Georgia Income Tax Rebate 2024 INTRODUCTION 3 BUSINESS ELECTRONIC FILING

By accelerating the reduction the rate for Tax Year 2024 will be 5 39 percent rather than the 5 49 percent set by HB 1437 This will mark a cut of 36 basis points from the Tax Year 2023 rate of 5 75 percent Register a New Business Refunds Audits and Collections Tax Rules and Policies Power of Attorney Tax Credits Georgia Tax Center Help Tax FAQs Due Dates and Other Resources Important Updates Motor Vehicles Subnavigation toggle for Motor Vehicles All Motor Vehicle Forms Online Services Titles and Registration TAVT Annual Ad Valorem

Georgia Income Tax Rebate 2024

Georgia Income Tax Rebate 2024

https://www.signnow.com/preview/6/325/6325846/large.png

Georgia Income Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Georgia-Tax-Rebate-2023-768x683.png

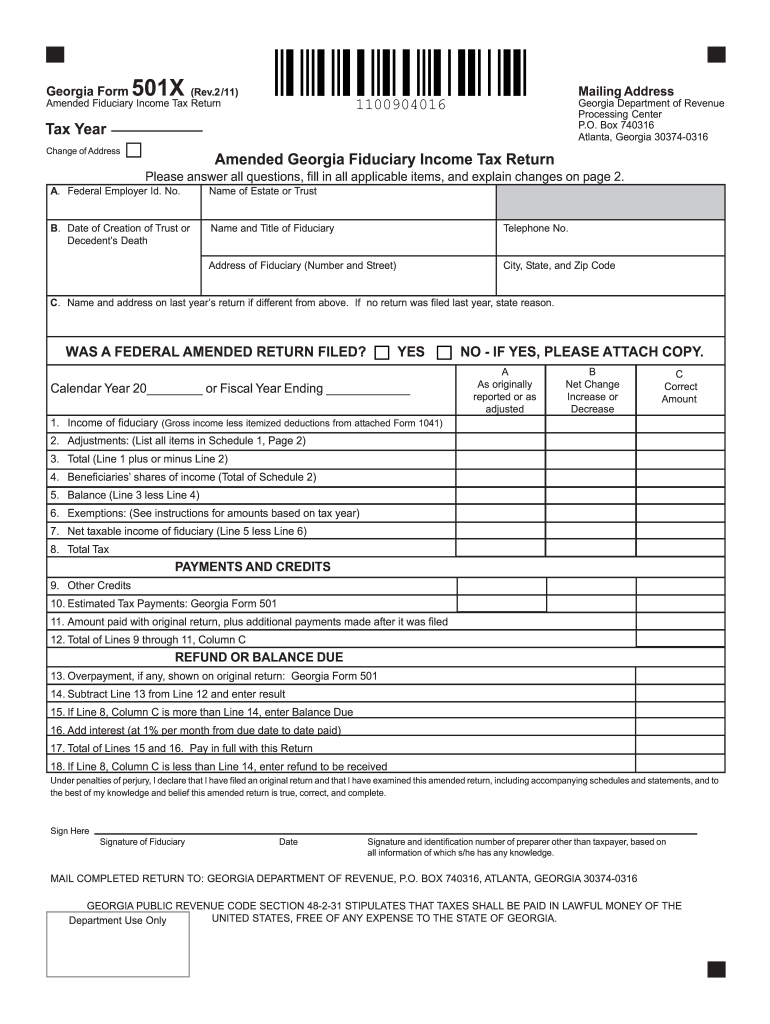

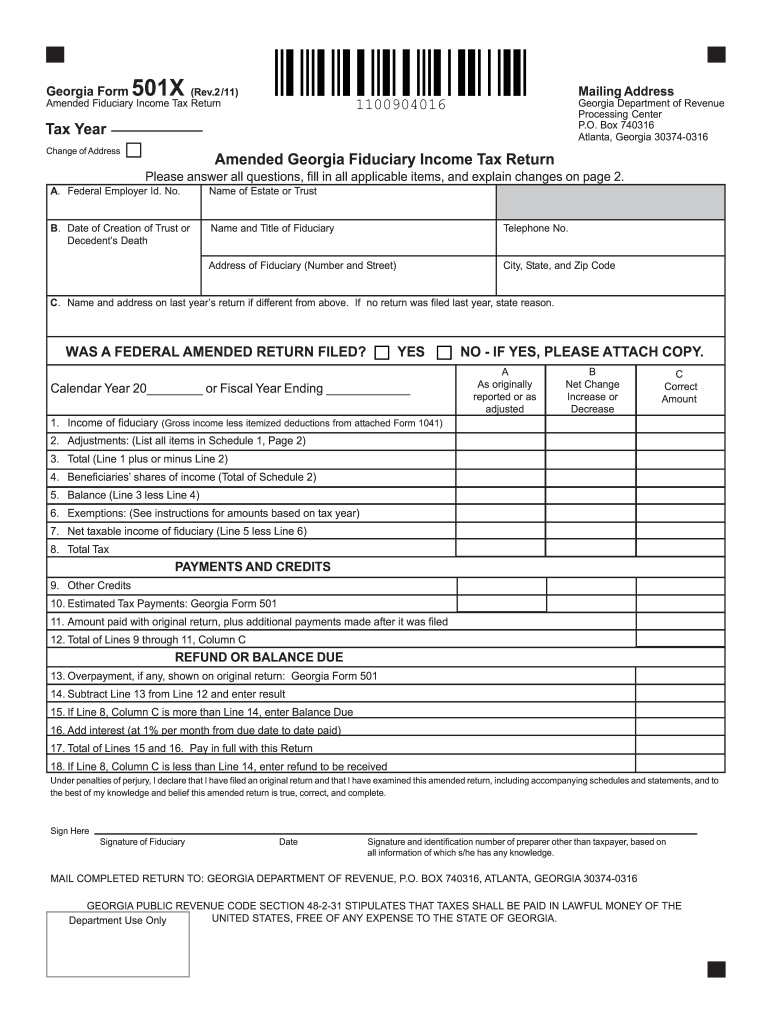

Georgia State Income Tax Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/578/869/578869707/large.png

Kemp said in December Father arrested after 4 year old girl shot killed in East Point police say VIDEO Man with 37 previous arrests leads Atlanta officers on chase with 3 children inside SUV The standalone form 501 NOL should only be used for years prior to 2023 Current Year NOL Type Added a checkbox on Form 600 Form 600S and Form 700 to designate the type of loss Normal NOL Farm Loss or Insurance Loss You may only select one type of loss

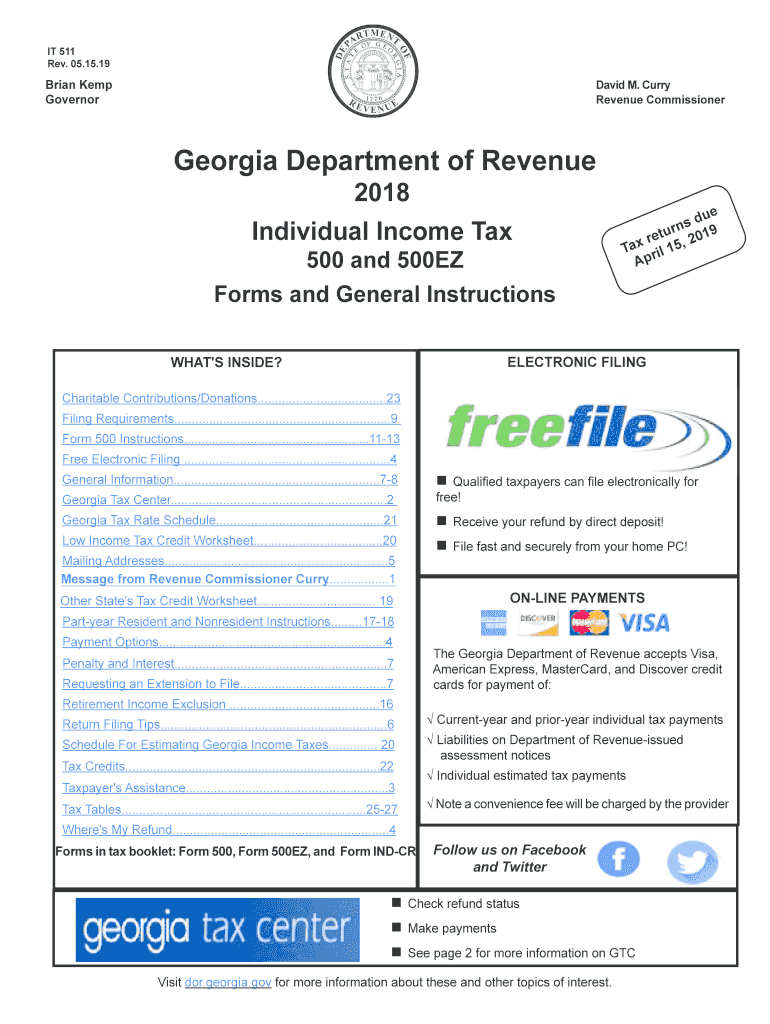

Georgia law lowers personal income tax rates starting in 2024 Tax News Update Email this document Print this document May 9 2022 2022 0732 Georgia law lowers personal income tax rates starting in 2024 The bill will gradually reduce the income tax rate from 5 49 to 4 99 over six years

Download Georgia Income Tax Rebate 2024

More picture related to Georgia Income Tax Rebate 2024

Individual Income Tax Rebate

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

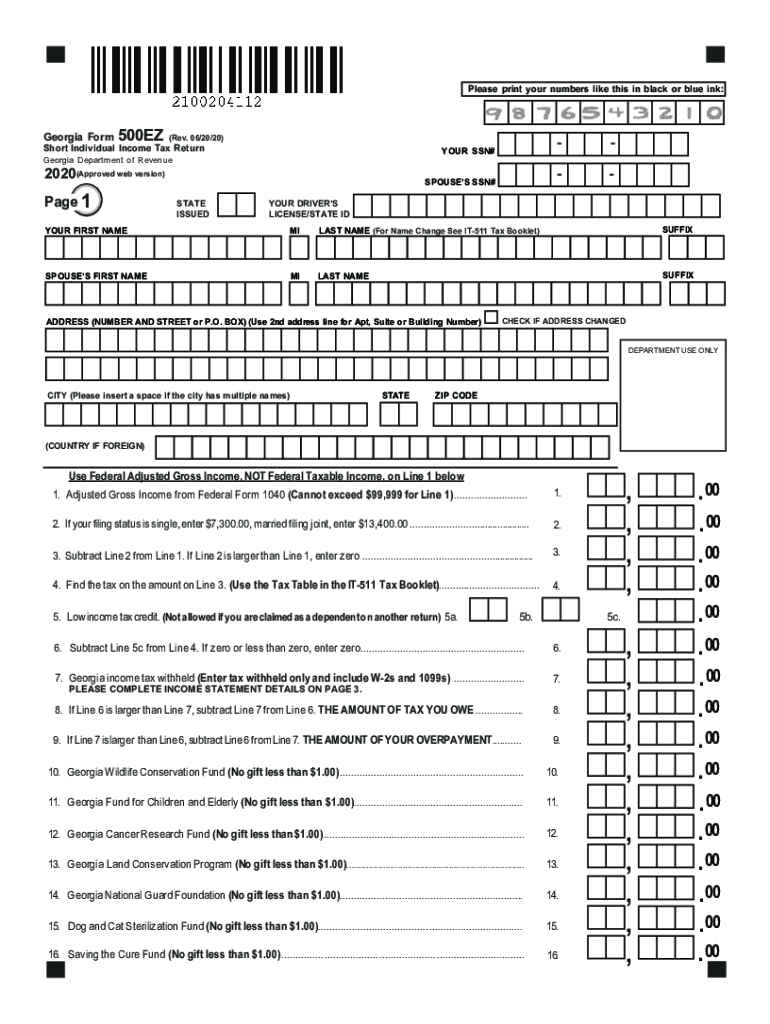

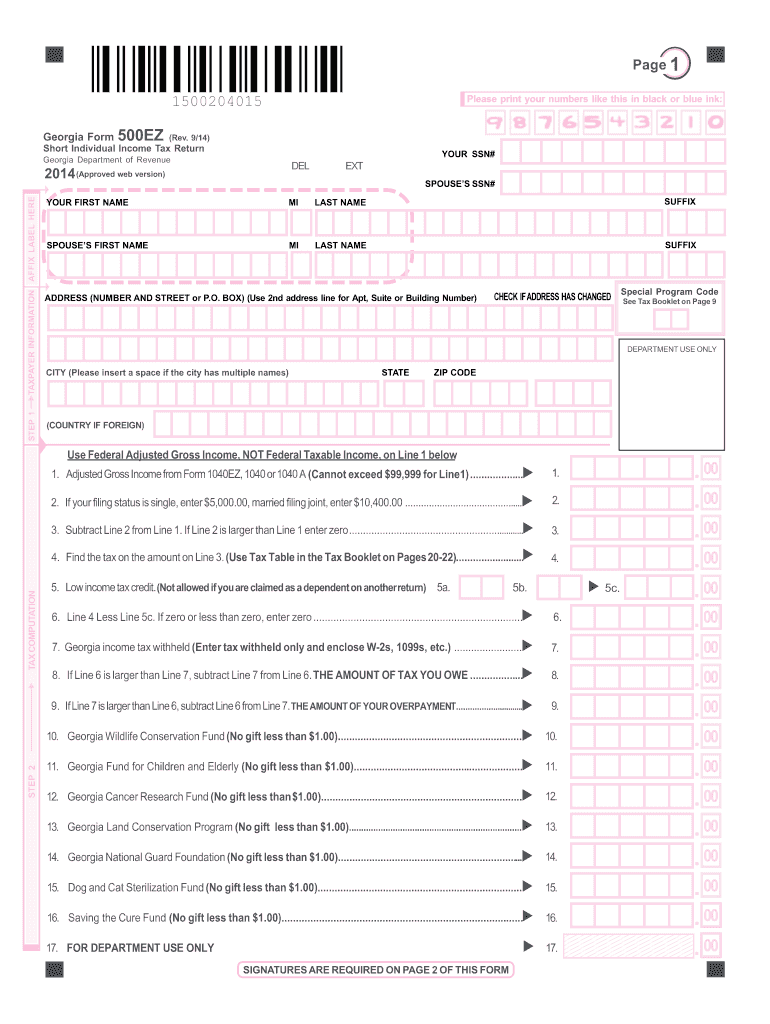

Georgia State Income Tax Form 500ez Kkload

https://kkload.weebly.com/uploads/1/3/4/3/134368882/247315007.png

Taxes In Georgia Country Income Corporate VAT More

https://expathub.ge/wp-content/uploads/2020/12/Taxes-in-Georgia-cover.jpg

The measure promises a 250 rebate for single filers 375 for single adults who head a household with dependents and 500 for married couples filing jointly The refund would only be paid to people who filed tax returns for both the 2020 and 2021 tax years Gov Brian Kemp has signed legislation that puts the wheels in motion to move Georgia to a flat state income tax The bill calls for the flat rate to drop beginning in 2024 and continue to drop

44 State ends fiscal year with another huge surplus despite slumping collections That means there may be another income tax refund to Georgians come spring 2024 Caption Credit AJC on Thirty four states will ring in the new year with notable taxA tax is a mandatory payment or charge collected by local state and national governments from individuals or businesses to cover the costs of general government services goods and activities changes including 17 states cutting individual or corporate income taxes and some cutting both

Georgia Tax Rebate Schedule When Can You Expect Your Refund Marca

https://phantom-marca.unidadeditorial.es/833ac641bd0aded8e3724f763ee84d4d/resize/1200/f/jpg/assets/multimedia/imagenes/2022/04/04/16490645502029.jpg

Perdue Proposes Eliminating Georgia State Income Tax 11alive

https://media.11alive.com/assets/WXIA/images/ad192733-1f1d-4626-ae4d-c09db200a37e/ad192733-1f1d-4626-ae4d-c09db200a37e_1920x1080.jpg

https://dor.georgia.gov/document/document/2024-employers-tax-guide/download

INTRODUCTION 3 BUSINESS ELECTRONIC FILING

https://gov.georgia.gov/press-releases/2023-12-04/gov-kemp-proposes-acceleration-largest-income-tax-cut-state-history

By accelerating the reduction the rate for Tax Year 2024 will be 5 39 percent rather than the 5 49 percent set by HB 1437 This will mark a cut of 36 basis points from the Tax Year 2023 rate of 5 75 percent

Georgia Income Tax Calculator 2023 2024

Georgia Tax Rebate Schedule When Can You Expect Your Refund Marca

Georgia State Income Tax Form 500ez Bestkup

The 2023 Tax Brackets By Income Modern Husbands Free Nude Porn Photos

Georgia Set To Distribute 500 Tax Rebate Directly To Your Account When To Receive Yours

2023 Georgia Income Tax Refund Surplus Check How Much Will I Get 11alive

2023 Georgia Income Tax Refund Surplus Check How Much Will I Get 11alive

Georgia 2022 Income Tax Updates Cherry Bekaert

Income Tax Rebate U s 87A For The Financial Year 2022 23

2014 Form GA 500EZ Fill Online Printable Fillable Blank PdfFiller

Georgia Income Tax Rebate 2024 - ATLANTA A 1 billion election year tax cut the Republican controlled General Assembly passed last year took effect on New Year s Day For now the phased in tax cut sets the state income tax rate for 2024 at a flat 5 49 down from the current 5 75 The tax rate will continue to decline annually arriving at 4 99 in 2029