Geothermal Tax Rebate Web Le taux de 30 du CITE s applique sur une base de d 233 penses Ces d 233 penses ne doivent d 233 passer les plafonds l 233 gaux 224 savoir 8 000 pour une personne seule et

Web 30 d 233 c 2022 nbsp 0183 32 See tax credits for 2022 and previous years The following Residential Clean Energy Tax Credit amounts apply for the prescribed periods 30 for property placed in Web G 233 othermie profonde I 3 I CONDITIONS D ELIGIBILITE ET DE FINANCEMENT 2021 L octroi de l aide est subordonn 233 224 l adh 233 sion de l op 233 ration au Fonds de garantie

Geothermal Tax Rebate

Geothermal Tax Rebate

https://www.hauserair.com/wp-content/uploads/2020/02/geothermal-1-624x781-1.png

Geothermal Heat Pump Tax Rebate PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/what-incentives-rebates-are-available-for-geothermal-in-connecticut-2.png

ENERGY STAR Rebates For Home Appliances PSEG Long Island

https://www.psegliny.com/saveenergyandmoney/-/media/4DD7C03D215B4B8D92D8A70026290724.ashx

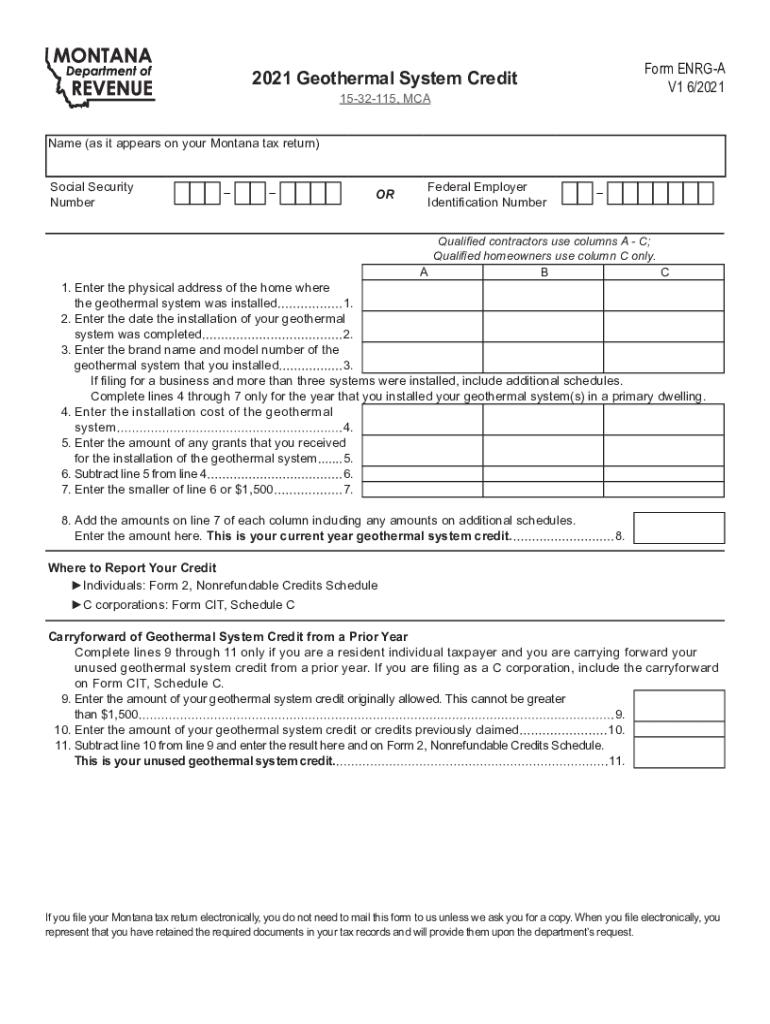

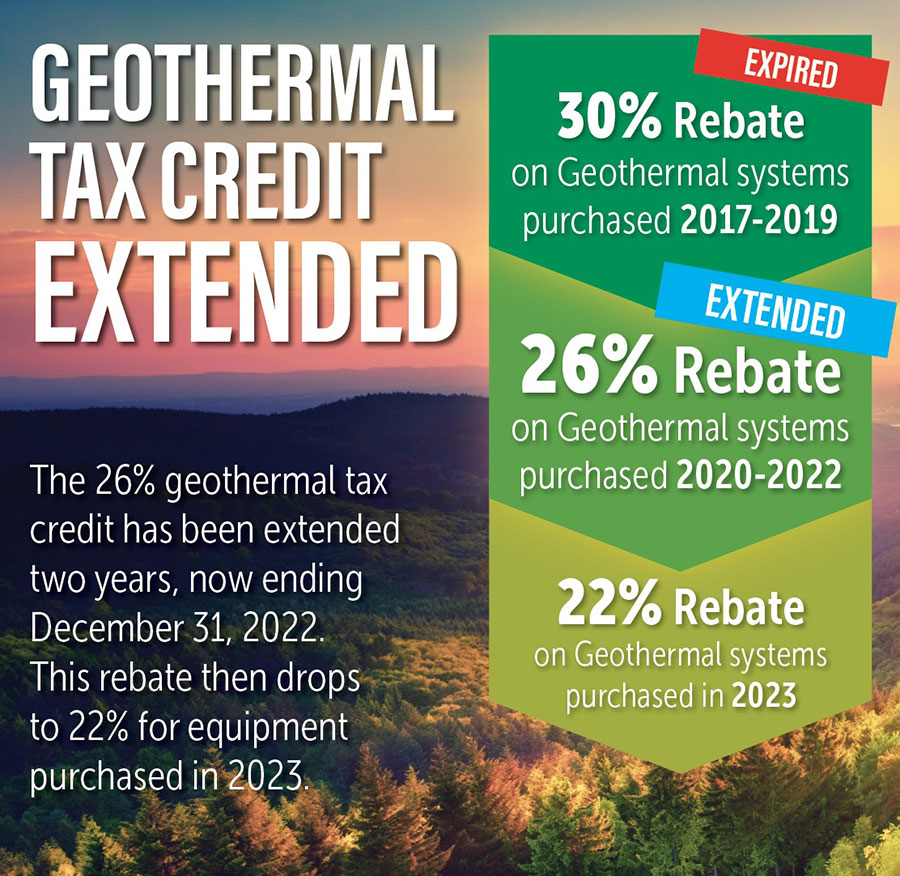

Web The Geothermal Tax Credit is classified as a non refundable personal tax credit It is an amount that is applied to your tax liability what you owe to the IRS in order to reduce or Web 4 janv 2021 nbsp 0183 32 Claiming a geothermal tax credit is as simple as filing your taxes next year The IRS issues federal tax credits themselves When submitting a tax return file

Web 4 mai 2023 nbsp 0183 32 Taxpayers who invest in energy improvements for their main home including solar wind geothermal fuel cells or battery storage may qualify for an annual Web 2034 22 The commercial tax credit is extended under a two tier structure A quot base rate quot of 6 or 1 5 of the bonus rate A quot bonus rate quot of 30 An additional Domestic Content

Download Geothermal Tax Rebate

More picture related to Geothermal Tax Rebate

Connecticut Light and Power Co Residential Geothermal Rebates

https://imgv2-2-f.scribdassets.com/img/document/125270046/original/c1c2a9d10f/1592909115?v=1

Energy Efficiency Tax Rebates Solar Energy Companies Energy

https://i.pinimg.com/originals/a9/10/96/a91096d8bb02f51a320d34d438372b3f.jpg

Heat Pump Geothermal Tax Credit PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2023/01/form-rpd-41346-geothermal-ground-coupled-heat-pump-tax-credit-claim.png?fit=530%2C749&ssl=1

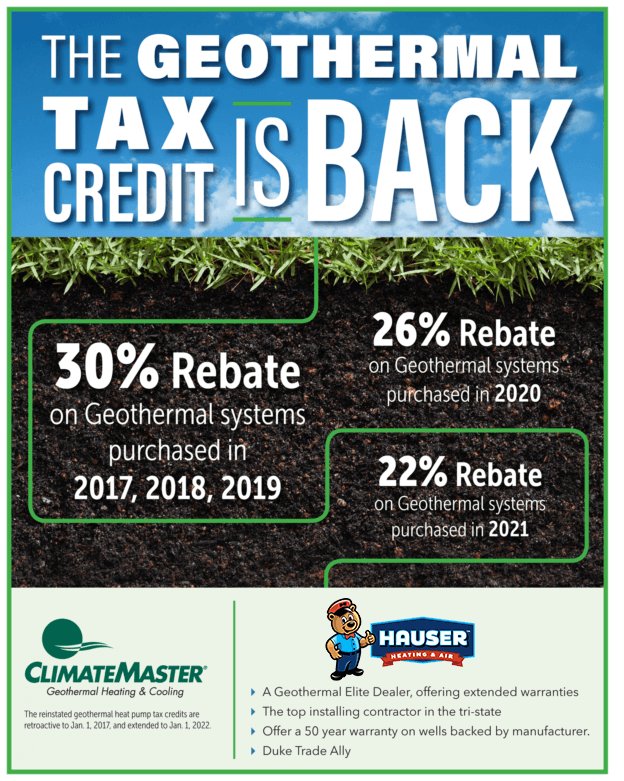

Web A 30 federal tax credit for residential ground source heat pump installations has been extended through December 31 2032 The incentive will be lowered to 26 for systems Web 9 f 233 vr 2023 nbsp 0183 32 You ll get a 30 tax break for expenses related to qualified improvements that use alternative power like solar wind geothermal or biomass energy The tax credit

Web 3 d 233 c 2019 nbsp 0183 32 The federal tax credit initially allowed homeowners to claim 30 percent of the amount they spent on purchasing and installing a geothermal heat pump system from Web Incentives for Geothermal Heat Pumps The 30 federal tax credit was extended through 2032 and will drop to 26 in 2033 and to 22 in 2034 before expiring altogether so act

30 Tax Rebate HB McClure

http://hbmcclure.com/wp-content/uploads/30-Percent-tax-credit-geothermal-1.jpg

Geothermal Tax Credit PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2023/01/geothermal-tax-credit.jpg

https://www.quelleenergie.fr/economies-energie/pompe-chaleur...

Web Le taux de 30 du CITE s applique sur une base de d 233 penses Ces d 233 penses ne doivent d 233 passer les plafonds l 233 gaux 224 savoir 8 000 pour une personne seule et

https://www.energystar.gov/about/federal_tax_credits/geothermal_heat_p…

Web 30 d 233 c 2022 nbsp 0183 32 See tax credits for 2022 and previous years The following Residential Clean Energy Tax Credit amounts apply for the prescribed periods 30 for property placed in

Vermont Energy Tax Credit Rebates Grants For Solar Wind And

30 Tax Rebate HB McClure

Fillable Online Understand The Geothermal Tax Credit Form Fill Out

Geothermal Rebates Extended Corken Steel Products

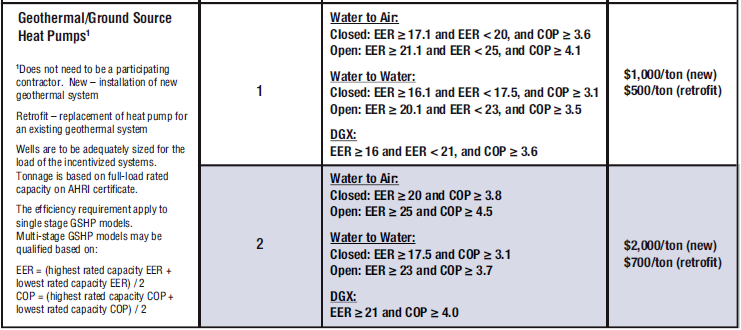

Geothermal Rebates Take Up To 45 Off Your Total Cost Of Job When You

Tax Rebates For Heat Pumps 2022 PumpRebate

Tax Rebates For Heat Pumps 2022 PumpRebate

Nys Star Tax Rebate Checks 2022 StarRebate

Agnus Good

The Homeowners Guide To Energy Tax Credits And Rebates Constellation

Geothermal Tax Rebate - Web The Geothermal Tax Credit is classified as a non refundable personal tax credit It is an amount that is applied to your tax liability what you owe to the IRS in order to reduce or