Geothermal Tax Rebates Web 28 ao 251 t 2023 nbsp 0183 32 If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual

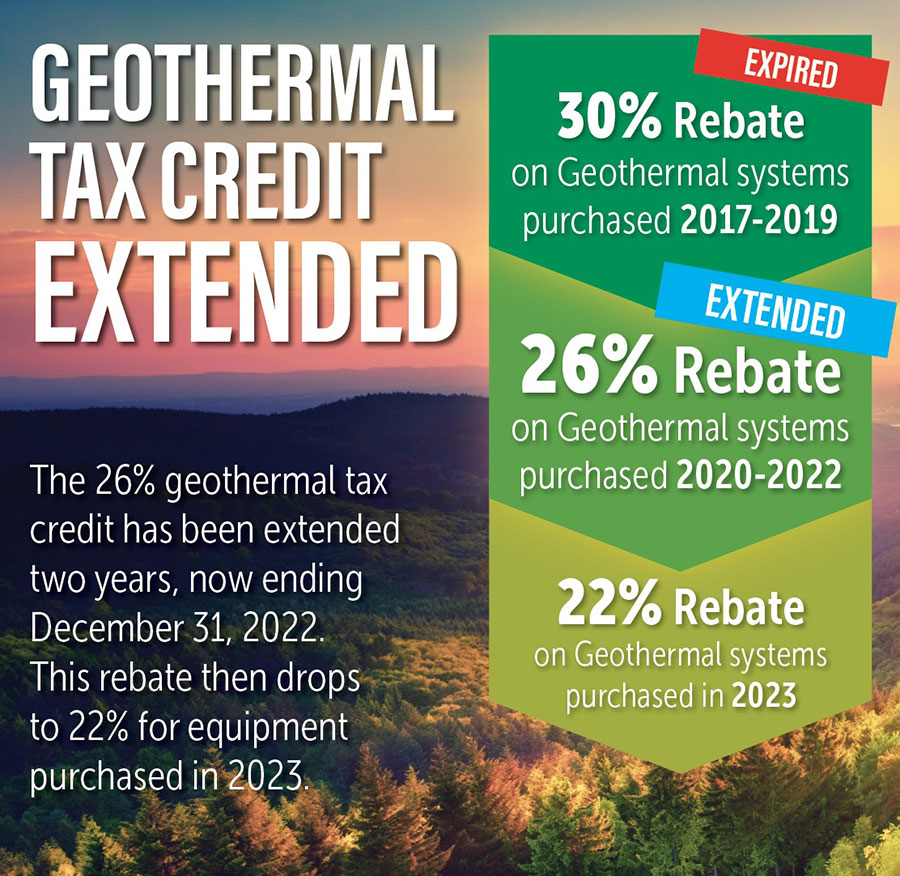

Web A 30 federal tax credit for residential ground source heat pump installations has been extended through December 31 2032 The incentive will be lowered to 26 for systems that are installed in 2033 and 22 in Web 3 d 233 c 2019 nbsp 0183 32 The federal tax credit initially allowed homeowners to claim 30 percent of the amount they spent on purchasing and installing a geothermal heat pump system from their federal income taxes The tax credit

Geothermal Tax Rebates

Geothermal Tax Rebates

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2023/01/form-rpd-41346-new-mexico-geothermal-ground-coupled-heat-pump-tax.png?w=530&ssl=1

Geothermal Heat Pump Tax Rebate PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/what-incentives-rebates-are-available-for-geothermal-in-connecticut-2.png

Connecticut Light and Power Co Residential Geothermal Rebates

https://imgv2-2-f.scribdassets.com/img/document/125270046/original/c1c2a9d10f/1592909115?v=1

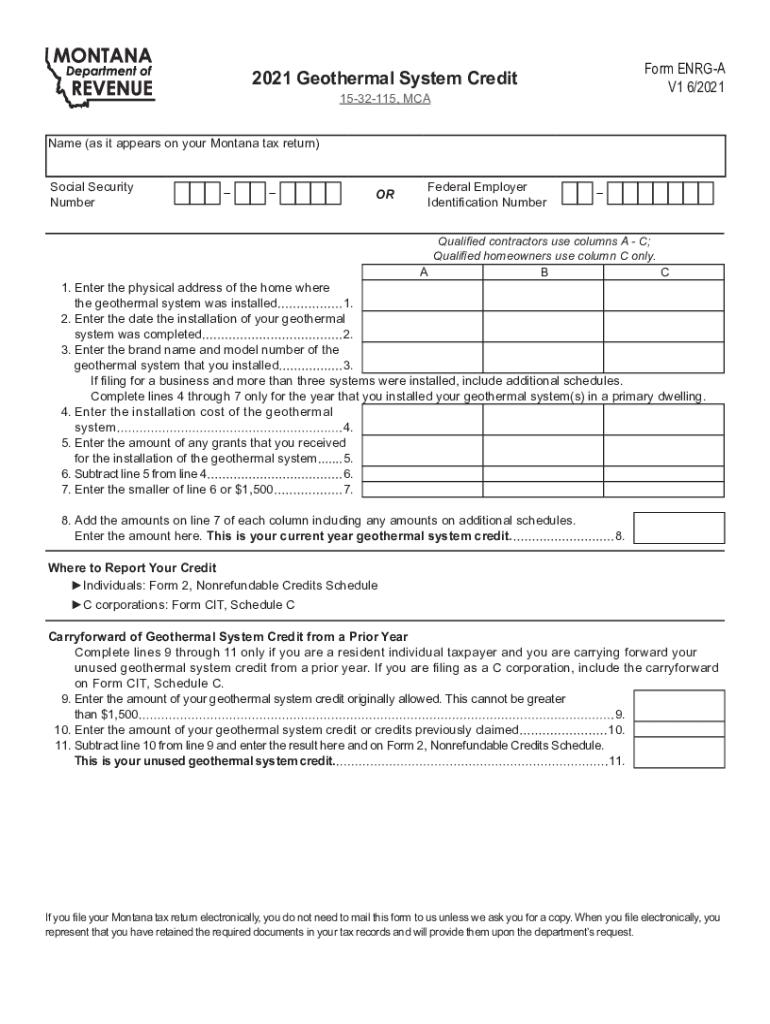

Web Geothermal Tax Credits Governments see that there are advantages in both the environmental and fiscal impacts of geothermal As a result there are many incentives Web 4 janv 2021 nbsp 0183 32 When submitting a tax return file Form 5695 under Residential Energy Credits to get credit for your geothermal heat pump For more information about the process of claiming your tax credit visit

Web 2034 22 The commercial tax credit is extended under a two tier structure A quot base rate quot of 6 or 1 5 of the bonus rate A quot bonus rate quot of 30 An additional Domestic Content Web 4 mai 2023 nbsp 0183 32 IR 2023 97 May 4 2023 WASHINGTON The Internal Revenue Service reminds taxpayers that making certain energy efficient updates to their homes could

Download Geothermal Tax Rebates

More picture related to Geothermal Tax Rebates

Read This Regarding The Changes Just Announced Regarding The Geothermal

https://i.pinimg.com/originals/33/5f/1a/335f1a0dbeba2d091dae7849a3738384.png

Geothermal Rebates Extended Corken Steel Products

https://corkensteel.com/wp-content/uploads/2021/08/geo-extension-2022.jpg

Vermont Energy Tax Credit Rebates Grants For Solar Wind And

https://i.pinimg.com/originals/34/0c/9c/340c9c4124f57767c3b9b5489ec3494e.jpg

Web 30 d 233 c 2022 nbsp 0183 32 In addition to the energy efficiency credits homeowners can also take advantage of the modified and extended Residential Clean Energy credit which provides a 30 percent income tax credit for clean energy Web 1 janv 2023 nbsp 0183 32 Clean Vehicle Credits If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can

Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can Web The geothermal system must be installed in the United States in a home owned by the taxpayer The tax credit applies for geothermal installations in new and existing homes

Energy Efficiency Tax Rebates Solar Energy Companies Energy

https://i.pinimg.com/originals/a9/10/96/a91096d8bb02f51a320d34d438372b3f.jpg

Tax Rebates For Heat Pumps 2022 PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/geothermal-rebates-take-up-to-45-off-your-total-cost-of-job-when-you-6.png

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

Web 28 ao 251 t 2023 nbsp 0183 32 If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual

https://www.waterfurnace.com/residential/ab…

Web A 30 federal tax credit for residential ground source heat pump installations has been extended through December 31 2032 The incentive will be lowered to 26 for systems that are installed in 2033 and 22 in

Geothermal Tax Credit PumpRebate

Energy Efficiency Tax Rebates Solar Energy Companies Energy

30 Percent Tax Credit Geothermal 06 16 HB McClure Company

Fillable Online Understand The Geothermal Tax Credit Form Fill Out

Geothermal Rebates Take Up To 45 Off Your Total Cost Of Job When You

Geothermal Wins With New IRA Tax Credits HVAC Distributors

Geothermal Wins With New IRA Tax Credits HVAC Distributors

Mass Save Rebates For Water Furnace Geothermal Heating Mass Save Rebate

Rebates Incentives For Waterless DX Geothermal

Geothermal Heat Geothermal Heat Pump Tax Credit PumpRebate

Geothermal Tax Rebates - Web 4 mai 2023 nbsp 0183 32 IR 2023 97 May 4 2023 WASHINGTON The Internal Revenue Service reminds taxpayers that making certain energy efficient updates to their homes could