Gluten Tax Deduction Most people who are living gluten free would agree that gluten free foods tend to be costlier than conventional foods When these foods are required for medical reasons is it possible to deduct them from your taxes as a medical

You may deduct the cost of Gluten Free GF food that is in EXCESS of the cost of the gluten containing food that you are replacing For example if a loaf of gluten free bread costs 5 00 Given how expensive gluten free foods may be many people on a gluten free diet are interested in saving money NCA is frequently asked about how to deduct the cost of gluten free food on

Gluten Tax Deduction

![]()

Gluten Tax Deduction

https://onplanners.com/sites/default/files/styles/template_fancy/public/template-images/printable-simple-tax-deductions-tracker-template-template.png

Gluten Free Tax Deduction Guide For Celiac And Other Special Diets

https://gfreefoodie.com/wp-content/uploads/2018/05/Best-Ever-Gluten-Free-Brownies-4-600x400.jpg

Gluten Free Tax Deduction Guide For Celiac And Other Special Diets

https://gfreefoodie.com/wp-content/uploads/2018/05/Best-Ever-Gluten-Free-Brownies-4-850x567.jpg

Gluten free food expenses can be ducted from taxes as part of medical expense deductions for people with Celiac Disease You must have a medical diagnosis or letter from a doctor directing you to follow a gluten free diet to take the deduction Here is how you can do a quick calculation to see how much money you could save by deducting the extra prices of gluten free foods First grab your most recently filed tax return You re

Individuals diagnosed with celiac disease may be able to receive tax deductions for expenses associated with gluten free foods and products However there are a few catches to obtaining them Tax law says you can deduct qualified medical expenses that exceed 7 5 of your adjusted gross income If your income is 60 000 per year that means you can deduct all

Download Gluten Tax Deduction

More picture related to Gluten Tax Deduction

Small Business Tax Deductions Worksheets

https://www.housview.com/wp-content/uploads/2018/08/small_business_tax_deductions_worksheet_the_best_worksheets_image_3.jpg

Should I Be Filing For A Gluten Free Food Tax Deduction Gluten Free

https://i.pinimg.com/736x/12/a6/a0/12a6a0f1835e1593cba1fcae23b799da.jpg

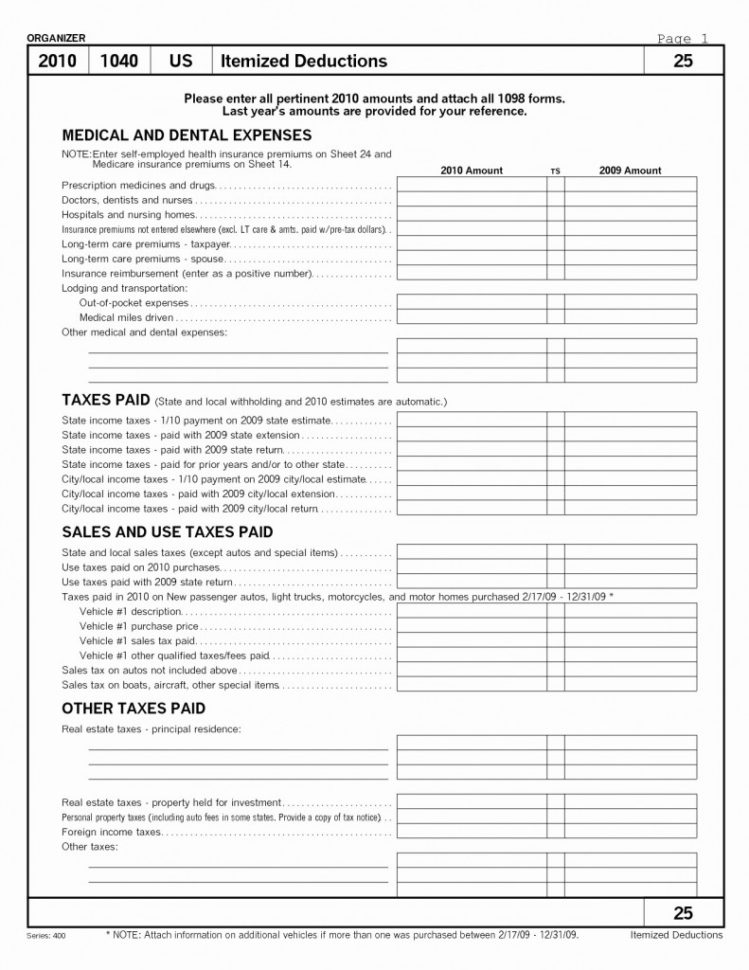

Itemized Deductions Spreadsheet Db excel

https://db-excel.com/wp-content/uploads/2019/01/itemized-deductions-spreadsheet-pertaining-to-business-itemized-deductions-worksheet-austinroofing-749x970.jpg

Many people are eating gluten free for a variety of reasons but only those with an official diagnosis with a gluten related disorder will be eligible for a tax deduction You ll need a To be eligible to deduct the excess costs of a gluten free diet under Internal Revenue Code Section 213 you must have a documented reason to require the observance of a gluten free

If you are diagnosed with celiac disease you may be able to claim tax deductions for the extra costs associated with buying gluten free food and products Any cost you incur for shipping gluten free foods is deductible You may not claim a tax deduction for any medical expenses paid for with funds from Health Savings Accounts or

Should I Be Filing For A Gluten Free Food Tax Deduction Gluten Free

https://i.pinimg.com/originals/02/9a/28/029a28c1f249f6b4b27a0d52c9b2d600.jpg

10 Tax Deduction Worksheet Worksheeto

https://www.worksheeto.com/postpic/2012/03/2015-itemized-tax-deduction-worksheet-printable_426931.png

https://gluten.org › is-your-gluten-free...

Most people who are living gluten free would agree that gluten free foods tend to be costlier than conventional foods When these foods are required for medical reasons is it possible to deduct them from your taxes as a medical

https://celiac.org › wp-content › uploads

You may deduct the cost of Gluten Free GF food that is in EXCESS of the cost of the gluten containing food that you are replacing For example if a loaf of gluten free bread costs 5 00

Itemized Deduction Worksheet Excel

Should I Be Filing For A Gluten Free Food Tax Deduction Gluten Free

California Itemized Deductions Worksheet

Student Loan Interest Deduction Worksheet Db excel

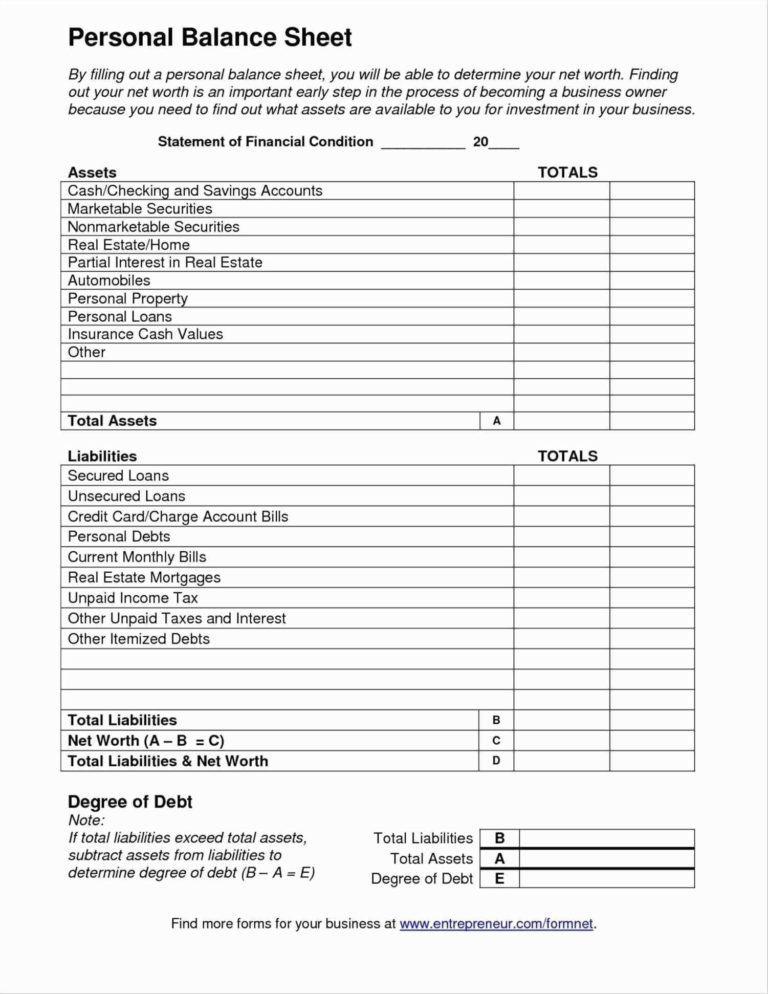

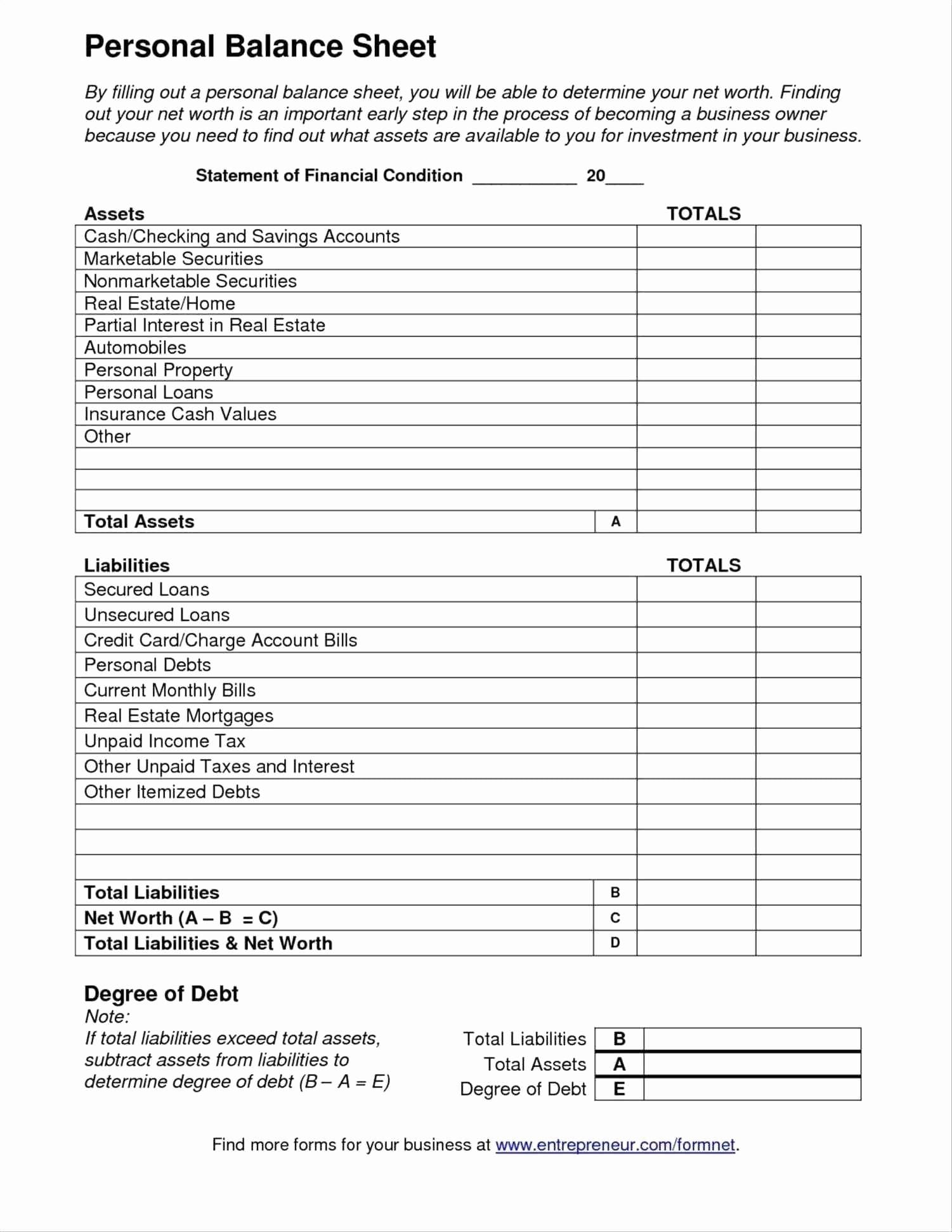

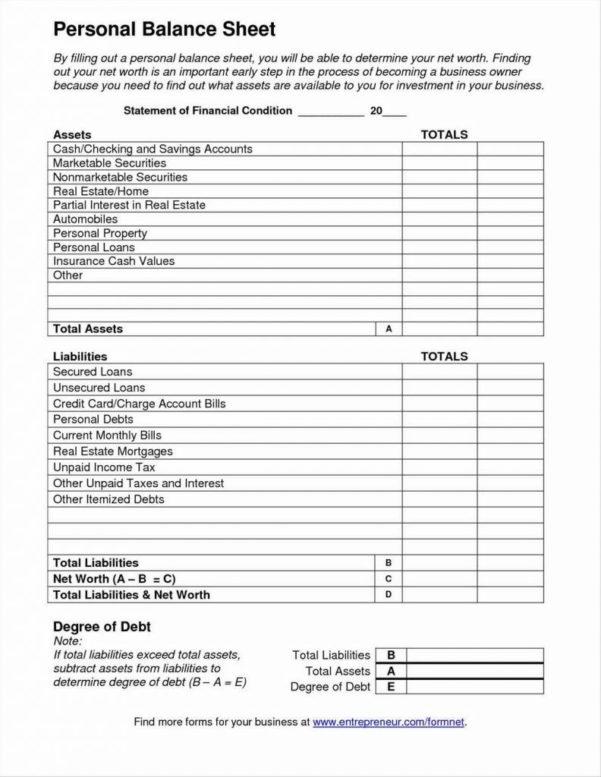

Real Estate Balance Sheet Excel Excel Templates

Gluten Free Tax Deduction For Celiac Disease YouTube

Gluten Free Tax Deduction For Celiac Disease YouTube

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

FunctionalBest Of Self Employed Tax Deductions Worksheet

Pin On Health

Gluten Tax Deduction - Individuals diagnosed with celiac disease may be able to receive tax deductions for expenses associated with gluten free foods and products However there are a few catches to obtaining them