Gluten Tax Credit Canada We ve answered some common questions on tax credits and support available below What do I need to do to claim my gluten free food expenses Food expenses due to allergies can be claimed as medical

To claim a medical expense tax credit for the purchase of gluten free food You must have a have a letter from a medical practitioner certifying that you have celiac disease For people living with Celiac Disease you will be happy to know that the Canada Revenue Agency does allow a tax deduction for the purchase of gluten free products The Canada

Gluten Tax Credit Canada

Gluten Tax Credit Canada

http://lifechiropracticpsl.com/wp-content/uploads/2015/01/Gluten-free-stamp.gif

With The Participation Of Canada The Canadian Film Of Video Production

https://i.pinimg.com/originals/aa/60/32/aa60329d06ee2c2b47c1f795c44d3048.png

The Gluten Free Lifestyle Modus Vivendi

https://modvive.com/wp-content/uploads/2020/08/gluten-free-tips.jpg

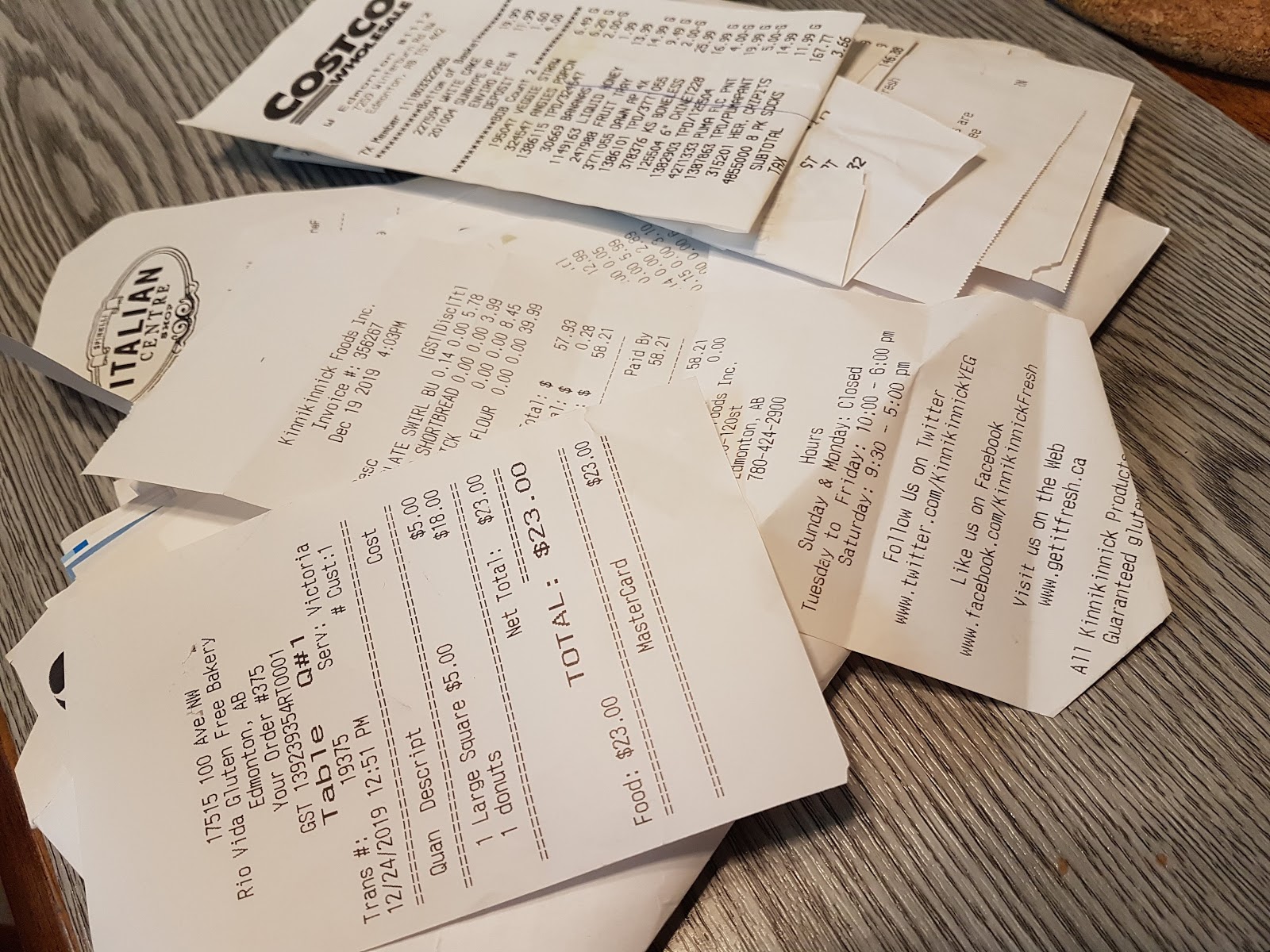

Some individuals can claim the Incremental cost of Gluten free Food as a medical expense on their income tax Turbo Tax has a webpage explaining how to claim medical expenses on your Section 118 2 2 r of the Income Tax Act provides for a non refundable medical expense credit for the incremental and pro rated cost of gluten free food for Canadians with celiac disease This

But since Canadian celiac disease sufferers are purchasing more expensive foods for health reasons the good news is that they can claim gluten free products on their tax According to Revenue Canada the items claimed on the spreadsheet to qualify as gluten free item must be 1 Items purchased or ingredients purchased to make gluten free food that are

Download Gluten Tax Credit Canada

More picture related to Gluten Tax Credit Canada

GLUTEN FREE DIET

https://gfb.global.ssl.fastly.net/wp-content/uploads/2014/08/gluten.png

Sin Gluten Pegui

https://www.pegui.com/wp-content/uploads/2016/11/gluten-free-1218048_1280.png

How To Claim Gluten Free Purchases For Your Taxes In Canada

https://1.bp.blogspot.com/-5VfeqcsS6G8/XhSxZy2_NSI/AAAAAAAB4MI/38FdaTrJmqsHssHGX9B5dlFGnyayOiSDgCKgBGAsYHg/s1600/IMG_20200106_100326_719.jpg

Despite popular diets the Canada Revenue Agency CRA knows that eating gluten free may be a medical requirement in these cases you can claim these costs as a medical expense Does your household qualify for this Celiac Disease and Canadian Income Tax As of 2003 incremental additional costs of Gluten Free GF products are an eligible medical expense on T1 individual tax return Individuals

Celiac Tax Credit Canada Is Celiac Disease A Disability Wondering if you could be eligible for a celiac tax credit This article will walk you through what you should know Persons who suffer from celiac disease gluten intolerance are entitled to claim the incremental costs associated with the purchase of gluten free GF products as a medical

Pasta Sin Gluten Gluten Free Pasta Gluten Free Cooking Gluten Free

https://i.pinimg.com/originals/5a/70/eb/5a70eb19ebc72dbc86e2b52b10b78bf4.jpg

https://hesabdarema.com/wp-content/uploads/2022/04/Tax-credit.jpg

https://www.hrblock.ca › blog › on-a-gluten …

We ve answered some common questions on tax credits and support available below What do I need to do to claim my gluten free food expenses Food expenses due to allergies can be claimed as medical

https://turbotax.intuit.ca › tips › dietary-expenses...

To claim a medical expense tax credit for the purchase of gluten free food You must have a have a letter from a medical practitioner certifying that you have celiac disease

Should I Be Filing For A Gluten Free Food Tax Deduction Gluten Free

Pasta Sin Gluten Gluten Free Pasta Gluten Free Cooking Gluten Free

What Is Gluten Free Diet Or Recipes For Weight Loss What Gluten Free

Gluten Free 1KG Bag Sweet Mixes

The Canadian Film Or Production Tax Credit And Quebecor Fund Tax

The Gluten Free Goods Store

The Gluten Free Goods Store

Credits Skindigenous

Gluten Free Creations Inc Carmel IN

Lung Health formerly Allertrex 31 95 From The Finchley Clinic

Gluten Tax Credit Canada - The tax offset system used in Canada for GFD coverage takes the form of a reimbursement of a cost previously incurred Hence the program does not help celiac patients