Gas Tax Rebate 2024 Reinstated and Extended Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and extended the following fuel tax credits through December 31 2024 Alternative fuel credit Alternative fuel mixture credit Second generation biofuel producer credit

Beginning Jan 1 2023 the credit equals 30 of certain qualified expenses including Qualified energy efficiency improvements installed during the year Residential energy property expenses Home energy audits There are limits on the allowable annual credit and on the amount of credit for certain types of qualified expenses Today s Homeowner Tips To qualify for the maximum credit you must have your upgrades installed by 2032 Beginning in 2033 the maximum percentage of your installation cost you can deduct is 26 which drops to 22 in 2034 Beyond 2034 the credit expires you cannot claim any percentage credit for new installations

Gas Tax Rebate 2024

Gas Tax Rebate 2024

https://i2.wp.com/data.formsbank.com/pdf_docs_html/255/2552/255274/page_1_thumb_big.png

Other States Ahead On Gas Tax Replacement Michigan Information Research Service Inc

https://home.mirs.news/AdobeStock_90217786-1-.jpeg

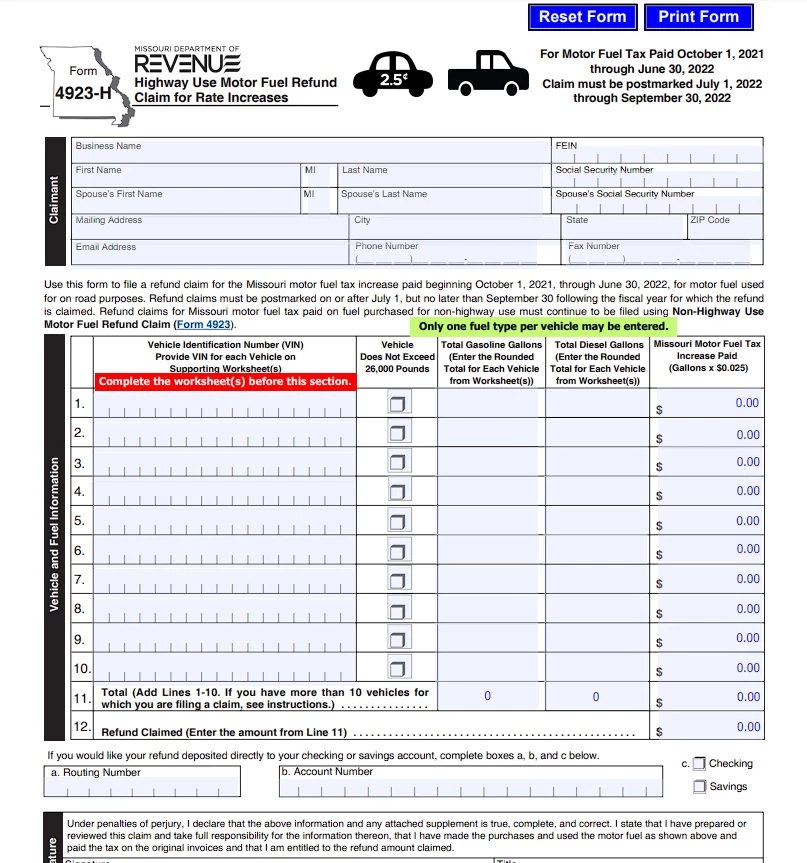

Gas Tax Rebate From Missouri Who Will Get It And How To Claim It

https://www.valuewalk.com/wp-content/uploads/2023/08/Gasoline.jpeg

You ll get a 30 tax break for expenses related to qualified improvements that use alternative power like solar wind geothermal or biomass energy The tax credit had dropped to 26 in 2021 but Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

Note The federal Internal Revenue Service IRS opens its Tax Season on January 29 2024 and the filing deadline for tax returns or an extension to file is Monday April 15 2024 Filing early is also the best way to prevent cybercriminals from stealing your refund If you have been a victim of identity theft you may enroll in the Department Use this form to file a refund claim for the Missouri motor fuel tax increase paid beginning July 1 2023 through June 30 2024 for motor fuel used for on road purposes Refund claims must be postmarked on or after July 1 but no later than September 30 following the fiscal year for which the refund is claimed

Download Gas Tax Rebate 2024

More picture related to Gas Tax Rebate 2024

4923 H 2014 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/468/470/468470575/large.png

California Gas Tax Rebate 2023 State Taxes TaxUni

https://www.taxuni.com/wp-content/uploads/2022/03/California-Gas-Tax-Rebate.jpg

GAS REBATE CALIFORNIA MCTR DEBIT CARD CALIFORNIA MIDDLE CLASS TAX REFUND CARD ACTIVATE FAST

https://i.ytimg.com/vi/AIu-Ifra3Cs/maxresdefault.jpg

On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates Starting January 1 2024 the clean vehicle tax credits can be accessed as point of sale rebates at participating dealerships This is great for two reasons You no longer have to wait until tax time to take advantage of the tax credit When point of sale the tax credit is no longer based on your personal tax liability

If the requirements outlined in HRS 235 110 32 are met HSEO shall provide the taxpayer a Credit Certificate to be filed with the taxpayer s state tax return Certificates are to be issued by March 1 2024 Qualifying renewable fuels producers seeking to claim the RFPTC for the 2024 tax year must submit the following to HSEO Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000

Will We Say Bye Bye Bye To PA Gas Tax

https://www.guttmanenergy.com/wp-content/uploads/2021/03/gas-tax.jpg

Here s How To Claim Your Missouri Gas Refund On July 1st

https://townsquare.media/site/464/files/2022/06/attachment-mo-gas-tax-form.jpg

https://www.irs.gov/businesses/small-businesses-self-employed/fuel-tax-credits

Reinstated and Extended Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and extended the following fuel tax credits through December 31 2024 Alternative fuel credit Alternative fuel mixture credit Second generation biofuel producer credit

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

Beginning Jan 1 2023 the credit equals 30 of certain qualified expenses including Qualified energy efficiency improvements installed during the year Residential energy property expenses Home energy audits There are limits on the allowable annual credit and on the amount of credit for certain types of qualified expenses

Trump s Gas Tax Hike Tests A Third Rail In Politics

Will We Say Bye Bye Bye To PA Gas Tax

Suspending The Gas Tax Is A Mistake Tax Foundation

Speaking Of Idaho Rick Just

What You Need To Know About The Proposed California Gas Tax Rebate The TurboTax Blog

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Petition Suspend The Gas Tax Now Chris Doughty For Governor

Federal Gas Tax Holiday How Much Would It Lower Gas Prices Money

What Are The Chances Of A NC Gas Tax Rebate In 2022 Budget Raleigh News Observer

Gas Tax Rebate 2024 - Note The federal Internal Revenue Service IRS opens its Tax Season on January 29 2024 and the filing deadline for tax returns or an extension to file is Monday April 15 2024 Filing early is also the best way to prevent cybercriminals from stealing your refund If you have been a victim of identity theft you may enroll in the Department