Georgia Rebate 2024 Eligibility Last updated December 02 2023 Stimulus checks from the federal government ended a couple of years ago but some states have provided financial relief through tax rebate checks or inflation

ATLANTA Georgia is one of several U S states lowering individual income tax rates in 2024 meaning more financial relief for taxpayers in the Peach State Gov Brian Kemp signed HB 1437 into law on April 26 2022 The new law replacd the graduated personal income tax with a flat rate of 5 49 which took effect Jan 1 2024 with gradual rate reductions until the flat rate reaches 4 99 Georgia Power customers who install a Level 2 208 240v EVSE charger may qualify for a rebate for each charger installed This program has limited funds therefore rebates are offered for installations completed on or before December 31 2024 while funds are available

Georgia Rebate 2024 Eligibility

Georgia Rebate 2024 Eligibility

https://phantom-marca.unidadeditorial.es/833ac641bd0aded8e3724f763ee84d4d/resize/1200/f/jpg/assets/multimedia/imagenes/2022/04/04/16490645502029.jpg

Use This Free Covid 19 Relief Eligibility Test Get Your ERTC Rebate In Georgia

https://www.dailymoss.com/wp-content/uploads/2022/08/use-this-free-covid-19-relief-eligibility-test-amp-get-your-ertc-rebate-in-georg-62f1ff340c113.jpeg

2023 2024 Income Eligibility Guidelines CDPHE WIC

https://www.coloradowic.gov/sites/default/files/media/image/IEG 22-23 English_02.png

The money comes from more than 1 billion in surplus funds the state currently While some in Washington D C are calling for tax increases we re sending money back to hardworking Georgians How the program works Understanding where you can make updates to earn money saving rebates starts with a home energy assessment A comprehensive home review by an experienced professional Recommendations for upgrades to make your home more efficient and comfortable 50 of cost up to 150 from Georgia Power towards the assessment

Mitchell Kelly dca ga gov Over the last three decades the Housing Tax Credit has become the most successful affordable rental housing production program in history Georgia DCA awards Housing Tax Credits to qualified developers The program serves households with incomes between 20 Area Median Income AMI and 80 AMI Federal Solar Tax Credit ITC Using the ITC homeowners can receive 30 of the total solar energy system purchase price back on their tax returns December 31st 2032 Jackson EMC Solar Power Rebate Program Eligible homeowners can receive 250 per kilowatt installed on their homes capped at 2 500

Download Georgia Rebate 2024 Eligibility

More picture related to Georgia Rebate 2024 Eligibility

UPSC NDA 2024 Calendar Announced NDA 2024 Exam Date NDA 2023 Age Limit Best NDA Coaching

https://i.ytimg.com/vi/yMk23Oqv1ho/maxresdefault.jpg

2022 2023 USAV Age Chart Released Texas Pistols Volleyball

https://texaspistolsvolleyball.com/wp-content/uploads/2020/11/2022-2023-Age-Chart-768x575.jpg

GSTV U Save And S CC Rebates 950 000 Eligible Households To Receive Payouts Starting April

https://humanresourcesonline-assets.b-cdn.net/images/hr-sg/content-images/priya_apr_2023_mofsingapore_gstusave_gstscc_payouts_mofsingaporefb.jpg?auto_optimize=medium

In March Kemp signed a bill returned some of a record budget surplus back to Georgia taxpayers Under the bill most Georgians would receive up to 250 for single filers 375 for heads of To be eligible for the refund you should have filed by the April 18 2023 tax deadline Or if you were granted an extension you must file by Oct 16 2023 You also must have had a tax liability

In Georgia the average cost of a solar power system is 2 60 per watt You can expect to pay 15 600 for a 6 kW home solar system The 30 federal tax credit is 4 680 in this case The net cost The credit rate was originally scheduled to drop to 26 in 2022 22 in 2023 and 0 in 2024 In 2022 Congress signed the Inflation Reduction Act IRA which among other things improved the federal credit Georgia Solar Program This is a solar rebate offered by the U S Department of Energy Unfortunately it is only available to

UCEED Eligibility Criteria 2024 Qualifications Age Limit Entrance Exam UCEED 2024

https://i.ytimg.com/vi/aLfhfqXNFi0/maxresdefault.jpg

Grocery Rebate Canada 2024 Check Payment Date Eligibility Apply

https://cwccareers.in/wp-content/uploads/2023/12/Grocery-Rebate-Canada-2024-.jpg

https://www.kiplinger.com/taxes/state-stimulus-checks

Last updated December 02 2023 Stimulus checks from the federal government ended a couple of years ago but some states have provided financial relief through tax rebate checks or inflation

https://news.yahoo.com/georgia-income-tax-moves-flat-173143512.html

ATLANTA Georgia is one of several U S states lowering individual income tax rates in 2024 meaning more financial relief for taxpayers in the Peach State Gov Brian Kemp signed HB 1437 into law on April 26 2022 The new law replacd the graduated personal income tax with a flat rate of 5 49 which took effect Jan 1 2024 with gradual rate reductions until the flat rate reaches 4 99

NDA 1 2024 Eligibility Selection Process Vacancies Cut Off NDA 1 2024 Details Sumit Sir

UCEED Eligibility Criteria 2024 Qualifications Age Limit Entrance Exam UCEED 2024

Georgia Eligibility Form Fill Online Printable Fillable Blank PdfFiller

Get Up To A 300 Rebate On Bausch Lomb Contact Lenses Sunshine Optometry

Lensrebates Alcon Com

AlconChoice Rebate Form How To Qualify And Fill Out Printable Rebate Form

AlconChoice Rebate Form How To Qualify And Fill Out Printable Rebate Form

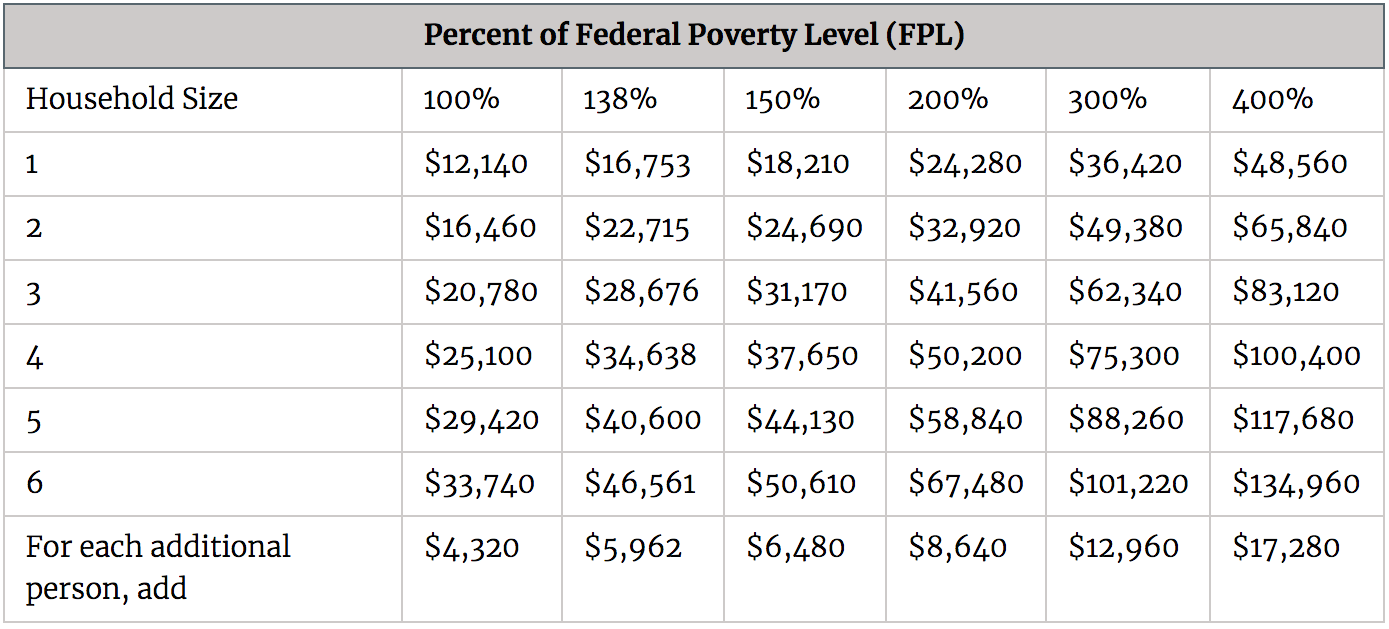

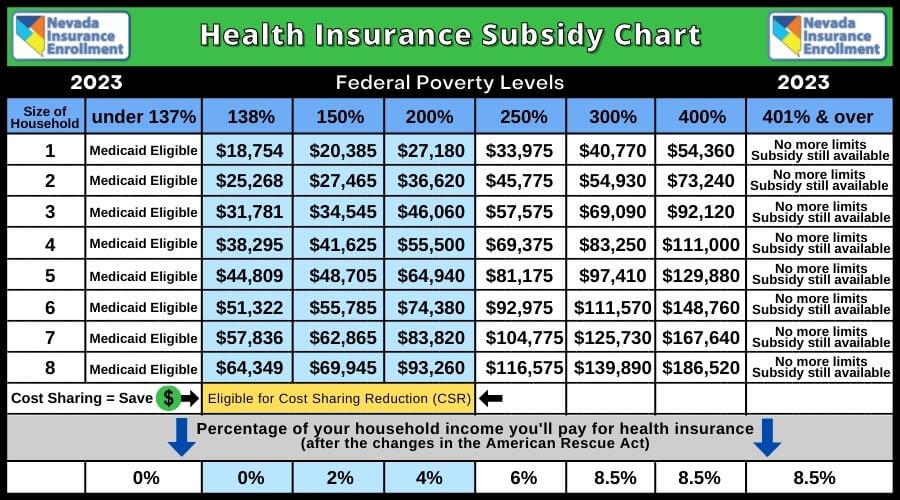

What Is Ohios Income Limit For Family To Get Caresource

Medicaid Obamacare Professor

Recovery Rebate Credit 2024 Eligibility Calculator How To Claim

Georgia Rebate 2024 Eligibility - On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax