Georgia Tax Rebate 2024 Eligibility ATLANTA Ga Atlanta News First State legislative leaders held a news conference Wednesday to deliver a series of tax announcements aimed at bringing tax relief to Georgia families House Speaker Jon Burns announced three separate tax relief initiatives Right now there is no more important

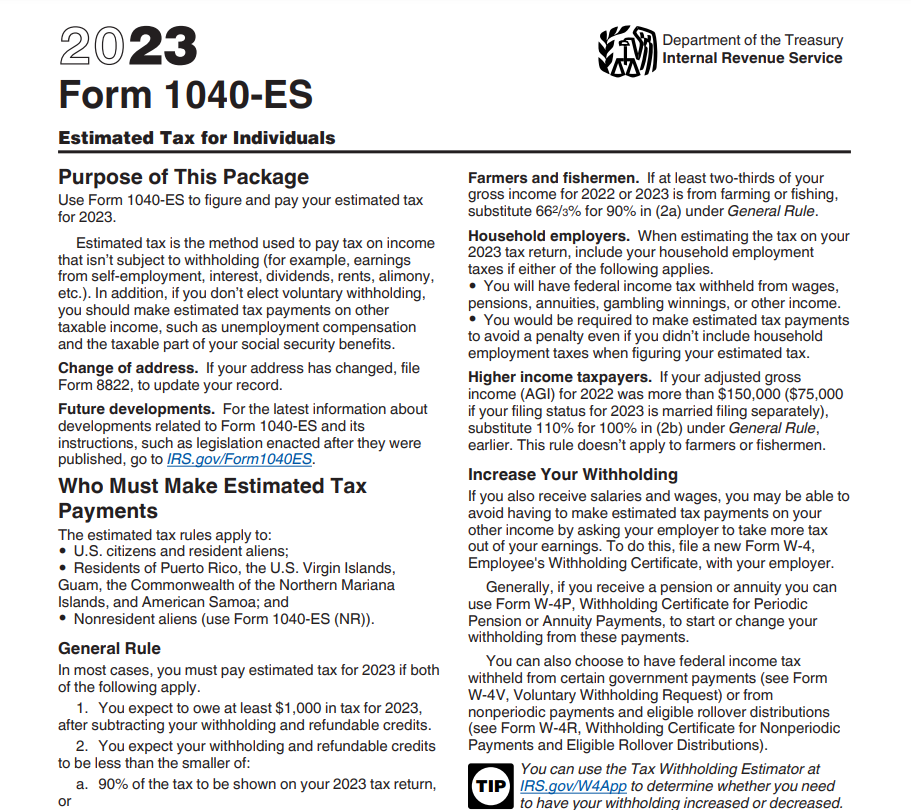

The Georgia Department of Revenue is working with software vendors to offer free electronic filing services to qualified Georgia taxpayers Please keep in mind the following Qualifying taxpayers can prepare and file both federal and Georgia individual income tax returns electronically using approved software for less or free of charge In 2024 Georgia lawmakers dropped the state s income tax from 5 75 to 5 49 Experts said this could save a family of four earning 75 000 income about 650 per year

Georgia Tax Rebate 2024 Eligibility

Georgia Tax Rebate 2024 Eligibility

http://printablerebateform.net/wp-content/uploads/2023/03/Georgia-Tax-Rebate-2023.png

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/EUE5M4WUMVGXRLG56GYBBNFX4U.jpg)

Georgia Tax Refund Still Haven t Seen Your Tax Rebate More Are Being Sent Out Soon WSB TV

https://cmg-cmg-tv-10010-prod.cdn.arcpublishing.com/resizer/l3iP9gpUiwxSbOw02DKpUI_I-9s=/1440x810/filters:format(jpg):quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/EUE5M4WUMVGXRLG56GYBBNFX4U.jpg

Brian Kemp Wants To Give Georgians At Least 250 Tax Rebate With State s Surplus Cash

https://d.newsweek.com/en/full/1967836/georgia-cash-surplus-plans.jpg

Apart from offering income tax refunds and property tax rebates from Georgia Gov Kemp also recommends using the surplus to improve education healthcare and provide affordable housing Gov Kemp s recommendations include setting aside 745 million in AFY 2023 and over 1 1 billion in FY 2024 for K 12 education and 303 million to adjust Jeff Amy Georgia House Speaker Jon Burns R Newington announces plans for an increased state income tax deduction for children Wednesday Jan 24 2024 at the state Capitol in Atlanta

People who filed tax returns in both 2021 and 2022 are eligible to receive the money which the Department of Revenue will start issuing in six to eight weeks Taxpayers must file their taxes The income tax rebate would give 1 billion dollars back to Georgia tax payers Single filers would be eligble for a 250 rebate while joint filers would recieve a 500 rebate Gov Kemp motioned the rebate after the state s surplus for fiscal 2022 was recorded at nearly 6 6 billion People such as those on social security would not be

Download Georgia Tax Rebate 2024 Eligibility

More picture related to Georgia Tax Rebate 2024 Eligibility

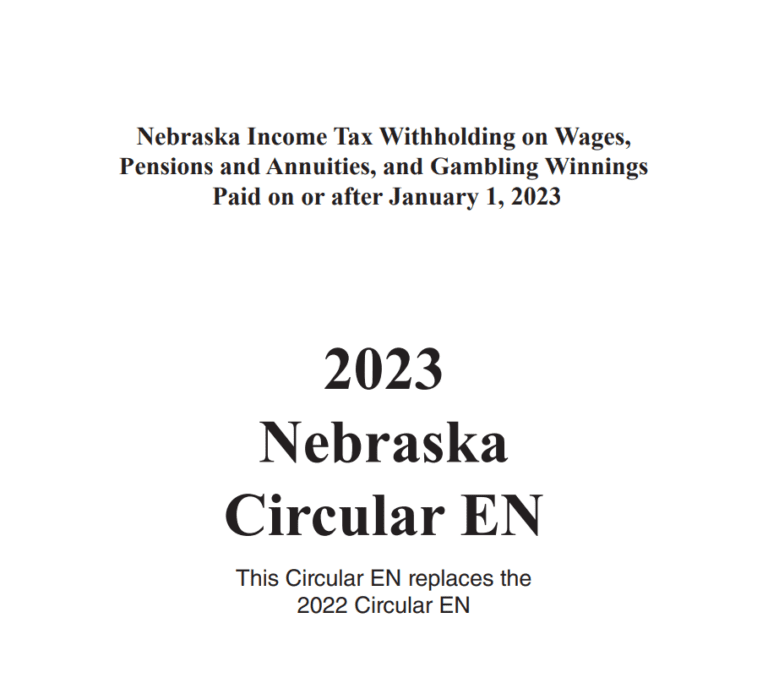

Nebraska Tax Rebate 2024 Eligibility Application Deadline Status PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2023/04/Nebraska-Tax-Rebate-2023-768x678.png

Who Is Eligible For The Council Tax Rebate Eligibility For The 150 Support And Payment

https://worldcitieschess.com/wp-content/uploads/2022/08/Who-is-eligible-for-the-council-tax-rebate-Eligibility-for-1024x683.jpg

(8).png)

HHM CPAs

https://global-uploads.webflow.com/6318e0f8eb1356b63a1cf3d4/6480de3495234daf1cfceaf8_Blog Banners (Blog Banner) (8).png

The Georgia Department of Revenue has begun issuing a special state income tax refund Governor Brian Kemp signed a bill in March that would give most Georgians up to 500 in refunds The money This legislation will amend HB 1437 which provides for a step down of 10 basis points in the income tax rate starting in 2025 and for each taxable year thereafter until the rate reaches 4 99 percent By accelerating the reduction the rate for Tax Year 2024 will be 5 39 percent rather than the 5 49 percent set by HB 1437

You may be eligible for the HB 162 Surplus Tax Refund if you Keep reading to learn more about the eligibility requirements and how to check the status of your Surplus Refund Please allow 6 8 weeks for refunds to be issued if filed by the April 18 2023 deadline Check Your Surplus Tax Refund Online Are you eligible Georgia s taxes are going down and earlier than expected As of Monday the new year brought in a new tax rate lowered from an income tax of 5 75 to 5 49 Gov Brian Kemp wants that income

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate-1024x576.jpg

2023 Georgia Tax Changes Surplus Tax Rebate Atlanta CPA

https://windhambrannon.com/wp-content/uploads/2023/04/AdobeStock_65426563-scaled-1-1160x774.jpeg

https://www.atlantanewsfirst.com/2024/01/24/georgia-house-speaker-make-major-tax-announcement/

ATLANTA Ga Atlanta News First State legislative leaders held a news conference Wednesday to deliver a series of tax announcements aimed at bringing tax relief to Georgia families House Speaker Jon Burns announced three separate tax relief initiatives Right now there is no more important

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/EUE5M4WUMVGXRLG56GYBBNFX4U.jpg?w=186)

https://dor.georgia.gov/taxes/free-file-alliance

The Georgia Department of Revenue is working with software vendors to offer free electronic filing services to qualified Georgia taxpayers Please keep in mind the following Qualifying taxpayers can prepare and file both federal and Georgia individual income tax returns electronically using approved software for less or free of charge

Income Tax Rebate Under Section 87A

Virginia Tax Rebate 2024

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Get Up To 1 300 In Tax Rebates Eligibility Criteria

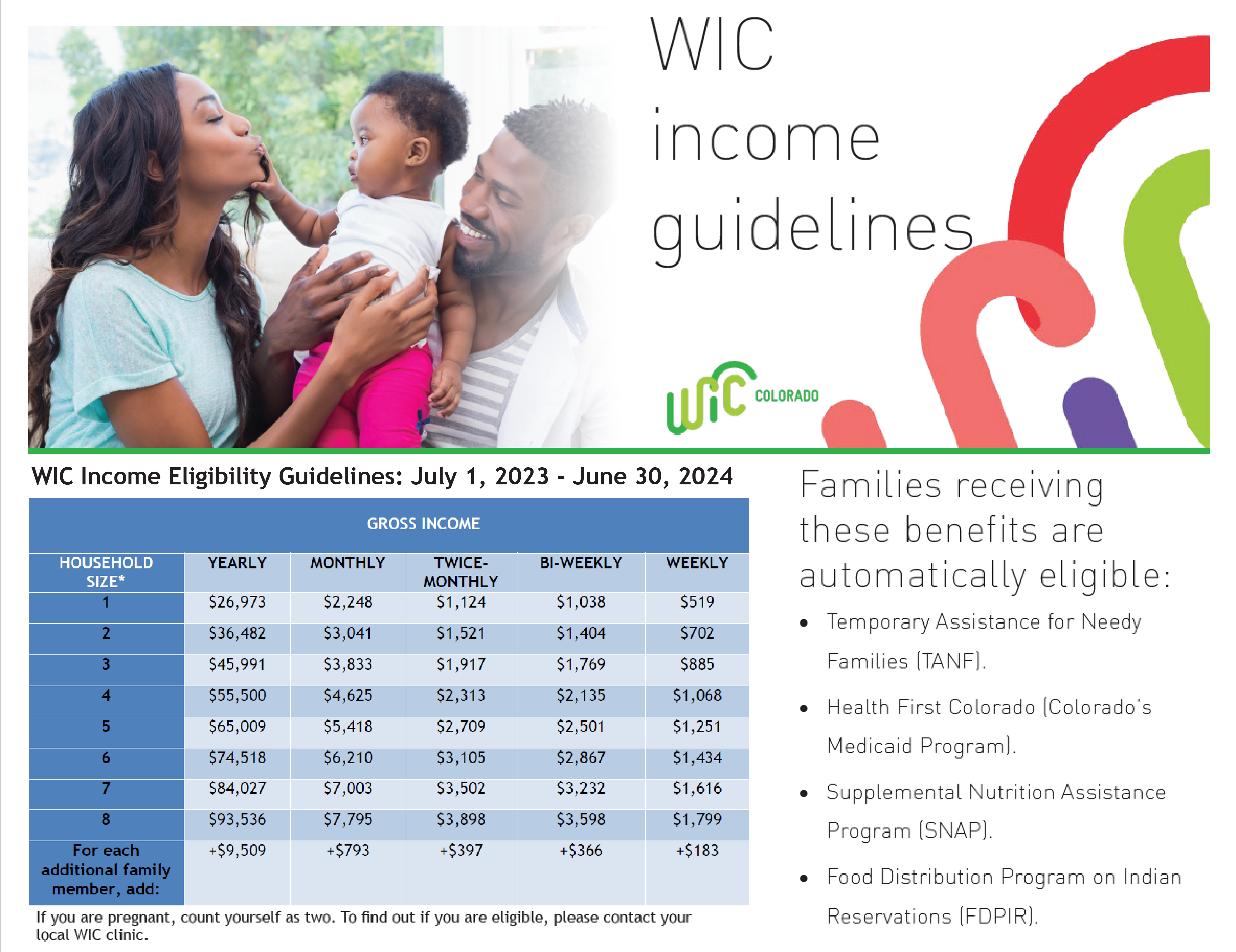

2023 2024 Income Eligibility Guidelines CDPHE WIC

GSTV U Save And S CC Rebates 950 000 Eligible Households To Receive Payouts Starting April

GSTV U Save And S CC Rebates 950 000 Eligible Households To Receive Payouts Starting April

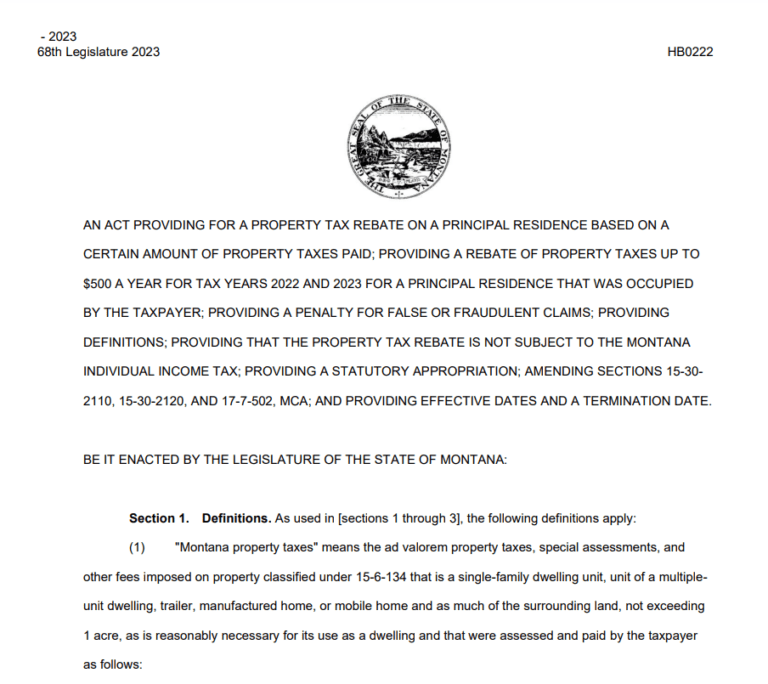

Montana Tax Rebate 2023 Benefits Eligibility How To Apply PrintableRebateForm

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim PrintableRebateForm

Georgia Tax Rebate 2024 Eligibility - People who filed tax returns in both 2021 and 2022 are eligible to receive the money which the Department of Revenue will start issuing in six to eight weeks Taxpayers must file their taxes