Georgia 529 Tax Deduction Deadline For contributions made to a Path2College 529 Plan account by April 18 2023 Georgia taxpayers may be eligible for a state income tax deduction up to 8 000

Georgia taxpayers may be eligible for a Georgia income tax deduction on contributions made to a Path2College 529 Plan up to 8 000 per year per beneficiary for joint filers or Georgia taxpayers may be eligible for a state income tax deduction up to 8 000 per beneficiary for those filing a joint return and up to 4 000 per beneficiary for

Georgia 529 Tax Deduction Deadline

Georgia 529 Tax Deduction Deadline

https://acumenwealth.com/app/uploads/2020/07/Student-Loan-1200x660.jpg

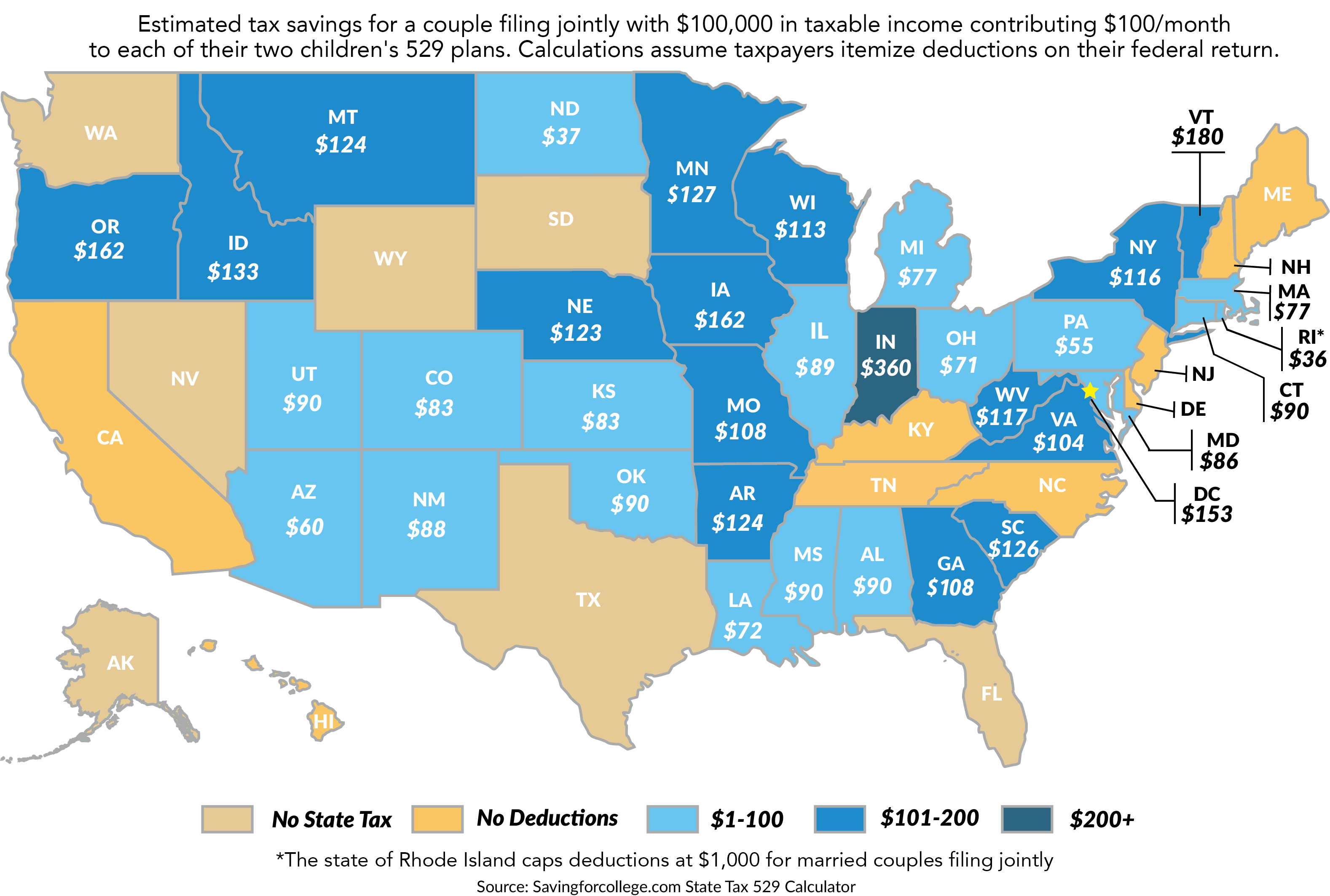

How Much Is Your State s 529 Plan Tax Deduction Really Worth

https://webresources-savingforcollege.s3.amazonaws.com/images/original-state-map-2017-12.png

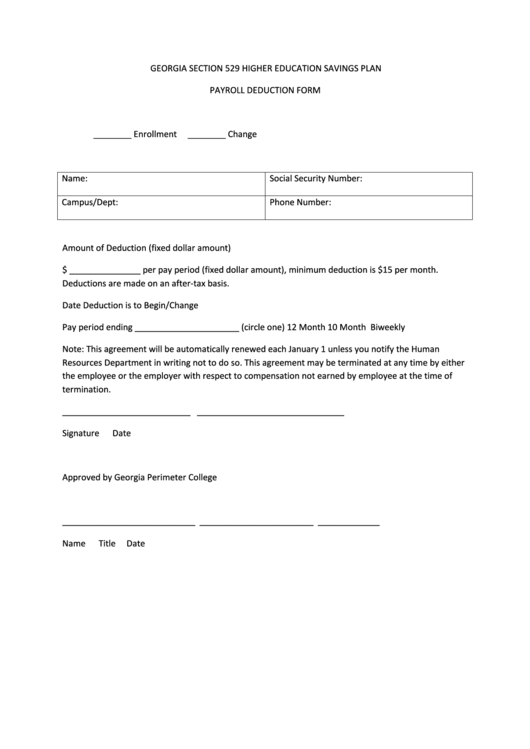

Payroll Deduction Form Georgia Section 529 Higher Education Savings

https://data.formsbank.com/pdf_docs_html/162/1623/162334/page_1_thumb_big.png

100 tax deferred growth and Georgia taxpayers can reduce their state taxable income by up to 8 000 per beneficiary per year if married filing jointly 4 000 for single filers Range of investment options Georgia taxpayers filing jointly can deduct up to 8 000 per year per beneficiary in the Path2College 529 Plan contributions from their Georgia adjusted gross income Individual filers can deduct up to 4 000

For tax years beginning on or before January 1 2016 you may deduct up to 2 000 of your contribution on behalf of any beneficiary of a Georgia Higher Education Savings For contributions made to a Path2College 529 Plan account by April 15 2024 Georgia taxpayers may be eligible for a 2023 state income tax deduction up to

Download Georgia 529 Tax Deduction Deadline

More picture related to Georgia 529 Tax Deduction Deadline

How Much Is Your State s 529 Plan Tax Deduction Really Worth

https://d3tc5xafqqxqk8.cloudfront.net/wp-content/uploads/2023/04/27141121/US-TAX-nl-1200x675.png

529 College Savings Plans All 50 States Tax Benefit Comparison

https://www.mymoneyblog.com/wordpress/wp-content/uploads/2021/06/mstar_529state_2023.gif

529 Plan Tax Deductions Are Offered By 34 States Here s The List For

https://www.businessinsider.nl/wp-content/uploads/2021/01/5fff27c03420f-scaled.jpg

The Georgia Path2College 529 Plan a TIAA managed 529 savings program features a year of enrollment track with 10 portfolios and six static investment options including a Principal Plus Interest Portfolio with a Path2College 529 Plan Frequently Asked Questions and Answers Investment Options College Savings Calculator State Employer Information

For more information about the Path2College 529 Plan call 1 877 424 4377 or click here for a Plan Description which includes investment objectives risks charges expenses If you are a Georgia resident who plans to put a child through college it s important to learn about the tax benefits available by contributing to the state s 529

Georgia Extends State Tax Deadlines For Victims Of Hurricane Ian

https://www.antarescpas.com/wp-content/uploads/2022/10/Presentation-Photos-17.png

Georgia 529 Plans Learn The Basics Get 30 Free For College Savings

https://www.upromise.com/articles/wp-content/uploads/sites/3/2021/01/Georgia-529-Plans.jpg

https://gsfc.georgia.gov/press-releases/2023-03-20/...

For contributions made to a Path2College 529 Plan account by April 18 2023 Georgia taxpayers may be eligible for a state income tax deduction up to 8 000

https://www.path2college529.com/resources/faq

Georgia taxpayers may be eligible for a Georgia income tax deduction on contributions made to a Path2College 529 Plan up to 8 000 per year per beneficiary for joint filers or

529 Plans Tax Deduction Deadline Approaches Scarlet Oak Financial

Georgia Extends State Tax Deadlines For Victims Of Hurricane Ian

529 College Savings Plans State by State Tax Benefit Comparison 2015

529 Calculator Start Saving For College Before Your Child Is Born

Everything You Need To Know About 529 Tax Deductions

GEORGIA 529 Plan Upcoming Changes For 2021 YouTube

GEORGIA 529 Plan Upcoming Changes For 2021 YouTube

529 Plan State Tax Deduction Limits And How To Choose A 529 Plan And

These States Have The Highest 529 Plan Tax Deductions

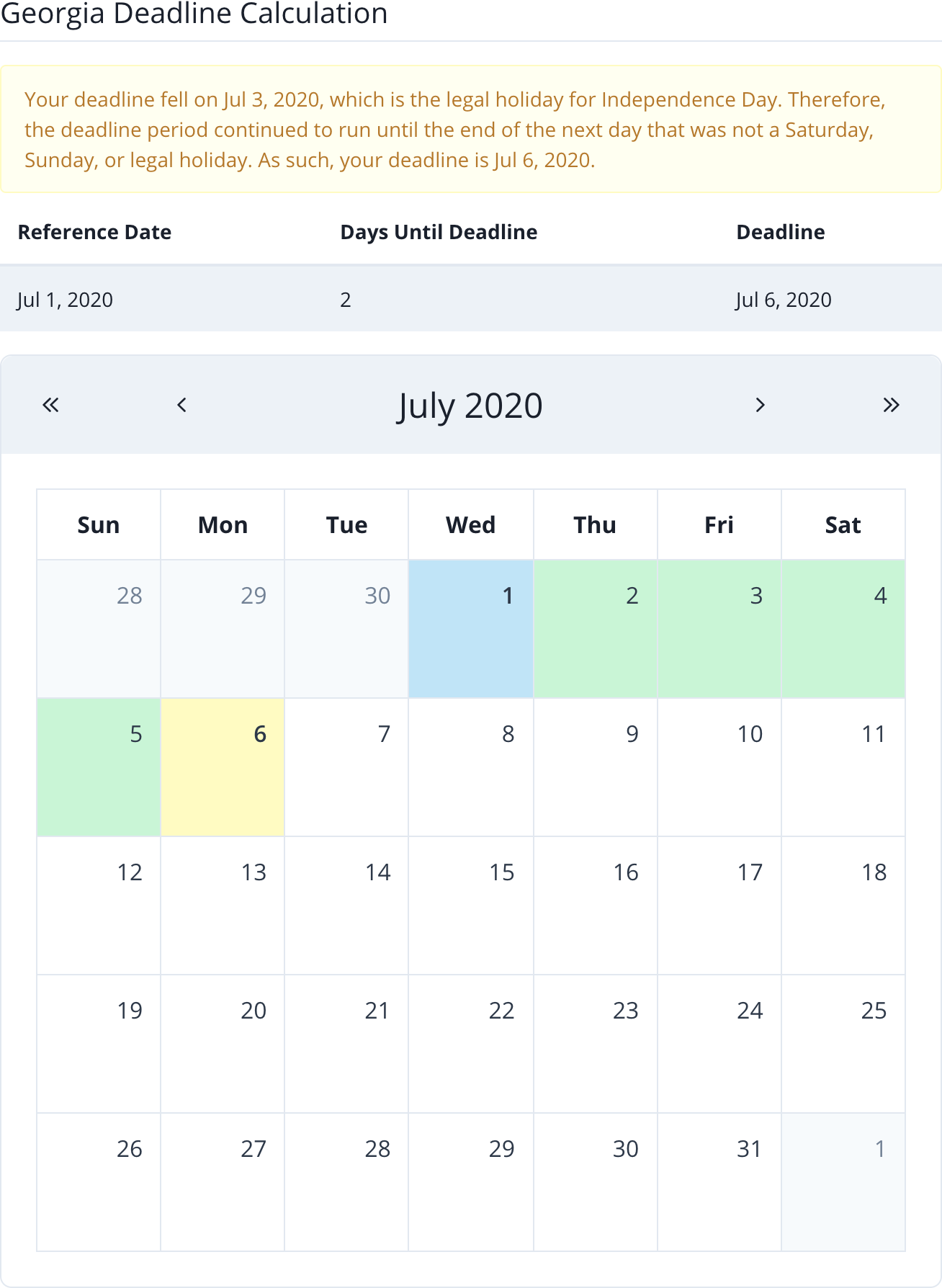

Calculating Georgia Deadlines Legal Calculators

Georgia 529 Tax Deduction Deadline - 100 tax deferred growth and Georgia taxpayers can reduce their state taxable income by up to 8 000 per beneficiary per year if married filing jointly 4 000 for single filers Range of investment options