Georgia State Tax Allowances Georgia provides a variety of withholding allowances that reduce your taxable income before employers calculate the deductions they make

Georgia withholding tax is the amount help from an employee s wages and paid directly by the employer This includes tax withheld from wages nonresident distributions lottery This publication contains information regarding withholding tax filing requirements based on the tax law as of January 1 2021 It includes applicable withholding tax tables basic

Georgia State Tax Allowances

Georgia State Tax Allowances

https://www.pdffiller.com/preview/6/325/6325846/large.png

Va Tax Changes 2024 Meade Sibilla

https://www.patriotsoftware.com/wp-content/uploads/2022/12/2023-Form-W-4.png

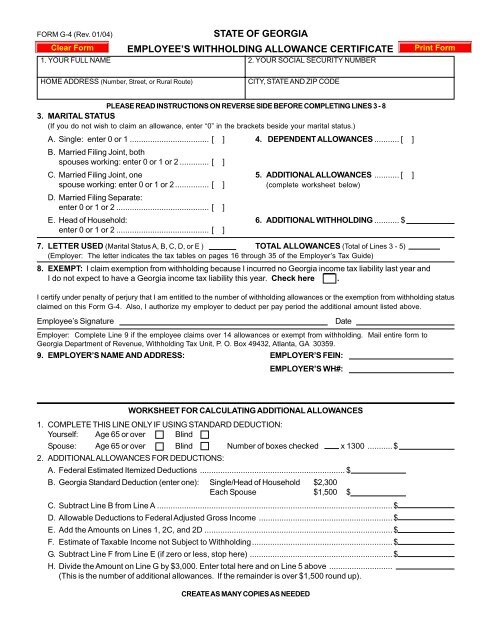

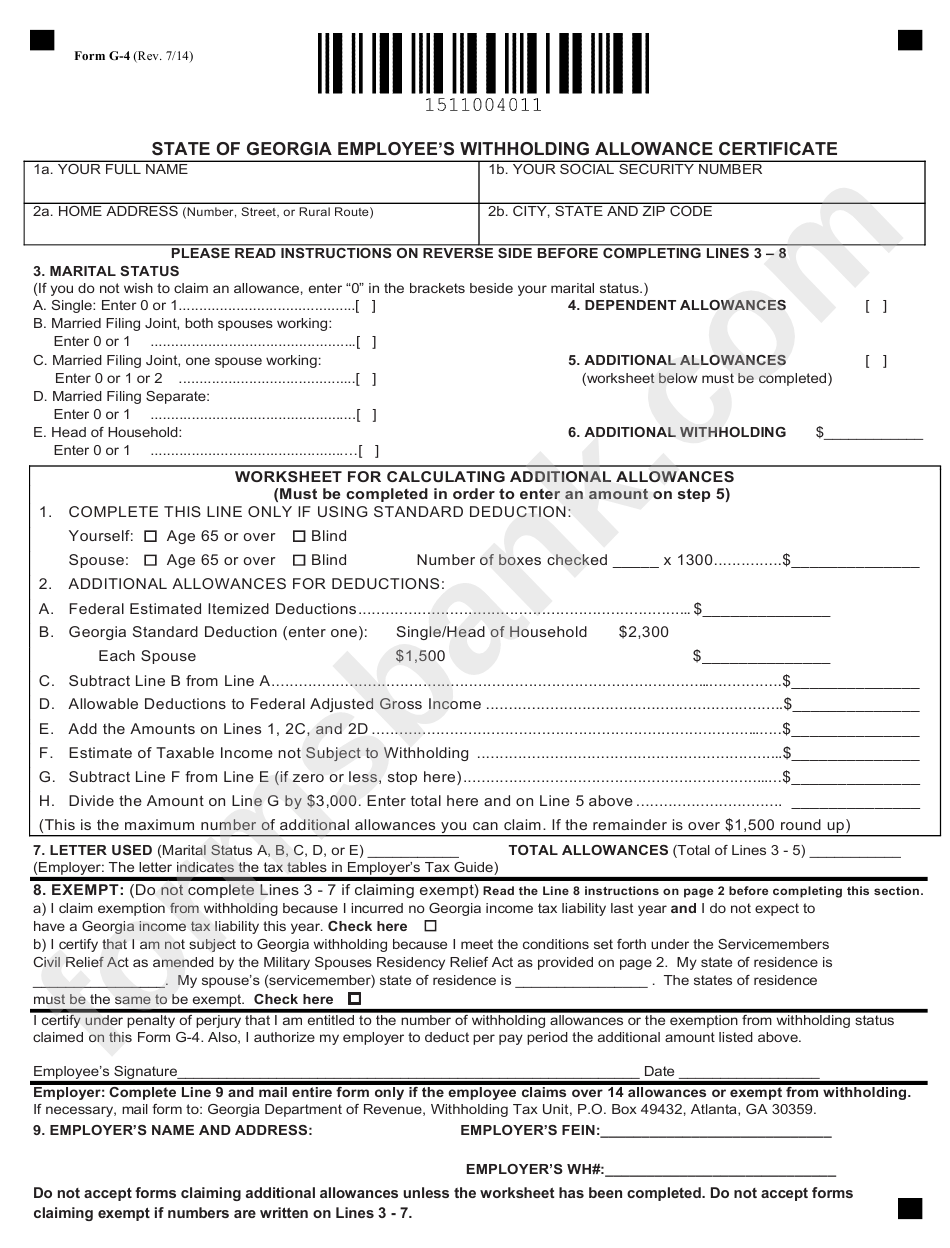

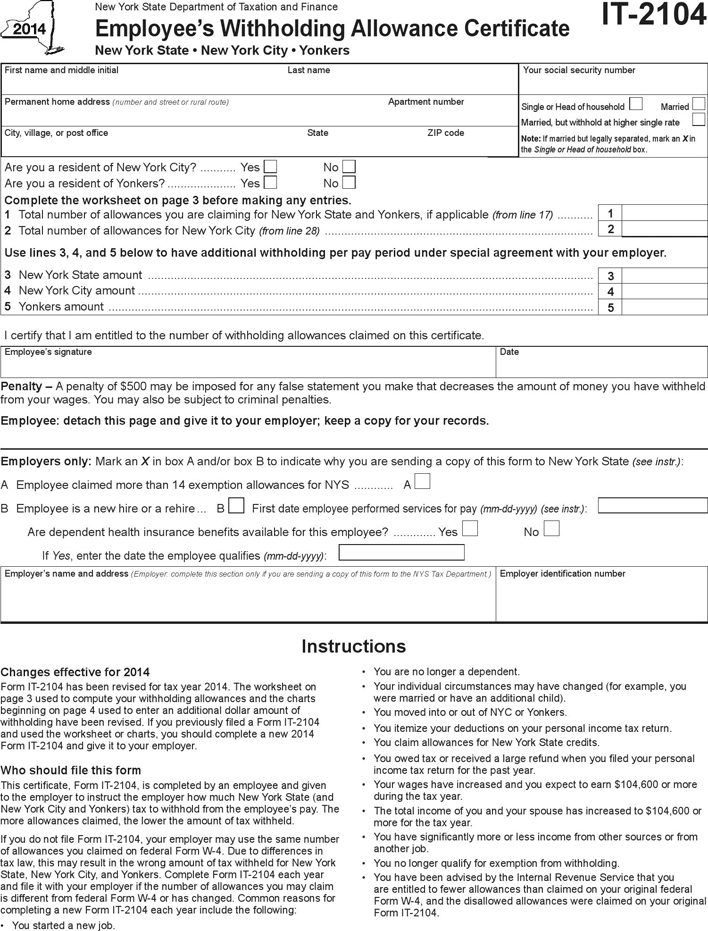

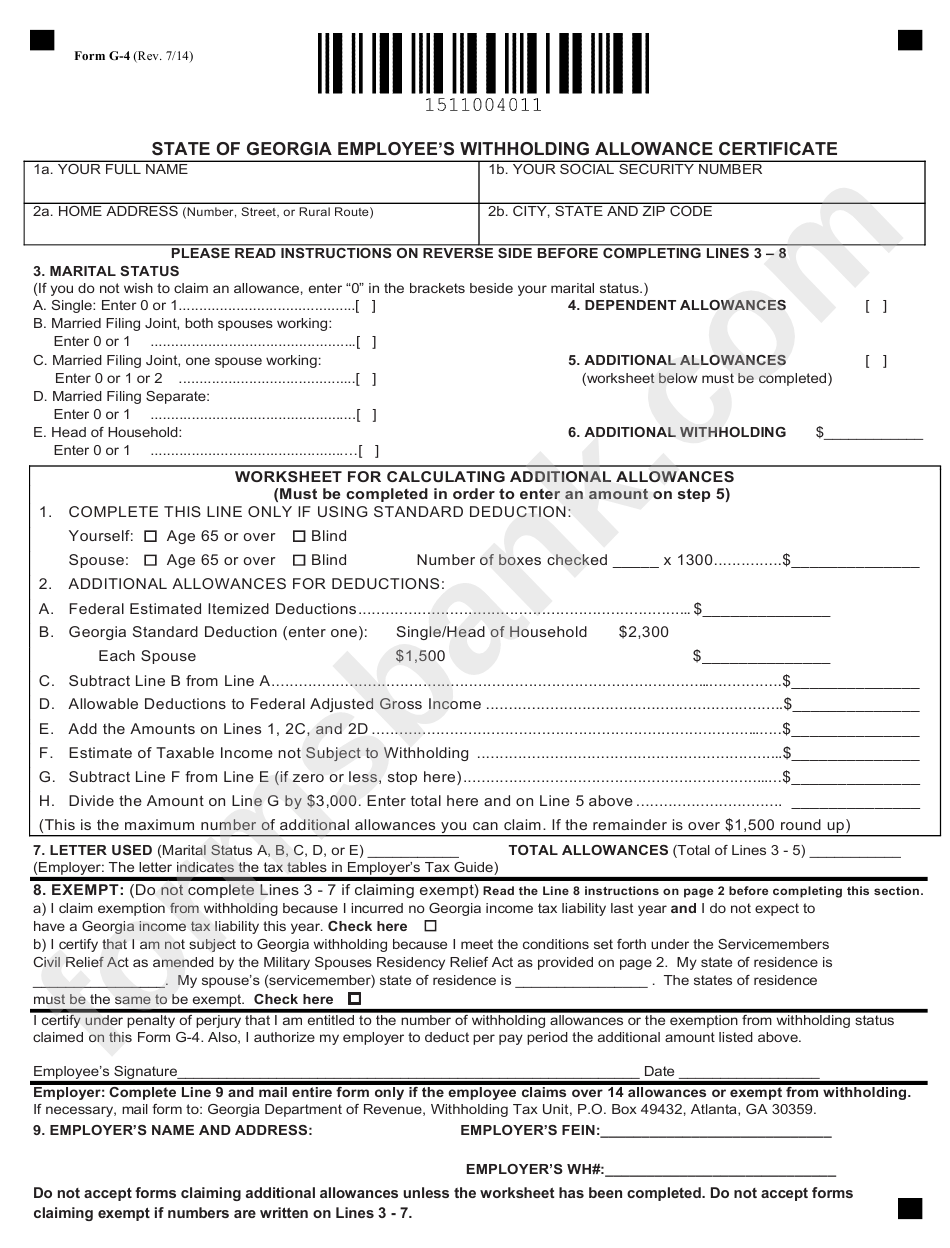

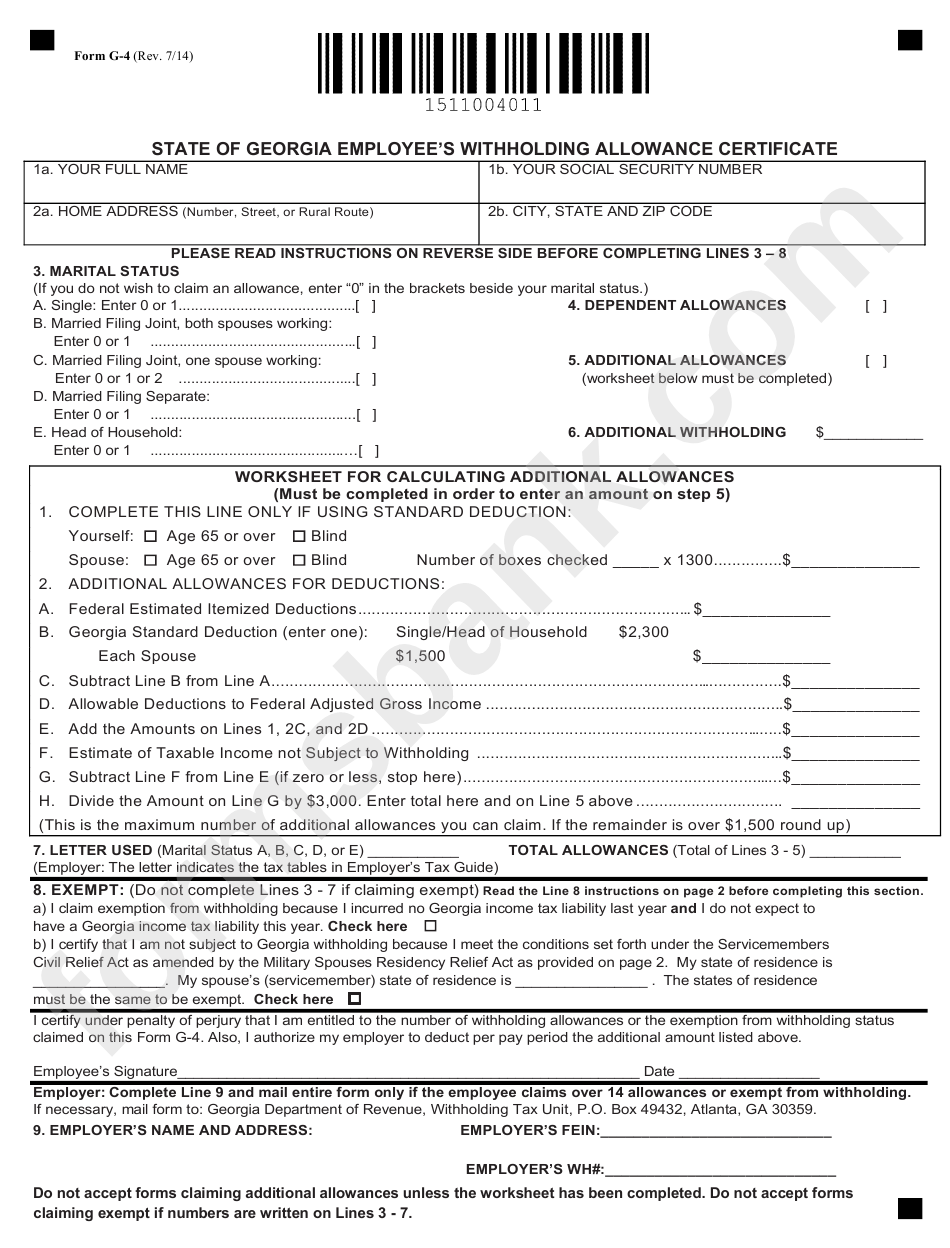

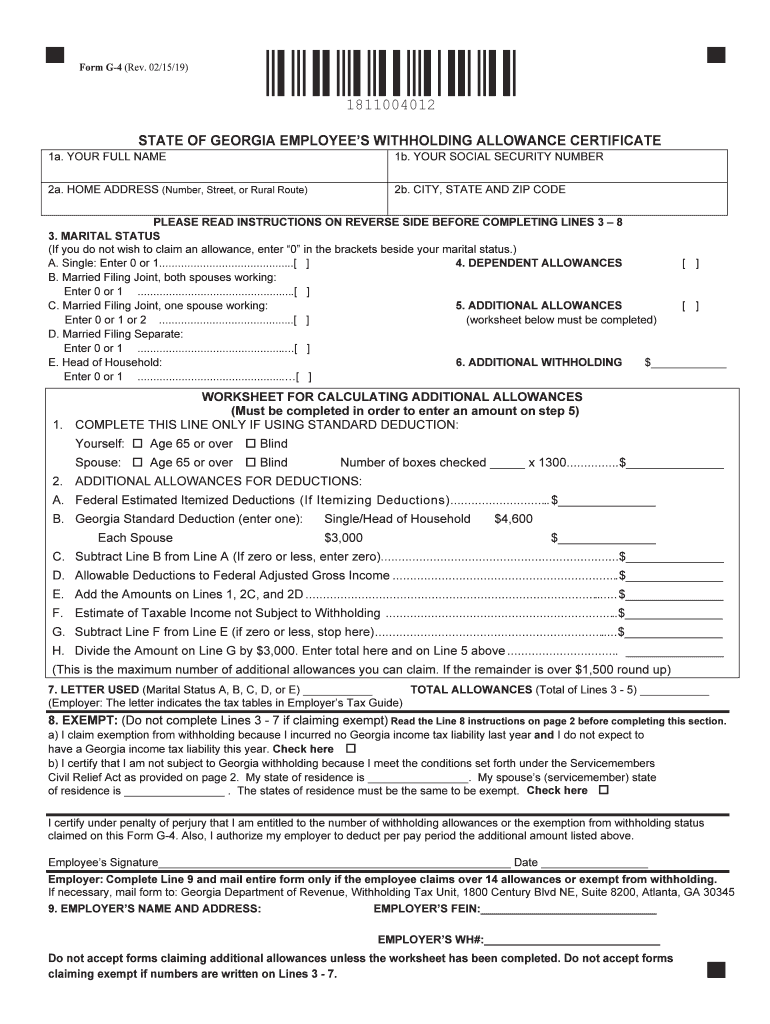

STATE OF GEORGIA EMPLOYEE S WITHHOLDING ALLOWANCE

https://img.yumpu.com/43100335/1/500x640/state-of-georgia-employees-withholding-allowance-.jpg

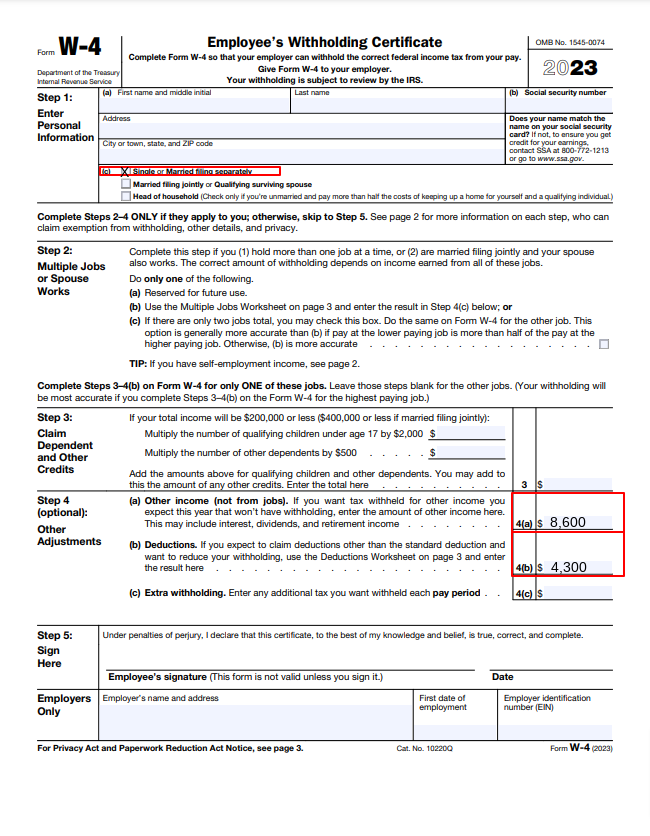

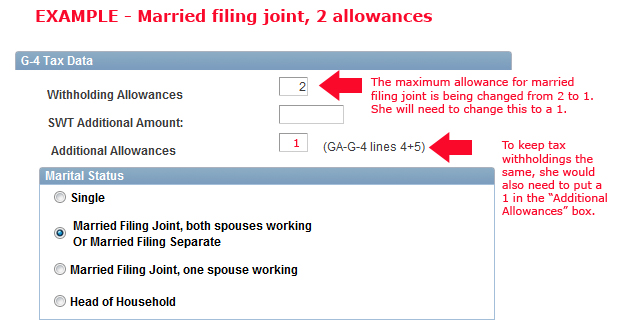

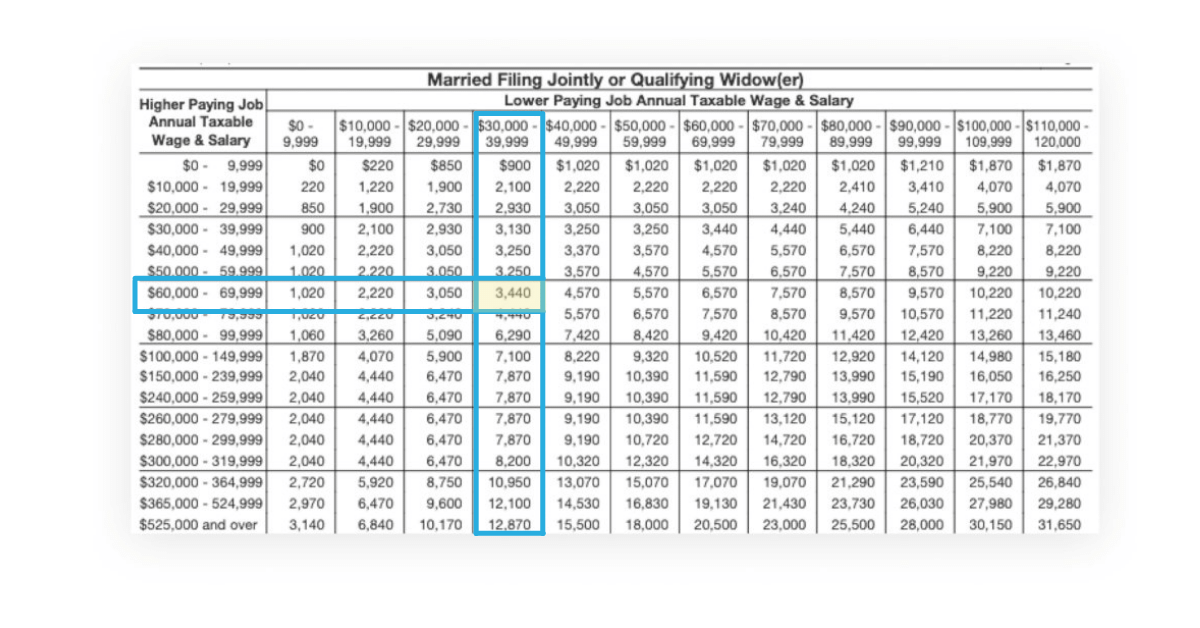

For 2023 tax returns filed in 2024 Georgia had six state income tax rates 1 2 3 4 5 and 5 75 Taxes owed depended on filing status and taxable income When you pay employees in Georgia you will need to set up their tax allowances as they indicated on their Georgia withholding form For more information and complete

The Georgia Department of Revenue has released its 2020 employer withholding tax guide which contains the income tax withholding wage bracket and percentage method SmartAsset s Georgia paycheck calculator shows your hourly and salary income after federal state and local taxes Enter your info to see your take home pay

Download Georgia State Tax Allowances

More picture related to Georgia State Tax Allowances

What Is A Withholding Allowance Tripmart

https://i.pinimg.com/originals/cf/00/51/cf00510d539e7da029407ba51cb53422.jpg

Employee s Withholding Allowance Certificate Free Download

https://www.formsbirds.com/formimg/employee-declaration-form/1185/employees-withholding-allowance-certificate-l1.png

Ms Employee Withholding Form 2023 Printable Forms Free Online

https://i0.wp.com/www.employeeform.net/wp-content/uploads/2022/07/free-ny-it-2104-employee-s-withholding-allowance-form-pdf-516kb-7-4.png

Georgia requires you to pay state income tax if you are a resident or nonresident who receives income from a Georgia source State income tax rates range from 1 to 52 rowsYour employees information on the W 4 state form determines how much you will withhold from their wages for state income tax Many states use state withholding allowances to determine

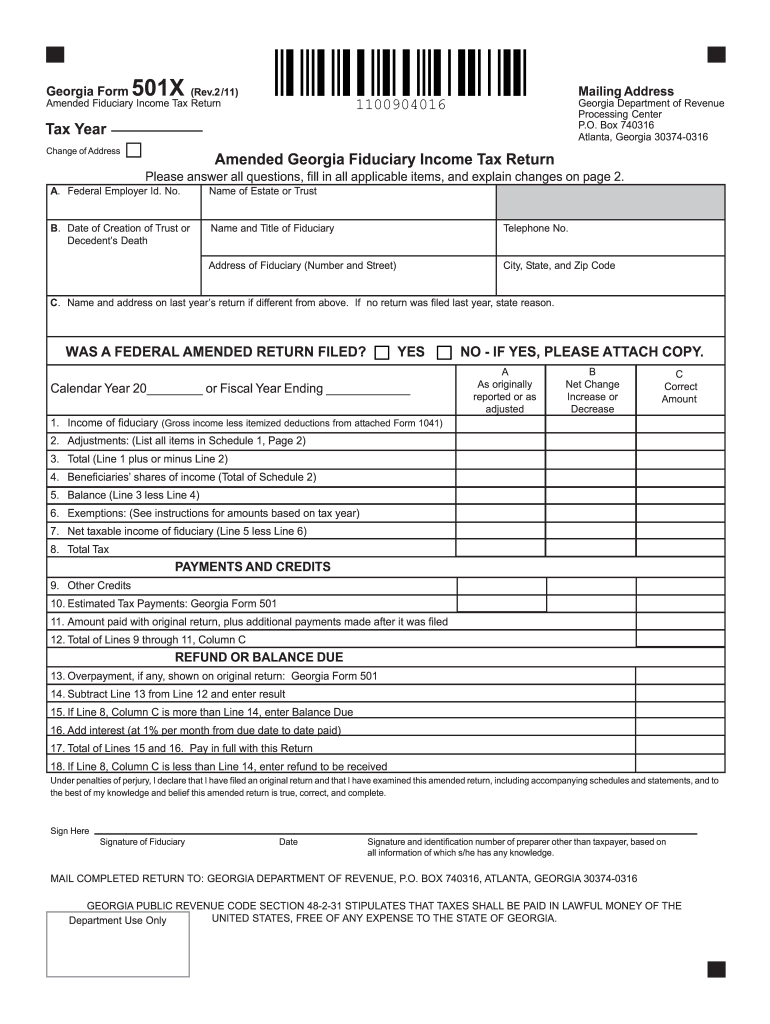

Georgia s withholding methods were updated June 4 to include changes to its tax rate and state allowance that take effect July 1 retroactively to Jan 1 2024 The Employees Withholding Allowance Certificate G 4 PDF 555 49 KB Form G4 is to be completed and submitted to your employer in order to have tax withheld from your wages

Georgia State Tax Withholding Form For Employees WithholdingForm

https://www.withholdingform.com/wp-content/uploads/2022/10/form-g-4-state-of-georgia-employee-s-withholding-allowance-5.png

Fab Four Binnacle Navigateur

https://i2.wp.com/financialsamurai.com/wp-content/uploads/2020/05/state-by-state-tax-guide-kiplinger.png?fit=1456,9999

https://www.sapling.com/12018010/many-clai…

Georgia provides a variety of withholding allowances that reduce your taxable income before employers calculate the deductions they make

https://dor.georgia.gov/taxes/withholding-tax-employers

Georgia withholding tax is the amount help from an employee s wages and paid directly by the employer This includes tax withheld from wages nonresident distributions lottery

Total Number Of Allowances You Are Claiming Arcticlasopa

Georgia State Tax Withholding Form For Employees WithholdingForm

News You Can Use July 15 2013

NJ Legal Weed Tax Breaks Highlights From Murphy s State Of The State

Form G 4 State Of Georgia Employee S Withholding Allowance

Georgia State Tax GoldDealer

Georgia State Tax GoldDealer

Ga Employee Withholding Form 2022 2024 Employeeform

Georgia State Tax Forms Printable Printable Forms Free Online

Payroll Withholding Calculator 2023 MonaDeimante

Georgia State Tax Allowances - When you pay employees in Georgia you will need to set up their tax allowances as they indicated on their Georgia withholding form For more information and complete