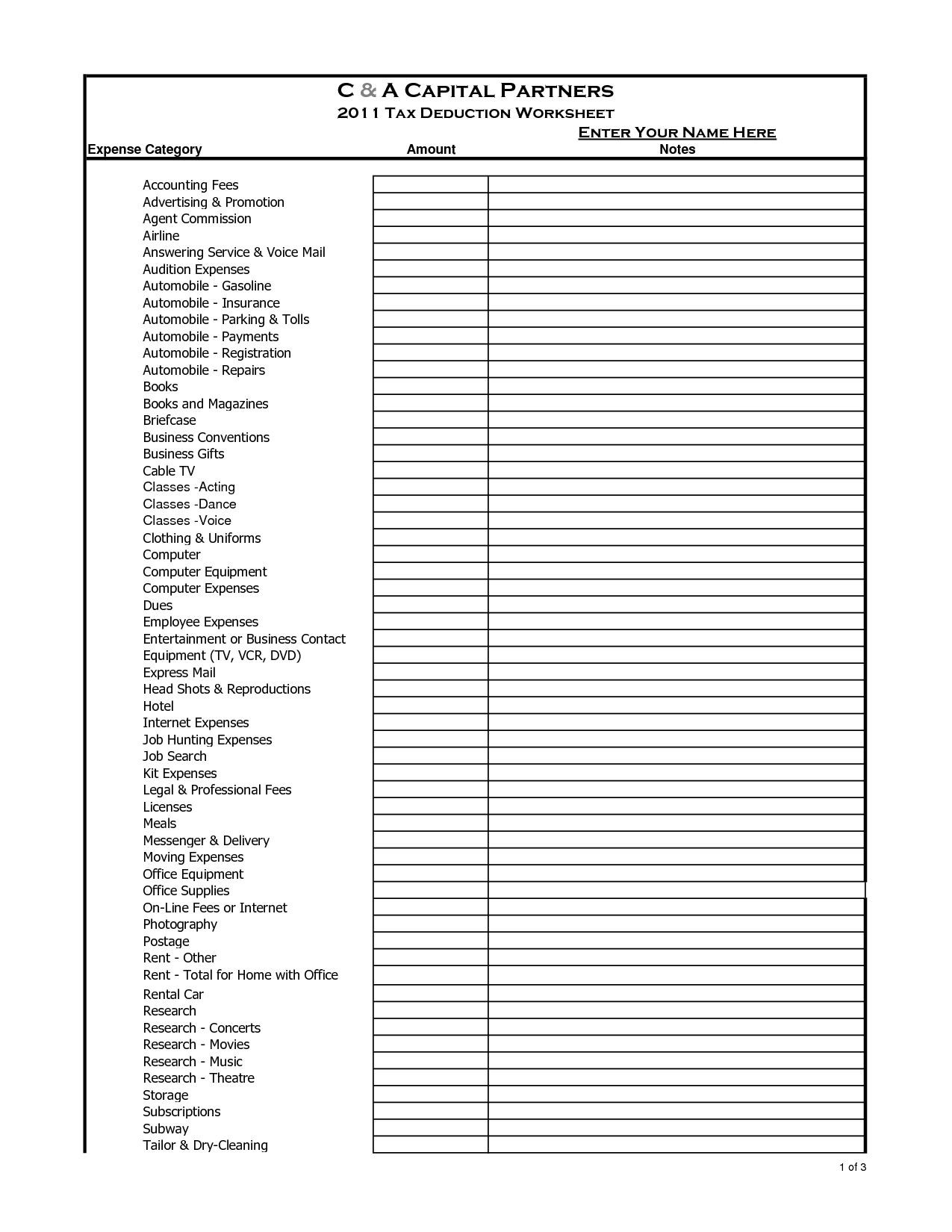

13 Car Expenses Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/10/tax-deduction-worksheet_449321.png

How To Get A Business Mileage Tax Deduction Small Business Bookkeeping

https://i.pinimg.com/originals/b4/03/b6/b403b6b7cb3715acc824f79e94ddae2d.jpg

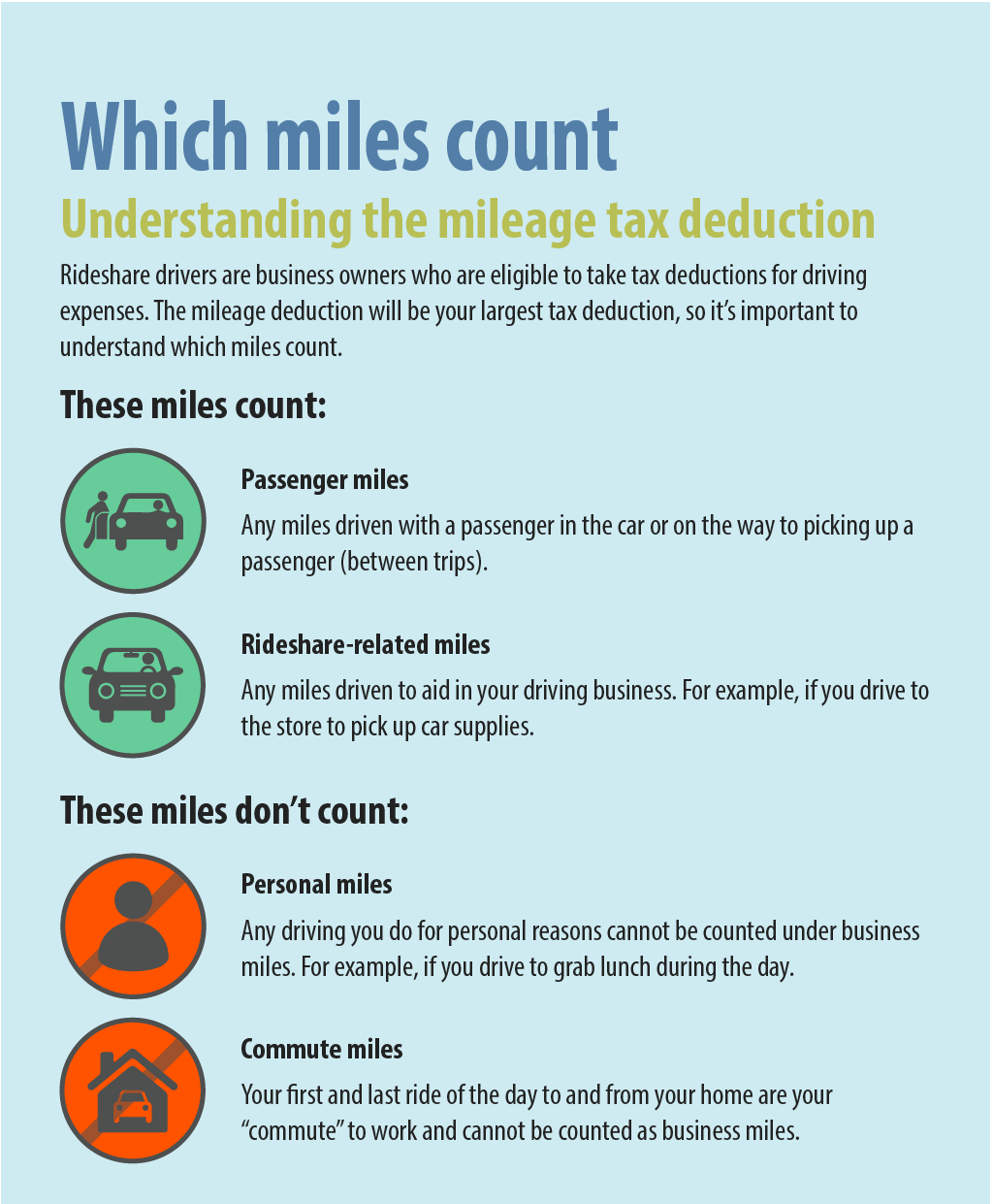

For 2024 the IRS standard mileage rates are 0 67 per mile for business 0 21 per mile for medical or moving and 0 14 per mile for charity If you drive for your business or plan to rack up Current Tax Deductible Mileage Rates How much you can deduct for mileage depends on the type of driving you did Business mileage is most common but you can also deduct mileage

The IRS offers two ways of calculating the cost of using your vehicle in your business The actual expenses method or Standard mileage rate method Each method has its advantages and WASHINGTON The Internal Revenue Service today issued the 2024 optional standard mileage rates used to calculate the deductible costs of operating an

Download Gas Mileage Tax Deduction Calculator

More picture related to Gas Mileage Tax Deduction Calculator

How To Get A Business Mileage Tax Deduction Small Business Sarah

https://i.pinimg.com/originals/a3/62/55/a362559fd8fc4165527746652c8c35c5.jpg

Easily Calculate Your Business Mileage Tax Deduction YouTube

https://i.ytimg.com/vi/_01WGdnfbNs/maxresdefault.jpg

Irs Compliant Mileage Log Template

https://storage.googleapis.com/driversnote-marketing-pages/US_logbook_template_preview.png

Calculate the deduction by multiplying the total actual expenses incurred gas maintenance oil by the business use percentage 600 42 8 256 8 Following the actual expenses method you can Deductible mileage calculation You can use the information below as a simple mileage calculator When doing your calculations multiply the miles you drove business charity etc by the

Our 2024 mileage deduction calculator uses standard IRS mileage rates to calculate your mileage deduction for taxes or reimbursement Learn the basics inside More information on tracking mileage and record keeping for your situation FAQ Calculating mileage reimbursements is a rather straightforward

13 Proven Mileage Tax Deduction Tips The Handy Tax Guy

https://www.handytaxguy.com/wp-content/uploads/2015/12/road-908176_640.jpg

Mileage Log For Tax Deduction Template Excel Templates Excel

http://www.exceltemplates.org/wp-content/uploads/2016/05/Mileage-Log.jpeg

https://www.mileagewise.com/mileage-deduction-guide

Steps to Claim the Deduction 1 Keep accurate records to support your claim You must either keep track of your vehicle expenses or keep a mileage log 2 Report

https://www.irs.gov/tax-professionals/standard-mileage-rates

17 rowsFind standard mileage rates to calculate the deduction for using your car for

Excel Brandon Anderson

13 Proven Mileage Tax Deduction Tips The Handy Tax Guy

2021 Mileage Reimbursement Calculator

Mileage Deduction Rules How To Deduct Mileage

24 Vehicle Lease Mileage Tracker Sample Excel Templates

Mileage Tax Deduction Tracking Log 2019

Mileage Tax Deduction Tracking Log 2019

How To Easily Deduct Mileage On Your Taxes The Accountants For Creatives

IRS Now Has A Higher Standard Mileage Rate Because Of Rising Gas Prices

Mileage Sheet IRS IRS Mileage Rate 2021

Gas Mileage Tax Deduction Calculator - IRS Tax Topic on deductible car expenses such as mileage depreciation and recordkeeping requirements If you use your car only for business purposes you may