Gift Tax Return Due Date 2022 Extension Use Form 8892 to request an extension for Form 709 and make a payment of gift tax

Gift recipients must pay gift tax for gifts worth 5 000 or more This also concerns gifts received from the same donor during a three year period if the aggregate value reaches 5 000 or goes Gift tax returns that have been extended can provide a breather for tax preparers That time should be used to plan the return obtain relevant information and identify issues

Gift Tax Return Due Date 2022 Extension

Gift Tax Return Due Date 2022 Extension

https://www.blog.priortax.com/wp-content/uploads/2022/11/when-are-taxes-due-2022-1.png

INCOME TAX RETURN DUE DATE FY 2021 22 AY 2022 23 WILL ITR DUE DATE

https://i.ytimg.com/vi/_z-Z3hV2SmQ/maxresdefault.jpg

Income Tax Due Dates For FY 2021 22 AY 2022 23 CACube

https://cacube.in/wp-content/uploads/2018/08/pexels-photo-6863259.jpeg

If you think you ll need more time to prepare your return you can file for a tax extension Filing an extension gives you until Oct 15 to get your return finalized IRS Form 709 is due by Tax Day usually on or around April 15 of the year following the year in which you make the taxable gifts If you find that you have to file IRS Form 4868 to request an automatic six month extension to file

For 2022 returns it s April 18 2023 or October 16 2023 if you file for an extension But keep in mind that if you owe gift tax the payment deadline is April 18 regardless of whether you file for an extension If a taxpayer does not request an extension for their income tax return Form 8892 is filed by the regular Form 709 due date for an automatic six month extension What can be considered a

Download Gift Tax Return Due Date 2022 Extension

More picture related to Gift Tax Return Due Date 2022 Extension

UPDATED 3 30 20 Gift Tax Return Due Dates Extended To July 15 2020

https://morgandisalvo.com/wp-content/uploads/2020/03/AdobeStock_244470043-scaled.jpeg

Gift Tax Limit 2022 Explanation Exemptions Calculation How To Avoid It

https://www.carboncollective.co/hs-fs/hubfs/2022_and_2021_Federal_Gift_Tax_Rates.png?width=2946&height=3240&name=2022_and_2021_Federal_Gift_Tax_Rates.png

Extend Due Dates Of Income Tax Returns From 31 07 2022 To 31 08 2022

https://taxguru.in/wp-content/uploads/2022/07/Extend-due-dates-of-Income-tax-returns-from-31.07.2022-to-31.08.2022.jpg

If you extend your Form 1040 tax return filing to October 15 the extended due date also applies to your gift tax return If you re married you can t file a joint gift tax return Each spouse needs to file a separate return if they make any If April 15th falls on a weekend or holiday the gift tax return due date is extended to the next business day If you re not ready to file by then you can request an extension for your income

Department of the Treasury Internal Revenue Service United States Gift and Generation Skipping Transfer Tax Return Go to www irs gov Form709 for instructions and the latest Rev Proc 2022 32 became effective July 8 2022 On or before the fifth anniversary of a decedent s date of death it is the exclusive procedure for obtaining an

Gift Tax Limit 2022 Calculation Filing And How To Avoid Gift Tax

https://learn.financestrategists.com/wp-content/uploads/Lifetime_Gift_Tax_Exemption_2022_-_Sample_Calculation.png

Due Date ITR Fiing For AY 2023 24 Is July 31st 2023 Academy Tax4wealth

https://academy.tax4wealth.com/public/storage/uploads/1686567553-file-income-tax-return-for-ay-2023-24-by-july-31st-2023.jpg

https://www.irs.gov/forms-pubs/about-form-8892

Use Form 8892 to request an extension for Form 709 and make a payment of gift tax

https://www.vero.fi/en/individuals/property/gifts

Gift recipients must pay gift tax for gifts worth 5 000 or more This also concerns gifts received from the same donor during a three year period if the aggregate value reaches 5 000 or goes

Know The Last Date To File Income Tax Return For FY 2021 22 AY 2022 23

Gift Tax Limit 2022 Calculation Filing And How To Avoid Gift Tax

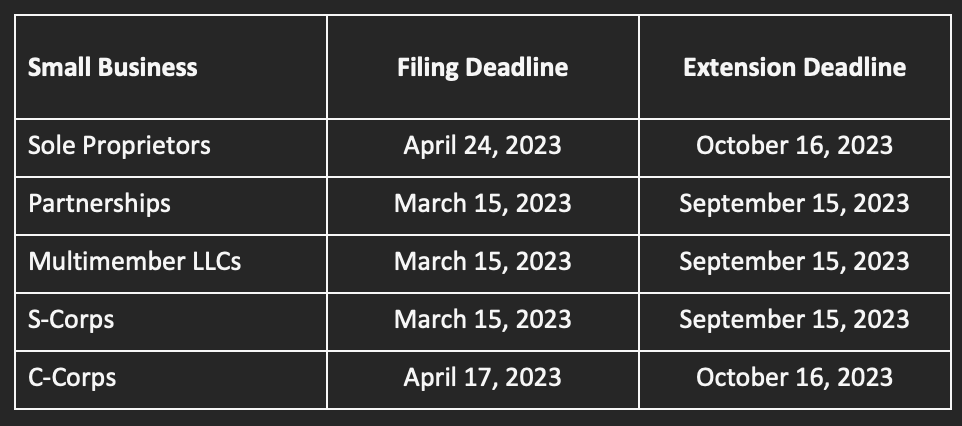

Tax Extension 2022 AislingTyler

Last Date To File Income Tax Return ITR For FY 2022 23 AY 2023 24

When Are 2021 Taxes Due Southernapo

Due dates For ITR Filing Online For FY 2022 23 Ebizfiling

Due dates For ITR Filing Online For FY 2022 23 Ebizfiling

Tax Advisory Capital Partners CPA Limited

Income Tax Returns Filing Due Dates Extended Ebizfiling

2022 Federal Tax Refund Calendar

Gift Tax Return Due Date 2022 Extension - IRS Form 709 is due by Tax Day usually on or around April 15 of the year following the year in which you make the taxable gifts If you find that you have to file IRS Form 4868 to request an automatic six month extension to file