Georgia Income Tax Exemptions Learn how to exclude up to 4 000 of retirement income from your Georgia tax return if you are 62 or older or permanently and totally disabled Find out the eligibility criteria and the types of retirement income that qualify for the exclusion

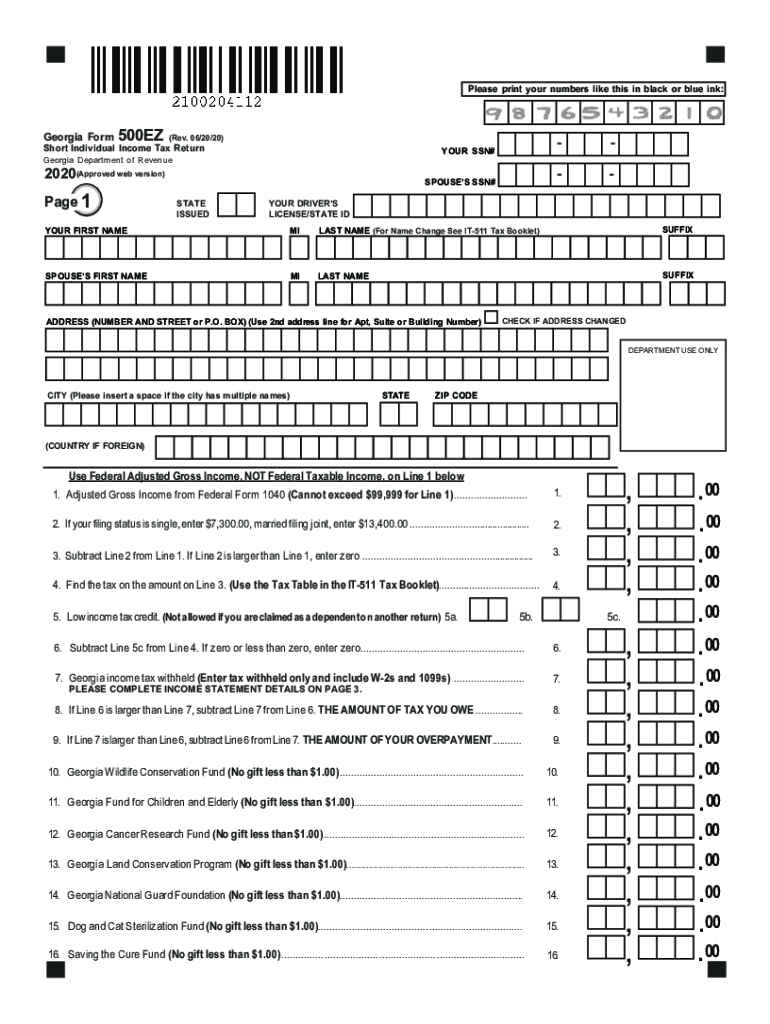

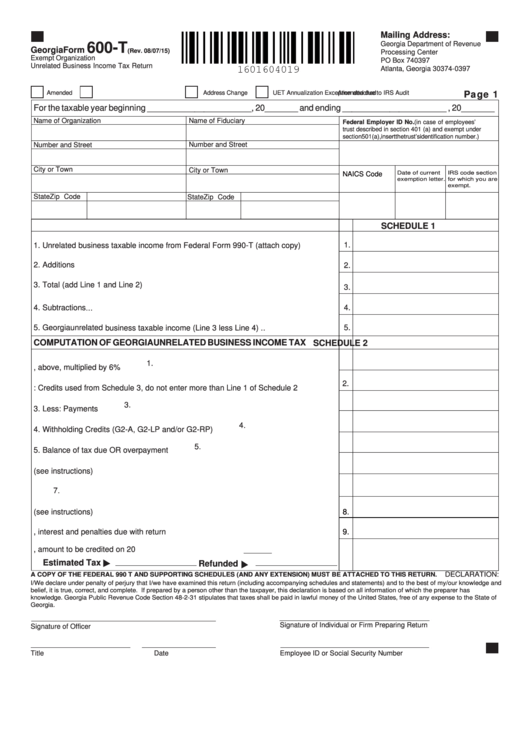

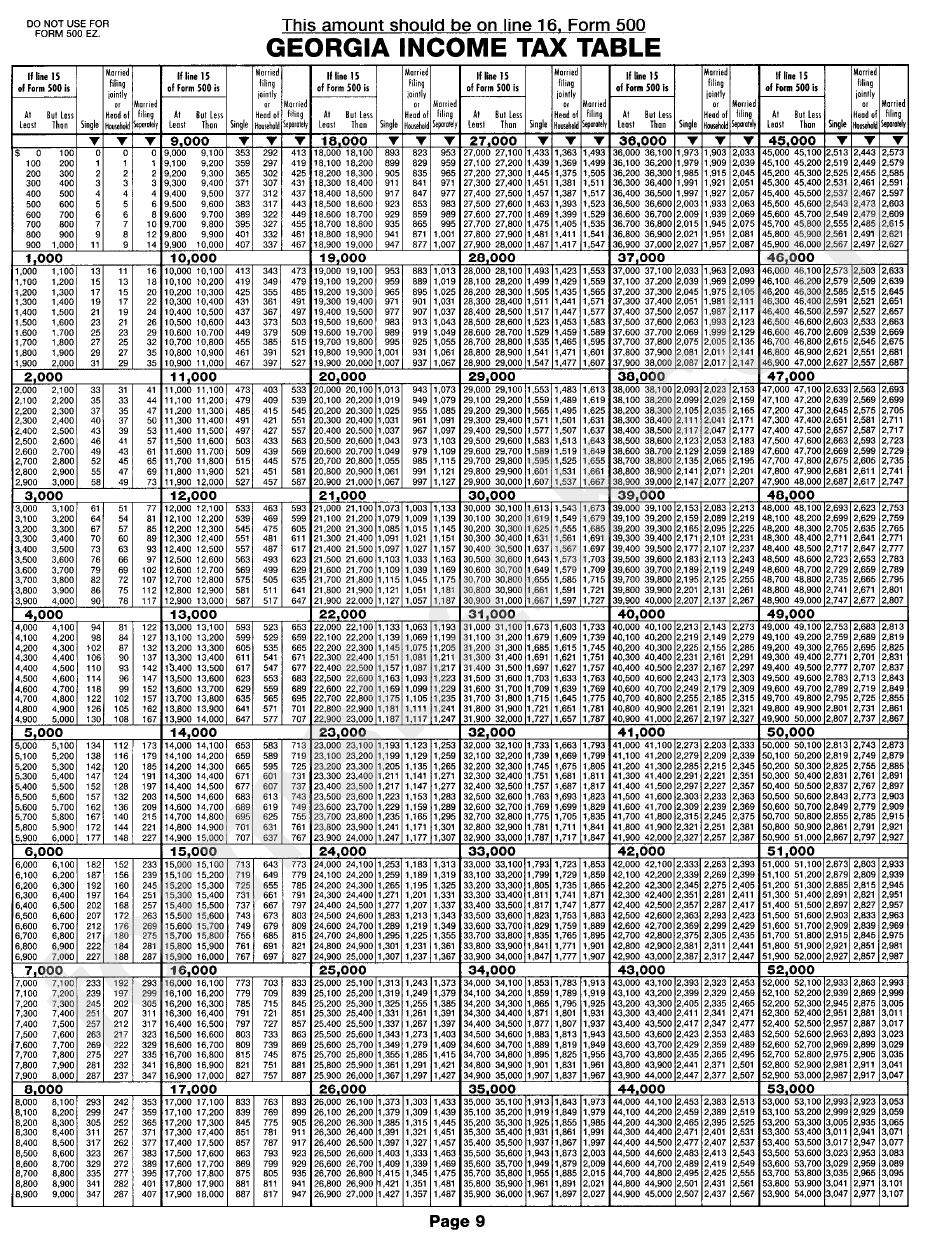

Find information and forms for Georgia income tax property tax homestead exemptions surplus tax refund and more File and pay taxes online or by mail check your refund status or request an extension See the summary of Georgia s income tax rate reductions standard deduction elimination and personal exemption increases from 2018 to 2030 The tax rate for 2024 is 5 39 and the exemption is 12 000 for single and head of household filers and 18 500 for married filers

Georgia Income Tax Exemptions

Georgia Income Tax Exemptions

https://policyoptions.irpp.org/wp-content/uploads/sites/2/2015/09/income-tax.jpg

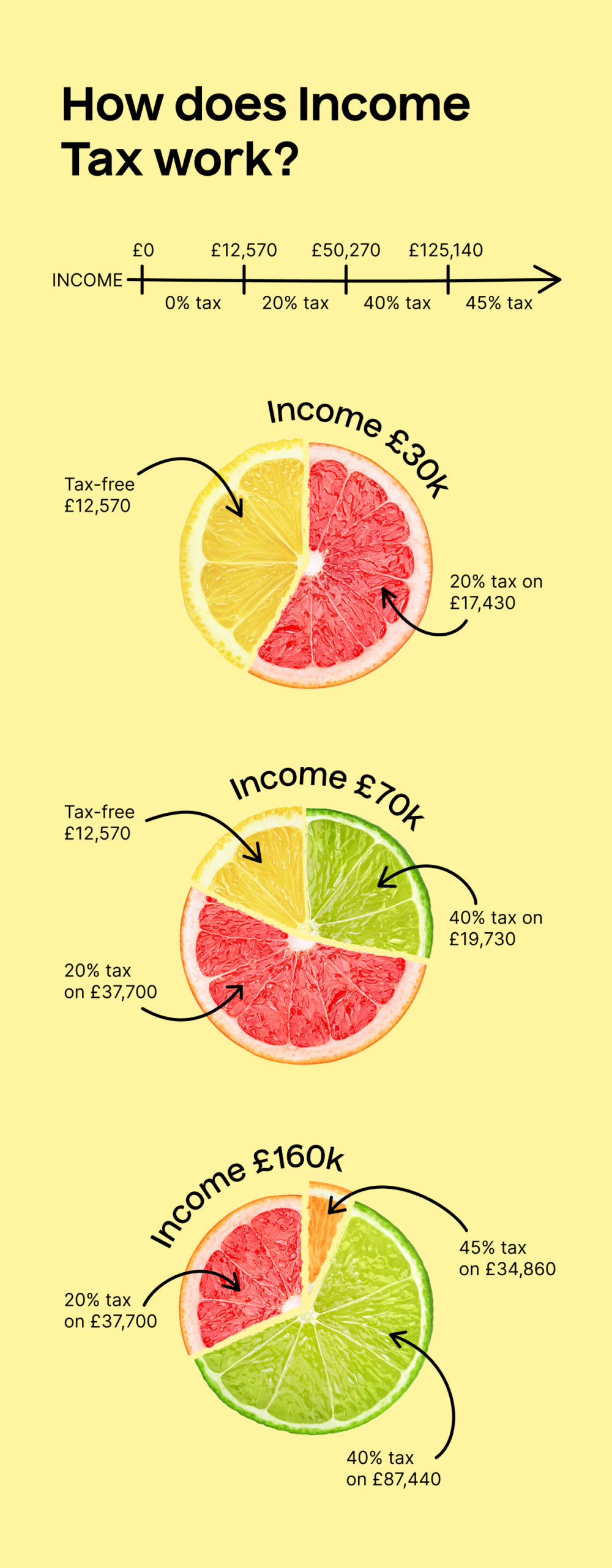

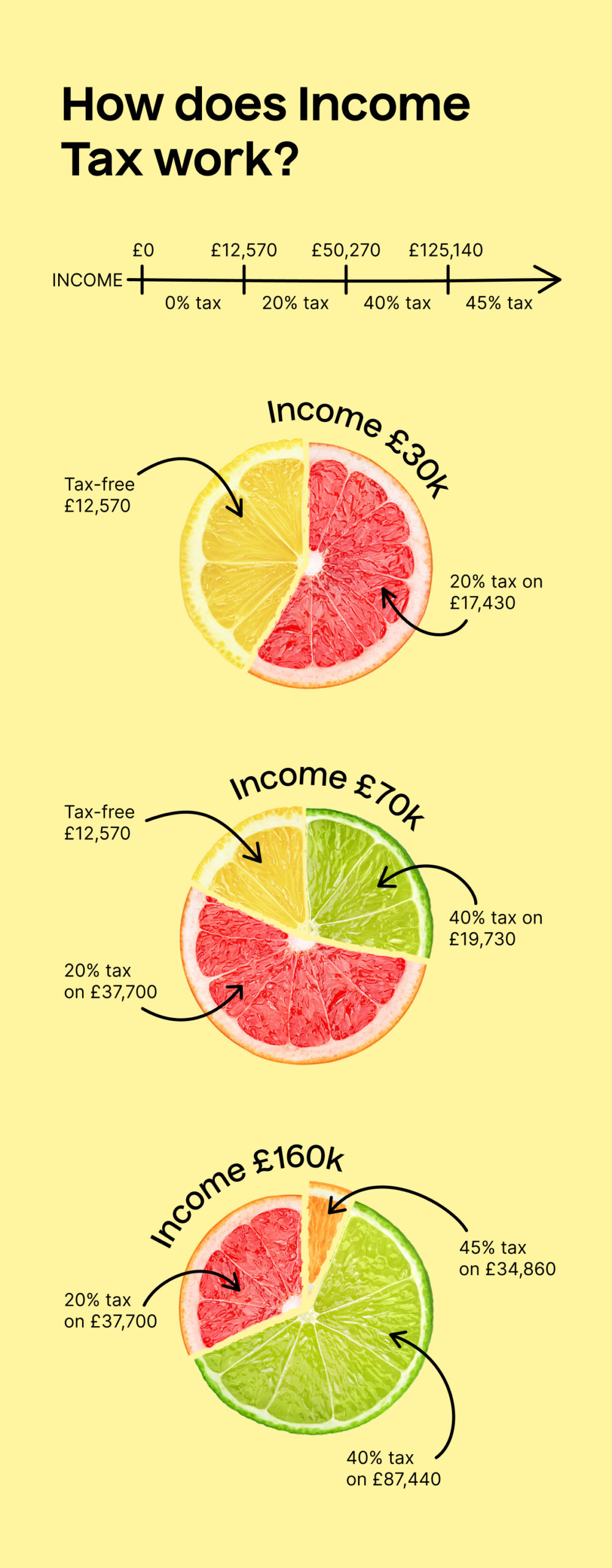

Income Tax Rates In The UK TaxScouts

https://taxscouts.com/wp-content/uploads/TaxScouts_IncomeTax-scaled.jpg

Understanding Income Tax Reliefs Rebates Deductions And Exemptions

https://i2.wp.com/ringgitplus.wpcomstaging.com/wp-content/uploads/2020/02/Tax-Exemptions-1.jpg?resize=874%2C548&ssl=1

Estimate your Georgia income tax for 2023 2024 based on your filing status income and deductions See the state tax brackets rates credits and exemptions for Georgia residents and Learn about Georgia s flat tax rate of 5 49 for 2024 and the previous six rates for 2023 Find out who needs to file a Georgia state income tax return and how to calculate your

You have income subject to Georgia income tax that is not subject to Federal income tax Your income exceeds the standard deduction and personal exemptions as indicated below Single Head of Household or Qualifying Widow er Your income exceeds Georgia s standard deduction and personal exemptions Typically income tax returns and payments are due April 15 unless you file an extension or the deadline is extended by the governor

Download Georgia Income Tax Exemptions

More picture related to Georgia Income Tax Exemptions

WFR Georgia State Fixes 2022 Resourcing Edge

https://resourcingedge.com/wp-content/uploads/2021/12/2022_-Employers_Tax_Guide.png

Get More Tax Exemptions For Income Tax In Malaysia IMoney

https://static.imoney.my/articles/wp-content/uploads/2021/03/05180919/Income-Tax-Exemption-2020.png

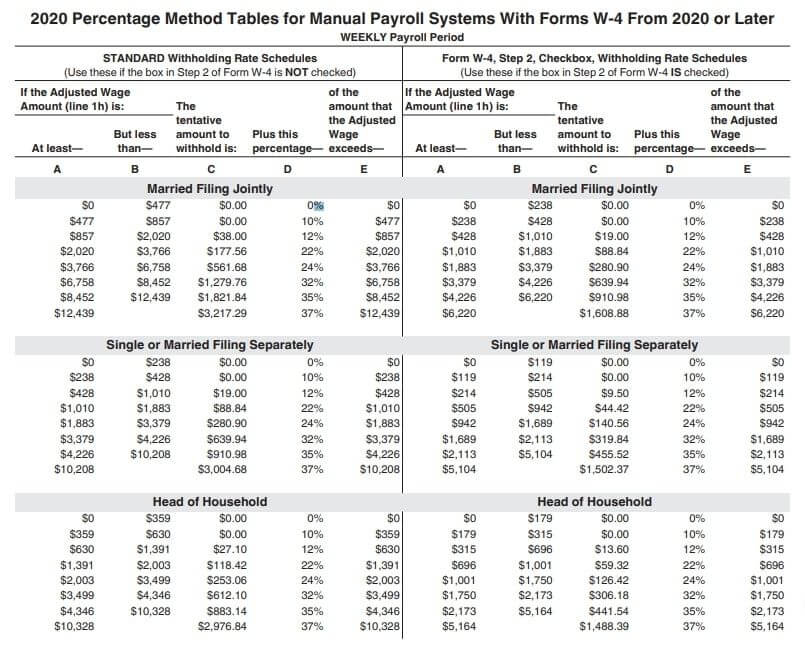

IRS Publication 15 T 2021 Tax Tables Federal Withholding Tables 2021

https://federalwithholdingtables.net/wp-content/uploads/2021/07/federal-withholding-tables-2021-federal-income-tax-1.jpg

In this article we ll walk you through your frequently asked questions regarding Georgia state tax exemptions including standard and itemized deductions and how to maximize your credits and deductions especially in light of recent changes to Georgia s tax law Georgia has a flat income tax rate of 5 39 as of Jan 1 2024 down from 5 49 It also offers tax cuts childcare relief and property tax caps for eligible taxpayers

Calculate your federal state and local taxes based on your household income location and filing status See Georgia s income tax brackets rates deductions and exemptions for 2023 Learn how Georgia taxes your income property and sales in 2024 including the flat tax rate of 5 49 percent and the exemptions for seniors and retirees Find out how to file your taxes appeal your assessment and compare rates across counties

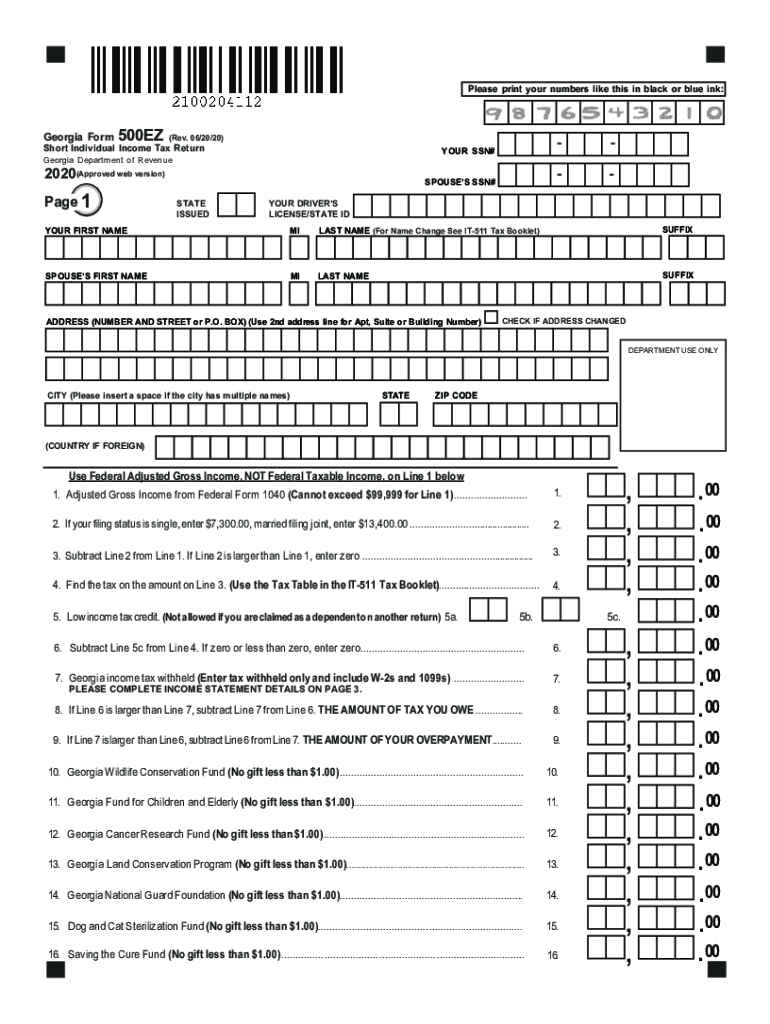

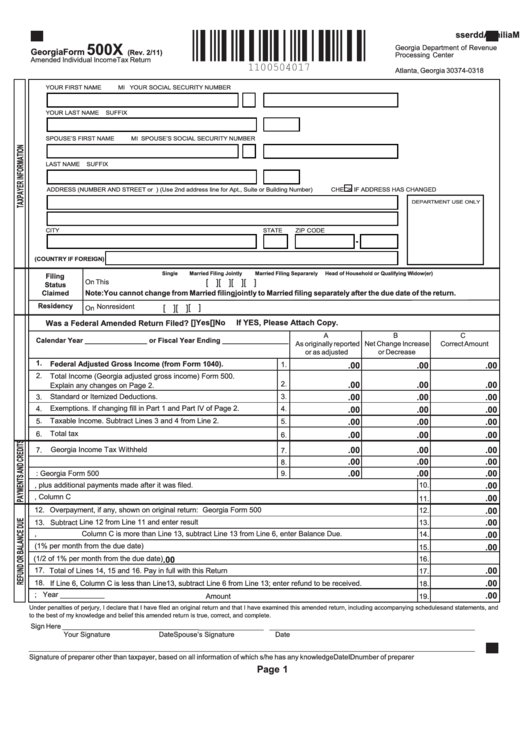

Georgia Form 500 Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/578/869/578869707/large.png

Perdue Proposes Eliminating Georgia State Income Tax 11alive

https://media.11alive.com/assets/WXIA/images/ad192733-1f1d-4626-ae4d-c09db200a37e/ad192733-1f1d-4626-ae4d-c09db200a37e_1920x1080.jpg

https://dor.georgia.gov/retirement-income-exclusion

Learn how to exclude up to 4 000 of retirement income from your Georgia tax return if you are 62 or older or permanently and totally disabled Find out the eligibility criteria and the types of retirement income that qualify for the exclusion

https://dor.georgia.gov/taxes/taxes-individuals

Find information and forms for Georgia income tax property tax homestead exemptions surplus tax refund and more File and pay taxes online or by mail check your refund status or request an extension

Georgia Individual Income Tax Withholding Form WithholdingForm

Georgia Form 500 Complete With Ease AirSlate SignNow

Income Tax Overview Booklet CIBC Private Wealth Page 2

Top 92 Georgia Income Tax Forms And Templates Free To Download In PDF

Form 500 Georgia Income Tax Table Printable Pdf Download

Personal Income Tax Guide In Malaysia 2016 Tech ARP

Personal Income Tax Guide In Malaysia 2016 Tech ARP

Data Visualization Effective Sales Tax Rates In Georgia David Sawyer

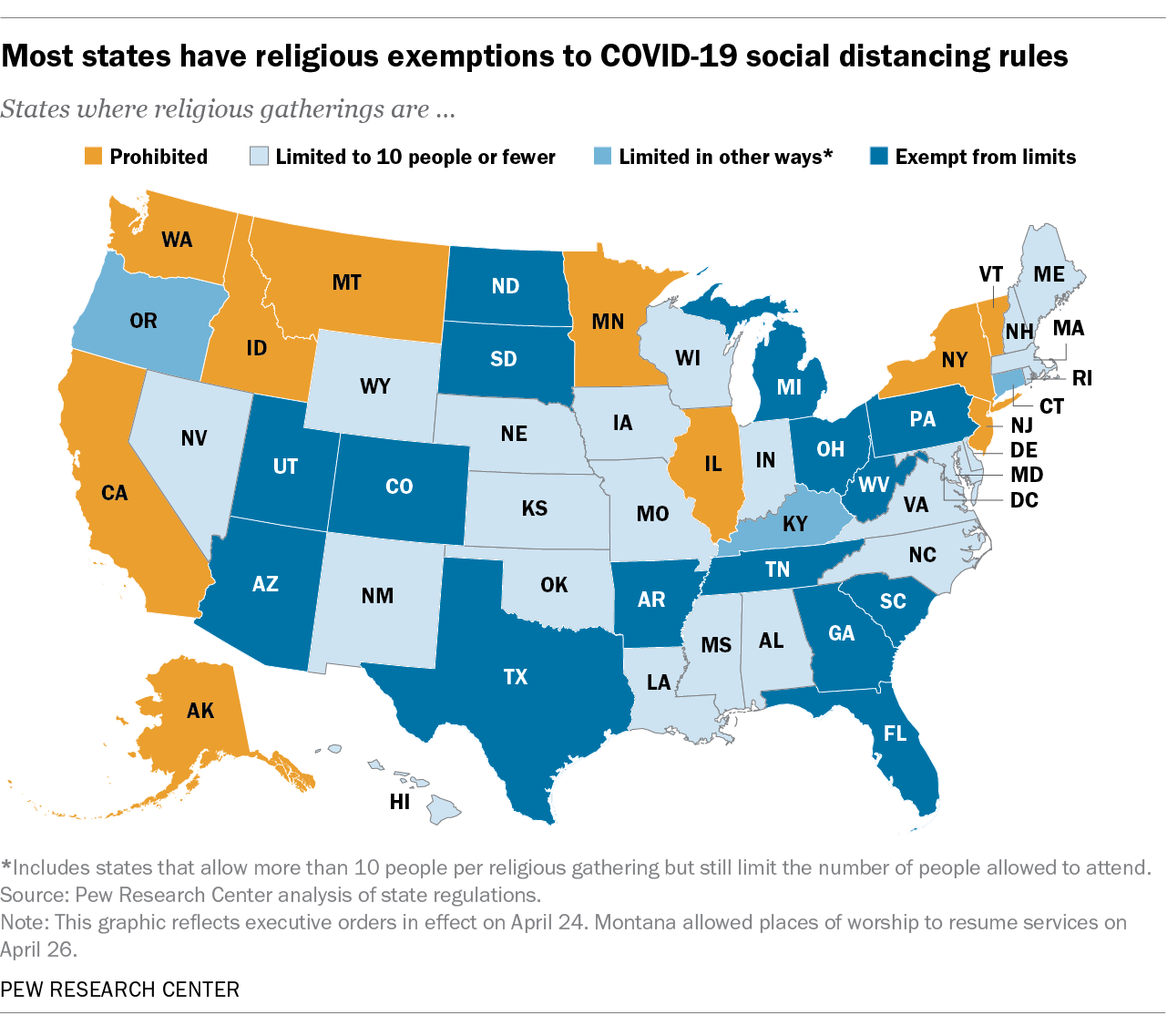

Most States Have Religious Exemptions To COVID 19 Social Distancing

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

Georgia Income Tax Exemptions - ATLANTA GA Governor Brian P Kemp joined by First Lady Marty Kemp Lieutenant Governor Burt Jones Speaker of the House Jon Burns and members of the Georgia General Assembly today announced plans to return over 1 billion to the taxpayers of Georgia via a third special tax rebate The proposed one time special refund would mirror previous