Golf Cart Rebate Tax Credit Web 12 avr 2023 nbsp 0183 32 Beginning January 1 2023 eligible vehicles may qualify for a tax credit of up to 7 500 The amount of the credit depends on when the eligible new clean vehicle is

Web 12 f 233 vr 2010 nbsp 0183 32 The IRS offers a green tax credit that s better than a deduction of between 4 000 and 6 000 off the purchase of an electric vehicle And in a new ruling Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

Golf Cart Rebate Tax Credit

Golf Cart Rebate Tax Credit

https://3.bp.blogspot.com/-A1d5sEeyRjs/VwPqteWy_0I/AAAAAAAApko/QQA1yGEv__07BMt364MjMXZXxW3H-bGmQCHM/s1600/understanding-electric-car-tax-credits-rebates.jpg

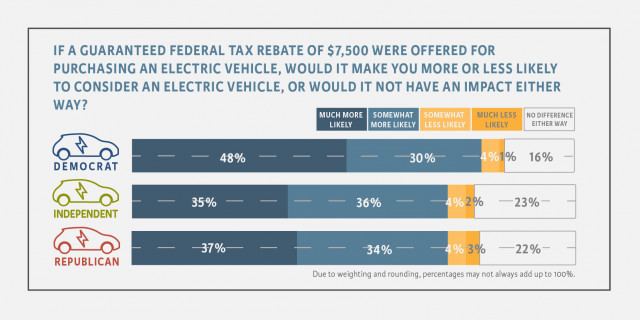

EV Tax Credit Support Climate Nexus May 2019

https://images.hgmsites.net/med/ev-tax-credit-support--climate-nexus-may-2019_100702679_m.jpg

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-recovery-rebate-3.png?w=530&ssl=1

Web Step 1 First purchase a golf cart that meets the standards necessary to qualify for the tax rebate on electric vehicle tax incentive program Video of the Day Step 2 Next to qualify Web 17 juin 2010 nbsp 0183 32 Determining the amount of the credit for 2021 is complicated and luckily is calculated by the manufacturer The 167 30D credit is equal to the sum of 2 500 plus 417 for each kilowatt hour of traction battery

Web 30 nov 2009 nbsp 0183 32 The IRS has advised that buyers of electric golf carts do not qualify for the tax credit for plug in electric drive motor vehicles under section 30D Read more Web 7 mars 2020 nbsp 0183 32 The IRS has singled out electric golf carts and said because they were generally used on public streets they did not qualify for the tax credit So the answer is easy No Don t assume that the electric car

Download Golf Cart Rebate Tax Credit

More picture related to Golf Cart Rebate Tax Credit

Recovery Rebate Credit Worksheet 2022 Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/01/recovery-rebate-credit-worksheet-youtube.jpg

Nys Charges Tax On Car Rebates 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/tax-credits-and-drive-clean-rebate-rochester-ev-accelerator-4.png

Electric Vehicle EV Incentives Rebates

https://wbmlp.org/docs/rebates/EVs/EV-Tax-Credits-23.png

Web Under Section 30 of the Internal Revenue Code qualified plug in vehicles purchased between February 17 2009 and December 31 2011 could be eligible for a tax credit Web 16 ao 251 t 2022 nbsp 0183 32 Most electric vehicles no longer qualify for the full 7 500 federal tax credit that helped millions of buyers lower the cost of switching from gas powered vehicles to

Web 19 oct 2009 nbsp 0183 32 Even in states that don t have their own tax rebate plans the federal credit is generous enough to pay for half or even two thirds of the average sticker price of a cart Web 7 ao 251 t 2023 nbsp 0183 32 As promised here is the current list of used EVs that qualify for tax credits in the US per the IRS separated by all electric BEVs and plug in hybrids PHEVs

Recovery Rebate Credit Worksheet Example Studying Worksheets Recovery

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/recovery-rebate-credit-worksheet-example-studying-worksheets.png

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

https://images.dailykos.com/images/912447/story_image/1040.PNG?1612073472

https://www.irs.gov/newsroom/heres-what-taxpayers-need-to-know-to...

Web 12 avr 2023 nbsp 0183 32 Beginning January 1 2023 eligible vehicles may qualify for a tax credit of up to 7 500 The amount of the credit depends on when the eligible new clean vehicle is

https://www.ustaxaid.com/blog/business/how-to-deduct-your-golf-cart

Web 12 f 233 vr 2010 nbsp 0183 32 The IRS offers a green tax credit that s better than a deduction of between 4 000 and 6 000 off the purchase of an electric vehicle And in a new ruling

2023 Recovery Rebate Tax Credit Recovery Rebate

Recovery Rebate Credit Worksheet Example Studying Worksheets Recovery

ERC Tax Rebate Apply For Employee Retention Tax Credit For 2020 2021

Recovery Rebate Credit 2020 Calculator KwameDawson

Pin On Jessica s Kitchen

Electric Vehicle Tax Credits And Rebates Available In The US Sorted By

Electric Vehicle Tax Credits And Rebates Available In The US Sorted By

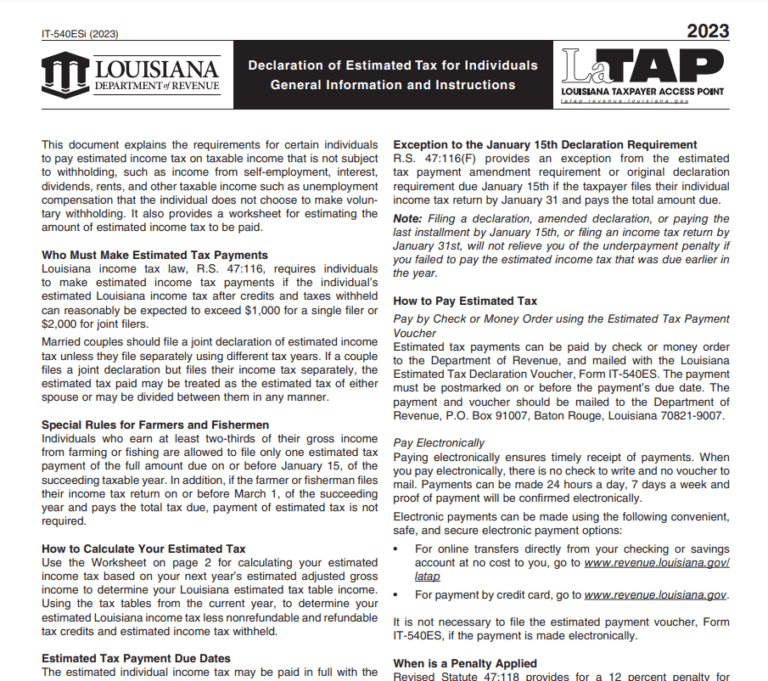

Louisiana Tax Credits 2023 Printable Rebate Form

New Car Rebate Part Of Tax 2022 Carrebate

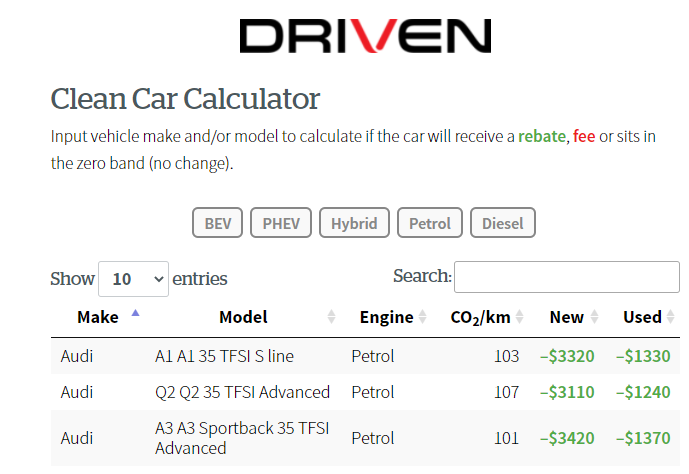

Clean Car Discount Scheme Driveline Fleet Car Leasing

Golf Cart Rebate Tax Credit - Web 7 mars 2020 nbsp 0183 32 The IRS has singled out electric golf carts and said because they were generally used on public streets they did not qualify for the tax credit So the answer is easy No Don t assume that the electric car